Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EV Market Share

- Thread starter jhm

- Start date

thank you for this dataperspective battery size for busses and logistics

(BYD only)

View attachment 321984

View attachment 321985

so range is from 145kWh to 591kWh

nominal one is the 324kWh bus

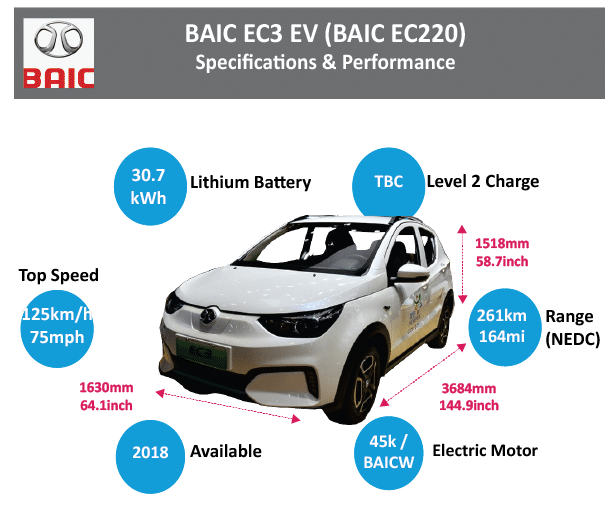

'If we gather sales by Automotive Groups, the Renault-Nissan-Mitsubishi Alliance is ahead, with 11% share (Up 1% regarding 2017), followed by BYD and Tesla, both with 9% share, while BAIC, the BMW Group and the Volkswagen Group all race for #4, with 8% share'

EV Sales: Global Top 20 - June 2018

View attachment 321982

ROW rest of world

Love it. Tesla is now the clear leader for the month, but not quite enough to push ahead of BYD for YTD ranking. Just 644 vehicles separate BYD and Tesla for YTD sales. Tesla should jump to about 24k in July.

Tesla is gaining market share. It has 9.32% share YTD, but 12.13% share of June sales.

This monthly market share is telling because it is clearly ramping up production. In July, Tesla could deliver 24k while the whole market is about 180k. Thus, Tesla could climb above 13.3%. If Tesla could magically ramp to 10k Model 3 per week for in the next month, it would capture 28% market share. I just point this out to show an upper limit to how much share the Model 3 could gain Tesla. Naturally, but the time Tesla realizes the 10k weekly rate, many other EVs will be selling more EVs too. So it is not really likely that Tesla will see 28% anytime soon, but the more quickly it ramps the M3, the more share it gains. My hope is that Tesla could capture 15% market share with the M3 added to MS/MX.

yeah but,

China has a strange sawtooth pattern to NEV sales, starts year slow, ramps up to december, then plummets to start again

so i expect 2nd half 2018 to be liftoff for Chinese manufacturers yet again.

but it could easily be shared by new entrants so byd, baic, saic, geely, so not mere brands but the oems.

speaking of oem, RNM could go either way, will there be an Osborne effect with LEAF 60kWh (definitely for USA, not for ROW) what about Kangoo upgrades? i think ZOE is maxxed out for now (both supply and demand) but there is change for kangoo and LEAF

i wouldn't be surprised if we had 8 oems at 7-9% for 2018, but none above 9.5%

ie

RNM

Tesla

BYD

BAIC

BMW

VW

Geely

SAIC

honestly Geely is well known in the media, but SAIC is the real powerhouse.

we haven't seen too many entrants from the China's SOE automakers, but its coming.

China has a strange sawtooth pattern to NEV sales, starts year slow, ramps up to december, then plummets to start again

so i expect 2nd half 2018 to be liftoff for Chinese manufacturers yet again.

but it could easily be shared by new entrants so byd, baic, saic, geely, so not mere brands but the oems.

speaking of oem, RNM could go either way, will there be an Osborne effect with LEAF 60kWh (definitely for USA, not for ROW) what about Kangoo upgrades? i think ZOE is maxxed out for now (both supply and demand) but there is change for kangoo and LEAF

i wouldn't be surprised if we had 8 oems at 7-9% for 2018, but none above 9.5%

ie

RNM

Tesla

BYD

BAIC

BMW

VW

Geely

SAIC

honestly Geely is well known in the media, but SAIC is the real powerhouse.

we haven't seen too many entrants from the China's SOE automakers, but its coming.

