The FAQ is a work in progress but the Glossary should help: Wiki - Options & "the Wheel" Glossary and FAQOK, how do I learn to figure out if people are talking about bull or bear call or put spreads? All I see is BPS and BCS over and over. I know one gives you a credit and the other doesn’t but is there something I am missing in the acronyms to be able to read faster?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Thanks for that!The FAQ is a work in progress but the Glossary should help: Wiki - Options & "the Wheel" Glossary and FAQ

So a B is always bear for calls and bull for puts?

What would a Bull Call Spread be called?

Off topicThanks for that!

So a B is always bear for calls and bull for puts?

What would a Bull Call Spread be called?

AquaY

Member

I don't know when you sold those 40 X BCS (-1000/+1100) so I don't know how conservative they were at the time . You can't go by the premium to judge that. You need to look at IV probability, Delta and macros to judge I think.This week 40 X BCS (-1000/+1100) pretty much rip all of the income I generated from BCS/BPS (since I started trying few weeks ago), as well as all covered call premium I generated this before trying BCS/BPS.

Usually I only sell BCS on Tue/Wed for the same week expiry because I want to see how price action goes first, then pick a OTM strike with $1 premium. However, last thursday/friday I saw the premium of -1000/+1100 can generate $1 premium and there's no way the SP can shoot over 10% this week esp 900 was the previous ATH and there have been no pull back after ER so I pulled the trigger. (The BPS premium was so bad as I tend to choose a safe strike <700, so I opened more BCS instead)

I have read comments here before and need to roll to the following week (max strike even no credit) when SP starts getting close to short leg (and last chance to roll is before the SP hits the mid-point of the spread). On Monday I started getting nervous when the SP gets over 980 but still strongly believe it won't hit 1000 as this must be the magic number if not 900. After it hits 1000 and keep on going, I was extremely nervous but still decide not to do anything because my experience told me this extremely strong momentum in one day will not last and would pull back later in the week, and also the BollingBand / RSI shows extremely overbought and never see this high number before (my original plan was to wait until thursday/friday to close so the cost of closing is much less if the price stays in low 1000). Yesterday I saw the pre-market is also getting pull back so I believe I was right. I was still a firm believer until I saw the price keeps going after the market open and it run to 1050->60>70>80->90. At that moment I was totally shocked and not sure what to do. And thus when the SP started dropping to 1050->40->30->20->10, then I close all my BCS immediately at each interval instead of rolling as I thought it won't help much to roll to next week anyway because the strike won't improve much at all. After closing all BCS, I then sell BCS -1200/+1300 for around $1-1.5 when SP gradually jumped back to 1020->30->40

I have been extremely conservative since I started playing BCS/BPS and chose only far OTM strike (eg. around $1-1.5 premium/contract). This is really painful and I wanna try to avoid this from happening ever again. I am confused about few things:

1) Should I choose the strike more aggressively every week to overcome the failure like this week? I was very conservative so the premium I generated each week was only $1-1.5/spread and one massive hit like this week has already wiped everything.

Going more aggressive, because of a loss is what gamblers do in the casino The bad ones.

Rethinking your strategy is a good idea but don't make any rash decisions.

Some say by being more aggressive you can build up a cushion to absorb negative events but then wouldn't your position have been more aggressive and you would have taken a bigger hit?

If you decide to become 20% more aggressive then your loss yesterday would have been 20% higher wiping you out just the same possibly.

This rally was amazing. Something that happens once a year or less.

I'm unsure of how to answer your questions except for this:2) To look back, one effective solution is to close the short leg immediately and let the long leg keep running in order to minimize the loss. However, we are no psychic and it may hurt even more.

3) I am amazed about how Yoona save his position with 0 net loss but I am also confused about the steps Yoona did

4) At the end of the day,

a) would it be better to wait (and do nothing until later in the week), or

b) just to follow the rule and roll the position to next week immediately (for max strike and no credit) before SP hit the short leg (eg. if short leg is 1000, we roll immediately when SP hits 995)? And if SP continues to hit the new short leg already for next week, we roll immediately again to the following week?, or

c) Take the loss as early as possible? (if so, how early?)

