The free color choice is definitely inventory only, and yes it does stack on top of any existing inventory discount.

Good I will reach out and unassign custom VIN. I thought existing inventory discount was discounting options but will try out.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

The free color choice is definitely inventory only, and yes it does stack on top of any existing inventory discount.

Tesla offering a $5k discount, is basically the same as offering 0% for 60 months if looking at $40k loan. They've done that recently. I know some people like to think their loan doesn't cost anything, but it's really just the dealer moving money around.Unless you're paying cash.

The primary difference is it alienates anyone not financing whereas a price discount applies to all interested buyers.

I see we have a bunch of cash folks in this thread. Apologies for my suggestion but I do think it is a good incentive as most people finance their car purchase.

I agree that dealers play games with the finances by doing whatever (e.g., extending the loan length) to lower the monthly payment. However, I do think lowering the interest rate is a smart move by Tesla as it would open up more buyers without having to lower the price of the car. Frankly, it would help the company's bottom line.RIght. Esp w/ TSLA bc/ they don't play finance "games" like some dealers do. It makes sense to lower prices. Then uou can get your own low APR from CU etc vs dealers who see it as a profit center

How does it make any difference? As I shared above, you can lower the monthly payment by lowering either the price, or finance rate. Lowering the price makes it more transparent and actually lowers the taxable amount of the vehicle. It benefits all, not just people financing.I do think lowering the interest rate is a smart move by Tesla as it would open up more buyers without having to lower the price of the car. Frankly, it would help the company's bottom line.

The quarterly reporting numbers and the metrics folks used to determine a healthy company. Keeping the price of vehicle higher is a good thing for Tesla as it shows up in their reporting through its cars net profit margin so lowering the APR (or giving out free Supercharging miles, etc.) is a better way for them to run their business than just lowering the price of their cars.How does it make any difference? As I shared above, you can lower the monthly payment by lowering either the price, or finance rate. Lowering the price makes it more transparent and actually lowers the taxable amount of the vehicle. It benefits all, not just people financing.

It would cost them money to lower the APR. I'm actually glad that Tesla doesn't play those typical dealer mind games.The quarterly reporting numbers and the metrics folks used to determine a healthy company. Keeping the price of vehicle higher is a good thing for Tesla as it shows up in their reporting through its cars net profit margin so lowering the APR (or giving out free Supercharging miles, etc.) is a better way for them to run their business than just lowering the price of their cars.

Lowering the APR isn't a dealer tactic. The dealer doesn't' control the APR, that's a banking decision. Tesla has its own finance division which allows it to control the APR it sets for buyers.It would cost them money to lower the APR. I'm actually glad that Tesla doesn't play those typical dealer mind games.

That's not strictly true. Dealers get kickbacks from banks if they fund a loan at a higher APR than necessary.Lowering the APR isn't a dealer tactic. The dealer doesn't' control the APR, that's a banking decision.

Good point. Even with that qualification my point stands that it is more financially beneficial for Tesla to lower the APR or provide other incentives (e.g., issue free Supercharging miles or color upgrades) than to lower the price of their cars. Obviously, all come with costs but the costs of the former are less "costly" (pun intended) for Tesla than reducing the net profit margin of their vehicles.That's not strictly true. Dealers get kickbacks from banks if they fund a loan at a higher APR than necessary.

For example the bank might offer a loan at 3.9% but give the dealer a $500 incentive if they get you to take 4.9%.

This is correct. I buy vehicles commercially using established lines of credit. I’ve had a couple of scummy dealerships try to mark up the rate. One even told me the finance department needed to make net profit on my sale, so he was marking up my rate 2.5%. I took his crap rate and paid off the vehicle on the first payment, resulting in a charge back and a penalty for the dealership.That's not strictly true. Dealers get kickbacks from banks if they fund a loan at a higher APR than necessary.

For example the bank might offer a loan at 3.9% but give the dealer a $500 incentive if they get you to take 4.9%.

Ignore that, prices are still the same. Was just gone for a bit.I'm waiting to buy a Model Y, holding for end of quarter sales, checking every day, did the price just go up this morning? Looks like the inventory stuff just went up around $500?

in LA there are a shortage of base grey RWD it seems, inventory gone for a couple days. No change for LR.Ignore that, prices are still the same. Was just gone for a bit.

RWD doesn’t appear to get the $7500 federal rebate now, so it would cost more than the LR. No need for Tesla to produce RWD now.in LA there are a shortage of base grey RWD it seems, inventory gone for a couple days. No change for LR.

Your probably seeing demo vehicles or ones from 2023. 2024 RWD are eligible for the rebateRWD doesn’t appear to get the $7500 federal rebate now, so it would cost more than the LR. No need for Tesla to produce RWD now.

There is the one I saw, demo car. Shows the MA $3500 rebate but nothing about the $7500 federal rebate.You’re probably seeing demo vehicles or ones from 2023. 2024 RWD are eligible for the rebate

Yes, it's a 2023 demoThere is the one I saw, demo car. Shows the MA $3500 rebate but nothing about the $7500 federal rebate.

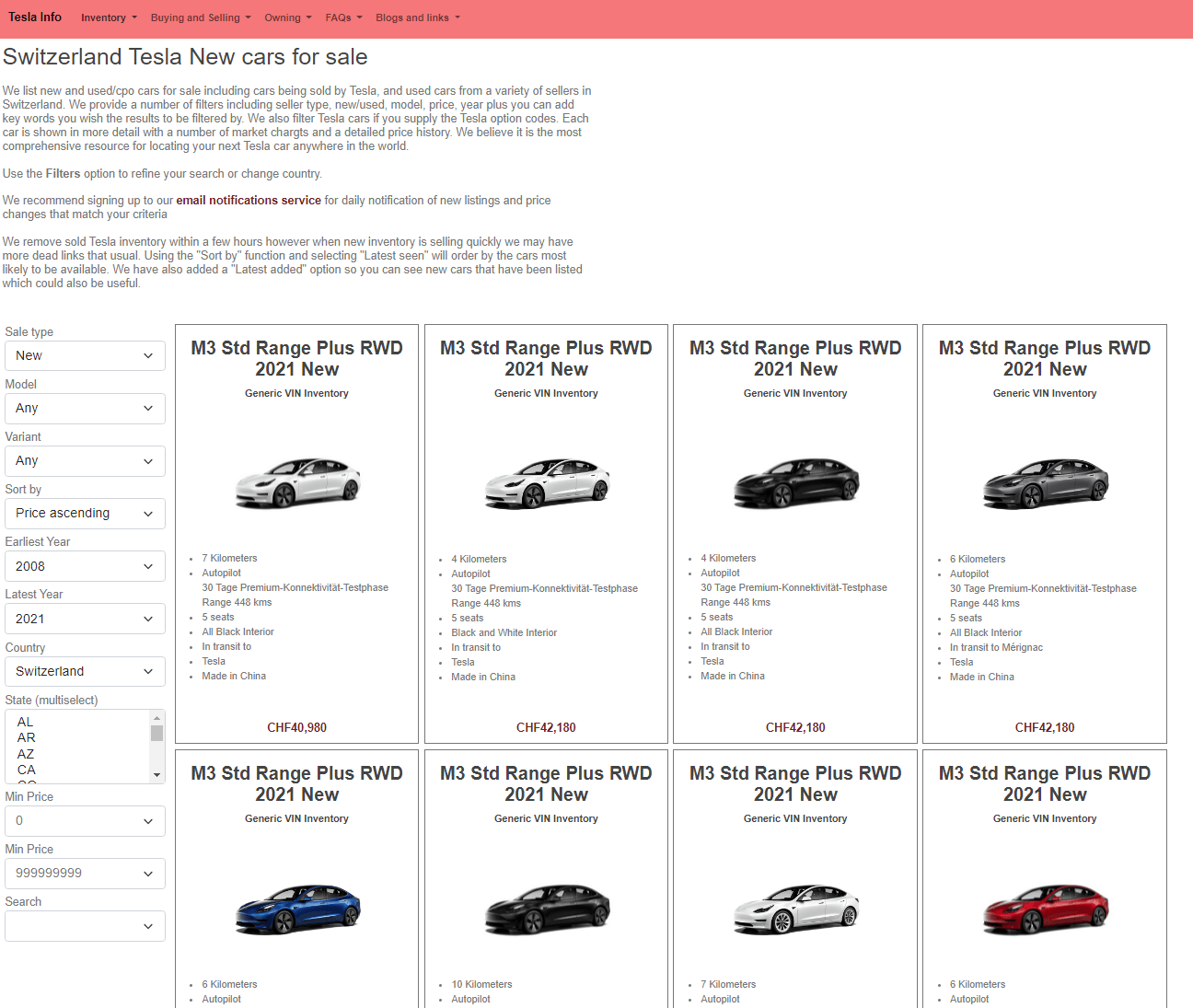

View attachment 1028107