Thanks, I've edited the post. I keep mentally thinking we're still in the 1000's.Im thinking you mean 1125/1165 and 1130/1170 otherwise I’m confused about how you rolled for that much strike improvement without paying a meaningful debit

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I keep praying that we get back thereThanks, I've edited the post. I keep mentally thinking we're still in the 1000's.

And that is why the main thread tends to not like this thread.I keep praying that we get back there

And that is why the main thread tends to not like this thread.

You never want to be “net short” Tesla. People need to reevaluate their positions if a huge run up to 1500 hurts them more than it helps them.

Just being frank and honest.

FlamingPIG

Member

On Friday afternoon, I roll

CC 1,100 11-19 to 1,150 11-26

was completed without error.

Today, when I look at my trading platform activity (Merrill Edge), I found that call option was assigned and is pending. The roll never happened. No error message, no any kind of indication that the roll never went through. My core share got call away and Im piss.

That was the first roll I ever did, noob here. Cant imagine that Merrill Edge platform is so bad like that.

Gonna switch platform. Which platform would you guys recommend?

CC 1,100 11-19 to 1,150 11-26

was completed without error.

Today, when I look at my trading platform activity (Merrill Edge), I found that call option was assigned and is pending. The roll never happened. No error message, no any kind of indication that the roll never went through. My core share got call away and Im piss.

That was the first roll I ever did, noob here. Cant imagine that Merrill Edge platform is so bad like that.

Gonna switch platform. Which platform would you guys recommend?

On Friday afternoon, I roll

CC 1,100 11-19 to 1,150 11-26

was completed without error.

Today, when I look at my trading platform activity (Merrill Edge), I found that call option was assigned and is pending. The roll never happened. No error message, no any kind of indication that the roll never went through. My core share got call away and Im piss.

That was the first roll I ever did, noob here. Cant imagine that Merrill Edge platform is so bad like that.

Gonna switch platform. Which platform would you guys recommend?

You set a limit order but didn’t check whether it filled? No platform would have warned you about that.

E*TRADE notifies you when an order expires unfilled. (Of course at that point it is too late to do anything.)You set a limit order but didn’t check whether it filled? No platform would have warned you about that.

FlamingPIG

Member

At what time did you set the market order?Market order, not limit

It took 30 minutes to roll 17 contracts on my platform at market order when I was rolling contracts. Lost 0.20 premium on the delay. But I kept refreshing and looking to make sure it got executed. Did it want my core shares called away.

Someone said that holding is the equivalent of buying at that price.You never want to be “net short” Tesla. People need to reevaluate their positions if a huge run up to 1500 hurts them more than it helps them.

Just being frank and honest.

However, even if I would not buy TSLA at $1500 on Friday, I can’t sell because the taxes I would have to pay on the capital gains would need to be offset buy buying back in the 1000s which is far from being certain. I did not consider selling covered call in the $1600s at 1 week expiry when we were at $1225 to be bearish. I consider it to be realistic even if it is a bearish basic strategy. However selling a covered call in at $900 would be a different thing to my eyes.

We all want to see TSLA at $3000 at some point, just not before end of 2022. And not too fast. The feeling is a little bit bitter when you see your portfolio doubling and then the stock does -30% after being ahead of itself and you stay there for 6-9 months. If you are only long, this doldrum of sideway trading is pure loss of time. While trading ICs or Strangles during that time seems the logic way to benefit from a stock that overshoot and goes back to a more reasonable value.

Last edited:

I have both IAB and TD. Both of them are no issue rolling unlike other brokers I have.On Friday afternoon, I roll

CC 1,100 11-19 to 1,150 11-26

was completed without error.

Today, when I look at my trading platform activity (Merrill Edge), I found that call option was assigned and is pending. The roll never happened. No error message, no any kind of indication that the roll never went through. My core share got call away and Im piss.

That was the first roll I ever did, noob here. Cant imagine that Merrill Edge platform is so bad like that.

Gonna switch platform. Which platform would you guys recommend?

I find TD to be the easiest to use.

