Less than $1 on a Monday is not great. If less than $0.50 I would move them immediately.Does anyone have any idea how low of a extrinsic value puts you at risk on getting puts exercised? My December 280p and June 350's are losing their extrinsic value fast. I really hope I don't have to make any moves and I think we will get a decent bounce once the twitter deal is done.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Closed out the -c205's and Jan 24 -c250's I sold on Friday to hit my weekly target in the first 25minutes - was too early as it happened, but as we all know, timing the market is a fools game, just be there-or-there-abouts,it's enough

I leave the -c220's in play, partly because I think they'll expire worthless, but also hoping they get exercised too

P.S. I don't think Elon is selling today, at first I thought it might be the case, but looks to me like TSLA followed the macro (with multiplier)

Lots of EV stocks down the shitter too, far worse than TSLA

I leave the -c220's in play, partly because I think they'll expire worthless, but also hoping they get exercised too

P.S. I don't think Elon is selling today, at first I thought it might be the case, but looks to me like TSLA followed the macro (with multiplier)

Lots of EV stocks down the shitter too, far worse than TSLA

bubb

Member

Another factor to consider vs. earlier this year with rates way up: there is now much higher opportunity cost of holding long puts that are deep in the money vs. exercising early and throwing the proceeds it in a treasury bill or whatever for the duration. I have DITM CSP (270) and am now monitoring extrinsic value vs. treasury bill prices maturing near monthly options expiration as part of timing my rolls.Does anyone have any idea how low of a extrinsic value puts you at risk on getting puts exercised? My December 280p and June 350's are losing their extrinsic value fast. I really hope I don't have to make any moves and I think we will get a decent bounce once the twitter deal is done.

intelligator

Active Member

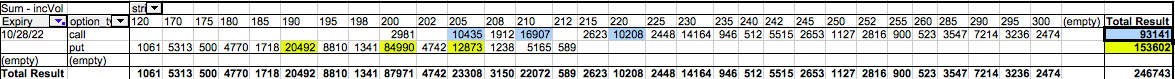

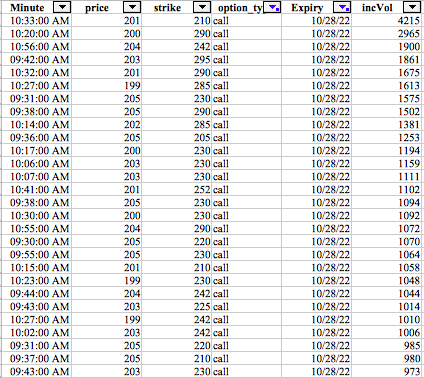

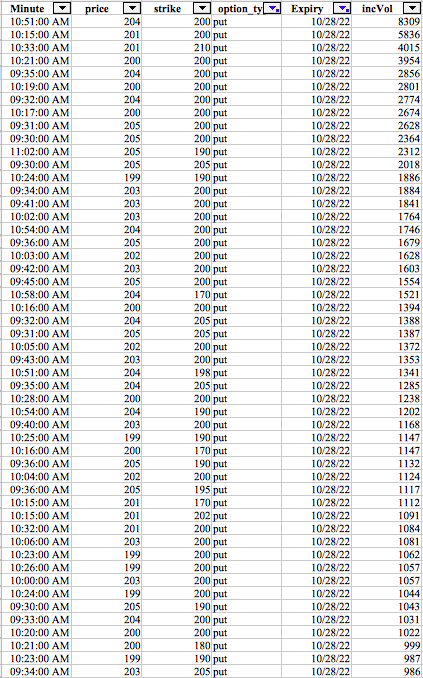

Options volume where contracts > 500 ... taken at 1130. The first is the sum per strike, per contract type, for the 28th. Below that are the call and put volumes, separate, with their time and price when they were executed, same expiry, through a portion of the tail-off to get an idea of the huge blocks vs more of the norm.

vwman111

Member

I keep getting hit with margin calls down at this level. It pains me to be selling and taking a permanent loss for what hopefully is a shorter term bottom. Was wondering about selling a portion of shares, and buying leaps to free up some cash to take pressure off margin calls and end up with a similar delta exposure. Currently looking at Jan 25 200C, 250C, or 300C.

