That is not true, brokers still have varying requirements for individual stocks which they can adjust at any time on top of Reg T without having portfolio marginReg T margin account is safer. Your margin requirement will never change. Last year I had a portfolio margin account and overnight IB changed their risk assessment and I was $2 million underwater.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Everyone with ITM calls expiring this Friday can relax; after waiting all week for a downturn I finally caved and sold a few puts. I expect them to be ITM by this afternoon.

In all seriousness, another not super great week for me timing wise. Trades are:

STO $755c 9/3 @ $1.60

STO $720p 9/3 @ $2.15

In all seriousness, another not super great week for me timing wise. Trades are:

STO $755c 9/3 @ $1.60

STO $720p 9/3 @ $2.15

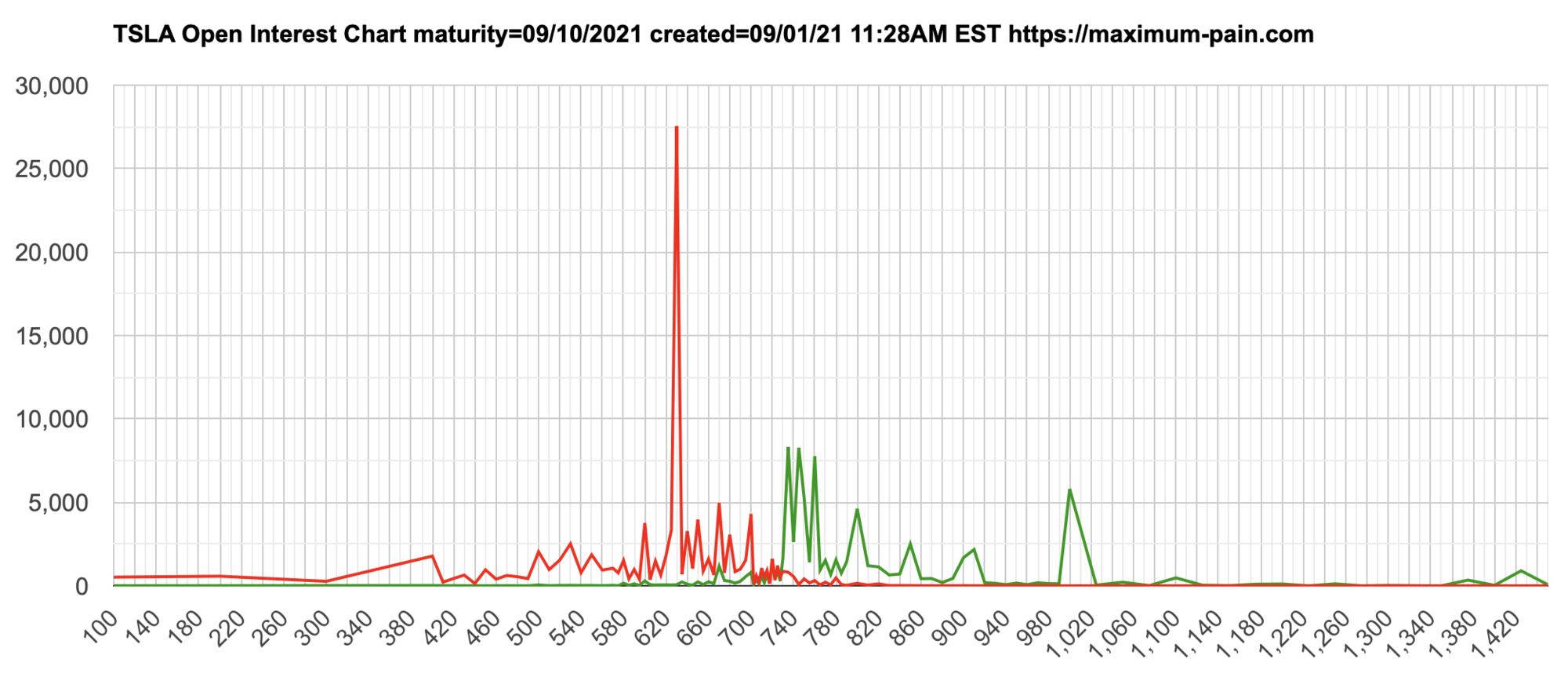

View attachment 704008

This looks to me like, at the minimum, 750 call holders are abandoning ship to focus their firepower on the 740s. Better yet, both the 740s and the 750s could be getting abandoned. One can only hope...

If this keeps up, I will have to join our TSLAQ comrades on TWTR sooner rather than later.

My money's on a $730ish close this week.

didn't they send out a note 2 weeks in advance? It pisses the hell out of me every time that happens. Sadly, transferring a portfolio margin account from one broker to another is quite complicated in my experience. I was looking at TD and even had them run sim on my portfolio. Their maintenance is a lot lower than IBKR. It's like a bad marriage where you can't afford the divorce lawyer.Reg T margin account is safer. Your margin requirement will never change. Last year I had a portfolio margin account and overnight IB changed their risk assessment and I was $2 million underwater.

I moved my 770s to 760s. I figure in the unlikely event it blows past 755 I've got some work to do anyway.

Not to get ahead of things but what are people thinking for next week? Some of the elders in the other thread seem to think next week might be time for a solid move up what with the Summer coming to an end and the technicals looking favorable.

I'm thinking to play it super safe and try to sell some "shitcalls" at 800 or 805 for $1 on a pop. Maybe I'll finally listen to my rule and not unload all I've got on the first day. Worst case scenario I can roll and hide behind the monthly. [ignoring worst scenario it goes to $1000 and I lose all my shares for $802.50 lol]

I'm thinking to play it super safe and try to sell some "shitcalls" at 800 or 805 for $1 on a pop. Maybe I'll finally listen to my rule and not unload all I've got on the first day. Worst case scenario I can roll and hide behind the monthly. [ignoring worst scenario it goes to $1000 and I lose all my shares for $802.50 lol]

Last edited:

Not to get ahead of things but what are people thinking for next week? Some of the elders in the other thread seem to think next week might be time for a solid move up what with the Summer coming to an end and the technicals looking favorable.

I'm thinking to play it super safe and try to sell some "shitcalls" at 800 or 805 for $1 on a pop. Maybe I'll finally listen to my rule and not unload all I've got on a Monday. Worst case scenario I can roll and hide behind the monthly. [ignoring worst scenario it goes to $1000 and I lose all my shares for $802.50 lol]

View attachment 704022

Keep in mind that FSD Beta 10 is supposed to ship this weekend. I'll be playing it safe, gauging the reaction to the release, and almost certainly staying on the other side of $800 even if we open the week as low as $730.

corduroy

Active Member

Tesla definitely has a lot of catalysts that could move the SP up and momentum appears to be building, but historically September is the worth month of the year for the overall market.Not to get ahead of things but what are people thinking for next week? Some of the elders in the other thread seem to think next week might be time for a solid move up what with the Summer coming to an end and the technicals looking favorable.

AquaY

Member

Reg T margin account is safer. Your margin requirement will never change. Last year I had a portfolio margin account and overnight IB changed their risk assessment and I was $2 million underwater.

As I understand it, Portfolio margin account may allow more leverage than a standard Reg T account.That is not true, brokers still have varying requirements for individual stocks which they can adjust at any time on top of Reg T without having portfolio margin

More leverage = More risk.

But since its a total portfolio risk assessment I would guess there are times either one has more risk.

The key take away is for you to understand the leverage you are using and the risks involved

ZenMan

Member

didn't they send out a note 2 weeks in advance? It pisses the hell out of me every time that happens. Sadly, transferring a portfolio margin account from one broker to another is quite complicated in my experience. I was looking at TD and even had them run sim on my portfolio. Their maintenance is a lot lower than IBKR. It's like a bad marriage where you can't afford the divorce lawyer.

Yes they may give two weeks notice but once they give notice they won't allow ANY increase to margin so you are very limited in what you can do to unwind and reduce risk exposure. I changed to Reg T from portfolio margin and have not experienced any change to my margin requirements even when I was reading IB increased margin requirements for TSLA earlier this year.

I would argue that the regular margin account is an overkill in the risk management department. For example: selling an ATM put on AAPL shouldn't take up the same amount of collateral as an ATM put on GME even though the strikes are the same @ 150. Funny enough, RBH for example implemented tighter margin control for high volatility stocks although their collateral requirement still remains indiscriminate.

Last edited:

Knightshade

Well-Known Member

Keep in mind that FSD Beta 10 is supposed to ship this weekend. I'll be playing it safe, gauging the reaction to the release, and almost certainly staying on the other side of $800 even if we open the week as low as $730.

Yeah but it's gonna be the same narrow release as the current version, with even time-optimistic Elon expecting further revisions and likely another month before a wide release (so almost certainly longer than that)

Off topic, sorry, but looks like I'll definitely be able to pay for the new Roadster by selling covered calls. lol #silverLining

What I really want to do this morning is get some BPS open for next week. However I committed to some volunteer work that is getting in the way.

What I DID do this morning is close out the long side of the BPS I closed earlier in the week. The thinking was that I'd try buying the insurance at a relatively low point, and then later sell the money making side at a relatively high point. What I found in practice was that introduced another moving part that was adding confusion for too little money, while I'm still tinkering with BPS more broadly and getting to know their dynamics.

I'll consider returning to this idea at some point in the future, but for now I'll take the roughly 50% loss from holding the long puts an extra couple of days and count it cheap. It was only a few hundred $$ against several $K from the early close on the short side and I don't mind that in the slightest. If nothing else I pretty quickly figured out that I'm not ready for this additional level of planning and thought to save dimes on insurance. I'll be closing both BPS legs together after this

What I DID do this morning is close out the long side of the BPS I closed earlier in the week. The thinking was that I'd try buying the insurance at a relatively low point, and then later sell the money making side at a relatively high point. What I found in practice was that introduced another moving part that was adding confusion for too little money, while I'm still tinkering with BPS more broadly and getting to know their dynamics.