@st_lopesI keep praying that we get back there

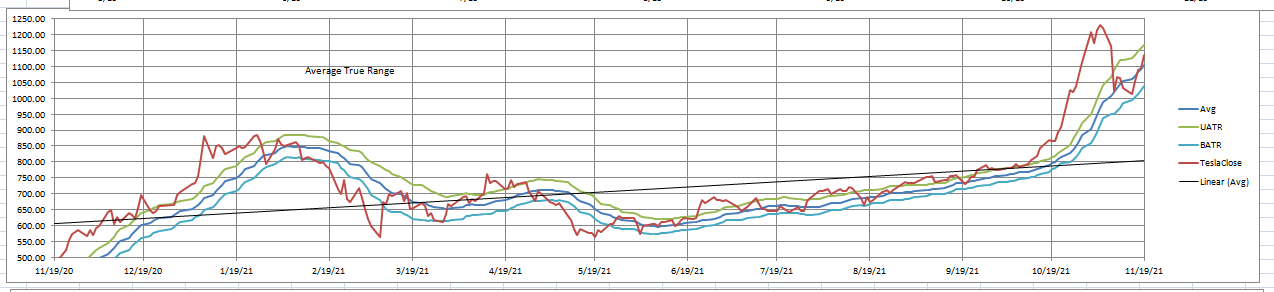

may a respectfully suggest you look at a smoothed graph of Tesla over the last 6 months with a linear regression line, (sloping _up_) then the same graph over the last 6 weeks and notice the linear regression line has a slightly steeper upwards slope. i personally don’t think the sudden upwards discontinuity will continue although it could become a “step up” “jump”.

it almost seems like a war brewing and elephants are stomping around, crushing mice accidentally but still crushing.

Wiki - Selling TSLA Options - Be the House

As a courtesy to theta gang here, I'll declaring I'll be buying some of the calls people are selling here. I've been analyzing entry and I might come in a little early but I think this will be hockey stick recovery. Price depression seems way overdone. Like one little pawn is paralyzing the...

I thought it was just because society is hard wired for ferocious tribalism.And that is why the main thread tends to not like this thread.

We’ve spent no time in 900s or 1000s. It’s healthy to revisit both for some time, even short, to consolidate gains and build a stronger new base of support.

But who knows maybe 1100 was the bottom!

To be fair the only position I’m very inclined to see expire worthless is a 1120/1220 BCS. My DITM calls can be flip rolled, just waiting for when I’m convinced we’re done chopping around at these levels to pull that trigger and set up for the next run higher.

My two catalysts are either confirmation of Elon sales being over (latest would be mid December if he does intend to sell before year end) or a clear retest of support in the 900s.

It may be more meaningful to look at these as % moves rather than $ moves. Higher prices mean larger $ variance but not necessarily higher volatility measured as % of underlying.@st_lopes

may a respectfully suggest you look at a smoothed graph of Tesla over the last 6 months with a linear regression line, (sloping _up_) then the same graph over the last 6 weeks and notice the linear regression line has a slightly steeper upwards slope. i personally don’t think the sudden upwards discontinuity will continue although it could become a “step up” “jump”.

it almost seems like a war brewing and elephants are stomping around, crushing mice accidentally but still crushing.

Wiki - Selling TSLA Options - Be the House

As a courtesy to theta gang here, I'll declaring I'll be buying some of the calls people are selling here. I've been analyzing entry and I might come in a little early but I think this will be hockey stick recovery. Price depression seems way overdone. Like one little pawn is paralyzing the...teslamotorsclub.com

I do agree that we are seeing a repositioning by many very large funds right now (elephants stomping). It wasn’t until October that Tesla caught up to macro YTD performance and even began to outperform. All the funds that were underweight were quite content up until that point. Panic sets in when Tesla is now market performing and seemingly setting up to outperform. TSLA could be a big driver to the Santa Clause rally this year, as these funds continue to re-weight and window dress, but the overhang of Elon’s selling will be an interesting headwind (read: volatility).

On Friday afternoon, I roll

CC 1,100 11-19 to 1,150 11-26

was completed without error.

Today, when I look at my trading platform activity (Merrill Edge), I found that call option was assigned and is pending. The roll never happened. No error message, no any kind of indication that the roll never went through. My core share got call away and Im piss.

That was the first roll I ever did, noob here. Cant imagine that Merrill Edge platform is so bad like that.

Gonna switch platform. Which platform would you guys recommend?

What strike was the call exercised? Maybe the buyer of your call exercised the contract at 1150 (though unlikely).

When I first started visiting this thread last year I remember seeing (or at least that's what I think I saw) a lot of spreads with a small bandwidth: 20, 30 maybe 50 points. I'm now seeing spreads with a bandwidth of 100, 200 or even more points. I always thought spreads were meant to limit risk, with the longest leg being the safeguard, but do such wide spreads still do that?

What happens to such wide BCS in the unlikely but not completely impossible event of a 300 to 400 point overnight drop? There are some black swan events that can cause such a drop: something happening to Elon, a big earthquake destroying the Fremont factory, a hack which puts control of all Teslas in hackers' hands, and probably some scenarios I am overlooking.

