Regarding Tesla's recent price hikes in the US—to what extent are they because of supply constraints or demand increases?

TMC member @Gigapress uses Google search trends, "probably the single best measure of what the populace is actually thinking about," to find this answer for themselves:

(Featured Image Courtesy of Tesla, Inc)

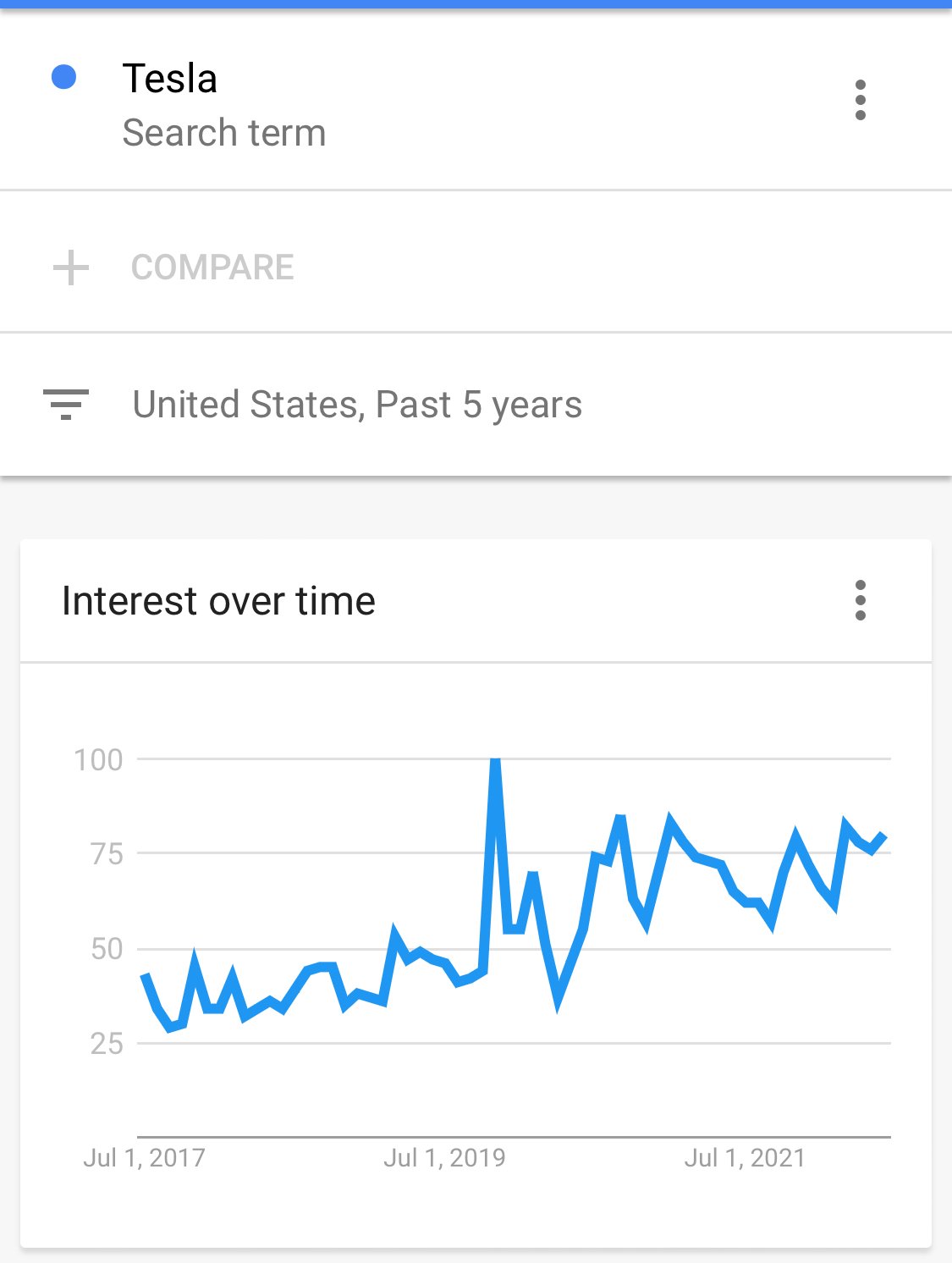

"The chart below is zoomed out to the last five years and it shows “Tesla” interest has very high variance, which means short term spikes are likely not statistically significant anyway, but the long-term trend shows general interest is double what it was in 2017."

