We know that Giga Texas produced

10k Model Ys between Sept 17 and Oct 30 for an average rate over that period of 1600/week. If we approximate and say that means on Oct 1 the rate was 1000/week, and Dec 15 was 3000/week. I realize the ramp is not linear, but if we just estimate say for 11 weeks the average was 2000, and then 3000 per week for the 12th and 13th weeks of the quarter, that's

28,000 from Texas.

With Giga Berlin, the estimated production rate based on VINs to norway has been > 3000/week for quite some time. Obviously this is not perfect, but I feel estimating an average of 2750/week for the quarter is very safe. That's

33,000 from Berlin.

We can just say a slight bump in Fremont to

145,000 (mostly S/X).

Lastly we already know Oct/Nov for Giga Shanghai was 87,000 and 88,000 roughly. Given the repeated denials of the shutdown, if we assumed another 87,000 from Shanghai that's a

total of 262,000.

All added up? that's 468,000.

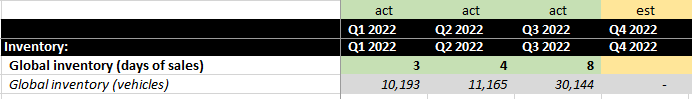

I don't think the Berlin/Texas estimates are too aggressive (I could see Texas being a slight overestimation, but Berlin a slight underestimation). So if the Shanghai production holds I just simply don't buy that deliveries will be ~430,000 like Troy is estimating. Another 40,000 seems like an unreasonably large amount of inventory to add. So I either think production is much lower or deliveries are much higher, but we have more insight into production so I lean more towards an upside surprise in deliveries. Thoughts?

tradingeconomics.com

tradingeconomics.com

tradingeconomics.com