Did the same, tomorrow!Why doesn't she tell us beforehand thenis the dark pool number for tomorrow already there?

Today's buy/resell calls didn't go as planned, let's see what tomorrow brings...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

The numbers are too close for comfort. Hopefully his last report on the 31st is 425,000+.

EVNow

Well-Known Member

That 420k analyst consensus hasn’t moved in sometime… so, what’s the whisper number ?The numbers are too close for comfort. Hopefully his last report on the 31st is 425,000+.

View attachment 922334

All news point to a beat … except perhaps

- incentives for S/X

- EU incentives for 3/Y in loot box

I don’t think a small miss or beat will move SP much (except for P&D speculators leaving)

SpeedyEddy

Active Member

Thank y’all for blasting off the dude:  -warming

-warming

will stay as long as you like my contributions

will stay as long as you like my contributions

@dl003 what do you make of the TSLA action the past couple days, is it running out of steam or we still have a shot at 210 in the short term before dump to 140’s?

In the broadest of sense, we still have a shot. Im just not seeing a path without some surprises on the fundamental front.@dl003 what do you make of the TSLA action the past couple days, is it running out of steam or we still have a shot at 210 in the short term before dump to 140’s?

In the broadest of sense, we still have a shot. Im just not seeing a path without some surprises on the fundamental front.

Are you playing anything or sitting out?

R

ReddyLeaf

Guest

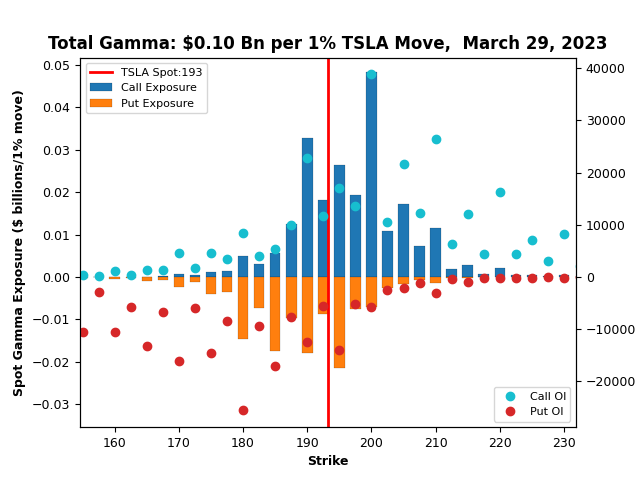

We closed above yesterday’s predicted $187.36 support, that’s good news (otherwise $140s could be tested), so still in “the channel.”I really need to be paying more attention to Wicked Stocks. His predictions are on both up and down sides, but once the trading direction is known (up or down), the limits that he describes are almost always good turn around targets. For example, last night’s prediction for today was support at a $187.36 descending speed line. The SP came within a few cents of that number twice, with reversal. Then, just a few minutes ago during the lunch hour (hmmmm), the price broke through, with a gap down. Clearly day traders are using these TA levels. Unfortunately, closing below $187.36 suggest more pain down to the $180.62 rising speed line. Perhaps the options sellers don’t want those minuscule number of excess 190 calls paid out this week (13888 call OI vs 13025 put OI this AM).

View attachment 922203

View attachment 922231

Wicked Stocks predictions for Wednesday, Mar 29th: $186.24 pivot point, $182.06 weekly support, $196.36 weekly resistance. Closing above $186.24 again still keeps us in the same channel. He still seems bullish, though not as confident as a last week.

EVNow

Well-Known Member

Some of these support/resistence levels are pretty good. Daily trader had the support at 185.60 .... guess what today low was. Even when the market was going down SP bounced off 185.50.We closed above yesterday’s predicted $187.36 support, that’s good news (otherwise $140s could be tested), so still in “the channel.”

Wicked Stocks predictions for Wednesday, Mar 29th: $186.24 pivot point, $182.06 weekly support, $196.36 weekly resistance. Closing above $186.24 again still keeps us in the same channel. He still seems bullish, though not as confident as a last week.

Other thing to watch out for is 20/50/200 average support. I know a lot of dealers follow that and invariably those provide support/resistance.

SpeedyEddy

Active Member

Today, again SPY daily options might lead TSLA, because the OI is very low, so I think opening can be either way and Option traders will wait to come in selling* C and P options around whatever SPY is at the moment around 10:00 EST and adjust on macro moves.

So fireworks only in the first and last half hour again?

* I think SPY daily options is a selling market more than a buying market of a few big players that are capable of reeling in max premium by manipulating during the day. Mostly successful (succes:fail about 5:1). They only stay away more on 3rd fridays, because the stakes are too high.

So fireworks only in the first and last half hour again?

* I think SPY daily options is a selling market more than a buying market of a few big players that are capable of reeling in max premium by manipulating during the day. Mostly successful (succes:fail about 5:1). They only stay away more on 3rd fridays, because the stakes are too high.

Last edited:

intelligator

Active Member

Today, again SPY daily options might lead TSLA, because the OI is very low

Are you subscribed to OI or updated quotes before market open?

SpeedyEddy

Active Member

Are you subscribed to OI or updated quotes before market open?

