I just finished a blog post with updated medium term financial models for Tesla/TSLA. There is a bear and a bull model.

You can download and view the full models here:

Tesla 2020-2022 Bear - PDF

Tesla 2020-2022 Bear - Excel

Tesla 2020-2022 Bear - Numbers

Tesla 2020-2022 Bull - PDF

Tesla 2020-2022 Bull - Excel

Tesla 2020-2022 Bull - Numbers

For reasoning behind the assumptions in this model, please refer to the 3rd section in this blog post:

My TSLA Investment Strategy

Before we know deliveries numbers, Q2 is kind of a crap shoot in my opinion. I'll revisit those numbers after the Q2 P&D.

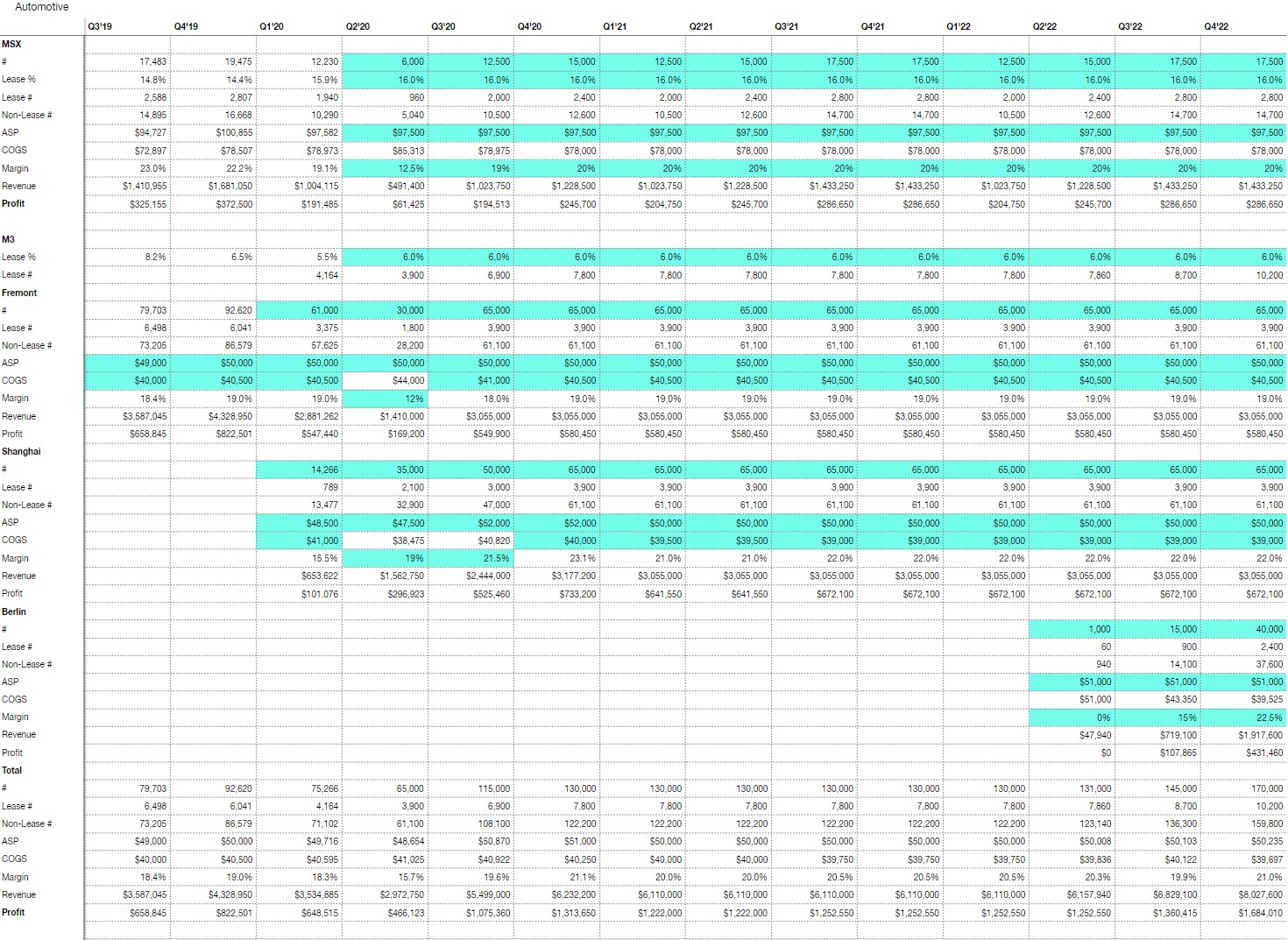

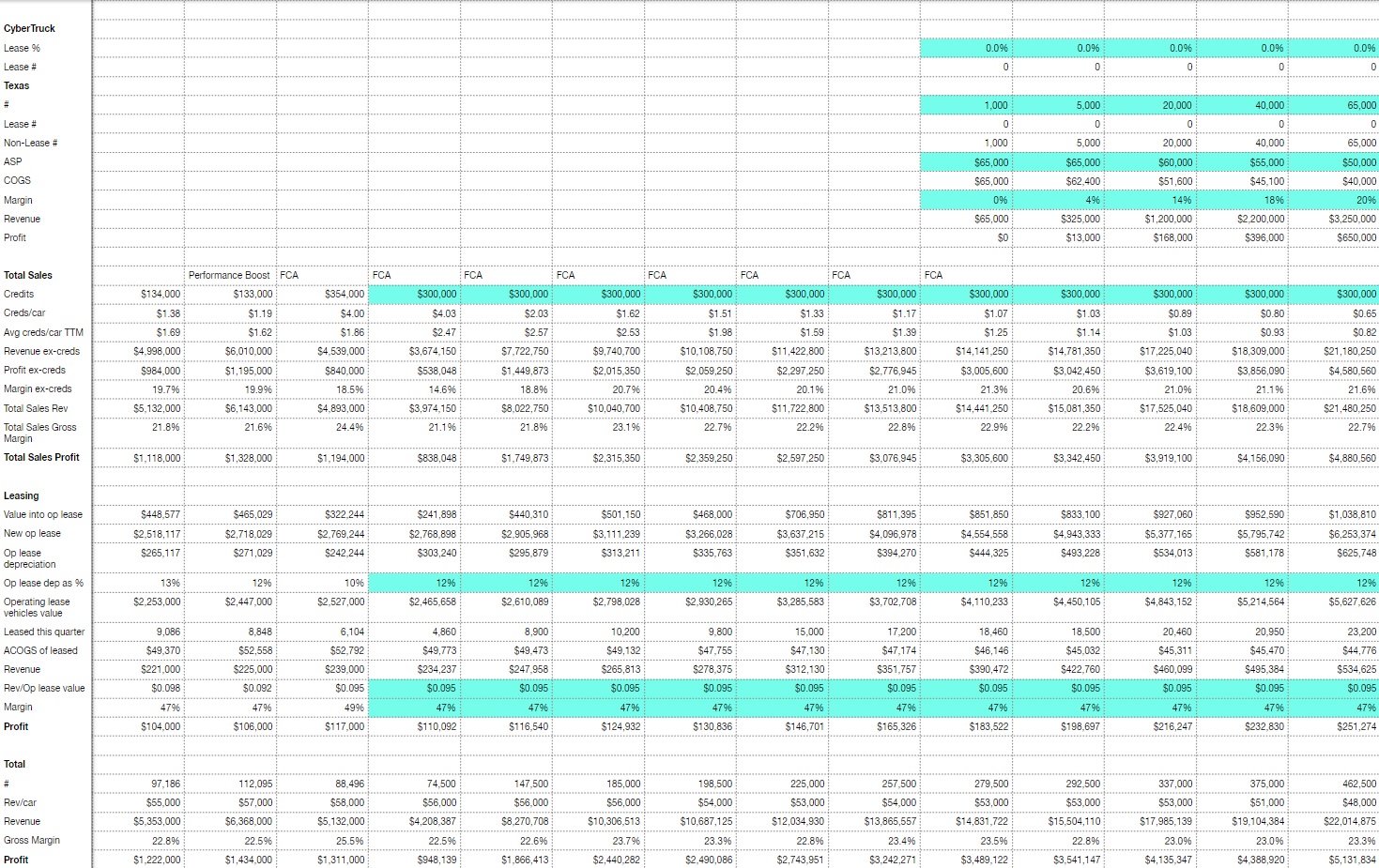

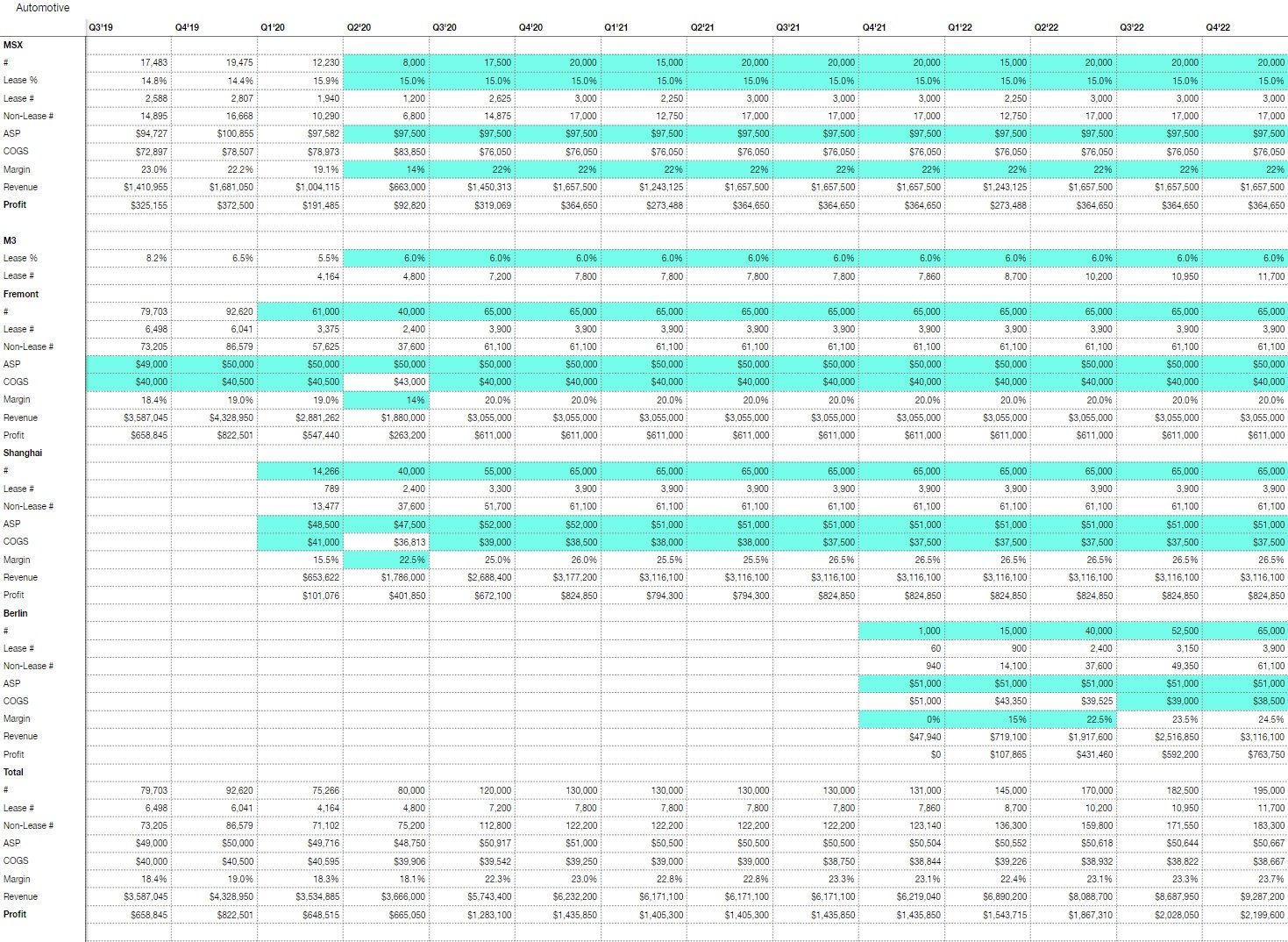

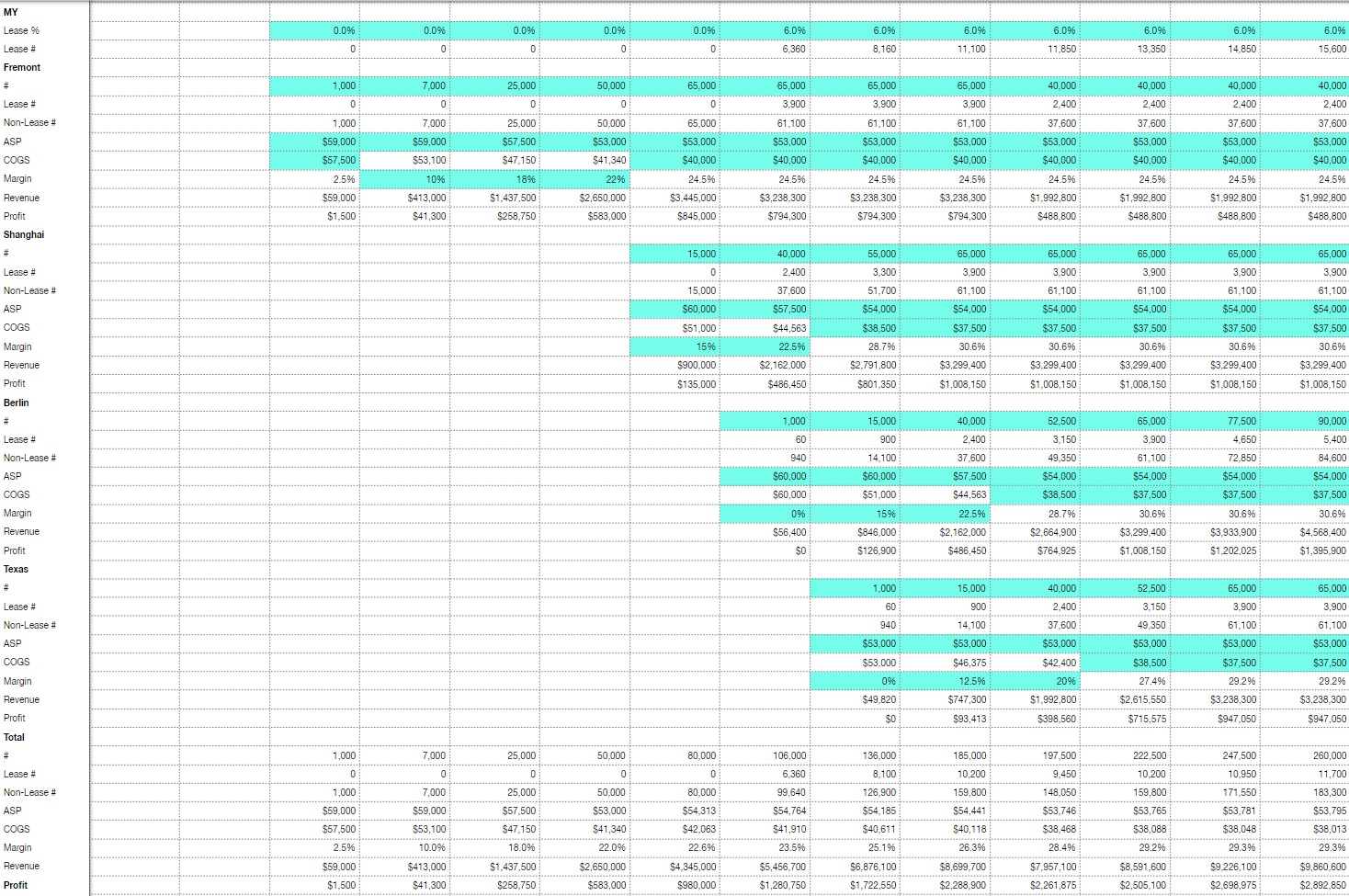

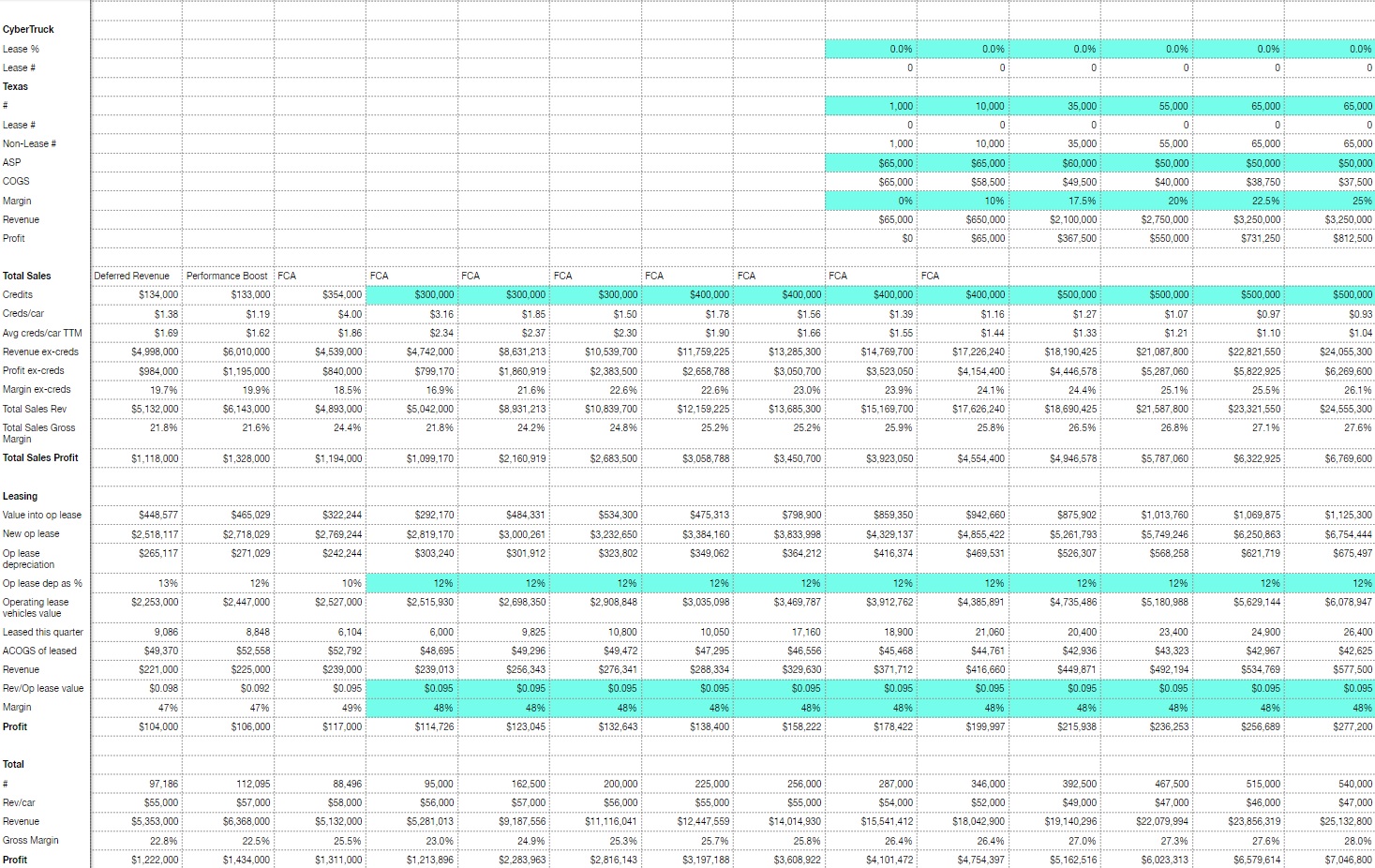

Bear Automotive:

