The entire post which you quoted was the reason.Can you please explain why you are biased towards TSLA and market going down from here?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

SpeedyEddy

Active Member

And another Gap-up to be filled.. Option-wise we could see a brake-move ultimately around $202.5 and maybe drop just below 200*. But we are surely getting into risk-off-territory, maybe all of april if (as I expect) EPS across the board will not be hit as much as people think. And then the FED will have to go strong on another hike early may. You know what the saying about may is. That will be very true in the case of another hike.

(World-scale incidents not included. Maybe somebody little but big will be found under an open window on square that has a name like the color of the fluid pouring out of his nose... Or the strait named after a country gets filled with boats of a country that is having a tantrum about the other country just being one of its own provinces.)

*I would like to earn a few bucks, trading out and in on that one.

(World-scale incidents not included. Maybe somebody little but big will be found under an open window on square that has a name like the color of the fluid pouring out of his nose... Or the strait named after a country gets filled with boats of a country that is having a tantrum about the other country just being one of its own provinces.)

*I would like to earn a few bucks, trading out and in on that one.

intelligator

Active Member

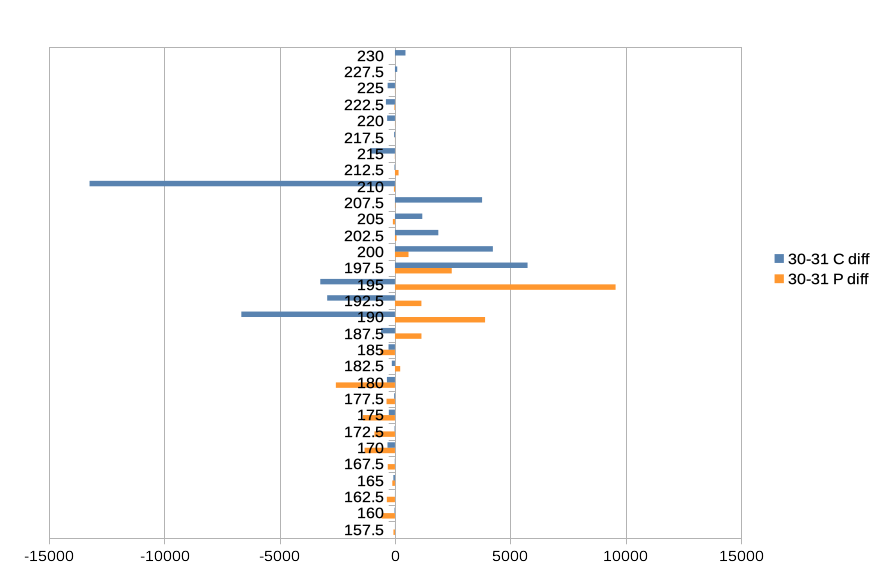

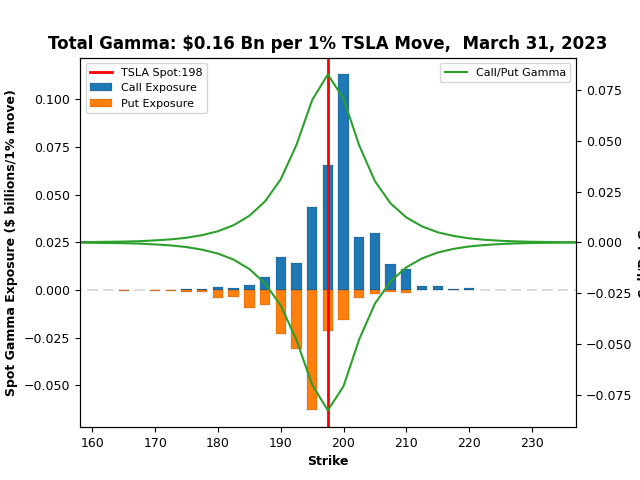

OI shift 30th to 31st ... P195 increased by 9568 , C210 decreased by 13241 ... gamma peak 197.45 - GLTA.

EDIT: Same thoughts @SpeedyEddy , we cross posted

EDIT: Same thoughts @SpeedyEddy , we cross posted

Last edited:

SpeedyEddy

Active Member

0DTE SPY update (yesterday's call was spot on, let's see if I can hit it again)

[SPY 405.60 D(aily)trading= indicating this is it, for the day, but a lot at stake, big OI (so in fact W(eekly))-wise, pointing 5 points lower]

[TSLA 199 D trading =indicating for this to stay, low OI, so MAxPain 192,50 will be overruled by trades of today.]