RobStark

Well-Known Member

Ok, Jaguar, you've got a serious back order on your iPace. What comes next? Will Jag jump into producing the volume of batteries they need to meet demand for iPace? Are they willing to burn cash like an Elon to be a serious EV maker? I hope they go for it. I also wish they would just partner with Tesla on the Supercharger network. I've always wished that Jaguar would step into the Tesla ecosystem. They can keep making classy cars and delivery the best EV experience along with Tesla.

FYI Jaguar Cars is part of JLR(Jaguar Land Rover).

JLR is a wholly owned subsidiary of Tata Motors ($12B market Cap)

Tata Motors is a subsidiary of Tata Group, Market Cap ~$130B 2017 Revenue $100B.

So a deal with Jaguar is really a deal with Tata Motors/Tata Group.

I think a dose of "not invented here syndrome" would be evident and would wound Tata Group pride to become part of Tesla ecosystem.

They purchased JLR to be the crown jewel in the empire, to show they are a world class company that can compete head to head with the world's best, not that they need a crutch to compete.

considering the manufacturer's revenue on the vehicles above, the tesla m3 entrance as a $50k (sales price) at 20k (production) per month places it above all SUV/sedans for the q3 2018 on a revenue basis. that gotta get the entire USA auto industrys attention. not quite pickup truck level, but ram pickup is vulnerable to 4th place.

yet Toyota could so easily make a Toyota RAV4 PHEV, if Mitsubishi can do it, Toyota could do in their sleep. but I predict the Toyota will wait until after the federal rebates are long gone, before bring a RAV4 PHEV to market.

the 3 month production break will stop it being the world best selling EV this year, but watch out for next ha ha

if they hold price steady while increasing range by 22%. then there is a good chance that the global best selling EV for 2017 (and first 5 months 2018) will come back with a vengeance.

of course competition in china in 2019 will be blood thirsty, so lots of cars, little profit.

if they hold price steady while increasing range by 22%. then there is a good chance that the global best selling EV for 2017 (and first 5 months 2018) will come back with a vengeance.

of course competition in china in 2019 will be blood thirsty, so lots of cars, little profit.

