Indices (SPX and QQQ) sitting at their weekly chart support levels, which are overall still showing bull trends. So, if there is a further breakdown, signaling the possible end of their bull markets, I don’t know if it’ll just last a couple weeks. Curious to know what indicators you keep an eye on.I guess I’ll make the counterpoint, that its not up from the Friday close.. being up 4-6% today after having been down 5% yesterday doesn’t really impress me in ability to say “:risk on” vs. bounce off the often Saturday selling that can occur. At this point, from Friday we’re essentially flat so indicative of risk capital deployment, well a few hours will telL. My guess is Sunday futures late tonite will probably fall, fall into Monday AM Pre mkt, then the games begin.

I think the overall risk OFF period that we are currently in, is going to continue and be volatile with lower indices, markets, commodities for the next couple weeks.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I agree with others and would add that you can keep rolling as it will eventually get back to ATH sooner rather than later. I'm more confident about that happening a week after earnings though and I've placed my trades accordingly. I think @BornToFly said it recently that "waiting is the hardest part" and patience. But theta burn helps with that.Not advice required from everyone here, let’s say you have a -p1150 7/1 that you rolled to -p1115 14/1 for a credit, would you roll it one week ou around Tuesday or Wednesday or would you take 2 weeks out? What is your rational between 1 week or 2 weeks between the balance for risk of assignment if getting DITM and adding time value versus the possibly if profit if a quick rebound occurs?

Thanks everyone

Knightshade

Well-Known Member

Doesn’t need to be short term. For example I bought some leaps in 2019 that are 180 strike expiring in March. If I knew that I wanted a bunch of cash and needed to sell next year before March I would exercise them now as I expect the stock to appreciate in the meantime. If I sold them and paid tax now I would end up with less profit.

Well, for something THAT DITM extrinsic is probably about 0, which I think I already covered.

But for anything with extrinsic left, which sounds like what the OP was asking about-- stuff that's not CRAZY deep ITM... you'd STILL be better off selling the calls (you won't have to actually pay the LT tax bill till next year anyway)-- then buying shares the same day to start a clock on them.

Though really if you're ONLY buying shares because you want to capture the gain between now and next year when you'll need money- buying shares doesn't make sense either... you'd just buy yourself more LEAPs-- long as you hold them the same 12+ months then sell you can capture the same delta between now and then at the same tax rate- PLUS get back the extrinsic left in your original LEAPs- PLUS need less $ -now- to get the same delta exposure compared to holding shares... in fact you could almost certainly get yourself higher delta exposure that way.

Clueless0_0

Member

FYI, for those of you that like to know what earning and financial events is going on next week.

Earnings: Commercial Metals, Accolade, Tilray

10:00 a.m. Wholesale trade

Tuesday

Earnings: Albertsons

6:00 a.m. NFIB survey

9:30 a.m. Kansas City Fed President Esther George

10:00 a.m. Fed Chairman Jerome Powell nomination hearing before Senate Committee on Banking, Housing, and Urban Affairs

4:00 p.m. St. Louis Fed President James Bullard

Wednesday

Earnings: Jefferies Financial, Infosys, KB Home, Wipro

8:30 a.m. CPI

2:00 p.m. Federal budget

2:00 p.m. Beige book

Thursday

Earnings: Delta Air Lines, Taiwan Semiconductor

8:30 a.m. Initial claims

8:30 a.m. PPI

10:00 a.m. Fed Governor Lael Brainard nomination hearing for Fed vice chair before Senate Committee on Banking, Housing, and Urban Affairs

12:00 p.m. Richmond Fed President Thomas Barkin

1:00 p.m. Chicago Fed President Charles Evans

Friday

Earnings: JPMorgan Chase, BlackRock,Citigroup, Wells Fargo

8:30 a.m. Retail sales

8:30 a.m. Import prices

9:15 a.m. Industrial production

10:00 a.m. Consumer sentiment

10:00 a.m. Business inventories

11:00 a.m. New York Fed President John Williams

Source:

What to watch in the markets in the week ahead

Inflation, rising rates and the Federal Reserve could whip stocks around in the week ahead

Week ahead calendar

MondayEarnings: Commercial Metals, Accolade, Tilray

10:00 a.m. Wholesale trade

Tuesday

Earnings: Albertsons

6:00 a.m. NFIB survey

9:30 a.m. Kansas City Fed President Esther George

10:00 a.m. Fed Chairman Jerome Powell nomination hearing before Senate Committee on Banking, Housing, and Urban Affairs

4:00 p.m. St. Louis Fed President James Bullard

Wednesday

Earnings: Jefferies Financial, Infosys, KB Home, Wipro

8:30 a.m. CPI

2:00 p.m. Federal budget

2:00 p.m. Beige book

Thursday

Earnings: Delta Air Lines, Taiwan Semiconductor

8:30 a.m. Initial claims

8:30 a.m. PPI

10:00 a.m. Fed Governor Lael Brainard nomination hearing for Fed vice chair before Senate Committee on Banking, Housing, and Urban Affairs

12:00 p.m. Richmond Fed President Thomas Barkin

1:00 p.m. Chicago Fed President Charles Evans

Friday

Earnings: JPMorgan Chase, BlackRock,Citigroup, Wells Fargo

8:30 a.m. Retail sales

8:30 a.m. Import prices

9:15 a.m. Industrial production

10:00 a.m. Consumer sentiment

10:00 a.m. Business inventories

11:00 a.m. New York Fed President John Williams

Source:

What to watch in the markets in the week ahead

Inflation, rising rates and the Federal Reserve could whip stocks around in the week ahead

Very helpful thanks!FYI, for those of you that like to know what earning and financial events is going on next week.

Week ahead calendar

Monday

Earnings: Commercial Metals, Accolade, Tilray

10:00 a.m. Wholesale trade

Tuesday

Earnings: Albertsons

6:00 a.m. NFIB survey

9:30 a.m. Kansas City Fed President Esther George

10:00 a.m. Fed Chairman Jerome Powell nomination hearing before Senate Committee on Banking, Housing, and Urban Affairs

4:00 p.m. St. Louis Fed President James Bullard

Wednesday

Earnings: Jefferies Financial, Infosys, KB Home, Wipro

8:30 a.m. CPI

2:00 p.m. Federal budget

2:00 p.m. Beige book

Thursday

Earnings: Delta Air Lines, Taiwan Semiconductor

8:30 a.m. Initial claims

8:30 a.m. PPI

10:00 a.m. Fed Governor Lael Brainard nomination hearing for Fed vice chair before Senate Committee on Banking, Housing, and Urban Affairs

12:00 p.m. Richmond Fed President Thomas Barkin

1:00 p.m. Chicago Fed President Charles Evans

Friday

Earnings: JPMorgan Chase, BlackRock,Citigroup, Wells Fargo

8:30 a.m. Retail sales

8:30 a.m. Import prices

9:15 a.m. Industrial production

10:00 a.m. Consumer sentiment

10:00 a.m. Business inventories

11:00 a.m. New York Fed President John Williams

Source:

What to watch in the markets in the week ahead

Inflation, rising rates and the Federal Reserve could whip stocks around in the week ahead

FS_FRA

Member

Echoing what many have written over the weekend, my 1/14 -990/+790 BPS could really do with a nice Green Day. Currently they are looking like *sugar*...

This morning I'm considering:

1. 1-week roll for credit at same strikes

2. roll as far as needed to get below -900/+700 for credit (this is my weak-macros play)

3. do nothing for another day or so

4. other not-advice ideas ? (BCS, IC, roll just the ITM short, etc.)

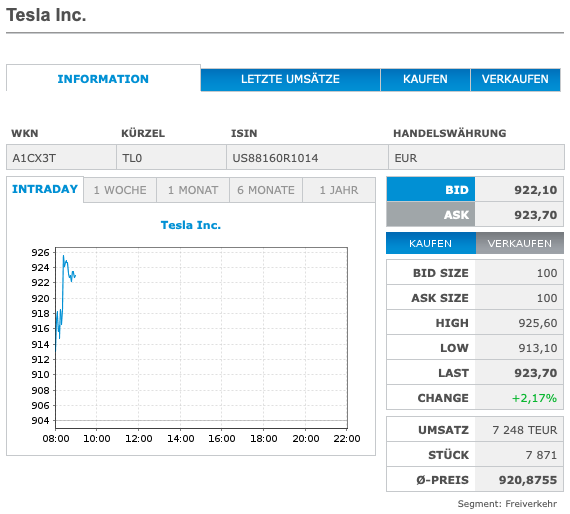

Not that it is ever really indicative, but Frankfurt is up 2% in early trading:

This morning I'm considering:

1. 1-week roll for credit at same strikes

2. roll as far as needed to get below -900/+700 for credit (this is my weak-macros play)

3. do nothing for another day or so

4. other not-advice ideas ? (BCS, IC, roll just the ITM short, etc.)

Not that it is ever really indicative, but Frankfurt is up 2% in early trading:

OK, my IBKR TWS is or doing something wrong, or fudging me over. I bought Feb25 800 puts for 15.48 a piece and they were at close 19.41. But they show up deep red affecting my margin bc somewhere over the weekend it thinks the market price is 11.70?

Now, I do understand that we are getting closer to the 25th of February, but with the SP barely nudging in after- and pre-market, I have a hard time believing this 11.70 is remotely true. I hope.

Now, I do understand that we are getting closer to the 25th of February, but with the SP barely nudging in after- and pre-market, I have a hard time believing this 11.70 is remotely true. I hope.

samppa

Active Member

I've got -1100/+800 bps for 1/14 and I'm not that worried.. these can be rolled still at 950.Echoing what many have written over the weekend, my 1/14 -990/+790 BPS could really do with a nice Green Day. Currently they are looking like *sugar*...

This morning I'm considering:

1. 1-week roll for credit at same strikes

2. roll as far as needed to get below -900/+700 for credit (this is my weak-macros play)

3. do nothing for another day or so

4. other not-advice ideas ? (BCS, IC, roll just the ITM short, etc.)

Not that it is ever really indicative, but Frankfurt is up 2% in early trading:

View attachment 754058

If we dip below 1000 then I'll roll.. but for now looking ahead, I'm quite bullish for this week.

FS_FRA

Member

-1100 ??I've got -1100/+800 bps for 1/14 and I'm not that worried.. these can be rolled still at 950.

If we dip below 1000 then I'll roll.. but for now looking ahead, I'm quite bullish for this week.

Yes, I got -1100p's early last week too because that looked like a good option for this week.-1100 ??

Not so much right now

samppa

Active Member

It's a roll from Elons sales time.. this is starting to be a neverending roll.-1100 ??

OK, my IBKR TWS is or doing something wrong, or fudging me over. I bought Feb25 800 puts for 15.48 a piece and they were at close 19.41. But they show up deep red affecting my margin bc somewhere over the weekend it thinks the market price is 11.70?

Now, I do understand that we are getting closer to the 25th of February, but with the SP barely nudging in after- and pre-market, I have a hard time believing this 11.70 is remotely true. I hope.

Options prices don’t change outside of normal market hours, so that seems like a glitch to me. Theta is only $0.55 for that option, so it should open at $18 give or take today - assuming no big stock price move

Looks like we go lower before any kind of rally. I posit that few if any predicted the price action of the past week with TSLA. I sold some BCS last Monday with trepidation and some CCs that have obviously fared well, but not on the basis that I thought the entire rally would collapse and be erased, but in the belief that it would stall for earnings. The BPS I sold on the never ending dips afterwards all look sick.

I believe that has many of us rattled here. TSLA executed well beyond even bullish expectations and is getting hammered ostensibly over a quarter or half a point of interest rates. I expected a beat down at some point, but timing is everything and the timing here is tough to swallow. But that is how the market works.

Should be an interesting week.

I believe that has many of us rattled here. TSLA executed well beyond even bullish expectations and is getting hammered ostensibly over a quarter or half a point of interest rates. I expected a beat down at some point, but timing is everything and the timing here is tough to swallow. But that is how the market works.

Should be an interesting week.

i suspect this -p900/+p800 is safe this week at 4 DTE, just need to ride out the stormin other news: yesterday STO BPS 1/14 -p900/+p800. I decided on -p900 (delta 7) because that's the 2nd-highest IO and volume in the afternoon; -p1000 (delta 24) i thought was very risky even though there was $123k more credit, so i am positioning my capital to hide farther back. The 950 wall and the 1000 wall are my 2 bodyguards. Really, really tempted by -p950, though, but i am thinking the extra $123k 'lost opportunity' insurance from black swan is my defense from losing capital.

waiting to IC it on -c1200/+c1300 (delta 5, 20% OTM)

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K