Conclusion for $TSLA is horizontal from here (199) like yesterday until close. No buying the rumour, so P&D from sunday will have a huge effect monday. If Deliveries much higher or lower than 420.000 or increasing Inventory will push back SP and 200 will not be taken out, unless Deliveries >425.000. Deliveries > 430.000 will end the sub $200's for longer then last time.

[Edit] Did not see @intelligator 's post before sending this, nice to see the similarities[/Edit]

[SPY 405.60 D(aily)trading= indicating this is it, for the day, but a lot at stake, big OI (so in fact W(eekly))-wise, pointing 5 points lower]

[TSLA 199 D trading =indicating for this to stay, low OI, so MAxPain 192,50 will be overruled by trades of today.]

Conclusion for $TSLA is horizontal from here (199) like yesterday until close. No buying the rumour, so P&D from sunday will have a huge effect monday. If Deliveries much higher or lower than 420.000 or increasing Inventory will push back SP and 200 will not be taken out, unless Deliveries >425.000. Deliveries > 430.000 will end the sub $200's for longer then last time.

[Edit] Did not see @intelligator 's post before sending this, nice to see the similarities[/Edit]

SpeedyEddy

Active Member

Is there an online calendar for Tesla events?

Tesla Investor Relations

Tesla's mission is to accelerate the world's transition to sustainable energy. Today, Tesla builds not only all-electric vehicles but also infinitely scalable clean energy generation and storage products.

CrunchyJello

Member

Tesla Investor Relations

Tesla's mission is to accelerate the world's transition to sustainable energy. Today, Tesla builds not only all-electric vehicles but also infinitely scalable clean energy generation and storage products.ir.tesla.com

Muchos gracias!

SpeedyEddy

Active Member

0DTE update: SPY running above 405 and $TSLA above 201, will be too costly, I guess, so somewhere today (They maybe will let it run until the afternoon) there would be some pressure on $TSLA Optionswise. (so my prior post is still intact. SPY preferably below 405 TSLA around 199 at close.

My hand is already touching the temporary-sell-button to at least make up for my little wednesday-evening mistake. After correcting that I will surely be back fully stacked tonight. I follow @dl003 's earlier green arrow.

My hand is already touching the temporary-sell-button to at least make up for my little wednesday-evening mistake. After correcting that I will surely be back fully stacked tonight. I follow @dl003 's earlier green arrow.

SpeedyEddy

Active Member

Why stop at $202.50? because that is the last Gap-down of march 2nd.

Expect it to be filled today and then it's all in P&D, what is to happen next. If filled and P&D is bad, there is nothing left to hold the other scenario from unfolding and my rolled -P 170's for next week are in dangerous territory (compensated fully by my -C250's)

Expect it to be filled today and then it's all in P&D, what is to happen next. If filled and P&D is bad, there is nothing left to hold the other scenario from unfolding and my rolled -P 170's for next week are in dangerous territory (compensated fully by my -C250's)

Last edited:

I'm going to load some cheap (BTO) Puts sometime today for the after P&D drop - something in the $1.25 range

Also looking to sell some $215's for next week for $2.50 each to pay for the Puts and have some extra.

Good luck to all and happy P&D!

Also looking to sell some $215's for next week for $2.50 each to pay for the Puts and have some extra.

Good luck to all and happy P&D!

You expect a drop, really? I'm thinking the opposite given that deliveries have looked impressive, we will see!I'm going to load some cheap (BTO) Puts sometime today for the after P&D drop - something in the $1.25 range

Also looking to sell some $215's for next week for $2.50 each to pay for the Puts and have some extra.

Good luck to all and happy P&D!

Earlier BTC 20x -p190 @$0.1 (net +$5.7), now I can focus on the impulsive -c195's... I expect we'll see a push-down back below $200 at some point, then I'll be selling puts for next week too...

Normally I'd roll those calls to July, but maybe I'll take them a week out on the same strike as a small hedge... there's +$4 in the premium so not too bad...

You expect a drop, really? I'm thinking the opposite given that deliveries have looked impressive, we will see!

Earlier BTC 20x -p190 @$0.1 (net +$5.7), now I can focus on the impulsive -c195's... I expect we'll see a push-down back below $200 at some point, then I'll be selling puts for next week too...