I'll consider returning to this idea at some point in the future, but for now I'll take the roughly 50% loss from holding the long puts an extra couple of days and count it cheap. It was only a few hundred $$ against several $K from the early close on the short side and I don't mind that in the slightest. If nothing else I pretty quickly figured out that I'm not ready for this additional level of planning and thought to save dimes on insurance. I'll be closing both BPS legs together after this

bkp_duke

Well-Known Member

Rolled down some 765 CCs to 750 today for a little be extra premium. Going to watch them closely the next 2 days.

Considering rolling up the puts on my 680/710/750/780 IC tomorrow, but have to see what the MMs what us to end at.

Considering rolling up the puts on my 680/710/750/780 IC tomorrow, but have to see what the MMs what us to end at.

I know we will be.Off topic, sorry, but looks like I'll definitely be able to pay for the new Roadster by selling covered calls. lol #silverLining

I remember watching the semi / roadster reveal and my wife and I saying that the Roadster looks really cool and we'd like one. But that was in the same tone of voice and thinking that would go into my saying I want a $1M sports car - never going to happen and not worth spending any more time on that we spend thinking about winning the lottery.

Except now the only question is cash or loan. #firstworldproblems (loan - keep the cash to sell more BPS

corduroy

Active Member

I've flirted with this idea as well, and gave it a try. But I think I will stick with this advice from now on:What I DID do this morning is close out the long side of the BPS I closed earlier in the week. The thinking was that I'd try buying the insurance at a relatively low point, and then later sell the money making side at a relatively high point. What I found in practice was that introduced another moving part that was adding confusion for too little money, while I'm still tinkering with BPS more broadly and getting to know their dynamics.

Most beginner options traders try to “leg into” a spread by buying the option first and selling the second option later. They’re trying to lower the cost by a few pennies. It simply isn’t worth the risk.

Sound familiar? Many experienced options traders have been burned by this scenario, too, and learned the hard way.

Don’t “leg in” if you want to trade a spread. Trade a spread as a single trade. Don’t take on extra market risk needlessly.

For example, you might buy a call and then try to time the sale of another call, hoping to squeeze a little higher price out of the second leg. This is a losing strategy if the market conditions take a downturn because you won’t be able to pull off your spread. You could be stuck with a long call and no strategy to act upon.

If you are going to try this trading strategy, don’t buy a spread and wait around hoping the market will move in your favor. You might think that you’ll be able to sell it later at a higher price, but that’s an unrealistic outcome.

Always treat a spread as a single trade rather than try to deal with the minutia of timing. You want to get into the trade before the market starts going down.

Source

Sorry guys really wish for the 730cc to called away this week. I got a chance to invest in a SpaceX stock fund and the Minimum is 250K. Can’t be maxed margined and all that.I have 730cc, 740cc, 755cc for this week. Won’t roll until Friday. Been doing well letting most expire worthless. Since I have 400 shares margined been debating of letting some go as I feel short term 730-740 is a ok price.

AquaY

Member

No problem if it doesn't happen. Have them call me to take your spotSorry guys really wish for the 730cc to called away this week. I got a chance to invest in a SpaceX stock fund and the Minimum is 250K. Can’t be maxed margined and all that.

alterac000

Member

What I really want to do this morning is get some BPS open for next week. However I committed to some volunteer work that is getting in the way.

What I DID do this morning is close out the long side of the BPS I closed earlier in the week. The thinking was that I'd try buying the insurance at a relatively low point, and then later sell the money making side at a relatively high point. What I found in practice was that introduced another moving part that was adding confusion for too little money, while I'm still tinkering with BPS more broadly and getting to know their dynamics.

I'll consider returning to this idea at some point in the future, but for now I'll take the roughly 50% loss from holding the long puts an extra couple of days and count it cheap. It was only a few hundred $$ against several $K from the early close on the short side and I don't mind that in the slightest. If nothing else I pretty quickly figured out that I'm not ready for this additional level of planning and thought to save dimes on insurance. I'll be closing both BPS legs together after this

I learned something today that is perhaps peripherally related to your BPS experiment but on the call side. My setup as follows, for the sake of easy math assume:

4x leaps

3x -680/+640 put vertical

3x -705/+745 call vertical (carried from 2 prior rolls)

2x 735lcc

2x 750lcc

The put and call verticals were opened separately and in my brain I was treating them as one, i.e. iron condor since their margin requirements were paired.

I was entertaining rolling my 735lcc's today to next week. However when I tried, my brokerage gave me an 'illegal -1 shares' and didn't allow it. After playing around a bit, I later assumed that since the -705/+745 spread was ITM my broker must have been treating the leaps as the cover for the -705c, even though the -705c's were part of the spread. This was while sp was about 738 today.

To clean things up I ended up BTC 2x735lcc, 1x750lcc, and then sold the 3x745calls from the call vertical arm, effectively dismantling the spread. This essentially equates to now 3x 705lcc and 1x 750lcc, and I can/will roll the 705lcc as needed. This is the first time I've encountered this so while folks are trading/rolling spreads, possibly be mindful that if the short arm goes ITM your broker may limit your about to manipulate/trade other CCs if you are maxed out like I was, until you deal with the ITM short position.

Whew

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K