I know that with my naked puts I also run a risk when such a black swan strikes, but that risk is that the shares get assigned and I am forced to buy shares that are worth a lot less than what I pay for them. But it doesn't wipe me out. If the shares are assigned I have enough cash to buy them. For each naked put that I sell I need a lot of initial margin and maintenance margin, so I can only sell a limited number of them. That means less premium earned, but also less risk.

The advantage of spreads is that they require a lot less initial margin and maintenance margin, which means you can sell many more and earn more premium. And a lot of people take this opportunity. But what happens with spreads that are a few hundred points wide if the stock opens lower than the longest leg? 100 BPS with a width of 200 points will then be $2 million in the red. Doesn't that mean that the maximum maintenance margin could be exceeded and the broker closes the positions, resulting in a total loss and maybe worse (a bigger loss than the cash and shares in the account, resulting in a debt)?

Am I wrong? I don't want to scare anyone, but would also not want any of my TMC friends to ever end up in such a situation.

What happens to such wide BCS in the unlikely but not completely impossible event of a 300 to 400 point overnight drop? There are some black swan events that can cause such a drop: something happening to Elon, a big earthquake destroying the Fremont factory, a hack which puts control of all Teslas in hackers' hands, and probably some scenarios I am overlooking.

I know that with my naked puts I also run a risk when such a black swan strikes, but that risk is that the shares get assigned and I am forced to buy shares that are worth a lot less than what I pay for them. But it doesn't wipe me out. If the shares are assigned I have enough cash to buy them. For each naked put that I sell I need a lot of initial margin and maintenance margin, so I can only sell a limited number of them. That means less premium earned, but also less risk.

The advantage of spreads is that they require a lot less initial margin and maintenance margin, which means you can sell many more and earn more premium. And a lot of people take this opportunity. But what happens with spreads that are a few hundred points wide if the stock opens lower than the longest leg? 100 BPS with a width of 200 points will then be $2 million in the red. Doesn't that mean that the maximum maintenance margin could be exceeded and the broker closes the positions, resulting in a total loss and maybe worse (a bigger loss than the cash and shares in the account, resulting in a debt)?

Am I wrong? I don't want to scare anyone, but would also not want any of my TMC friends to ever end up in such a situation.

agreed, that is why i look at charts with both linear and log Y axis, the semi log graphs being similar to % i guess.It may be more meaningful to look at these as % moves rather than $ moves. Higher prices mean larger $ variance but not necessarily higher volatility measured as % of underlying.

I do agree that we are seeing a repositioning by many very large funds right now (elephants stomping). It wasn’t until October that Tesla caught up to macro YTD performance and even began to outperform. All the funds that were underweight were quite content up until that point. Panic sets in when Tesla is now market performing and seemingly setting up to outperform. TSLA could be a big driver to the Santa Clause rally this year, as these funds continue to re-weight and window dress, but the overhang of Elon’s selling will be an interesting headwind (read: volatility).

When I first started visiting this thread last year I remember seeing (or at least that's what I think I saw) a lot of spreads with a small bandwidth: 20, 30 maybe 50 points. I'm now seeing spreads with a bandwidth of 100, 200 or even more points. I always thought spreads were meant to limit risk, with the longest leg being the safeguard, but do such wide spreads still do that?

What happens in the unlikely but not completely impossible event of a 300 to 400 point overnight drop? There are some black swan events that can cause such a drop: something happening to Elon, a big earthquake destroying the Fremont factory, a hack which puts control of all Teslas in hackers' hands, and probably some scenarios I am overlooking.

I know that with my naked puts I also run a risk when such a black swan strikes, but that risk is that the shares get assigned and I am forced to buy shares that are worth a lot less than what I pay for them. But it doesn't wipe me out. If the shares are assigned I have enough cash to buy them. For each naked put that I sell I need a lot of initial margin and maintenance margin, so I can only sell a limited number of them. That means less premium earned, but also less risk.

The advantage of spreads is that they require a lot less initial margin and maintenance margin, which means you can sell many more and earn more premium. And a lot of people take this opportunity. But what happens with spreads that are a few hundred points wide if the stock opens lower than the longest leg? 100 BPS with a width of 200 points will then be $2 million in the red. Doesn't that mean that the maximum maintenance margin could be exceeded and the broker closes the positions, resulting in a total loss and maybe worse (a bigger loss than the cash and shares in the account, resulting in a debt)?

Am I wrong? I don't want to scare anyone, but would also not want any of my TMC friends to ever end up in such a situation.

