Thanks for this. I’m definitely not more knowledgeable. Though my confirmation bias is now confirmed.Anyway, I found this interesting. Maybe someone who's more knowledgeable can pick this thread up and figure out how much institutional buying is likely in the next few months as TSLA starts looking less risky.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

PastorDave

Member

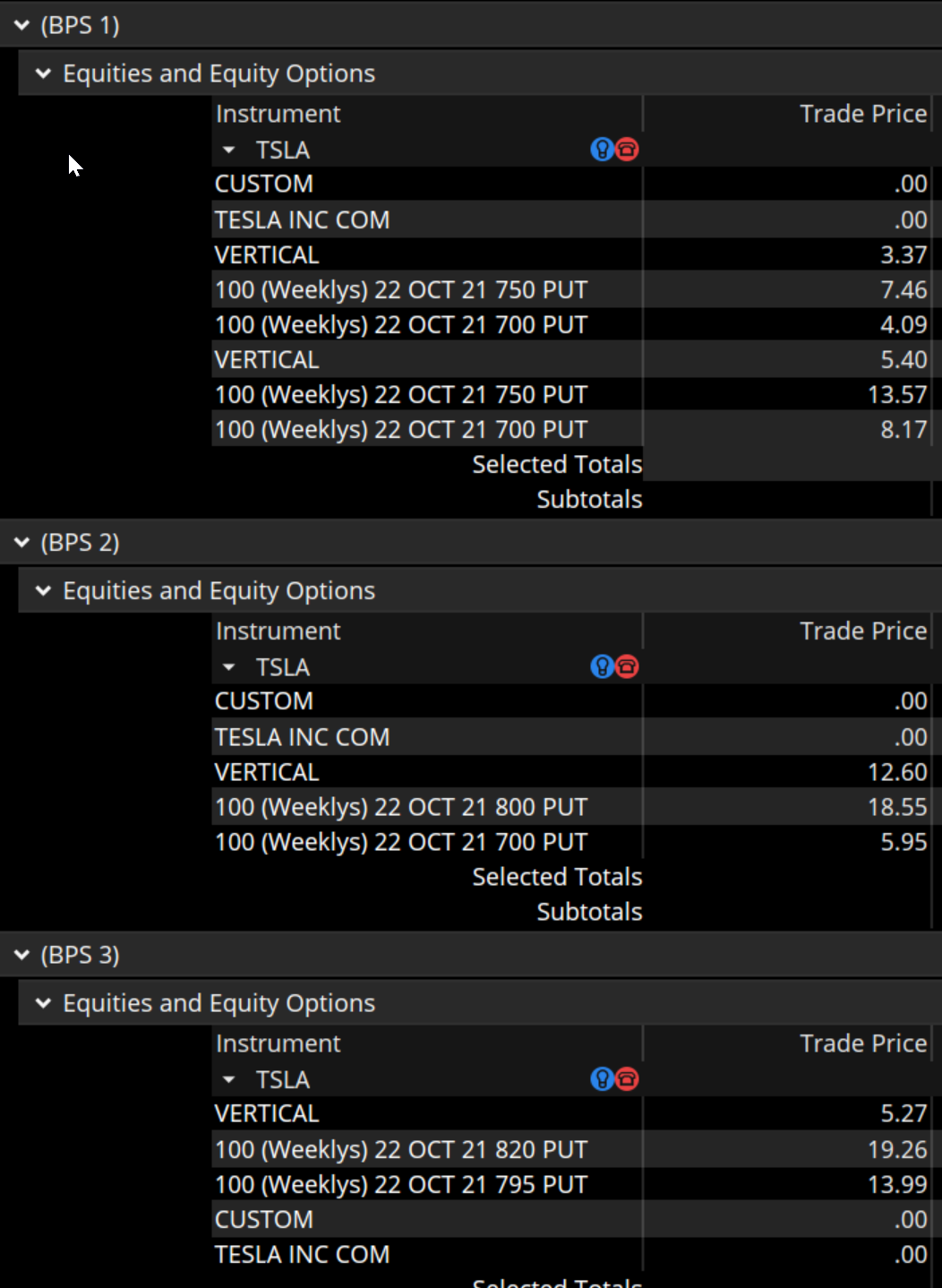

Ok, so plan and performance.

I don't have a lot of time left to post, so I'm going to try to make this quick. I did about 40k last week, mostly from puts, and this was in line with my best weeks. I mostly sold BPS around 750, but a significant amount of ATM or ITM BPS on the way up that I then closed early. Calls for the week were about even for me; I thankfully closed a huge pile of 830cc on Thursday for 50% profit, as I thought we might have another run on Friday. I honestly thought we'd end the day at 829.99 at most though, with 819.99 more likely. Glad I didn't bet on that though.

For my plan, I've got a ton of long calls that I'm going to convert:

11/26 600c

I'm going to roll these up to:

11/26 700c

This will free up 9.3k or so per contract, while delta exposure goes from 1 per contract to .91. To make up the difference I'm going to add a few contracts to bring me back up to the same delta. I should still be able to roll each contract for about $2/wk, as per my plan, and this will allow delta to increase if the SP goes up. If delta = 1, I feel like I'm wasting money in the option. I'm not sure what I'm going to do with the rest of the capital that is free up, but most likely sell safe (by my definition) BPS or IC for income.

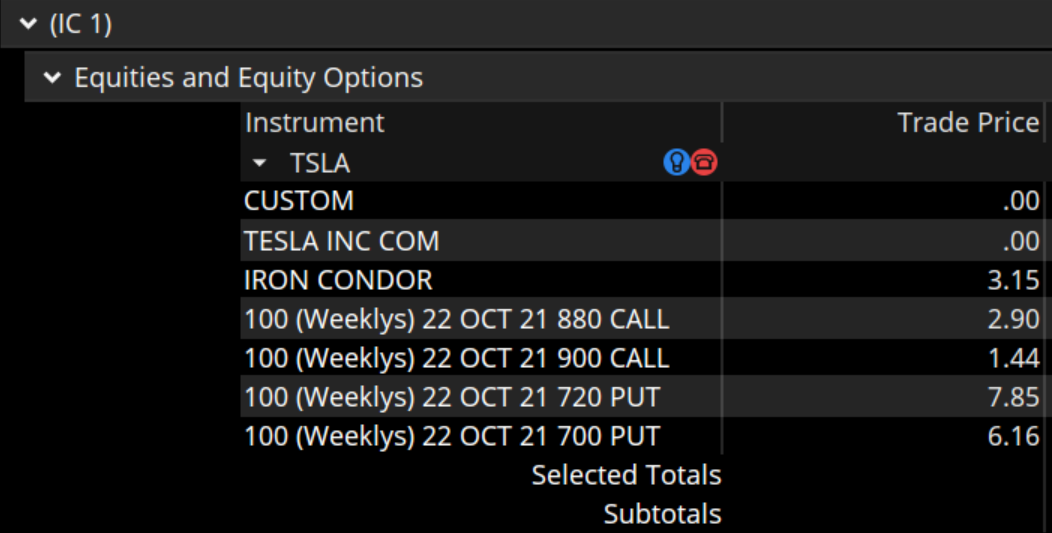

Positions for next week:

I already closed out my 1:1 credit trades for next week at 50% profit, and I'm a bit worried about that IC, and might close it early, but otherwise things are looking good.

I don't have a lot of time left to post, so I'm going to try to make this quick. I did about 40k last week, mostly from puts, and this was in line with my best weeks. I mostly sold BPS around 750, but a significant amount of ATM or ITM BPS on the way up that I then closed early. Calls for the week were about even for me; I thankfully closed a huge pile of 830cc on Thursday for 50% profit, as I thought we might have another run on Friday. I honestly thought we'd end the day at 829.99 at most though, with 819.99 more likely. Glad I didn't bet on that though.

For my plan, I've got a ton of long calls that I'm going to convert:

11/26 600c

I'm going to roll these up to:

11/26 700c

This will free up 9.3k or so per contract, while delta exposure goes from 1 per contract to .91. To make up the difference I'm going to add a few contracts to bring me back up to the same delta. I should still be able to roll each contract for about $2/wk, as per my plan, and this will allow delta to increase if the SP goes up. If delta = 1, I feel like I'm wasting money in the option. I'm not sure what I'm going to do with the rest of the capital that is free up, but most likely sell safe (by my definition) BPS or IC for income.