Normally I'd roll those calls to July, but maybe I'll take them a week out on the same strike as a small hedge... there's +$4 in the premium so not too bad...

I think that's what will propel us down (all my opinion, not financial advice) is that P&D will be good.

I'm looking at -

445k Production

418k delivered

Still a record, but this will cause a sell the news, and everyone to jump on TSLA because questions about margins can now be assumed, and they will assume low.

Consensus right now is $0.85 a share EPS (I think this will get smashed and come in just above $1 EPS)

Everyone is banging on the margin drum and deliveries of less than 430k will send us down.

Over 440k is the only way I see us gapping up.

Again, just my opinion, but more often than not - sell the news.

R

ReddyLeaf

Guest

Today’s run up is going just like I predicted (caused by sustained ETF buying so they can show TSLA ownership by EOQ in their reporting). Unfortunately, I thought the 200 call wall would hold and, therefore, earlier in the week, sold -c200s at $0.75 and -c205s/+c215s at $0.25 (part of IC). Ooops. Just rolled to 4/6 -c215s for $0.70 and closed the -c205s/+c215s, for just a little small profit. The extra premium from the +p180s/-p190s was more than enough to compensate. All out for this week, trying to decide if I should sell BPS, BCS, ICs, or nothing for next week. Hmmmmmmm.

SpeedyEddy

Active Member

Like a knife through butter… MM ‘s will be scratching their heads, expensive lunch… mmmm what now?Why stop at $202.50? because that is the last Gap-down of march 2nd.

Expect it to be filled today and then it's all in P&D, what is to happen next. If filled and P&D is bad, there is nothing left to hold the other scenario from unfolding and my rolled -P 170's for next week ar in dangerous territory (compensated fully by my -C250's)

EVNow

Well-Known Member

MMs don't care. They are fully delta hedged.Like a knife through butter… MM ‘s will be scratching their heads, expensive lunch… mmmm what now?

Hedge funds and other Wall St operators OTOH ... are usually not fully hedged.

juanmedina

Active Member

I am all in on $215's and $220's for next week. Take my shares  .

.

SpeedyEddy

Active Member

Lot of work to stop MM's (Or Wall street operator's?) damage on all of these options running in the money, did not think this would happen running into the weekend, but it can become a bloodbath if a short squeeze will be triggered. Volume still far too low for that to be called.

Interesting. I (really) have a party tonight (over here it is 18:38) and have to look on my phone a few times for sure...

Interesting. I (really) have a party tonight (over here it is 18:38) and have to look on my phone a few times for sure...

Last edited:

Risky.I am all in on $215's and $220's for next week. Take my shares.

We are at an important level. 203 is where the daily trend flips from bear to bull and 206 is where the retracement of the 217-164 drop should end, meaning any higher and we're more likely talking about a new rally instead of just a retracement (dead cat bounce). Anyone with enough money to buy and hold TSLA at this level by EOD today will most likely run it up further next week, ie P&D will be a "beat." Market posturing is clear now; it is bullish going into Monday. I'd at least wait for EOD to sell calls.

I closed 2/3 of my 235CC's for next week at close to break even. Sold some 185P's. Sure there will likely be a sell the news event but it will be sold from a higher price than we are at right now, if we close today around this level.

Last edited:

Normally I would have sold some calls after such a run-up, but with P&D coming up I’m not taking any chances, no matter how enticing the premiums are for just four trading days. The last time that I sold calls in front of an event - earnings in January - I burned my fingers. I’m not going to be greedy.

On the other hand, it could be an example of "buy the rumor, sell the news". If I check the premiums April for C220 and 225, they seem to me still attractive.Normally I would have sold some calls after such a run-up, but with P&D coming up I’m not taking any chances, no matter how enticing the premiums are for just four trading days. The last time that I sold calls in front of an event - earnings in January - I burned my fingers. I’m not going to be greedy.

on the SPY front, the daily trend has also flipped to bullish and so I'm not going to worry about a rug pull until we're at 410-411, which could come by Wednesday next week, if we close over 405 today.

I know it may seem crazy, but if SPY loses 405 and TSLA 200 by EOD today, that'll be very concerning.

I know it may seem crazy, but if SPY loses 405 and TSLA 200 by EOD today, that'll be very concerning.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K