5) I am still thinking how to recoup some of my loss this week....

It's good to rethink strategies and to know what questions you need to find answers to.

@Yoona posted a little while back a list of her rules to stay out of trouble. Look back and try and find that.

Also, she listed in another post links to managing credit spreads.

There is a wealth of info on the internet. Many good videos explaining different strategies to take.

I'd suggest you dedicate some time to study them and learn so you can understand for example how she got out of her particular situation

Just my 2 cents.

Now, I have to figure out how to manage my 980 puts for this week

I do have a thought as well about compounding the cash being used on spreads. The closer we are to using all of the cash on spreads, the more that we do not want to compound. The problem with putting all the new cash to work in a larger and larger spread count (position size), is that one bad week / one max loss, and you just wiped yourself out (except for the premium). This is .. bad.

I agree with the risk of putting ‘all’ proceeds at risk.

On the other hand, if you use say 50% of available cash or margin on spreads, and you put your proceeds back into increasing your cash or margin, it is compounding but you’re still only putting half your total at risk, and the half that would remain after a max loss keeps growing.

Another option would be to put half the proceeds into compounding and take half out to do something else with (living expenses or tax bill set aside or buy some real estate or whatever), and then if a max loss occurs at least you still have everything you previously took out.

I just think there’s usable grey area between not compounding at all and putting everything at risk every week.

tradenewbie

Member

Thanks, definitely need sometimes to digest, but I guess timing is very important.my pre-hertz IC was suddenly -526% and still dropping fast

when faced with a huge loss, my fave/normal 1st reaction is to press the nuke button (ie take the loss and move on)

but i remembered that 3-4? times in the last 2? months, Mondays gave a false head fake (ie the week is too early and this may be a temporary problem)

so i decided not to nuke

in summary, i

1) moved my IC to next week; the goal is to give me more time to fix the problem

2) adjusted the bcs higher (from -c1000 to -c1020); the goal is not to make $ but to get out of the way

3) adjusted the bps higher (from -p800 to -p850); the goal is to make $

4) added more bps (-p850); i felt this was ok since 20% OTM

5) added more bcs but at higher strike (-c1100); this is the riskiest move since only 10% OTM

6) added more bcs but at higher strike (-c1300); i felt this was ok since 30% OTM

7) used all the credits in #3-6 to close the -c1020 bcs of #2

the new 11/5 IC is 10-30% OTM with better range; layered bcs is heavier than bps because all the good prems are on the call side

depending on the sp move, gradually make the IC range narrower to squeeze out more credit

10/29 -c1300 CC will refund me the commissions/fees

Regarding moving the IC and adjust the bcs higher to next week(from -c1000 to -c1020), did you do it on Monday or Tuesday? And at around what price when you did it since you also improved your strike by $20?

tradenewbie

Member

Thanks. To answer you question:I don't know when you sold those 40 X BCS (-1000/+1100) so I don't know how conservative they were at the time . You can't go by the premium to judge that. You need to look at IV probability, Delta and macros to judge I think.

Going more aggressive, because of a loss is what gamblers do in the casino The bad ones.

Rethinking your strategy is a good idea but don't make any rash decisions.

Some say by being more aggressive you can build up a cushion to absorb negative events but then wouldn't your position have been more aggressive and you would have taken a bigger hit?

If you decide to become 20% more aggressive then your loss yesterday would have been 20% higher wiping you out just the same possibly.

This rally was amazing. Something that happens once a year or less.

- I sold the BCS (-1000/+1100) last thursday and friday. (usually I sold BCS on Monday/Tue on the same week expiry, but I was expecting there would be some sort of pull back this week since last week has none, and was thinking it won't go too far away from 900 even if it bounce from pullback, that's why I sold last thursday/friday instead of this week...)

- Agree on the gamblers part, and I was way too conservative (usually -650/+550, -680/+580) since I started BPS, that's why I am thinking I should be more aggressive (or I mean less conservative).

jeewee3000

Active Member

Absolutely.I agree with the risk of putting ‘all’ proceeds at risk.

On the other hand, if you use say 50% of available cash or margin on spreads, and you put your proceeds back into increasing your cash or margin, it is compounding but you’re still only putting half your total at risk, and the half that would remain after a max loss keeps growing.

Another option would be to put half the proceeds into compounding and take half out to do something else with (living expenses or tax bill set aside or buy some real estate or whatever), and then if a max loss occurs at least you still have everything you previously took out.

I just think there’s usable grey area between not compounding at all and putting everything at risk every week.

How much % of available cash I sell spreads against is not fixed but is correlated with my conviction of the chosen strikes. If the stock price were to drop 20% for example, I'd be inclined to sell more BPS at more agressive strikes. Now we are trading near the top of the current channel so selling calls or BCS (but I prefer cc's currently) lies more in my comfort zone than BPS.

I'm holding some 10/29 -850/+800 BPS since that is what I deem truly safe. Still holding out on selling BPS for next week, awaiting a dip or at least signs of a hard floor.

PastorDave

Member

I tend to agree. From the options OI chart, it looks to me like the ideal MM price right now is just above 1030 (the crossover point) to just below 1050:Just looked into this. By my calculation, the gamma expiring this week is closer to 20% now. Haven't looked back how this compares to historical numbers, but that doesn't seem unusually high.

I do agree that a good chunk of the ownership today is coming from options. These numbers (172 million as of close) are a good bit higher than the highs we have seen in the run up to 900 in early q1 in the page I track here.

There are 2 counter points though. A lot of this exposure is coming from farther dated options (22 and beyond) which is a good thing. Secondly I suspect there's more spread trading going in Tesla than a year ago, significantly inflating this metric.

So I am leaning towards a hypothesis that there are unlikely to be sharp drops, unless there's a sudden dump from Elon, which seems improbable.

Time will tell. I am light on all BPS with only a 860 short for this week.

Lo and behold, we're trading right above 1030 in the premarket immediately after OI data is released. (run up from 1018ish starting at exactly 7am)

The OI for calls is only at 334k, which is in the normal range. If there's a gamma squeeze, I think it's not a significant one. 60M shares traded two days in a row looks more like institutional FOMO to me. I think after Friday it was obvious to anyone we were going to 1000, so anything under that was a no-brainer. To me, it looks like we've found the floor around these levels, and it's not impossible we go higher from here soon once that floor is clearly established.