Positions for next week:

I already closed out my 1:1 credit trades for next week at 50% profit, and I'm a bit worried about that IC, and might close it early, but otherwise things are looking good.

Although I've been driving Teslas since 2013 I only started investing in TSLA in 2018. I was lucky with my timing as from 2019 the sizeable investment turned into millions. Over the last year I've been focusing on selling naked puts (cash covered), which has also produced excellent results. But those naked puts require of lot of cash for the maintenance margin, so I'm looking to expand to the spread strategy.

I'm not a newbie to options, I wrote naked strangles and straddles on the Dutch AEX index 15 years ago, covered with futures. Those futures made it very stressful. I had to buy and sell via phone, and if the investment banker was out for lunch I was toast. The spreads sound a lot less stressful, as the risk is known in advance and there are ways to react to mitigate that risk. Another advantage ofcourse is the much lower maintenance margin.

When choosing spreads that are far OTM - even less stressful - premiums however are low. Many here compensate this by opening a lot of spreads (50, 100, 200 and more). I'm not looking to start with such large numbers. But I don't rule out that eventually I will also end up with that many spreads. At first sight a lot of spreads looks more risky. But is it? This weekend I've been giving that question a lot of thought and my conclusion is that spreads that are far OTM (15% or more) are not very risky.

The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

- A substantial collaboration (Apple, VW)

But what are the odds of such an event happening? I give it a chance of less than once per year. So that would mean a complete loss of the value of the spreads once every 52 weeks, at most. Which means that if you manage to earn more premium per week than 1/52 of the total risk of a weekly position, you will be safe. And I think it should be possible to earn much more premium, as many here have proven. If each week you earn premiums that equal 1/30 or 1/40 of the risk, it means that after 30 or 40 weeks you've earned enough to mitigate the risk of one trade that is a complete loss. And if you open both BPS and BCS, which cannot be hit by the same event, you can earn enough after 15 to 20 weeks to mitigate that risk. (I'm a Tesla bull, but the stock doesn't go up in a straight line, so I don't think you need to be a bear to open bearish call spreads).

The above examples are for spreads that are far OTM. Opening spreads closer to the SP increases the risk of a complete loss, but also offers the chance to earn more premium with a smaller spread. It will therefore take fewer succesful weeks to mitigate the risk of a trade that is a total loss.

I'm still trying to figure out which position I would be most comfortable with. I suppose trying different strikes with a limited number of spreads will provide more insight.

I'm not a newbie to options, I wrote naked strangles and straddles on the Dutch AEX index 15 years ago, covered with futures. Those futures made it very stressful. I had to buy and sell via phone, and if the investment banker was out for lunch I was toast. The spreads sound a lot less stressful, as the risk is known in advance and there are ways to react to mitigate that risk. Another advantage ofcourse is the much lower maintenance margin.

When choosing spreads that are far OTM - even less stressful - premiums however are low. Many here compensate this by opening a lot of spreads (50, 100, 200 and more). I'm not looking to start with such large numbers. But I don't rule out that eventually I will also end up with that many spreads. At first sight a lot of spreads looks more risky. But is it? This weekend I've been giving that question a lot of thought and my conclusion is that spreads that are far OTM (15% or more) are not very risky.

The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

- A substantial collaboration (Apple, VW)

But what are the odds of such an event happening? I give it a chance of less than once per year. So that would mean a complete loss of the value of the spreads once every 52 weeks, at most. Which means that if you manage to earn more premium per week than 1/52 of the total risk of a weekly position, you will be safe. And I think it should be possible to earn much more premium, as many here have proven. If each week you earn premiums that equal 1/30 or 1/40 of the risk, it means that after 30 or 40 weeks you've earned enough to mitigate the risk of one trade that is a complete loss. And if you open both BPS and BCS, which cannot be hit by the same event, you can earn enough after 15 to 20 weeks to mitigate that risk. (I'm a Tesla bull, but the stock doesn't go up in a straight line, so I don't think you need to be a bear to open bearish call spreads).

The above examples are for spreads that are far OTM. Opening spreads closer to the SP increases the risk of a complete loss, but also offers the chance to earn more premium with a smaller spread. It will therefore take fewer succesful weeks to mitigate the risk of a trade that is a total loss.

I'm still trying to figure out which position I would be most comfortable with. I suppose trying different strikes with a limited number of spreads will provide more insight.

corduroy

Active Member

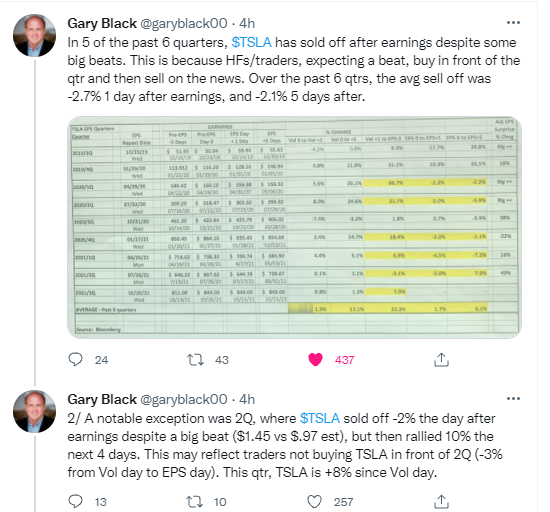

More interesting data from Gary Black. It sure looks like we are setting up for a classic sell the news dump next Thursday. I'm planning on saving lots of margin to open BPS at the end of next week.

Last edited:

pz1975

Active Member

I would say start very OTM with wide spreads and smaller number of contracts. That allows for the safest entry into the strategies for learning purposes. As you learn more and especially how to avoid the big losses then you can get more aggressive.Although I've been driving Teslas since 2013 I only started investing in TSLA in 2018. I was lucky with my timing as from 2019 the sizeable investment turned into millions. Over the last year I've been focusing on selling naked puts (cash covered), which has also produced excellent results. But those naked puts require of lot of cash for the maintenance margin, so I'm looking to expand to the spread strategy.

I'm not a newbie to options, I wrote naked strangles and straddles on the Dutch AEX index 15 years ago, covered with futures. Those futures made it very stressful. I had to buy and sell via phone, and if the investment banker was out for lunch I was toast. The spreads sound a lot less stressful, as the risk is known in advance and there are ways to react to mitigate that risk. Another advantage ofcourse is the much lower maintenance margin.

When choosing spreads that are far OTM - even less stressful - premiums however are low. Many here compensate this by opening a lot of spreads (50, 100, 200 and more). I'm not looking to start with such large numbers. But I don't rule out that eventually I will also end up with that many spreads. At first sight a lot of spreads looks more risky. But is it? This weekend I've been giving that question a lot of thought and my conclusion is that spreads that are far OTM (15% or more) are not very risky.

The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

But what are the odds of such an event happening? I give it a chance of less than once per year. So that would mean a complete loss of the value of the spreads once every 52 weeks, at most. Which means that if you manage to earn more premium per week than 1/52 of the total risk of a weekly position, you will be safe. And I think it should be possible to earn much more premium, as many here have proven. If each week you earn premiums that equal 1/30 or 1/40 of the risk, it means that after 30 or 40 weeks you've earned enough to mitigate the risk of one trade that is a complete loss. And if you open both BPS and BCS, which cannot be hit by the same event, you can earn enough after 15 to 20 weeks to mitigate that risk. (I'm a Tesla bull, but the stock doesn't go up in a straight line, so I don't think you need to be a bear to open bearish call spreads).

The above examples are for spreads that are far OTM. Opening spreads closer to the SP increases the risk of a complete loss, but also offers the chance to earn more premium with a smaller spread. It will therefore take fewer succesful weeks to mitigate the risk of a trade that is a total loss.

I'm still trying to figure out which position I would be most comfortable with. I suppose trying different strikes with a limited number of spreads will provide more insight.

Even the once per year (or maybe more) week where you are at risk of a huge loss, there are ways (described in this thread many times) to avoid them by rolling out and up/down, increasing number of contacts at narrower spreads to lower the loss threshold point, etc.

My main goal is to safely earn decent profits each week and be very aggressive to avoid losses by rolling as soon at the sold option nears or becomes ITM. Even if I think it may rebound the other way, I prefer to be proactive and roll quickly. This way I do lose out on possible profits but almost always avoid the devastating loss.

Since it is still the weekend and no trading going on, I am posting this question here hoping for some information.

My question is regarding Wash Sale rules - Do they apply to Roth IRA and Regular IRAs?

In my brokerage account, Fidelity clearly designates which transactions fell under wash sale and the losses don't qualify for deduction. So that is simple to transfer to tax filing to show the gains/losses. But what if I have a similar transaction in my IRA? Does it need to be accounted for along with the brokerage account?

With the Roth IRA, since the entire amount is tax free, is there any wash sale adjustment to be done for this one?

My question is regarding Wash Sale rules - Do they apply to Roth IRA and Regular IRAs?

In my brokerage account, Fidelity clearly designates which transactions fell under wash sale and the losses don't qualify for deduction. So that is simple to transfer to tax filing to show the gains/losses. But what if I have a similar transaction in my IRA? Does it need to be accounted for along with the brokerage account?

With the Roth IRA, since the entire amount is tax free, is there any wash sale adjustment to be done for this one?

Wash (deferred tax deduction) isn't relevant to pure IRA or Roth situations since in an IRA nothing is taxed until withdrawal, and in Roth, nothing is taxed (unless under 5 years). Losses and gains stand on their own.Since it is still the weekend and no trading going on, I am posting this question here hoping for some information.

My question is regarding Wash Sale rules - Do they apply to Roth IRA and Regular IRAs?

In my brokerage account, Fidelity clearly designates which transactions fell under wash sale and the losses don't qualify for deduction. So that is simple to transfer to tax filing to show the gains/losses. But what if I have a similar transaction in my IRA? Does it need to be accounted for along with the brokerage account?

With the Roth IRA, since the entire amount is tax free, is there any wash sale adjustment to be done for this one?

However, if you trade the same stock in a taxable account and an IRA, you can lose the loss tax advantage because the wash rules apply, but there is no basis change to the IRA position. You will need to track and report this yourself as it is outside any single account.

Also with BPS you can always do anchor throwing.Although I've been driving Teslas since 2013 I only started investing in TSLA in 2018. I was lucky with my timing as from 2019 the sizeable investment turned into millions. Over the last year I've been focusing on selling naked puts (cash covered), which has also produced excellent results. But those naked puts require of lot of cash for the maintenance margin, so I'm looking to expand to the spread strategy.

I'm not a newbie to options, I wrote naked strangles and straddles on the Dutch AEX index 15 years ago, covered with futures. Those futures made it very stressful. I had to buy and sell via phone, and if the investment banker was out for lunch I was toast. The spreads sound a lot less stressful, as the risk is known in advance and there are ways to react to mitigate that risk. Another advantage ofcourse is the much lower maintenance margin.

When choosing spreads that are far OTM - even less stressful - premiums however are low. Many here compensate this by opening a lot of spreads (50, 100, 200 and more). I'm not looking to start with such large numbers. But I don't rule out that eventually I will also end up with that many spreads. At first sight a lot of spreads looks more risky. But is it? This weekend I've been giving that question a lot of thought and my conclusion is that spreads that are far OTM (15% or more) are not very risky.

The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

But what are the odds of such an event happening? I give it a chance of less than once per year. So that would mean a complete loss of the value of the spreads once every 52 weeks, at most. Which means that if you manage to earn more premium per week than 1/52 of the total risk of a weekly position, you will be safe. And I think it should be possible to earn much more premium, as many here have proven. If each week you earn premiums that equal 1/30 or 1/40 of the risk, it means that after 30 or 40 weeks you've earned enough to mitigate the risk of one trade that is a complete loss. And if you open both BPS and BCS, which cannot be hit by the same event, you can earn enough after 15 to 20 weeks to mitigate that risk. (I'm a Tesla bull, but the stock doesn't go up in a straight line, so I don't think you need to be a bear to open bearish call spreads).

The above examples are for spreads that are far OTM. Opening spreads closer to the SP increases the risk of a complete loss, but also offers the chance to earn more premium with a smaller spread. It will therefore take fewer succesful weeks to mitigate the risk of a trade that is a total loss.

I'm still trying to figure out which position I would be most comfortable with. I suppose trying different strikes with a limited number of spreads will provide more insight.

Just sell as many shares as you have delta-exposure. This is cheap because you just have to pay interest, but get loads of cash with no further downside.

The gains on the short shares cancel the loss of your BPS, but you get not exposure to the upside anymore.

With BCS this does not work as you have to borrow the money for the shares, but those shares only give 50% margin - not offsetting your debt.

AquaY

Member

I'm not following this.However, if you trade the same stock in a taxable account and an IRA, you can lose the loss tax advantage because the wash rules apply, but there is no basis change to the IRA position. You will need to track and report this yourself as it is outside any single account.

Are you saying if you have a regular taxable account AND an IRA and buy and sell say TSLA shares in both and in the IRA you sell at a loss and buy them back that it's somehow reported to the IRS for your taxable account?

In my mind, the biggest knowable Tesla related events that can cause 10% swings overnight are Production and Delivery numbers, and Earnings reports. Those have set dates every quarter, so they are easy to navigate. Macro issues can bring it down, but most of those we can't plan for/predict. Something happening to Elon has been my biggest fear since starting to go all-in back in 2013. Black swan events is why I try to be conservative with my BPS, and will shoot for 10-20% below the SP on my weeklies, even though I will make less money than I would by being aggressive if nothing bad happens.The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

You lost me. Can you explain this like I'm 5?Also with BPS you can always do anchor throwing.

Just sell as many shares as you have delta-exposure. This is cheap because you just have to pay interest, but get loads of cash with no further downside.

The gains on the short shares cancel the loss of your BPS, but you get not exposure to the upside anymore.

bkp_duke

Well-Known Member

I know I have mentioned Coverdell ESA and Roth IRA for kids before, but this is new to me:

markjkohler.com

markjkohler.com

Has anyone tried this pooling of accounts into an LLC and traded with them?

I have setup the ESA and the Roth's, but both are limited on options trading and don't allow spreads, which kills my returns.

Thoughts and opinions?

529 versus ESA: The Best for College Savings - Mark J. Kohler

The Coverdell ESA is better than the 529 and by far the best tool to save and build wealth for college expenses tax-free.

Has anyone tried this pooling of accounts into an LLC and traded with them?

I have setup the ESA and the Roth's, but both are limited on options trading and don't allow spreads, which kills my returns.

Thoughts and opinions?

BrownOuttaSpec

Active Member

Thoughts and opinions?

That's really cool/informatiave but I need to get a great CPA ASAP.

Wash (deferred tax deduction) isn't relevant to pure IRA or Roth situations since in an IRA nothing is taxed until withdrawal, and in Roth, nothing is taxed (unless under 5 years). Losses and gains stand on their own.

However, if you trade the same stock in a taxable account and an IRA, you can lose the loss tax advantage because the wash rules apply, but there is no basis change to the IRA position. You will need to track and report this yourself as it is outside any single account.

I'm not following this.

Are you saying if you have a regular taxable account AND an IRA and buy and sell say TSLA shares in both and in the IRA you sell at a loss and buy them back that it's somehow reported to the IRS for your taxable account?

Same question here. How would IRS even find out that the same position was traded in the IRA ass well as taxable account? Nothing of IRA trading gets reported to IRS unless there was a distribution or something.

Buttershrimpodamus prediction of the week:

I'm seeing a rise to 880 by Tuesday with a sharp reversal once it's touched.... likely Wednesday would predict a 800 price touch and finishing at 810 Friday.

Personally, I'm hoping for the total exhilaration that can be realized when share price fluctuates slowly between 820-850, finishing at 830 Friday.

I don't see us going lower than 750 this week, and I don't see us going higher than 950.... that's like 5 buttershrimp deviations.

I'm seeing a rise to 880 by Tuesday with a sharp reversal once it's touched.... likely Wednesday would predict a 800 price touch and finishing at 810 Friday.

Personally, I'm hoping for the total exhilaration that can be realized when share price fluctuates slowly between 820-850, finishing at 830 Friday.

I don't see us going lower than 750 this week, and I don't see us going higher than 950.... that's like 5 buttershrimp deviations.

I'm not following this.

Are you saying if you have a regular taxable account AND an IRA and buy and sell say TSLA shares in both and in the IRA you sell at a loss and buy them back that it's somehow reported to the IRS for your taxable account?

If you sell for a loss in the IRA, there is no special treatment to begin with, so you can (p/re)buy at will with no impact. If you sell for a loss in the taxable and purchased the same stock within 30 days either way in the IRA, you lose the capital gains deduction permanently. The rule was created to avoid bypassing the wash rule by shifting a losing position to an IRA, but its net is wide.

@EV forever

The account owner needs to track the cross account interactions to not take a non allowed deduction.

Can IRA Transactions Trigger the Wash-Sale Rule?

That'd be great as I've rolled some $820 CC's. I don't expect it to happen, but happy if it does or doesn't. I've too many long shares and LEAPs to care either way if it goes past $900.Buttershrimpodamus prediction of the week:

I'm seeing a rise to 880 by Tuesday with a sharp reversal once it's touched.... likely Wednesday would predict a 800 price touch and finishing at 810 Friday.

Personally, I'm hoping for the total exhilaration that can be realized when share price fluctuates slowly between 820-850, finishing at 830 Friday.

I don't see us going lower than 750 this week, and I don't see us going higher than 950.... that's like 5 buttershrimp deviations.

PastorDave

Member

One thing to keep in mind is that most folks in this tread aren't trading with all of their possible margin/cash. So even if the stock falls 15% overnight and doesn't recover prior to the expiration of a spread, at most we would be out the percentage of our of our accounts that we're selling spreads on (25-35% depending on individual risk tolerance). Ouch, but not impossible to recover from. So even if a black swan does hit, it will probably be ok if we've been building cash. Personally, I do a bit of a mix in order to hit my target income goals without risking more total cash than I'm comfortable with. So I trade some safer positions that are OTM and take more margin alongside some riskier ATM or ITM positions that take very little margin, but that I have some confidence might be profitable. I do admit to using more cash the past few weeks than I would rather due to being more conservative than usual with selling calls, but I also felt highly confident that the SP would not drop too badly going into earnings after the production and delivery numbers.Although I've been driving Teslas since 2013 I only started investing in TSLA in 2018. I was lucky with my timing as from 2019 the sizeable investment turned into millions. Over the last year I've been focusing on selling naked puts (cash covered), which has also produced excellent results. But those naked puts require of lot of cash for the maintenance margin, so I'm looking to expand to the spread strategy.

I'm not a newbie to options, I wrote naked strangles and straddles on the Dutch AEX index 15 years ago, covered with futures. Those futures made it very stressful. I had to buy and sell via phone, and if the investment banker was out for lunch I was toast. The spreads sound a lot less stressful, as the risk is known in advance and there are ways to react to mitigate that risk. Another advantage ofcourse is the much lower maintenance margin.

When choosing spreads that are far OTM - even less stressful - premiums however are low. Many here compensate this by opening a lot of spreads (50, 100, 200 and more). I'm not looking to start with such large numbers. But I don't rule out that eventually I will also end up with that many spreads. At first sight a lot of spreads looks more risky. But is it? This weekend I've been giving that question a lot of thought and my conclusion is that spreads that are far OTM (15% or more) are not very risky.

The only real risk is an event that causes the SP to drop (in case of BPS) or rise (in case of BCS) by 15% or more overnight, making it impossible to close the positions with a limited loss or roll them further OTM. Which events can cause such a huge movement?

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

But what are the odds of such an event happening? I give it a chance of less than once per year. So that would mean a complete loss of the value of the spreads once every 52 weeks, at most. Which means that if you manage to earn more premium per week than 1/52 of the total risk of a weekly position, you will be safe. And I think it should be possible to earn much more premium, as many here have proven. If each week you earn premiums that equal 1/30 or 1/40 of the risk, it means that after 30 or 40 weeks you've earned enough to mitigate the risk of one trade that is a complete loss. And if you open both BPS and BCS, which cannot be hit by the same event, you can earn enough after 15 to 20 weeks to mitigate that risk. (I'm a Tesla bull, but the stock doesn't go up in a straight line, so I don't think you need to be a bear to open bearish call spreads).

The above examples are for spreads that are far OTM. Opening spreads closer to the SP increases the risk of a complete loss, but also offers the chance to earn more premium with a smaller spread. It will therefore take fewer succesful weeks to mitigate the risk of a trade that is a total loss.

I'm still trying to figure out which position I would be most comfortable with. I suppose trying different strikes with a limited number of spreads will provide more insight.

Also, my profits are up something like 2 or 3x since finding this thread, so I'm a fan of the methods (thanks guys!). I think your idea to just try a few things out is the best way to go.

So, besides a potential FSD screw up that few people brought up here, there's another possibility for a drop that has been referenced, but not very explicitly. There was a youtube vid between @heydave7 and @bradsferguson discussing this....

For a sudden large drop I could think of:

- Something happening to Elon

- An earthquake destroying the Fremont factory

- A flooding destroying Giga Shanghai

- A sudden attack by China on Taiwan

- A terrorist attack like 9/11

For a sudden large rise I could think of:

- Another stock split

- A take-over (unlikely given Tesla's market cap) or merger

But what are the odds of such an event happening? I give it a chance of less than once per year.

...

Elon has a bunch of stock options expiring in 8/22, but he expressed the intention to deal with them in Q4 2021, b/c his tax rate may go from 53% to 57% in 2022 if Biden gets his way. Maybe it won't if Manchin gets in the way, but no way to tell if Elon will wait for that resolution.

These stock options will get hit with taxes if exercised unlike our calls that we can exercise withiout triggering a taxable event.

Elon has an option to borrow ~$20B against his shares pledged with banks to exercise and pay taxes(which I think is unlikely, as that will be close to 25% borrowing threshold set by the Tesla board) and then incur significant interest payments every year or he can sell 12.3m shares to pay these expenses.

He's allowed to trade within 7 weeks after ER as insider and potentially could do it in multiple batches before 8/22, but if the goal is to minimize taxes, then I think he may do it all in 2021. He may or may not split it into multiple days of selling within the 7 weeks. He may do it via a dark pool and sell to some bank(s) at an agreed upon price. But then the bank(s) could dump it to the open market the next day.

Worst case scenario is 12.3m shares get sold on a single day some time after ER. This may cause a 10% drop.

Best case is the stock keeps rising anyway, who knows.

Last edited:

bkp_duke

Well-Known Member

So, besides a potential FSD screw up that few people brought up here, there's another possibility for a drop that has been referenced, but not very explicitly. There was a youtube vid between @heydave7 and @bradsferguson discussing this.

Elon has a bunch of stock options expiring in 8/22, but he expressed the intention to deal with them in Q4 2021, b/c his tax rate may go from 53% to 57% in 2022 if Biden gets his way. Maybe it won't if Manchin gets in the way, but no way to tell if Elon will wait for that resolution.

These stock options will get hit with taxes if exercised unlike our calls that we can exercise withiout triggering a taxable event.

Elon has an option to borrow ~$20B against his shares pledged with banks to exercise and pay taxes(which I think is unlikely, as that will be close to 25% borrowing threshold set by the Tesla board) and then incur significant interest payments every year or he can sell 12.3m shares to pay these expenses.

He's allowed to trade within 7 weeks after ER as insider and potentially could do it in multiple batches before 8/22, but if the goal is to minimize taxes, then I think he may do it all in 2021. He may or may not split it into multiple days of selling within the 7 weeks. He may do it via a dark pool and sell to some bank(s) at an agreed upon price. But then the bank(s) could dump it to the open market the next day.

Worst case scenario is 12.3m shares get sold on a single day some time after ER. This may cause a 10% drop.

Best case is the stock keeps rising anyway, who knows.

The video a page back discussed this (the one interviewing a Market Maker). Basically the conclusion reached was this would be a "dark pool" sale of shares by Elon through a bank of his choice, and we probably would not hear about it until it is said and done.

The number of shares as you say is not small, but compared to some events we had last year like Tesla issuing new shares, it's not that large either. I think with the current up-trend, we could probably absorb that many shares in a day without a lot of change in the share price. It would probably be the FUD news after the fact which would move the market more, but even then, not that much.

My 0.02, I think it is already baked into the stock price, as everyone expects it is coming.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K