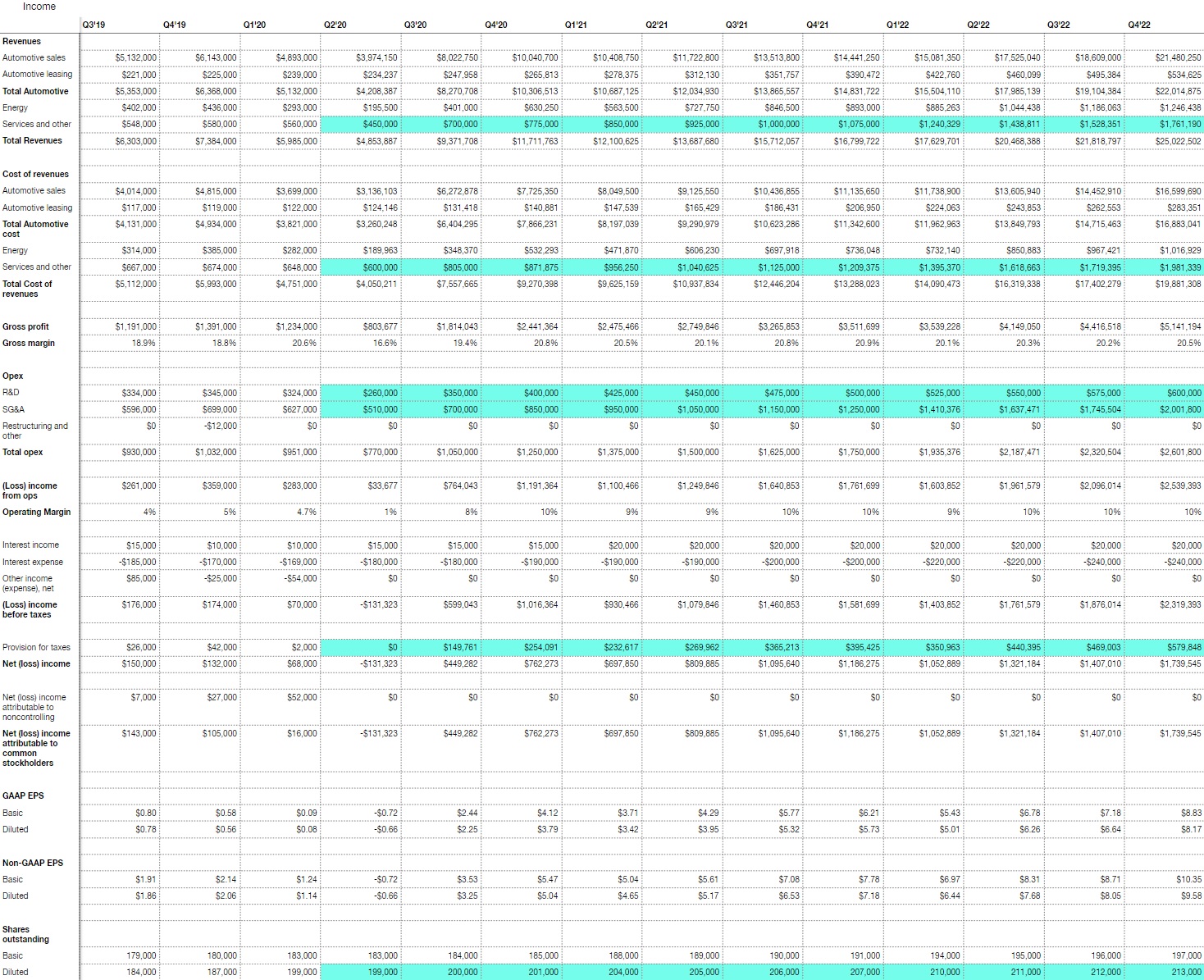

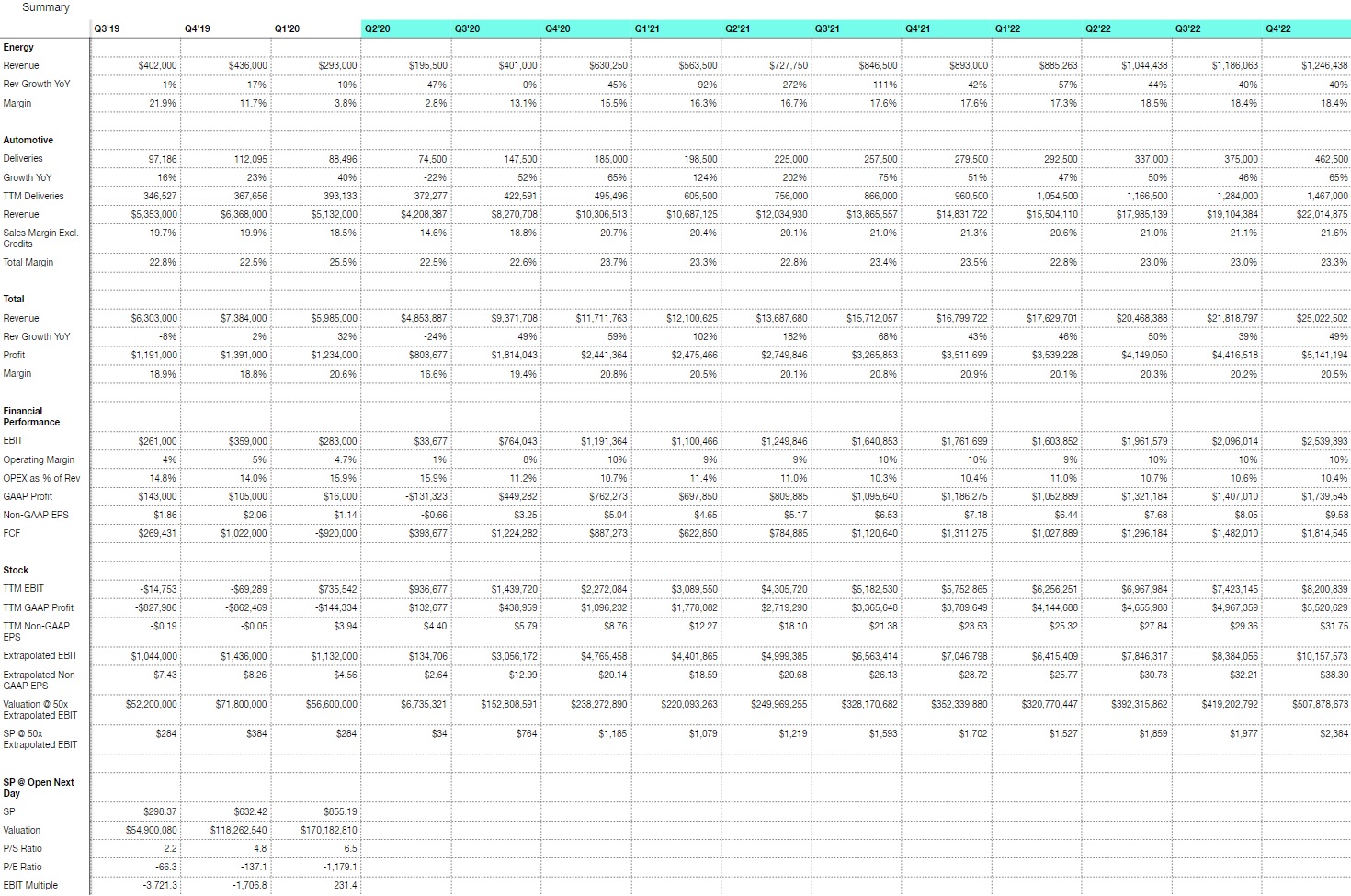