I realize there is additional risk with OTM calls. Other than that, am i missing something? My objective is to keep my delta exposure the same while getting out of daily margin calls. This has been an awful 2 weeks!

I realize there is additional risk with OTM calls. Other than that, am i missing something? My objective is to keep my delta exposure the same while getting out of daily margin calls. This has been an awful 2 weeks!

Time value was getting thin, so I've rolled Nov 275 strike puts to Jan 273.33s (1.40ish credit plus the 1.67 strike improvement) and to Feb 275s for just under $5 credit.

I expect that both of these will be rolling again well before their expiration dates.

I had considered a csp to bps roll on a subset on some of these. Somewhere around a 50% increase in capital at risk (rolling 1 csp into 16 $25 wide BPS) I could get a 200/175 bps for next week. I decided that was too close to the sun and too aggressive for me. The good news here is that the roll into BPS can also be used to shorten DTE by a lot, so I'll keep an eye on additional roll opportunities. These positions won't necessarily live on all the way into next year or beyond.

I expect that both of these will be rolling again well before their expiration dates.

I had considered a csp to bps roll on a subset on some of these. Somewhere around a 50% increase in capital at risk (rolling 1 csp into 16 $25 wide BPS) I could get a 200/175 bps for next week. I decided that was too close to the sun and too aggressive for me. The good news here is that the roll into BPS can also be used to shorten DTE by a lot, so I'll keep an eye on additional roll opportunities. These positions won't necessarily live on all the way into next year or beyond.

What a wild morning. Closed my gambled CC's early this morning. 30 mins later, we broke under 200 and was kicking myself for closing too early! 30 mins after that and we're up again?!?!

Nothing wrong with taking profits. I did the same thing with no regrets.

scubastevo80

Member

Wrote BPS this morning when we breached the down 4.5% mark for Friday $180/$160 for $0.75. Could have got closer to $1 if I timed it better, but I'll be happy to take this to be bank if we flatline around $200 for a few days.

Closed 230 CC for 0.57 and took approximately 65% gain since friday.

Now we wait for a pop.

Same thing here

I did end up buying half of them back for a little less than I sold them. The other half are still sold for extra cash for margin.Thinking of buying back the shares I sold @ 203 if we get back up to 203. Thoughts?

The nice thing about the dip is that I bought back at a profit a bunch of CCs I had on my shares. At least now the 10,000 shares I bought back are uncovered.

the problem I run into with Fidelity when I look into selling shares and buying LEAPS, is that LEAPS don't give me any margin. So it doesn't help unless you use little of the cash you generated, which means buying cheap OTM LEAPS that risk expiring worthless in the future....I keep getting hit with margin calls down at this level. It pains me to be selling and taking a permanent loss for what hopefully is a shorter term bottom. Was wondering about selling a portion of shares, and buying leaps to free up some cash to take pressure off margin calls and end up with a similar delta exposure. Currently looking at Jan 25 200C, 250C, or 300C.

I realize there is additional risk with OTM calls. Other than that, am i missing something? My objective is to keep my delta exposure the same while getting out of daily margin calls. This has been an awful 2 weeks!

The other question to be asking yourself is what the purpose of buying the leaps would be for you. When buying DITM and long dated leaps, I view these as share replacement calls. One would buy them in order to increase leverage. I.e. - buying 2 leaps instead of 100 shares and having about 1.6 delta.the problem I run into with Fidelity when I look into selling shares and buying LEAPS, is that LEAPS don't give me any margin. So it doesn't help unless you use little of the cash you generated, which means buying cheap OTM LEAPS that risk expiring worthless in the future....

But if you don't need the leverage then shares are better.

intelligator

Active Member

After seeing the price climb late afternoon, I decided to close 10/28 -220 CCs , hours late ... the difference between closing at 90% and 20% profit. Better than having to roll. Most all call volume for the 28th is now above 220, somebody knows something

SebastienBonny

Member

Yeah, selling 240 cc for next week would be comfortable to me so getting above 220 would be very welcome for a good premium.After seeing the price climb late afternoon, I decided to close 10/28 -220 CCs , hours late ... the difference between closing at 90% and 20% profit. Better than having to roll. Most all call volume for the 28th is now above 220, somebody knows something

I was wondering: is there a smaller chance of being assigned when you’re short a put option with a strike that is a broken number (266,67, 303,33) than a whole number (270, 305)?

