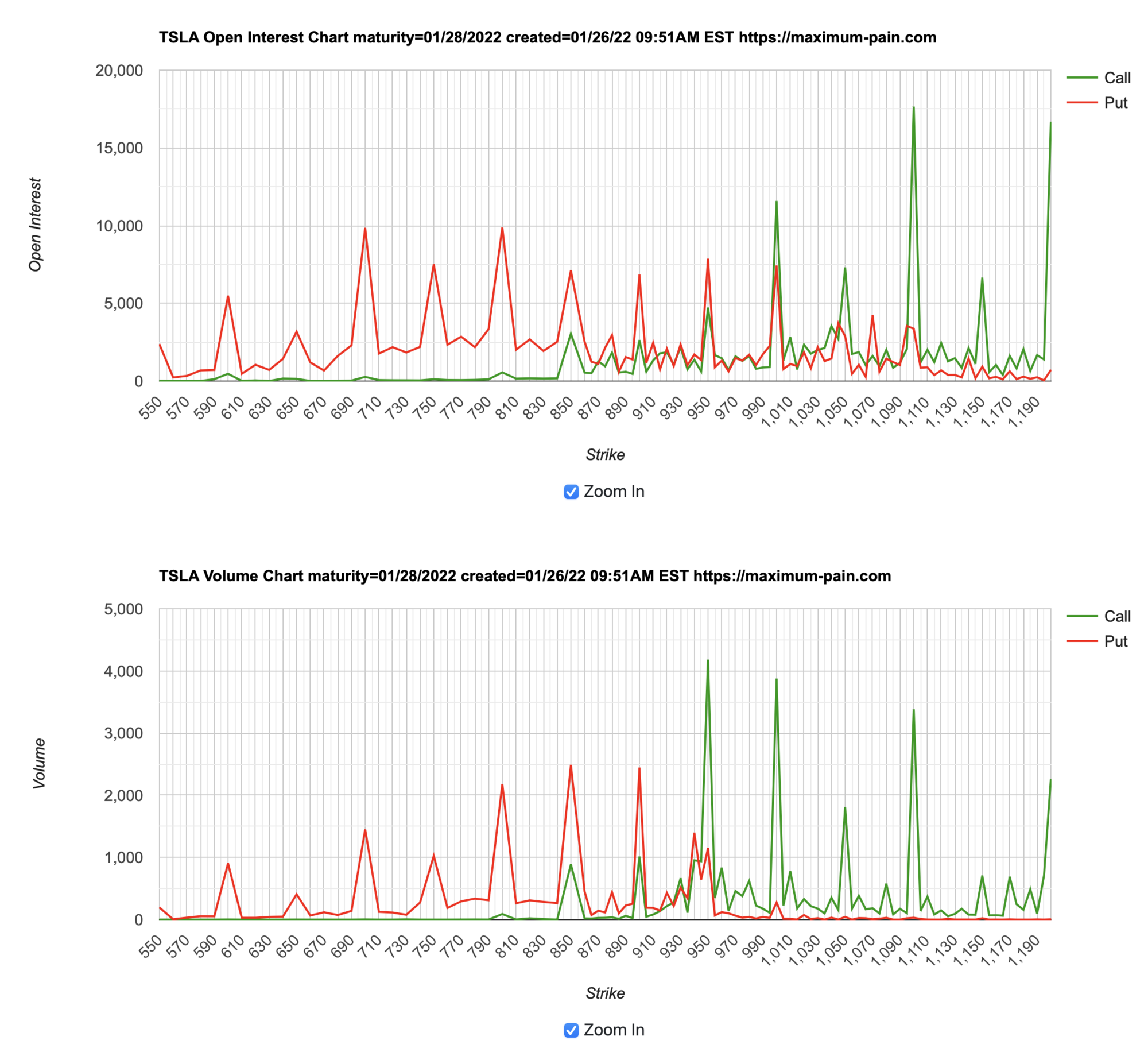

I'm looking at 950/900bps this week and I do not see an urgent reason to bail out - but then again, last week I was sure of 1030 so there's that.

1000/900 I'm on the fence between rolling or keeping.

However I see some volume at 950 which impacts both positions... Sigh...

1000/900 I'm on the fence between rolling or keeping.

However I see some volume at 950 which impacts both positions... Sigh...