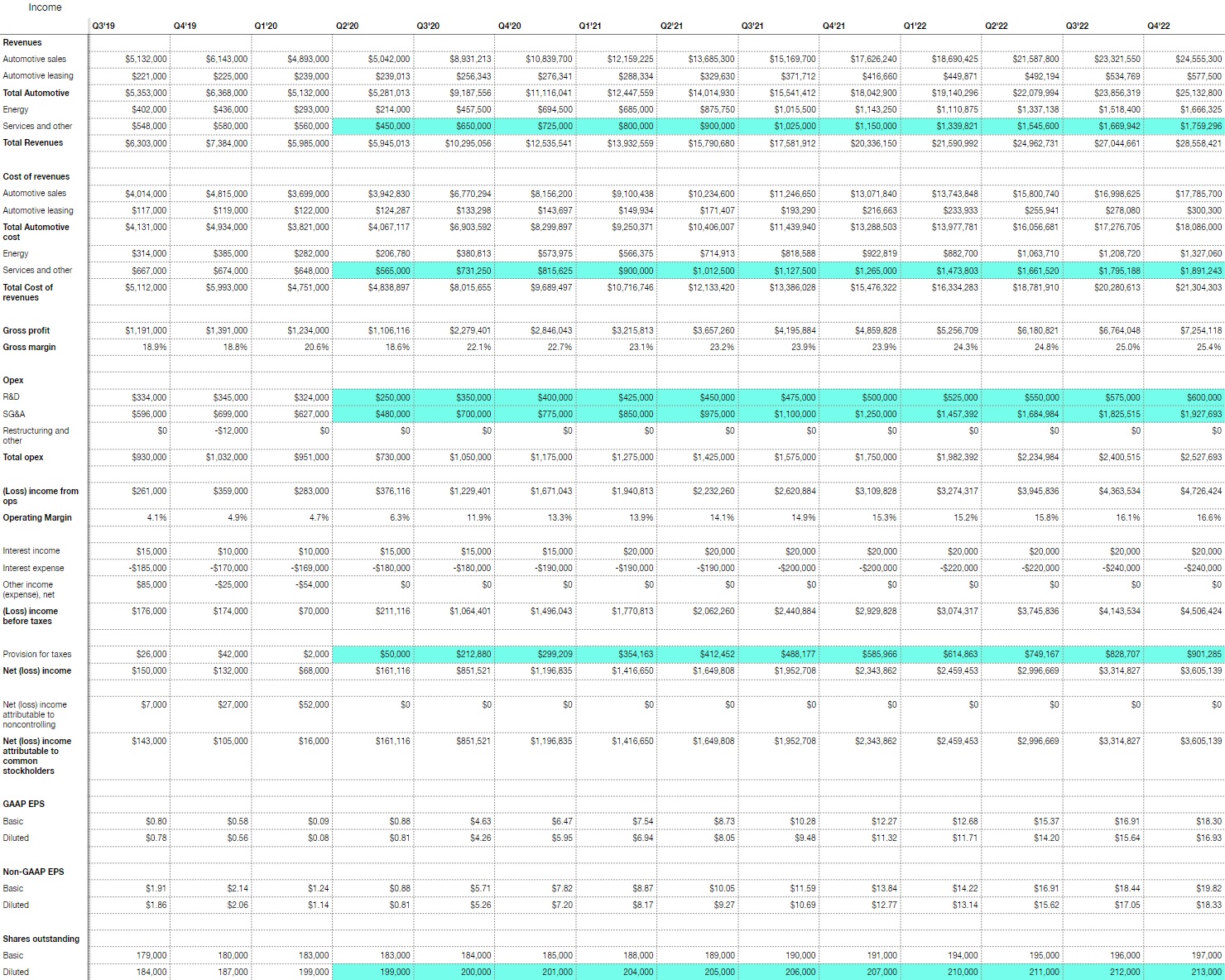