FlatSix911

Porsche 918 Hybrid

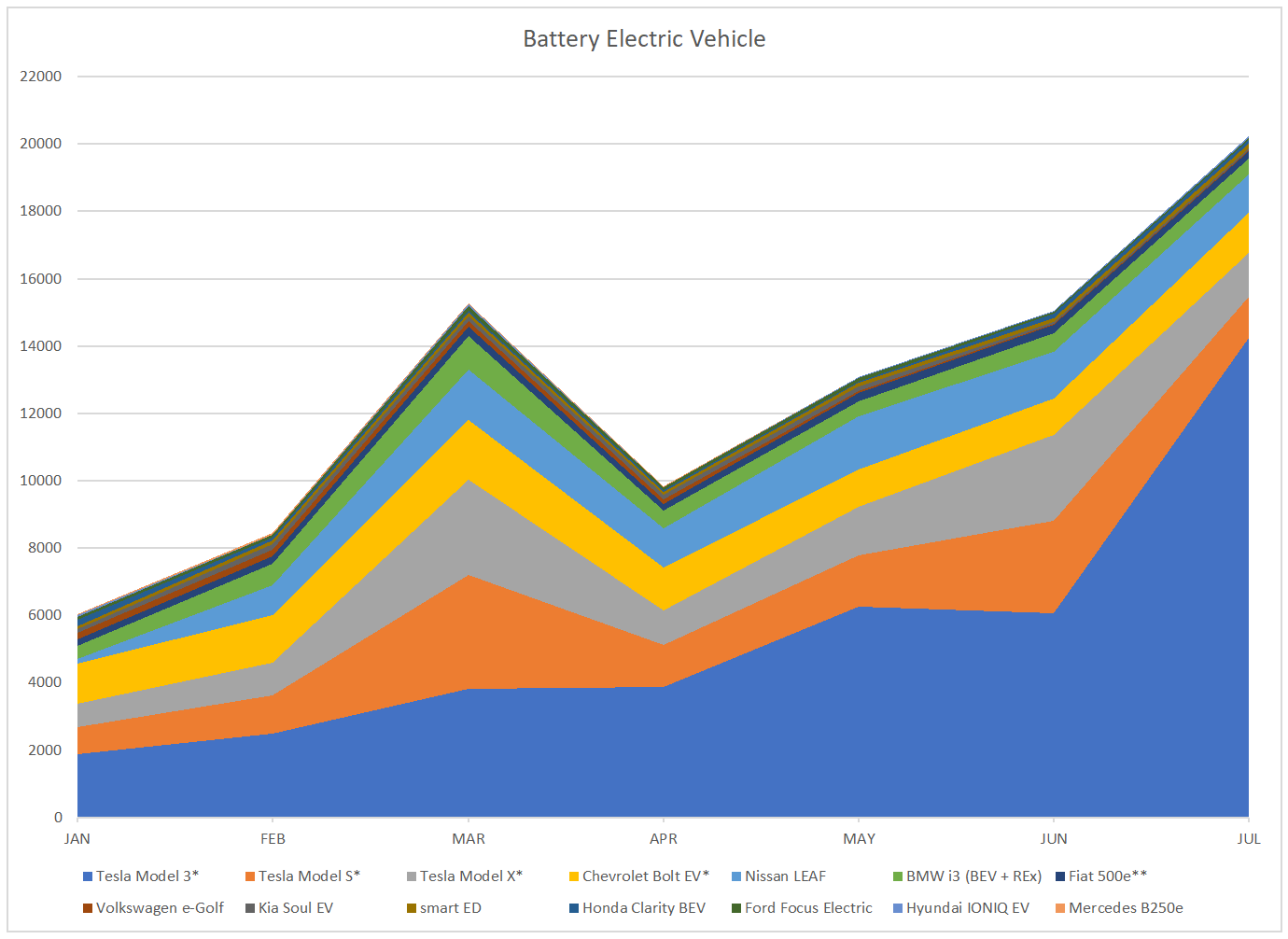

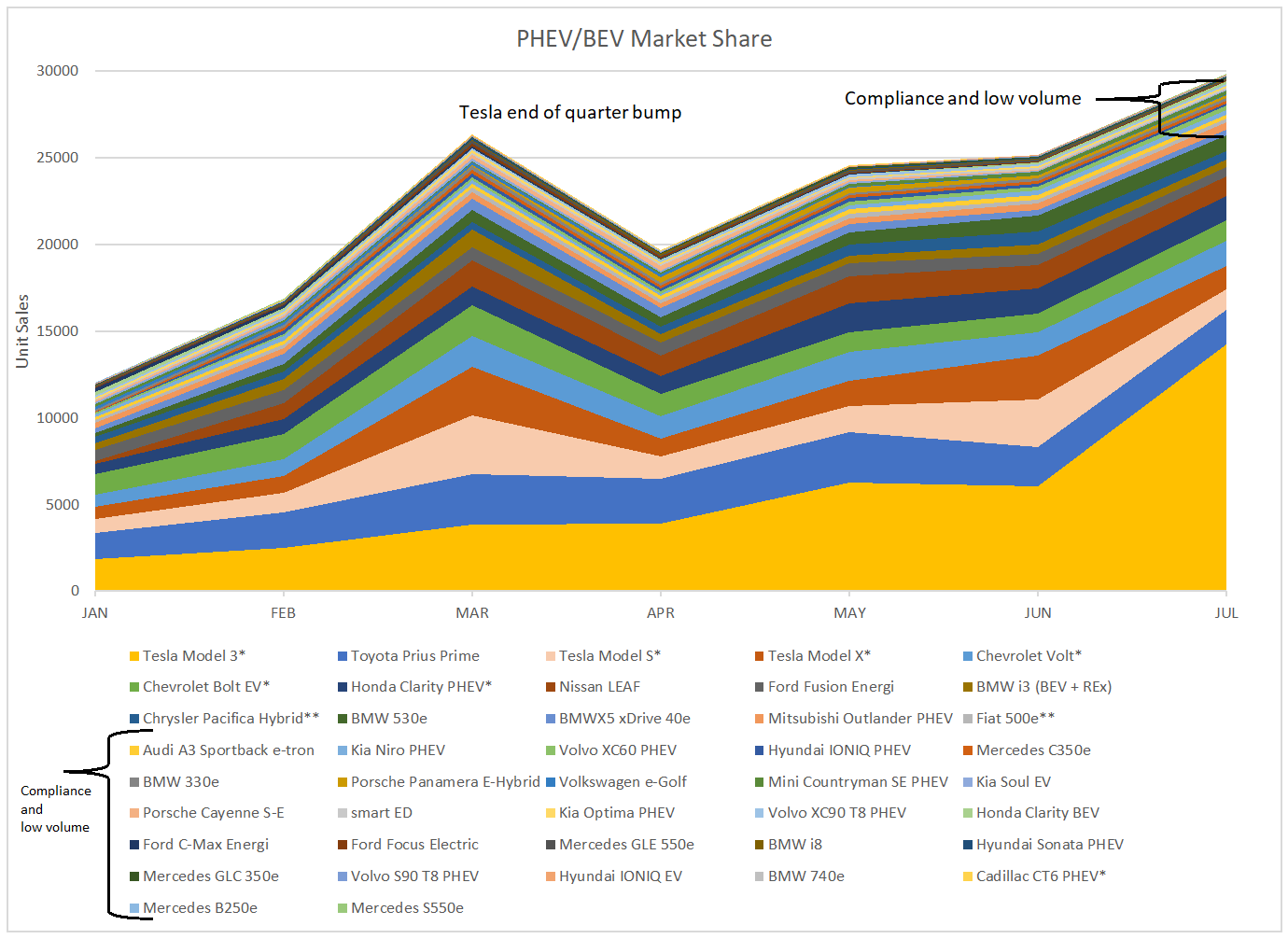

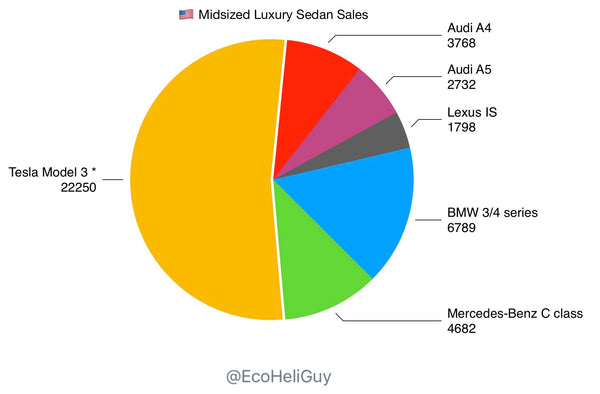

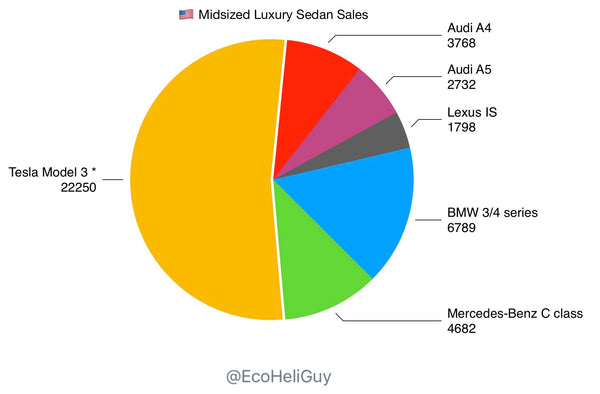

Here are a few charts from a blog that put things in perspective for the US EV market share

mspohr

Well-Known Member

Electric cars exceed 1m in Europe as sales soar by more than 40%

Electric cars exceed 1m in Europe as sales soar by more than 40%

Electric cars exceed 1m in Europe as sales soar by more than 40%

Tesla, An Uncomfortable Wake-Up Call For Germany. All Hands On Deck! | CleanTechnica

This article demonstrates how compelling a market share strategy is. For the author, all the debate around EVs ended when the Model 3 began to outsell any offering from Germany automakers. But of course, the recognition comes easily 6 years too late. The author laments that specs for models to come out in 2020 to 2025 are already behind the specs that Tesla is already delivering. So Germany is simply behind the tech learning curve and it is uncertain that it can catch up. Massive market share will continue to be lost to Tesla.