Many owners of the put options with a broken number were already holding them before the split, so that means they’ve held on to them for at least a few months and don’t seem to be highly motivated on exercising them early.

The ones holding options with whole numbers all bought them after the split. Perhaps they are more keen on assigning the shares.

Or does that not make any sense at all?

Many owners of the put options with a broken number were already holding them before the split, so that means they’ve held on to them for at least a few months and don’t seem to be highly motivated on exercising them early.

The ones holding options with whole numbers all bought them after the split. Perhaps they are more keen on assigning the shares.

Or does that not make any sense at all?

R

ReddyLeaf

Guest

Oops, I did just the opposite. While sleeping, I bought enough shares this AM (200-204) to fill out another 100 lot. Got back this afternoon from rotating the tires, saw the SP spike, so sold 1x 10/28 -c220 @ $3.30. Perhaps a mistake, or maybe just a buy-write. Because of all these “buying opportunities,” I’m overweight on shares (CCs) vs puts.After seeing the price climb late afternoon, I decided to close 10/28 -220 CCs , hours late ... the difference between closing at 90% and 20% profit. Better than having to roll. Most all call volume for the 28th is now above 220, somebody knows something

One thing I learned with the 1:1 balanced short straddle is that as the SP drops and the -c/-p are rolled down, cash is released from the CSP, which I was then using to buy more shares. For example, rolling down $10 from 240 to 230 released $1000/contract (allowing me to buy ~4-5 shares if appropriately timed). I did this a couple times, rolling out weeks as well. Now, I’m overweight CCs vs CSPs and as the SP rises, I must inject cash back into the CSPs at $1000/contract for every $10 SP rise and straddle roll. If the SP rise is ONLY $10/wk it should be no problem staying ahead of the rise and rolling out. Unfortunately, a faster rise means I must let some CCs go and sell CSPs (likely at lower strikes than ATM).

I know this is simple and intuitive, but I just hadn’t thought through the mechanics of SP rise on straddles. Originally, they were ATM around $250, but the SP has dropped so much that, even with rolling down, they are slightly OTM high. If the SP rockets back above $250 this week, I won’t have enough cash to roll the CCs out and back CSPs at 250. Thus, I must roll out at lower strike CSPs, losing the ATM premiums as my CSPs fall off the wheel. This will convert the $230 straddles to something like $230/$250 strangles. Not a terrible problem, perhaps even a bit easier to roll (or expire the puts), but something that I had not really thought about as I kept buying stock with my free cash.

The past month I’ve really enjoyed having 10x more free cash in the accounts than normal, (even though the “total value” has dropped dramatically with SP). Now, as the SP rises (hopefully), I will enjoy the total value balance rising, while fretting about the lack of free cash and trying to roll the strikes higher. First world problems.

FYI, decided to try the short straddle method because I can’t seem to time the market, guess the direction correctly, or understand why the SP has dropped below $350-$400. Everything seems upside down or backwards. Hopefully this isn’t too much of a lousy method since the shares/funds are in retirement accounts and I will eventually need the money (maybe 5-10 years).

So for quite a long time now, I have been using the "Non-margin Buying Power" (on Fidelity) or "Non-Marginable Purchasing Power" (on Etrade) to decide how much margin was left for doing BPS. And I always try to keep it at a high level. Last week when the SP was pretty low I was checking Fidelity and while my Non-Margin BP was about $350K, I noticed in the margin balance details page that my "House Surplus" was down to about $70K. And this got me quite concerned as it is hidden away from normal view.

To fix some of this, I did a few BPS to CC conversions this morning and freed up another $20K of margin.

Its unclear to me how Fidelity calculates this House Surplus, wondering if people have got margin called on that?

Also, I can't find any similar number on Etrade. Do they have something like that I need to be concerned about?

To fix some of this, I did a few BPS to CC conversions this morning and freed up another $20K of margin.

Its unclear to me how Fidelity calculates this House Surplus, wondering if people have got margin called on that?

Also, I can't find any similar number on Etrade. Do they have something like that I need to be concerned about?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K