Bear Income:

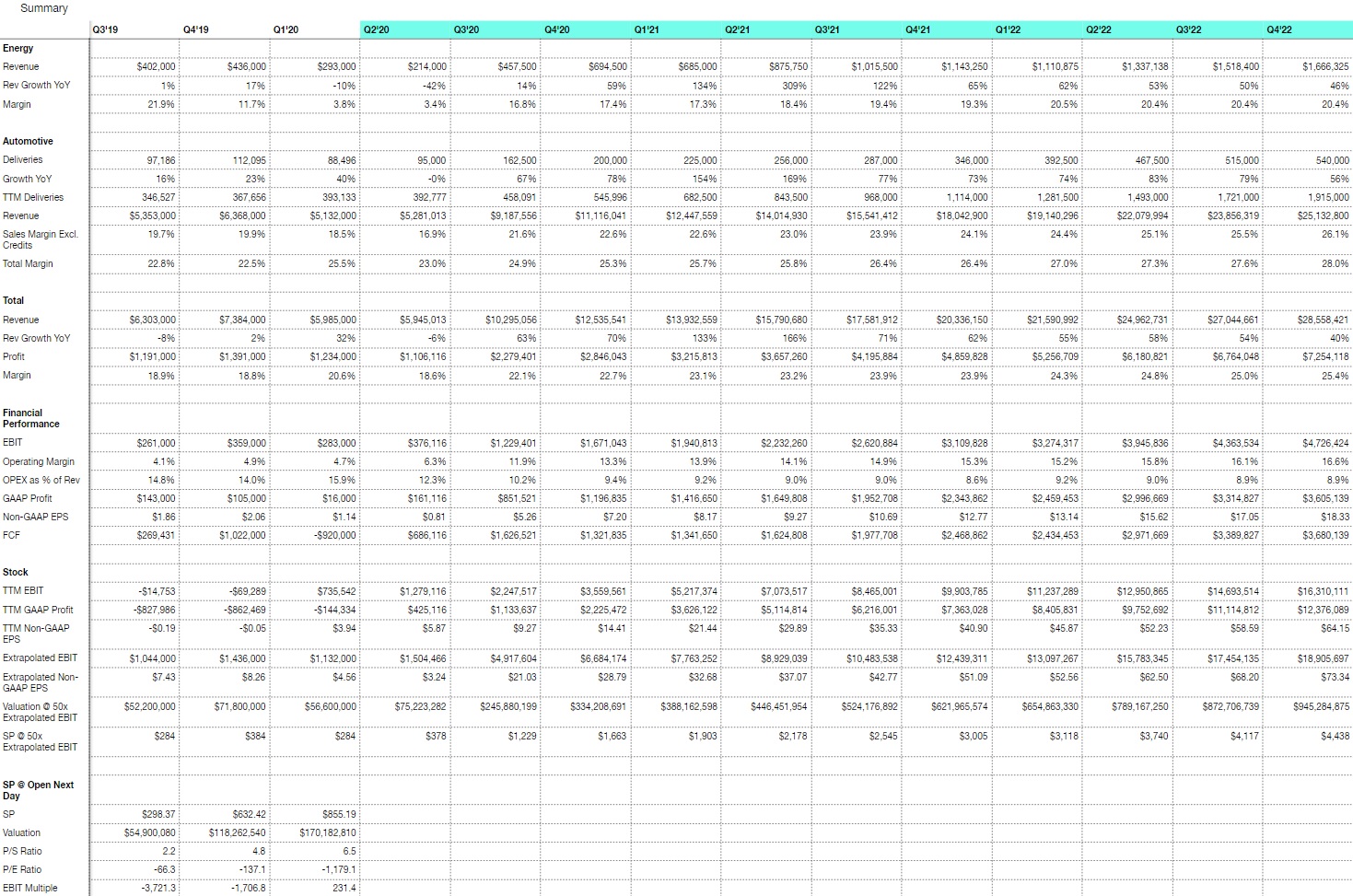

Bear Summary:

