dhanson865

Well-Known Member

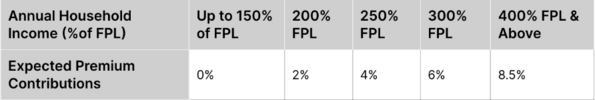

I have a while before ACA matters but I just spent a little time playing with www.healthcare.gov and seeing what income I needed to lose the subsidy in my state for a family of 2.

income I reported, monthly premium, annual premium, money left over after health care premiums.

$105,000 premium $391.33 x 12 $4,695.96 $100,304.04

$115,000 premium $462.33 x 12 $5,547.96 $109,452.04

$125,000 premium $533.33 x 12 $6,399.96 $118,600.04

$135,000 premium $603.33 x 12 $7,239.96 $127,760.04

$145,000 premium $674.33 x 12 $8,091.96 $136,908.04

$155,000 premium $745.33 x 12 $8,943.96 $146,056.04

$165,000 premium $816.33 x 12 $9,795.96 $155,204.04

$171,000 premium $858.33 x 12 $10,299.96 $160,700.04 (this level had $1 a month subsidy)

$175,000 premium $859.33 x 12 $10,311.96 $164,688.04 (this level was with no subsidy)

doesn't seem that scary losing the ACA subsidy, If I choose to pull more out I can just make it as high as I want and overcome any loss in subsidy.

Maybe when the cliff comes back there would be an small space where you would have to avoid by either going higher or lower in income to keep from being in some short term reversal in funds around that actual cliff.

income I reported, monthly premium, annual premium, money left over after health care premiums.

$105,000 premium $391.33 x 12 $4,695.96 $100,304.04

$115,000 premium $462.33 x 12 $5,547.96 $109,452.04

$125,000 premium $533.33 x 12 $6,399.96 $118,600.04

$135,000 premium $603.33 x 12 $7,239.96 $127,760.04

$145,000 premium $674.33 x 12 $8,091.96 $136,908.04

$155,000 premium $745.33 x 12 $8,943.96 $146,056.04

$165,000 premium $816.33 x 12 $9,795.96 $155,204.04

$171,000 premium $858.33 x 12 $10,299.96 $160,700.04 (this level had $1 a month subsidy)

$175,000 premium $859.33 x 12 $10,311.96 $164,688.04 (this level was with no subsidy)

doesn't seem that scary losing the ACA subsidy, If I choose to pull more out I can just make it as high as I want and overcome any loss in subsidy.

Maybe when the cliff comes back there would be an small space where you would have to avoid by either going higher or lower in income to keep from being in some short term reversal in funds around that actual cliff.

Last edited: