I expect Giga Shanghai to have lower production in Q3 because they have now enough cars in transit to Europe and Australia to enable a constant flow. Imagine you need 3 liters of water to water your plants, but your garden hose is so long that it takes 2 liters just to fill up the hose. Therefore you would use 5 liters the first time and only 3 liters each time after that. Europe plus Australia sales are around 100K per quarter. The number of cars in transit to and within Europe & Australia at any given time is around 58K. It's not a small number. This used to be close to zero when Tesla didn't care about a constant flow but was OK with delivering 85-90% of cars in the third month of the quarter. That doesn't work anymore. There are not enough ships, not enough employees, not enough time and it costs too much to expedite deliveries. Therefore Tesla has changed tactics.

Here is Tesla's inventory situation. It has been increasing quite a lot in the last few quarters but the increase will slow down after Q2 because there are now enough cars in transit to eliminate the quarterly delivery wave.

Inventory was equal to 15 days of supply at the end of Q1 2023 according to Tesla. See Page 6 of the

Q1 2023 shareholder letter. In the footnotes of page 6, Tesla explains the calculation from units to days of supply. I estimate that inventory will be equal to 19 days of supply at the end of Q2. We will find out the actual number when we have the Q2 shareholder letter probably on 19 July.

The increase in inventory from 15K in Q2 2022 to 114K in Q2 2023 is 99K units. These 99,000 cars came from overproduction at Giga Shanghai. That's no longer needed. Giga Shanghai can go back to producing enough cars to match sales. I hope that explains why I estimate a lower production in Q3.

@Troy many thanks for your generous sharing of data and thoughts here on TMC. What you are doing is difficult and under appreciated. It is easy-ish to pull data together at fairly high quality for one quarter. To do so repeatedly and consistently on a continuous basis is a very different matter entirely. Very well done, and many thanks, BZ.

However regarding the Shanghai issue .....

.... I do however disagree with you on what you are suggesting above, namely that Tesla will throttle Shanghai production output "to enable a constant flow" after it has mopped up any consequences of unwinding the wave.

Specifically you are suggesting:

Q1 : 218,539

Q2 : 233,453

Q3 : 208,000

Q4 : 207,000

This implies that Tesla would be leaving approximately 25,000 cars per quarter unbuilt in Shanghai in both Q3 and Q4 versus the yet-to-be-known achievable capacity from Q2-2023 of 233,453. I also see that Q3-2022 was 232,492 so this does suggest that the maximum steady state capacity for Shanghai is now at 233,000 or so. This implies that you think Tesla are prepared to leave 50,000 cars (3/Y) unbuilt during 2023 in Shanghai.

It might be that Tesla does indeed throttle capacity slightly, but if so I would expect it to be for the following reasons:

- to divert cell capacity to another facility (this has been done before by Tesla);

- to divert other component capacity to another facility (this has been done before by Tesla);

- to enable maximum focus on product quality (which I'm not sure I've directly observed before, but which would be rational);

- to better match any demand softness, i.e. to maintain a minimum gross margin for a given product mix (which they have now alluded to, but which we have yet to see in action);

On the last one we know from quarterly calls that the operating margin is now being targetted by the management team as well as the growth targets. So unless they can make cost imprvements then inevitably at some point they may need to throttle to stay at the minimum desired margin on the price/demand curve. So far we know that they are continually adjusting price to maintain full factories, and we know that cost improvements have been going on as well, so it is a multi-variable picture. But we have yet to see (in the 3/Y, to the best of my knowledge) that they have ever deliberately reduced capacity due to lack of demand at the minimum desired margin-driven price point. This may come one day given the revised statement re operating margin now being a key metric, which is why I call it out as being a possible reason for a future production throttle. But if it comes for this reason as early as Q3/Q4 I will be surprised.

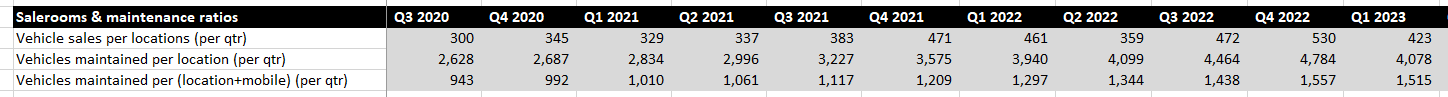

There is another potential reason which is because the remainder of the chain between production and final sale becomes constrained, i.e. the delivery chain. Noting that Fremont is also in steady state, this of course might happen because Austin/Berlin increasingly take a wedge of the available delivery capacity. However Austin/Berlin are primarily using land-based delivery and by looking at the store ratio data (as a proxy) we can observe that the land based capacity is not obviously choked:

On the sea-borne capacity the vehicle carriers are either fully dedicated to Shanghai, or only really carrying other traffic in the return direction (e.g. Berlin > Taiwan; Fremont > Japan) which is a minor detour. So I can't see that as being a real constraint, and in any case global shipping is in a soft patch so I'd of thought that some spare capacity could be acquired if needed. And in any case this ignores China domestic uptake which still seems strong enough to take an excess of 3/Y at the prices that Tesla are still comfortable with.

So .... I can't see why Tesla would want to leave those 50,000 cars (3/Y) unbuilt in Shanghai in 2023 as a planned decision. I can see why events may force that on them, but not why they might choose to go down that path for the reasons you suggest.

Unless of course the 233,000/qtr capacity is not really a true steady-state capacity, but only achievable as a burst capacity that has downside consequences in subsequent quarters.

What am I missing ?