No but you always can see on MaxPain what EOD OI is and there is no after hours or premarket option trading

I know I swore off BPSs for life, but thinking about -170/+155 for Friday depending on premiums after the open. I can’t see us dropping there with P&D this weekend. Also hoping to sell new CC for Friday on opening bounce. Would like to stay above 210 just in case FOMO kicks in.

I got a hit this AM on 6Apr$210 at $2.75, +40% from Tuesday’s close.Why doesn't she tell us beforehand thenis the dark pool number for tomorrow already there?

Today's buy/resell calls didn't go as planned, let's see what tomorrow brings...

I closed a couple -210C/Mar31 yesterday for 90% profit, thinking FOMO may kick in leading up to P&D. On the bounce this morning, opened a -202.5C/Mar31 for $1.Would like to stay above 210 just in case FOMO kicks in.

intelligator

Active Member

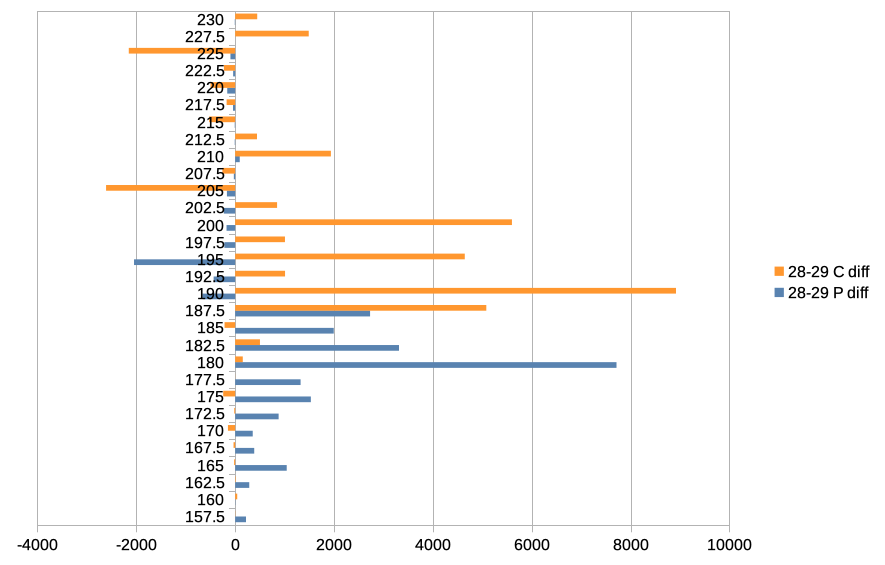

OI shift increased at C190 (+8919) and P180 (+7716). This is based on closing quote data on the 28th and the release of the delayed quotes at 9:45 am this morning, the 29th. The range I chose was for readability...

Rolled 20 x p175 3/31 to 20 x p180 4/6 for a net premium of $2.65. Yesterday I could have done the same without raising the strike, but I didn't pull the trigger because it was only Tuesday. I just now realized we have one less trading day next week. I'm feeling positive about P&D, so I think the 5 point higher strike is not a big issue (not advice).

Edit: hmm, that was some bad timing. Who pulled the plug?

Edit: hmm, that was some bad timing. Who pulled the plug?

SpeedyEddy

Active Member

Without elaborating again a lot in the future, because you know my drill I will use a more acronymic style of calling my SPY-daily-options-related expectations for TSLA SP intraday.

first the current levels, then max pain or trading levels options D(ay)/W(eek)/M(onto), then concluding expected move (may vary during trading session!!) and then explain other factors

[TSLA 193 above W max pain] [SPY 400 above D max pain, but little OI so trading levels will become key: 399.5! No move, watch macro, will update] [later SP could a bit to correct if other SPY-stock catches up with the big names. Then MM's possibly will manipulate $TSLA down]

a bit to correct if other SPY-stock catches up with the big names. Then MM's possibly will manipulate $TSLA down]

So based on this analysis I sold part of the stock $194.78 to buy back any dip (In Holland we do not have tax on trade-profits, but only on holdings per jan 1. So trading is interesting, gross profit=net profit. Will change in 2027 or later. I tell, because you don't have to worry about tax (harvesting, capital gains) effects

first the current levels, then max pain or trading levels options D(ay)/W(eek)/M(onto), then concluding expected move (may vary during trading session!!) and then explain other factors

[TSLA 193 above W max pain] [SPY 400 above D max pain, but little OI so trading levels will become key: 399.5! No move, watch macro, will update] [later SP could

So based on this analysis I sold part of the stock $194.78 to buy back any dip (In Holland we do not have tax on trade-profits, but only on holdings per jan 1. So trading is interesting, gross profit=net profit. Will change in 2027 or later. I tell, because you don't have to worry about tax (harvesting, capital gains) effects

SpeedyEddy

Active Member

SpeedyEddy

Active Member

TA-wise: Another Gap-up today, so there are lots of reasons to look down the coming weeks, Will it be P&D or ER?

[Edit]. But closely watch today's Gap-up. If closed, we might see like yesterday a rise into the close again. If broken, technically 183 and a bit could be next[/Edit]

[Edit]. But closely watch today's Gap-up. If closed, we might see like yesterday a rise into the close again. If broken, technically 183 and a bit could be next[/Edit]

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K