dhanson865

Well-Known Member

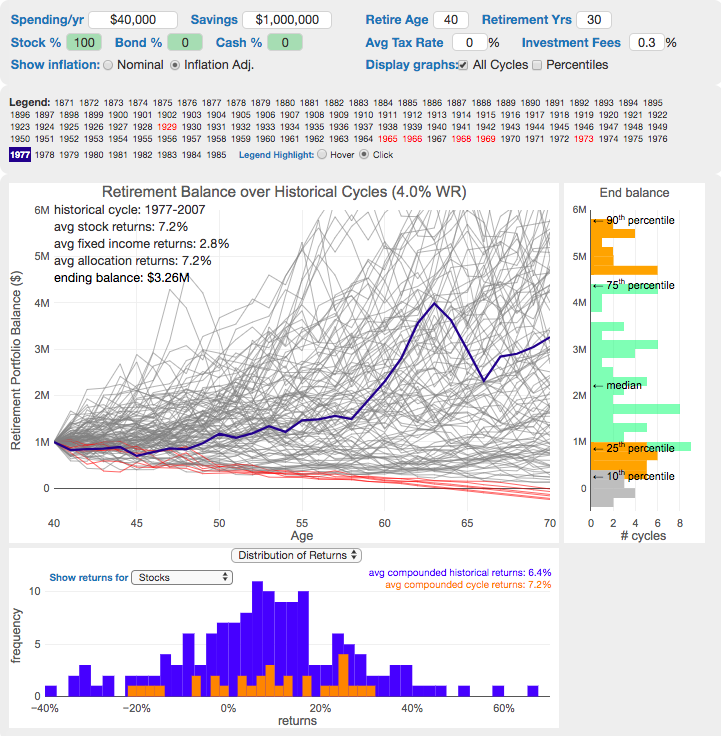

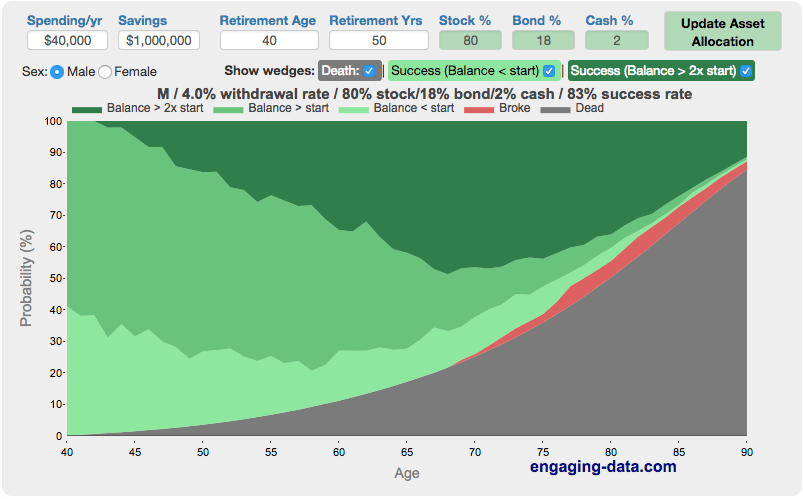

I lIke this guys financial calculators and models. Gives the option for a lot of variable tweaking and alternatie projections. READ the instructions for each financial calculator, like the FIRE model or Will my money last calcs.. one can easily put in something like SS and pension or alternate income streams to add to the modeling.

Disclaimer: no interest or relationship whatsoever

Home - Engaging Data

Engaging Data is a virtual workshop/gallery of javascript tools, data visualizations and maps of stuff that I find interesting and fun. Enjoy and Learn.engaging-data.com

Rich, Broke or Dead? Post-Retirement FIRE Calculator: Visualizing Early Retirement Success and Longevity Risk - Engaging Data

A FI/RE early retirement calculator visualizing longevity risk in early retirement and enables you to compare the probability success, failure and mortality.

engaging-data.com

engaging-data.com

I'm liking this one. Until TSLA goes sky high I can skirt the 0% capital gains limit (~ $25,900 standard deduction + $83,350 long term capital gains married filing jointly bracket top = ~$109,250), for simple math call it $110,000 on good years and $55,000 anytime my funds drop below $1.7M (when TSLA price drops).

With that strategy in mind I can start at 1.9M when I turn 55 and not run out in 50 years if TSLA somehow stagnates and just ramp it up if TSLA takes off.

$110,000 is ~5.8% at the start and would basically fall back to $55,000 or about 3% if TSLA goes south (and yes in flyover country I can live on $55K no problem).

Attachments

Last edited: