Well, all my saved orders triggered first thing this morning. Put spreads rolled from 12/3 to 12/10 for great premiums. I set at least one order too high because I preferred to close it out this week instead... and it rolled anyway. Oops. Though I can't have too many regrets while the price is headed up like this and the newly sold put spreads are already showing a nice profit!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

FS_FRA

Member

Rolled my 12/3 BPS 900/700 to 12/10 for $3.20

Looking to close my 12/3 1220 and 1240 CC @85% profit as an when... MMD now please!

Looking to close my 12/3 1220 and 1240 CC @85% profit as an when... MMD now please!

BrownOuttaSpec

Active Member

Isn't someone supposed to scold us for closing out positions so early in the week?  I'm still holding my 12/3 805/905 @60% gain so far.

I'm still holding my 12/3 805/905 @60% gain so far.

juanmedina

Active Member

I closed most of my BPS and Puts and sold some 1220cc. Now waiting for Elon to start selling some shares  .

.

corduroy

Active Member

I'm still holding all my -900/800s and -850/750s 12/3s. I'll probably close later in the week and wait for a red day to open more for 12/10 so just watching on the sidelines today.Isn't someone supposed to scold us for closing out positions so early in the week?I'm still holding my 12/3 805/905 @60% gain so far.

intelligator

Active Member

rolled 12/3 -975/+750 out and down to 12/10 -910/+810 net credit ... trying to better manage margin

bkp_duke

Well-Known Member

rolled 12/3 -975/+750 out and down to 12/10 -910/+810 net credit ... trying to better manage margin

Not advice - but something to consider since I'm in a similar position. You could just close the position entirely and wait for a drop to open the 12/10 position. That's just my personal trading style, I like to open BPS on a small drop, instead of rolling, just to try to pick up some extra premium.

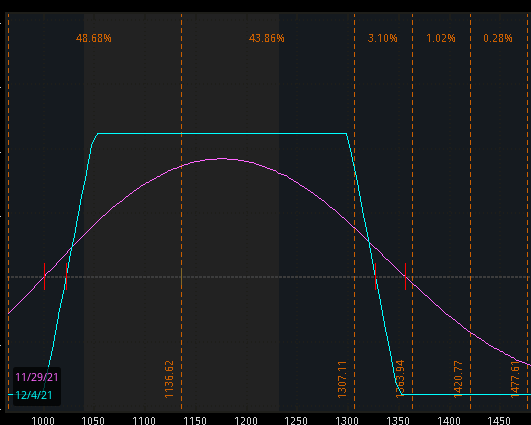

12/3 1050-1300 is my best IC to date, first time in very rare situation where credit is 20% higher/taller than the max loss... just need SP to please please please stay in the range 4 DTE

This is mainly a watching week for me with various rolled positions that should now be heading towards expiry. I had a IB perform a couple of liquidations last week when margin got a bit tight. The most unusual was the liquidation of 141 x 1260C+ that were part of 300 x 1210/1260 BCS. This left me with 141 naked calls and a Bulletin from IB warning me my account was exposed and they would start charging $500 per day from the 12/2. That's a new one for me but easily managed by buying some 1260's or BTC some of the 1210. At this stage I'm letting theta run down and will close them out closer to Friday unless they're at risk.

With the number of naked calls in this account it left new BPS actually lowering my maintenance margin. So I sold 255 x 1000/1040 BPS @$9.05 on Friday that are now over 50% profit. I've also sold another 100 x 990/1020 BPS today for $2.75 that are also looking OK. Otherwise I'll be watching and waiting for everything to close out this week.

With the number of naked calls in this account it left new BPS actually lowering my maintenance margin. So I sold 255 x 1000/1040 BPS @$9.05 on Friday that are now over 50% profit. I've also sold another 100 x 990/1020 BPS today for $2.75 that are also looking OK. Otherwise I'll be watching and waiting for everything to close out this week.

Last edited:

I legged in BCS 1300/1500 this morning (for 1.30) to existing 995/795 BPS opened last week. Expiry 12/3. Lets see how this goes this week. I see approvals for Austin and Berlin as positive for the stock this week, but there is also likely Elon selling still. Highest likelihood is the continuation of the bull flag forming.12/3 1050-1300 is my best IC to date, first time in very rare situation where credit is 20% higher/taller than the max loss... just need SP to please please please stay in the range 4 DTE

View attachment 738613

View attachment 738617

samppa

Active Member

I've been experimenting with this one trade gone bad.. last wednesday I was left with an Iron fly of +p1200/-p1250/-c1250/+c1300.

Closed the call side at around 90% profit, and was left with a totally ITM put spread of -p1250/+p1200. 5 contracts.

Could find no good rolls, so decided to throw in some more capital. Rolled it to 12/03 BPS -p1170/+p970, for minimal credit. Still 5 contracts.

And just now sold a BCS of -c1200/+c1300 to make this effectively an Iron Condor, expiring 12/03: +p970/-p1170 /-c1200/+c1300. It's still 5 contracts. Now this position has collected $64.72/contract, so I've saved it and it's now profitable (taking max loss would now result in profit of $14.7/contract).

Original BCS that has led to this was -c1100/+c1150, opened on 11/19. Lets see how this week goes.

Closed the call side at around 90% profit, and was left with a totally ITM put spread of -p1250/+p1200. 5 contracts.

Could find no good rolls, so decided to throw in some more capital. Rolled it to 12/03 BPS -p1170/+p970, for minimal credit. Still 5 contracts.

And just now sold a BCS of -c1200/+c1300 to make this effectively an Iron Condor, expiring 12/03: +p970/-p1170 /-c1200/+c1300. It's still 5 contracts. Now this position has collected $64.72/contract, so I've saved it and it's now profitable (taking max loss would now result in profit of $14.7/contract).

Original BCS that has led to this was -c1100/+c1150, opened on 11/19. Lets see how this week goes.

Isn't someone supposed to scold us for closing out positions so early in the week?I'm still holding my 12/3 805/905 @60% gain so far.

juanmedina

Active Member

Cool find! I followed your lead. It's actually a no loose trade!

I don't get it?

Last edited:

Max profit is greater than max loss. So if it goes to max loss, you still make money. Your calculator is wrong, or you entered the legs wrong.

bkp_duke

Well-Known Member

Max profit is greater than max loss. So if it goes to max loss, you still make money.

The options prices must have shifted considerably. I wasn't able to re-create this.

BrownOuttaSpec

Active Member

I don't think all 4 legs were bought at the same time to get the numbers they were seeing. The BPS was bought when the SP was lower today ($1120?) and the BCS was bought when the SP was higher ($1135?). Not sure, but just a guess. Would have to play around with the numbers, but something like this? TSLA Iron Condor calculator I am not sure though, I thought I matched the numbers of Yoona's post but I am only seeing a very small gain. Maybe IV calmed down a lot since then.

I don't think it works that way. There are no risk free trades, max loss is the maximum you can lose. You don't get max loss and max profit at the same time. It is either or.Max profit is greater than max loss. So if it goes to max loss, you still make money.

juanmedina

Active Member

Max profit is greater than max loss. So if it goes to max loss, you still make money. Your calculator is wrong, or you entered the legs wrong.

you are right that's not an IC. Here is the corrected trade but still doesn't make sense:

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K