But let's go back to the market share strategy. Go back to 2014 when Tesla was struggling to ramp up 20k Model S per year. At this point in time, the whole auto industry ought to have set itself to developing a challenger to the S and attempt outsell it. At that point, OEMs had a much better chance of being able to catch up and even surpass Tesla in its share of the BEV market. They could have afforded to lose money on these models as they were gaining critical experience and perspective on how to deliver a compelling EV. It's one thing to catch up to Tesla when it was building 20k to 40k, but quite another thing as Tesla is approaching 200k to 400k, nearly tripling in a single year. Ironically, had a BMW or Audi kept pace with Tesla, they would actually be gaining massive market share today, rather than losing it. Tesla is outselling BMW in the US now, BMW could have shared in the explosive growth of EVs at this time.

So the race is on. Tesla has done a couple of laps while others try to figure out how to get off the starting block. Good luck.

This article demonstrates how compelling a market share strategy is. For the author, all the debate around EVs ended when the Model 3 began to outsell any offering from Germany automakers. But of course, the recognition comes easily 6 years too late. The author laments that specs for models to come out in 2020 to 2025 are already behind the specs that Tesla is already delivering. So Germany is simply behind the tech learning curve and it is uncertain that it can catch up. Massive market share will continue to be lost to Tesla.

But let's go back to the market share strategy. Go back to 2014 when Tesla was struggling to ramp up 20k Model S per year. At this point in time, the whole auto industry ought to have set itself to developing a challenger to the S and attempt outsell it. At that point, OEMs had a much better chance of being able to catch up and even surpass Tesla in its share of the BEV market. They could have afforded to lose money on these models as they were gaining critical experience and perspective on how to deliver a compelling EV. It's one thing to catch up to Tesla when it was building 20k to 40k, but quite another thing as Tesla is approaching 200k to 400k, nearly tripling in a single year. Ironically, had a BMW or Audi kept pace with Tesla, they would actually be gaining massive market share today, rather than losing it. Tesla is outselling BMW in the US now, BMW could have shared in the explosive growth of EVs at this time.

So the race is on. Tesla has done a couple of laps while others try to figure out how to get off the starting block. Good luck.

RobStark

Well-Known Member

For the author,

You realize the author is our very own TMC Investment Forum well known member Alex Voigt?

He has been lamenting the slow motion crash that is the ICEv dependent German Economy for quite a while now.

German total Workforce 38M Directly Employed by Auto Industry 800k Indirectly Employed by Auto Industry ~4M.

Germany exports 38% of GDP. Its world renowned reputation for quality and engineering prowess is based on the German Auto Industry.

Without Mercedes, BMW,Audi, and Porsche

Miele would not be able to sell $2k dishwashers. A large part of the reason consumers around the world are willing to pay such a premium over South Korean dishwashers is Hergestellt in Deutschland.

A former Miele CEO once noted that he evaluated potential new markets by going there personally and noting how often he saw German cars. If local consumers were willing to pay a premium for German over American,Japanese, and Korean cars they would do the same for Miele Appliances.

This is deadly serious for Germany. And Europe. Without the a strong German Auto Industry there is no bailouts for Ireland, Portugal,Spain, or Greece.

TSLA Market Action: 2018 Investor Roundtable

Let me drop this here so it does not get lost in the market action thread.

Basically Tesla's share of the global market is at about 0.4% and fast approaching 1%. I think this is at a scale where Tesla become a highly valuable acquisition target for any automaker the hopes to survive the next decade. To be sure, I do not want Tesla to be acquired. The point is simply that the value of Tesla as an acquisition target is very high. This should actually boost the market valuation of Tesla for many years well above what a conventional DCF model might suggest.

For example, WhatsApp was acquired at a huge premium by FaceBook. This is because it represented a huge market share risk to FaceBook, not because it was intrinsically valuable. The situation with Tesla is of course not completely analogous. My point is simply that acquisition value can be substantially higher than intrinsic value. As shareholders, we need to understand the sort of premium that an potential acquirer would be willing to pay.