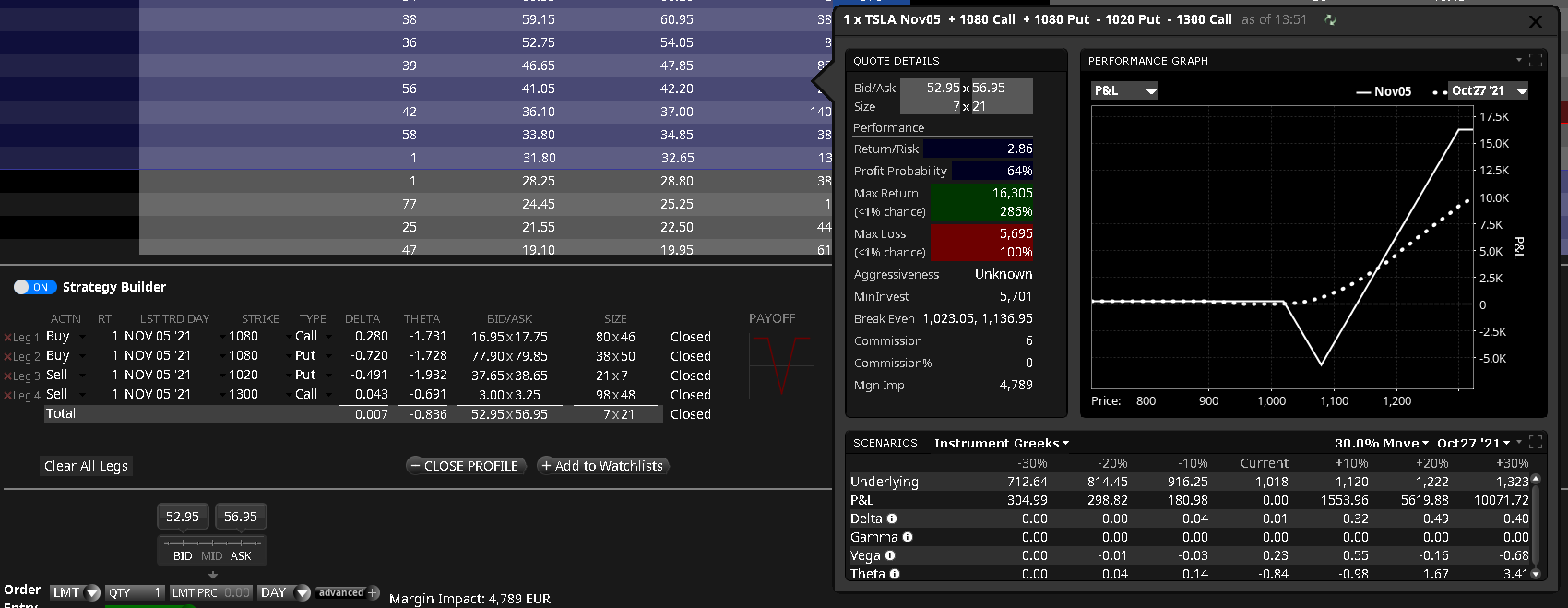

I did a bit of theory-crafting ..

Premise: SP will be volatile & either crash or breakout furter.

This strategy pays if we break out a lot more to the upside, but did everything to limit the downside. Losses due to theta won't accumulate before tuesday next week. This is a very low margin-strategy (basically you have to pay upfront & that is the max you can loose).

If SP trends upwards further, then one can close anytime for a gain. Profit is limited above 1300 next week.

I thought this would be something different then the usual BPS, IC, etc.

You can also play it reverse (called broken wing butterfly then iirc. Edit: ratio butterfly or "skip strike"-butterfly. Broken wing is when you dont buy protection to one side.). Just think about the P/L-Chart as mirrored in both axis. Like 5k if SP stays in the "break-even"-range, 16k downside under 900 (or so), small gain on the upside.

Why would one want to play that one? Well.. if SP moves up, you can raise the "losing side" for cheap & make it a freefly. (More info/example: How to Lock in Profits with Broken Wing Butterflies - have just skimmed it after a quick google-search).

Premise: SP will be volatile & either crash or breakout furter.

This strategy pays if we break out a lot more to the upside, but did everything to limit the downside. Losses due to theta won't accumulate before tuesday next week. This is a very low margin-strategy (basically you have to pay upfront & that is the max you can loose).

If SP trends upwards further, then one can close anytime for a gain. Profit is limited above 1300 next week.

I thought this would be something different then the usual BPS, IC, etc.

You can also play it reverse (

Why would one want to play that one? Well.. if SP moves up, you can raise the "losing side" for cheap & make it a freefly. (More info/example: How to Lock in Profits with Broken Wing Butterflies - have just skimmed it after a quick google-search).

AquaY

Member

I was thinking the exact same thing and why i didn't sell many BPS at the end of last week as I would normally do for this week.Thanks. To answer you question:

- I sold the BCS (-1000/+1100) last thursday and friday. (usually I sold BCS on Monday/Tue on the same week expiry, but I was expecting there would be some sort of pull back this week since last week has none, and was thinking it won't go too far away from 900 even if it bounce from pullback, that's why I sold last thursday/friday instead of this week...)

- Agree on the gamblers part, and I was way too conservative (usually -650/+550, -680/+580) since I started BPS, that's why I am thinking I should be more aggressive (or I mean less conservative).

After this week, ShitCall has taken on a new meaning for me. Wiki - Options & "the Wheel" Glossary and FAQ

Tslynk67

Well-Known Member

I'm thinking to setup for next week... very conservative IC is on my mind, something like 700/800 1200/1300

I note that the call premiums 20% out are worse than the puts, which I find surprising

My goal is ~1% portfolio only for a bit, until things settle

I must admit that I'm more worried about the upside than down

Edit: or maybe just stick to BPS, or even good old naked puts for some weeks

Answers on a postcard to the usual address...

I note that the call premiums 20% out are worse than the puts, which I find surprising

My goal is ~1% portfolio only for a bit, until things settle

I must admit that I'm more worried about the upside than down

Edit: or maybe just stick to BPS, or even good old naked puts for some weeks

Answers on a postcard to the usual address...

Last edited:

InTheShadows

Active Member

Sold 100 shares with a trail stop of 8.10 yesterday during the spike.

Didn’t do anything else. However on reflection last night comparing my account values after close to what they were during the spike nearly all of the fluctuation came from my leaps.

Reading through everyone’s post here, particularly with the call side woes, I started to think of how I could manage to capture some of these spikes and make them more permanent.

What I came up with, for my tax sheltered accounts only. Next time we get something that starts looking like the top is blowing off to sell LCC that are fairly aggressive. So around the time I entered the order to sell my shares (30 min before the sell off) sell weekly 1150 or 1200 calls. That would capture some extra high gamma premium and in my tax sheltered accounts, I’m ok with those calls being sold at that price and then waiting for things to resettle and buy them back, or look for some other leaps to buy.

The shares I sold were part of the plan I made over the weekend to convert some shares to leaps and also leave some more cash for selling BPS.

If we get another spike today, (and I’m not in a meeting where I can watch the ticker) I’m going to test this LCC concept with one contract.

All of my BPS should trigger today with their GTC 80% orders. I am not sure how I’m going to roll with next week. I touched a goal I set for the end of next April yesterday during the spike so I might take a week off from selling.

Didn’t do anything else. However on reflection last night comparing my account values after close to what they were during the spike nearly all of the fluctuation came from my leaps.

Reading through everyone’s post here, particularly with the call side woes, I started to think of how I could manage to capture some of these spikes and make them more permanent.

What I came up with, for my tax sheltered accounts only. Next time we get something that starts looking like the top is blowing off to sell LCC that are fairly aggressive. So around the time I entered the order to sell my shares (30 min before the sell off) sell weekly 1150 or 1200 calls. That would capture some extra high gamma premium and in my tax sheltered accounts, I’m ok with those calls being sold at that price and then waiting for things to resettle and buy them back, or look for some other leaps to buy.

The shares I sold were part of the plan I made over the weekend to convert some shares to leaps and also leave some more cash for selling BPS.

If we get another spike today, (and I’m not in a meeting where I can watch the ticker) I’m going to test this LCC concept with one contract.

All of my BPS should trigger today with their GTC 80% orders. I am not sure how I’m going to roll with next week. I touched a goal I set for the end of next April yesterday during the spike so I might take a week off from selling.

scubastevo80

Member

Do you guys have any basic options strategies to generate income for those of us with limited cash ($10-25k)? I'm trying to help my parents put excess money to work and I'm limited in my own accounts from trading TSLA or related derivatives.

sold Jan 20 ATM PUTS for ~100, 10% gains. Risk is will get the shares

Past 3 weeks, I got decent (3-5%) gains on weekly BPS on the experiment. (BPS just reverse of BCS it seems)

The selling of BCS is like the goto strategy in tasty trade videos. 2-3 years back, I tested this approach and I lost like 80% of the trades. The reason was because we were in bull market and everything was going up - and it was not the right strategy at that time.

Tasty even has a video on Karen the super trader (look it up) -- but later there are reports that even her funds got destroyed because she couldn't manage the risks.

Reading posts here frequently to learn from you guys/gals.

(My eyes are not in trade all the time, so not efficient with the weekly setups). cheers!!

Past 3 weeks, I got decent (3-5%) gains on weekly BPS on the experiment. (BPS just reverse of BCS it seems)

The selling of BCS is like the goto strategy in tasty trade videos. 2-3 years back, I tested this approach and I lost like 80% of the trades. The reason was because we were in bull market and everything was going up - and it was not the right strategy at that time.

Tasty even has a video on Karen the super trader (look it up) -- but later there are reports that even her funds got destroyed because she couldn't manage the risks.

Reading posts here frequently to learn from you guys/gals.

(My eyes are not in trade all the time, so not efficient with the weekly setups). cheers!!

InTheShadows

Active Member

Nothing wrong with being “too conservative”. The returns we get are ridiculous enough as it is. Doing spreads that are so far out they have a 99.6% chance of profitability is the can always sleep at night approach to becoming mega wealthy. Then you will almost never have to worry about needing to manage the positions and compound growth is still your friend.Thanks. To answer you question:

- I sold the BCS (-1000/+1100) last thursday and friday. (usually I sold BCS on Monday/Tue on the same week expiry, but I was expecting there would be some sort of pull back this week since last week has none, and was thinking it won't go too far away from 900 even if it bounce from pullback, that's why I sold last thursday/friday instead of this week...)

- Agree on the gamblers part, and I was way too conservative (usually -650/+550, -680/+580) since I started BPS, that's why I am thinking I should be more aggressive (or I mean less conservative).

Do you guys have any basic options strategies to generate income for those of us with limited cash ($10-25k)? I'm trying to help my parents put excess money to work and I'm limited in my own accounts from trading TSLA or related derivatives.

If you can get spread options trading permission (for E*Trade it's Options Level 3), then you can sell put spreads "like everyone else" here. For instance, with just under $10K, you can sell 2x $50 spreads or 1x $100 spread. However, if the stock price turns against you, you could lose the whole starting sum. So presumably, you'd want to pick low-risk trades.

Once you can sell enough spreads to accomulate an extra $5K in profits, if you're not taking the income out then you can sell one additional $50 spread the following week to increase your total income. Though, per the recent brief discussion, if you continue to use all your money to back spreads, you continue to put it all at risk each week, and you'll have all the more reason to seek low-risk trades.

You can go for Iron Condors or the like instead of plain put spreads for somewhat more profit, though as we just saw with this week's ~$100 movements in a day, there's risk of total loss on one side or the other, or even on both if not handled well.

Perhaps the place to start is to establish how much income you need from the initial investment. If you set a modest goal, you can choose pretty safe spreads. For instance, looking for $500 weekly income per $5000 backing will be pants-on-fire risky compared to looking for $100/wk per $5000 backing. Picking some high figure is not necessarily undoable, but will likely require a lot more attention and involve a lot more heartburn to avoid losses that eat up your gains.

Last edited:

Insane number of calls are being purchased, a lot of them for this week’s 1100 and a bunch of Mar 22 1250s. Put to call ratio is at 0.1. Yesterday we started strong but then the put to call ratio crept up to 0.4 later in the day.

TheTalkingMule

Distributed Energy Enthusiast

Added 11/5 BPS $840p/$740p @ $2.12

This volatility is delightful.

Edit: Now paying ~$2.35. Pretty sure my role in this thread will be to identify and initiate good value spreads so that everyone else can wait 5 minutes and get 15% more.

This volatility is delightful.

Edit: Now paying ~$2.35. Pretty sure my role in this thread will be to identify and initiate good value spreads so that everyone else can wait 5 minutes and get 15% more.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K