Sage advice. Majority of my shares are in retirement accounts that do not offer any margin. I became interested in spreads due to the low capital requirements and my set goals for end of year with this capital in brokerage account. As this account is growing, I've begun to think there would be less risk if I just bought shares and sold naked puts with a percentage of the margin available (past few months have changed my definition of less risky hah!). Black swans are black swans because we don't expect them.

Timely reminder. Thanks.

Knightshade

Well-Known Member

When I first started visiting this thread last year I remember seeing (or at least that's what I think I saw) a lot of spreads with a small bandwidth: 20, 30 maybe 50 points. I'm now seeing spreads with a bandwidth of 100, 200 or even more points. I always thought spreads were meant to limit risk, with the longest leg being the safeguard, but do such wide spreads still do that?

What happens in the unlikely but not completely impossible event of a 300 to 400 point overnight drop? There are some black swan events that can cause such a drop: something happening to Elon, a big earthquake destroying the Fremont factory, a hack which puts control of all Teslas in hackers' hands, and probably some scenarios I am overlooking.

I know that with my naked puts I also run a risk when such a black swan strikes, but that risk is that the shares get assigned and I am forced to buy shares that are worth a lot less than what I pay for them. But it doesn't wipe me out. If the shares are assigned I have enough cash to buy them. For each naked put that I sell I need a lot of initial margin and maintenance margin, so I can only sell a limited number of them. That means less premium earned, but also less risk.

The advantage of spreads is that they require a lot less initial margin and maintenance margin, which means you can sell many more and earn more premium. And a lot of people take this opportunity. But what happens with spreads that are a few hundred points wide if the stock opens lower than the longest leg? 100 BPS with a width of 200 points will then be $2 million in the red. Doesn't that mean that the maximum maintenance margin could be exceeded and the broker closes the positions, resulting in a total loss and maybe worse (a bigger loss than the cash and shares in the account, resulting in a debt)?

Am I wrong? I don't want to scare anyone, but would also not want any of my TMC friends to ever end up in such a situation.

Generally wider spreads allow a wider band of management options.

The rule of thumb is you can roll the spread out (and often down) for a net credit up until it hits about the halfway point of your spread.

With a $20 spread a drop of $11 means you likely can not longer roll without losing money.

With a $200 spread you'd need a drop of $101 before that was the case.

Some folks noted that as the SP gets higher, the smaller spreads especially get much more harder to manage... such that even $100 spreads were maybe too small with a >$1000 SP because that's less than a 10% drop, and that's when I saw $200 spreads get more popular.

I don't think there's ever been a when-markets-are-closed 20% drop in SP but yeah the proverbial "Elon hit by a bus" news could certainly cause one.

Regarding margin- I don't believe you'd be forced closed

At my broker at least when I open the spreads they reserve enough margin to cover max loss right when you open the position. So you shouldn't ever need any "more" than that no matter where the price goes.

In contrast, you CAN get hit with margin calls on your naked puts (assuming you used margin to secure them) if the SP drops far enough.... because on naked puts the amount at risk changes with the SP... (there's a formula based on amount OTM or ITM of the puts)... this is not the case with spreads where the specific risk is defined at opening.

(that said- but I also have not been hundreds of pts underwater on a spread, so I suppose there COULD be something they do but I'm not sure why they'd need to, no amount down past your long leg changes your loss amount at all)

Regarding margin- I don't believe you'd be forced closed

At my broker at least when I open the spreads they reserve enough margin to cover max loss right when you open the position. So you shouldn't ever need any "more" than that no matter where the price goes.

I assume the danger is like this: You start with 1000 shares at $1000 and for that you’re given $500k margin. You buy 50x $100 put spreads on margin at 20% OTM, using your $500k of margin. Fremont is destroyed by an earthquake and the stock goes to $500. Your spreads go to max loss and you’re at $500k margin used with nothing of value to show for it. But because the stock went to $500 your allowed margin is now $250k. So the broker liquidates 500 shares to cover the $250k excess margin debt, leaving you 500 shares worth $250k and a margin debt of “only” $250k, but new available margin of $125k, and I guess they just go on liquidating until you’re left with nothing?

The solution for put spreads would seem to be to not use that much of your available margin?

Shortly, though, Tesla will have four factories, and the team taking the earnings calls will have sufficient credentials with investors than even a black swan taking out one factory or Elon himself would hopefully not cut the value of the company in half. Will we really get more black-swan-y than a nearly 20% dump after Elon announced he’s selling? Wait, that has the ring of “famous last words”. Forget I asked! Maybe just use less margin.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K