With all the crazy surrounding the stock, we need to recognize that sitting on nearly 1% with the potential to take that to 20% by 2030 commands huge acquisition value. Indeed some of the bear activity going on may be motivated to soften up the price, oust Musk, and make Tesla obtainable. It's shorting not because Tesla is worth so little, but because Tesla is worth much, much more!

Let me drop this here so it does not get lost in the market action thread.

Basically Tesla's share of the global market is at about 0.4% and fast approaching 1%. I think this is at a scale where Tesla become a highly valuable acquisition target for any automaker the hopes to survive the next decade. To be sure, I do not want Tesla to be acquired. The point is simply that the value of Tesla as an acquisition target is very high. This should actually boost the market valuation of Tesla for many years well above what a conventional DCF model might suggest.

For example, WhatsApp was acquired at a huge premium by FaceBook. This is because it represented a huge market share risk to FaceBook, not because it was intrinsically valuable. The situation with Tesla is of course not completely analogous. My point is simply that acquisition value can be substantially higher than intrinsic value. As shareholders, we need to understand the sort of premium that an potential acquirer would be willing to pay.

With all the crazy surrounding the stock, we need to recognize that sitting on nearly 1% with the potential to take that to 20% by 2030 commands huge acquisition value. Indeed some of the bear activity going on may be motivated to soften up the price, oust Musk, and make Tesla obtainable. It's shorting not because Tesla is worth so little, but because Tesla is worth much, much more!

FlatSix911

Porsche 918 Hybrid

Interesting market data from Inside EV's ... Global August Sales: Model 3 Dominates, Tesla #1 Overall

Interesting market data from Inside EV's ... Global August Sales: Model 3 Dominates, Tesla #1 Overall

The best selling model for the month is the Tesla Model 3 with record 18,300 (estimated). This massive figure enabled it to take the lead for the year too with 59,305 after eight months.

Wow, and September Model 3 deliveries could almost double the year to date total.

Wow, and September Model 3 deliveries could almost double the year to date total.

Yeah. Mongo, if you conflate quarterly numbers (60k) and Monthly (20k)...

So will Q4 double year to day?

Nice to see Model 3 sales ytd finally pull out ahead of Nissan LEAF. As Plug-in Car Manufacturer, Tesla pulled out ahead of BYD ytd ending July.Interesting market data from Inside EV's ... Global August Sales: Model 3 Dominates, Tesla #1 Overall

Tesla will seriously pull away from BYD and the rest of the pack in the September results. I think we'll see this race heat up as the front runner speeds away.

FlatSix911

Porsche 918 Hybrid

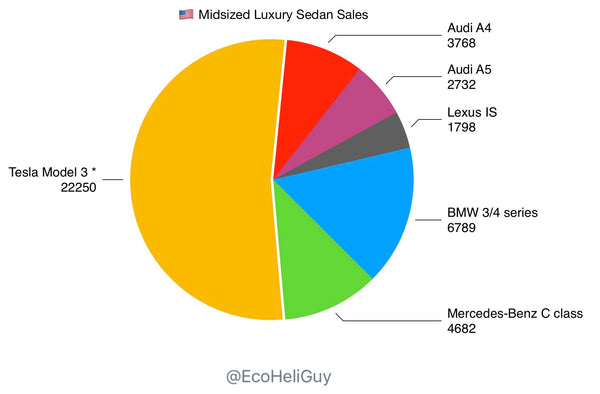

Interesting chart of the mid-size luxury sedan market ... BMW Board Member Talks About Electric Car Cost Nightmare

mspohr

Well-Known Member

Sounds like BMW is in severe denial.Interesting chart of the mid-size luxury sedan market ... BMW Board Member Talks About Electric Car Cost Nightmare

Adapt or die.

FlatSix911

Porsche 918 Hybrid

Sounds like BMW is in severe denial.

Adapt or die.

I agree... BMW is in deep trouble in the US Market.

They sold less than a third of the 3 & 4 series compared to the Model 3 sales in August

Similar threads

- Replies

- 0

- Views

- 746

- Replies

- 3

- Views

- 758

- Replies

- 10

- Views

- 959