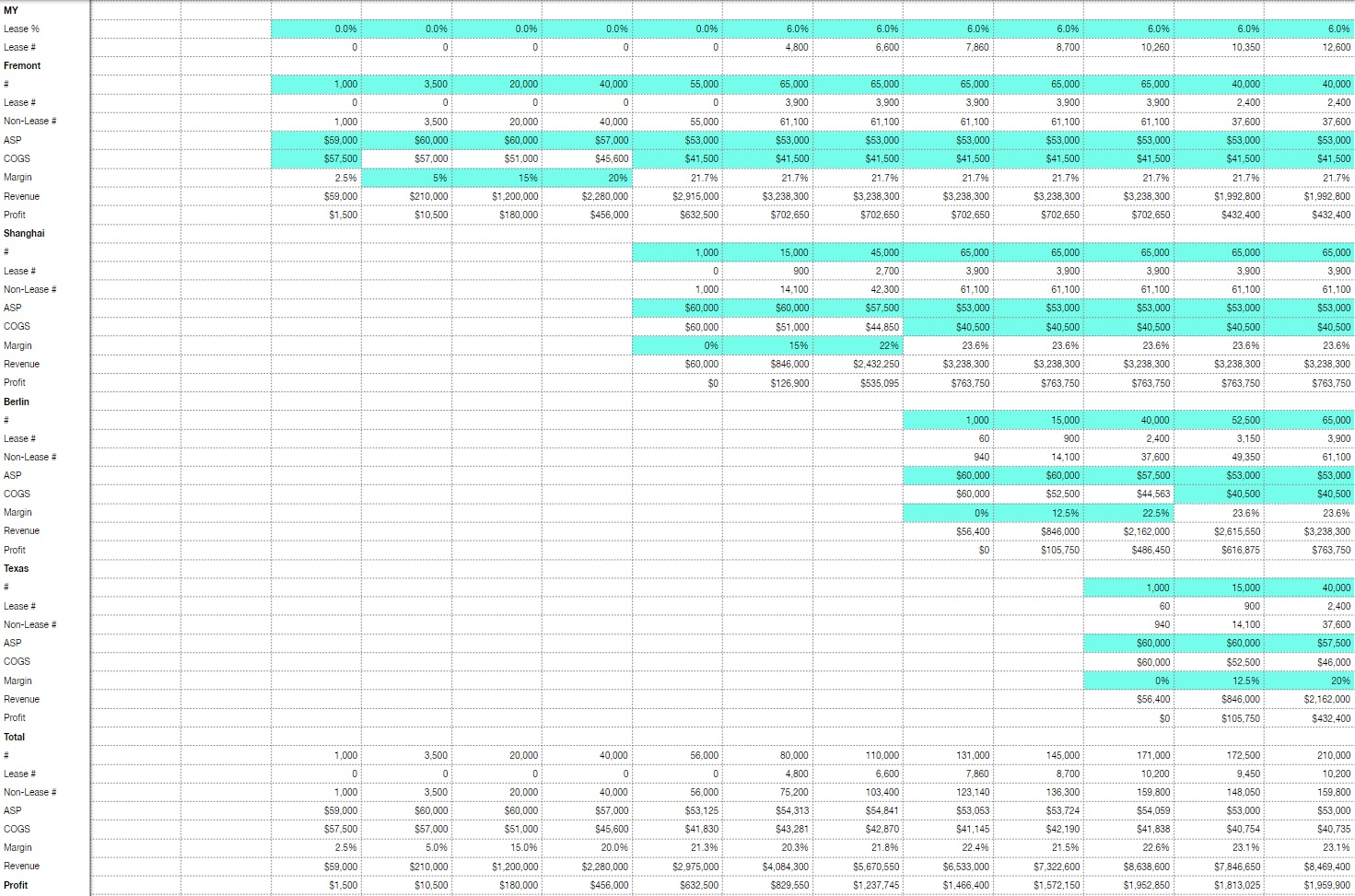

Bull Automotive:

Bull Income:

Bull Summary:

You can download and view the full models here:

Tesla 2020-2022 Bear - PDF

Tesla 2020-2022 Bear - Excel

Tesla 2020-2022 Bear - Numbers

Tesla 2020-2022 Bull - PDF

Tesla 2020-2022 Bull - Excel

Tesla 2020-2022 Bull - Numbers

For reasoning behind the assumptions in this model, please refer to the 3rd section in this blog post:

My TSLA Investment Strategy

Before we know deliveries numbers, Q2 is kind of a crap shoot in my opinion. I'll revisit those numbers after the Q2 P&D.

Bear Automotive:

Bear Income:

Bear Summary:

Bull Automotive:

Bull Income:

Bull Summary: