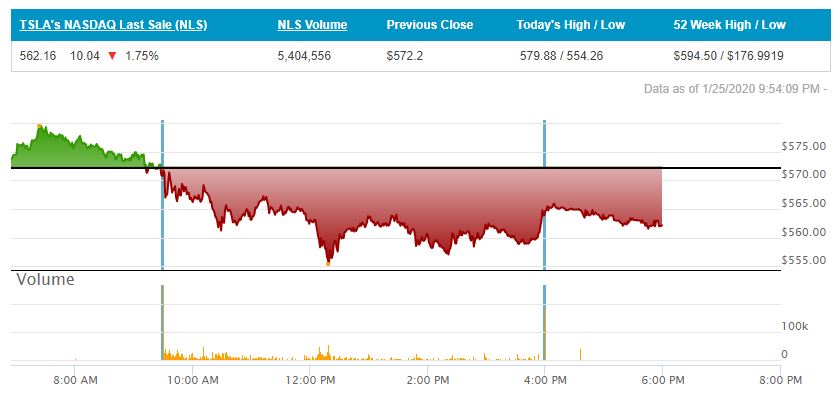

Friday began with pre-market enthusiasm towards TSLA pushing the price to near 480 before the stock began a slow descent to opening. We've seen these descents into opening become a major theme lately, and I believe they're sponsored by the hedge funds. This was, after all, an options expiration day, and the hedge funds weren't about to take it lying down. To no one's great surprise, as the macros dipped into the red, the manipulators had an easier time with their task this day. A dip to a price point of 550 would have made certain hedge funds ecstatic, and judging by the ferocious starting around noon, they were trying to get it down that far. Alas, too early a push can be problematic and TSLA never this day equalled that effort. The manipulations created quite a breathtaking array of icicles today, confirming mischief underway. About 30 minutes before close, I did indeed do some buying (remember that I had sold Wednesday morning with this plan of a Friday rebuy), and I was quite happy with the result. I was expecting the usual loading up on shares that traders do in the final 20 minutes of a Friday afternoon in order to benefit from the Monday morning buyers' exuberance, but I was blown away by the extent of the buying and its effect on the stock price during the final 20 minutes. The result was so striking that I suspect traders will amend their techniques and start buying earlier on Friday afternoons for a while. Remember that if a pattern is too obvious too many weeks in a row, it will be changed by opportunists front-running the pattern.

Considering that the NASDAQ was down nearly 1% on Friday, TSLA's dip of 1.29% was very mild. I'd normally expect about a 150% response by a tech-like stock to a NASDAQ dip.

Look at the downhill movement of TSLA in after-hours trading. Was this fear of coronavirus's affect on the market come Monday or was it yet another manipulation artifact? I checked the after-hours trading of a few tech companies for comparison. Some had no dip in after-hours trading, and some had a minor dip (noticeably less than TSLA's). With NASDAQ futures down about 1.2% on Saturday night, we could well see unhappy macros come Monday morning. That said, the combination of just 3 days to go before the TSLA ER plus the usual Monday Morning Buying Exuberance might be enough to offset it.

This week's fudster of the week award goes to Craig Irwin of Roth Capital Partners

who proclaimed on CNBC that a large part of the buying of this recent TSLA rally was likely retail investors. Here's a Tweet that brings some sanity to the subject:

This week's best supporting actor award for TMC member stripping away the BS of an analyst to the core goes to

@Leo9 for this comment:

"Adam Jonas put out a $10-500 price target on $TSLA and was still wrong."

Concerns about the economic impact of coronavirus brought the Dow down 0.58% and the NASDAQ down 0.93% on Friday. Is there a possible silver lining to the cloud for Tesla? TMC's

@printf42 thinks so

in this interesting post.

Short-sellers were tagged with 44.5% of TSLA selling on Friday. Recently I've anticipated fairly low percentage of selling by shorts on days such as Friday, even with a daily chart showing so many artifacts of manipulations. I think the hedge funds just find a way to keep their slight of hand out of the FINRA space on such a days, so as to avoid raising too much attention.

Consider, for example, that TSLA has risen $121 during the past three weeks, yet every Friday during that time has been red. Coincidence that these down days just happen to fall on options expiration days? Hardly. Today's daily trading chart was a regular tornado alley with the multiple deep dips and quick partial-recoveries that I call "icicles" and that mark manipulative bursts of selling meant to activate the algos to join in and to trip the stop-loss targets of retail longs. There's no way that a legitimate institutional investor is going to sell like that. Why push the stock price down in the most fearful manner possible if you're trying to unload a large quantity of shares at the best price?

Looking at the tech chart, you can see that Wednesday morning's close brought us to the high 560s, where we've been closing plus or minus about $5 these past three days. Bad macros could spoil this coming Monday's party, but if macros behave themselves I suspect the ole gal might have more Monday morning buyers exuberance in store for us to begin the week. Tuesday and Wednesday will be positioning for the ER and concerns about coronavirus will play some type of role in the balancing. The upper bollinger band stands at nearly 593, which makes $600 TSLA look a whole lot less daunting.

For the week, TSLA closed at 564.82, up 54.32 from last Friday's 510.50. If you include the 173.61 gains from the previous 6 weeks, TSLA is now up 227.93 in 7 weeks. I'm glad I'm still riding this train. Enjoy your weekend.

Conditions:

* Dow down 170 (0.58%)

* NASDAQ down 98 (0.93%)

* TSLA 564.82, down 7.38 (1.29%)

* TSLA volume 14.4M shares

* Oil 54.19 (on 1/25)

* Percent of TSLA selling tagged to shorts: 44.5%