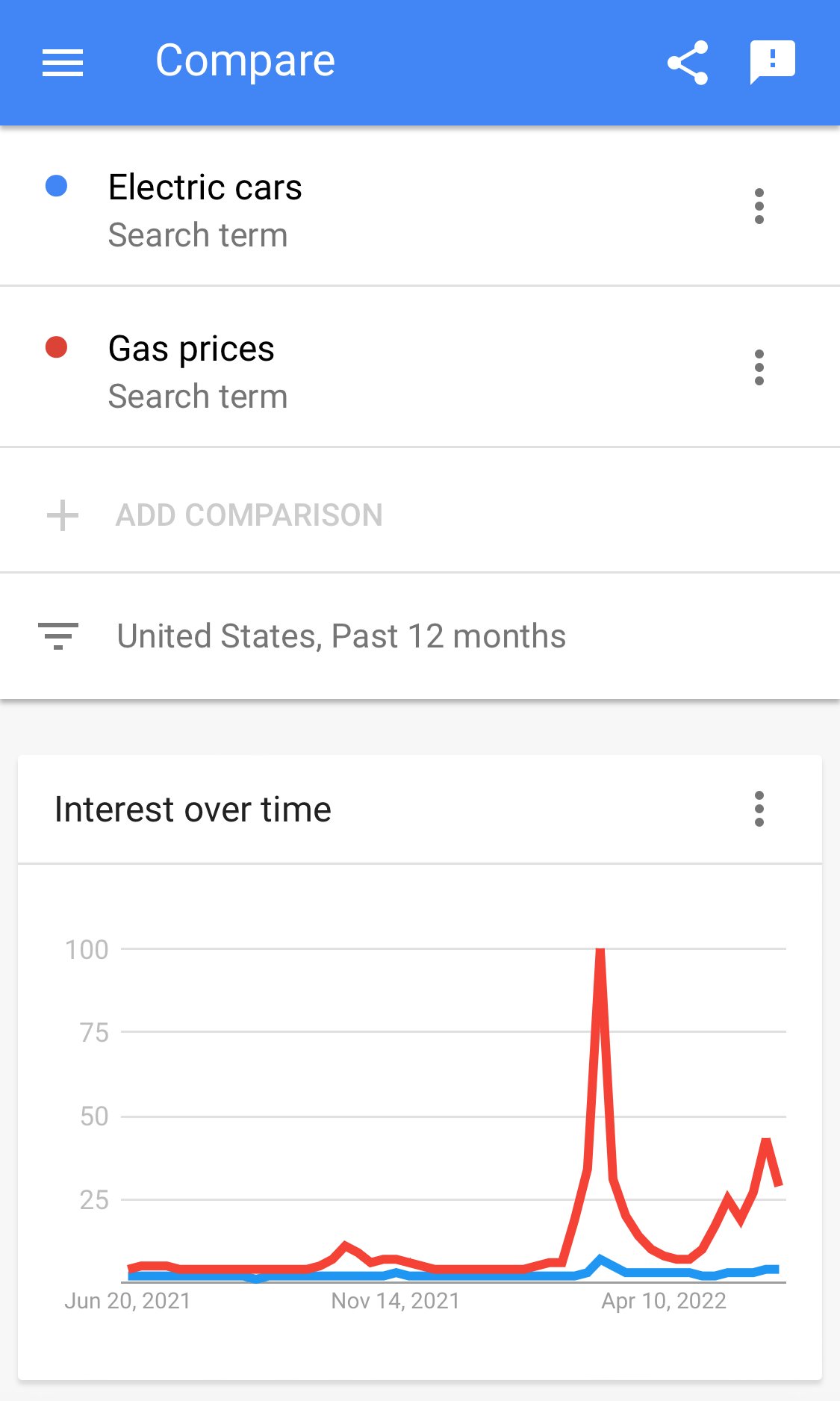

"The big one is this: Unsurprisingly, we see a strong correlation between searches for “gas prices” and “electric cars”. Although gas prices have roughly 20x more interest in general, both search terms tend to follow each other’s relative movements."

"Relatedly, “how much does it cost to charge an electric car” is at triple the interest in the USA compare to last year’s baseline."

Conclusion -

"The dominant conclusion remains that a LOT of people became curious about electric cars when Mr. Putin decided to send troops across the border and fuel prices surged."

"Twitter, FUD, politics, oil-funded smear campaigns, recession, and a bunch of other things demonstrably do not matter as much as frustration with sending money up in smoke at the pump every week."

Please read their full analysis below:

teslamotorsclub.com

teslamotorsclub.com

(TMC Staff Note: This post was taken from the Investor's Roundtable discussion in order to promote it to TMC's Blog feed.)

TMC member @Gigapress uses Google search trends, "probably the single best measure of what the populace is actually thinking about," to find this answer for themselves:

(Featured Image Courtesy of Tesla, Inc)

"The chart below is zoomed out to the last five years and it shows “Tesla” interest has very high variance, which means short term spikes are likely not statistically significant anyway, but the long-term trend shows general interest is double what it was in 2017."

"The big one is this: Unsurprisingly, we see a strong correlation between searches for “gas prices” and “electric cars”. Although gas prices have roughly 20x more interest in general, both search terms tend to follow each other’s relative movements."

"Relatedly, “how much does it cost to charge an electric car” is at triple the interest in the USA compare to last year’s baseline."

Conclusion -

"The dominant conclusion remains that a LOT of people became curious about electric cars when Mr. Putin decided to send troops across the border and fuel prices surged."

"Twitter, FUD, politics, oil-funded smear campaigns, recession, and a bunch of other things demonstrably do not matter as much as frustration with sending money up in smoke at the pump every week."

Please read their full analysis below:

Moderators' Choice: Posts of Particular Merit

I may not be likely to repeat this post, but I'm feeling a bit generous right now. From Gordon Johnson to many others whenever they've seen a company doing toooo well there has tended to be fraud, excessive optimism and hubris. Thus the actual facts are simply not credible to "linear thinkers"...

(TMC Staff Note: This post was taken from the Investor's Roundtable discussion in order to promote it to TMC's Blog feed.)

Last edited: