Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

@Max Plaid you make me so brave!

STO BPS 110/100 for 1/6/23. 2.95

STO BPS 90/75 for 1/6/23. 0.85

And no, it was only one each. What’d ya think I’m nuts? Just managed to get my account to where liquidation takes place at 60 or so.

STO BPS 110/100 for 1/6/23. 2.95

STO BPS 90/75 for 1/6/23. 0.85

And no, it was only one each. What’d ya think I’m nuts? Just managed to get my account to where liquidation takes place at 60 or so.

SebastienBonny

Member

Had to do something I didn’t want to but it was necessary.

Bought 100 PUT jan 25.

Sold 200 CC jan 25 to pay for the put (together with the sale of a 40 PUT I already had).

This to give me a margin relief until SP of 50…

This seems a better position, because the CC is obviously fully covered.

I have a 210 jan 25 PUT on margin, mostly TSLA, so this was needed.

I really don’t want to sell at that level in 25, but will have rolling opportunities on this.

This is a hard lesson, but will avoid margin in the future or at least very conservative.

Bought 100 PUT jan 25.

Sold 200 CC jan 25 to pay for the put (together with the sale of a 40 PUT I already had).

This to give me a margin relief until SP of 50…

This seems a better position, because the CC is obviously fully covered.

I have a 210 jan 25 PUT on margin, mostly TSLA, so this was needed.

I really don’t want to sell at that level in 25, but will have rolling opportunities on this.

This is a hard lesson, but will avoid margin in the future or at least very conservative.

Last edited:

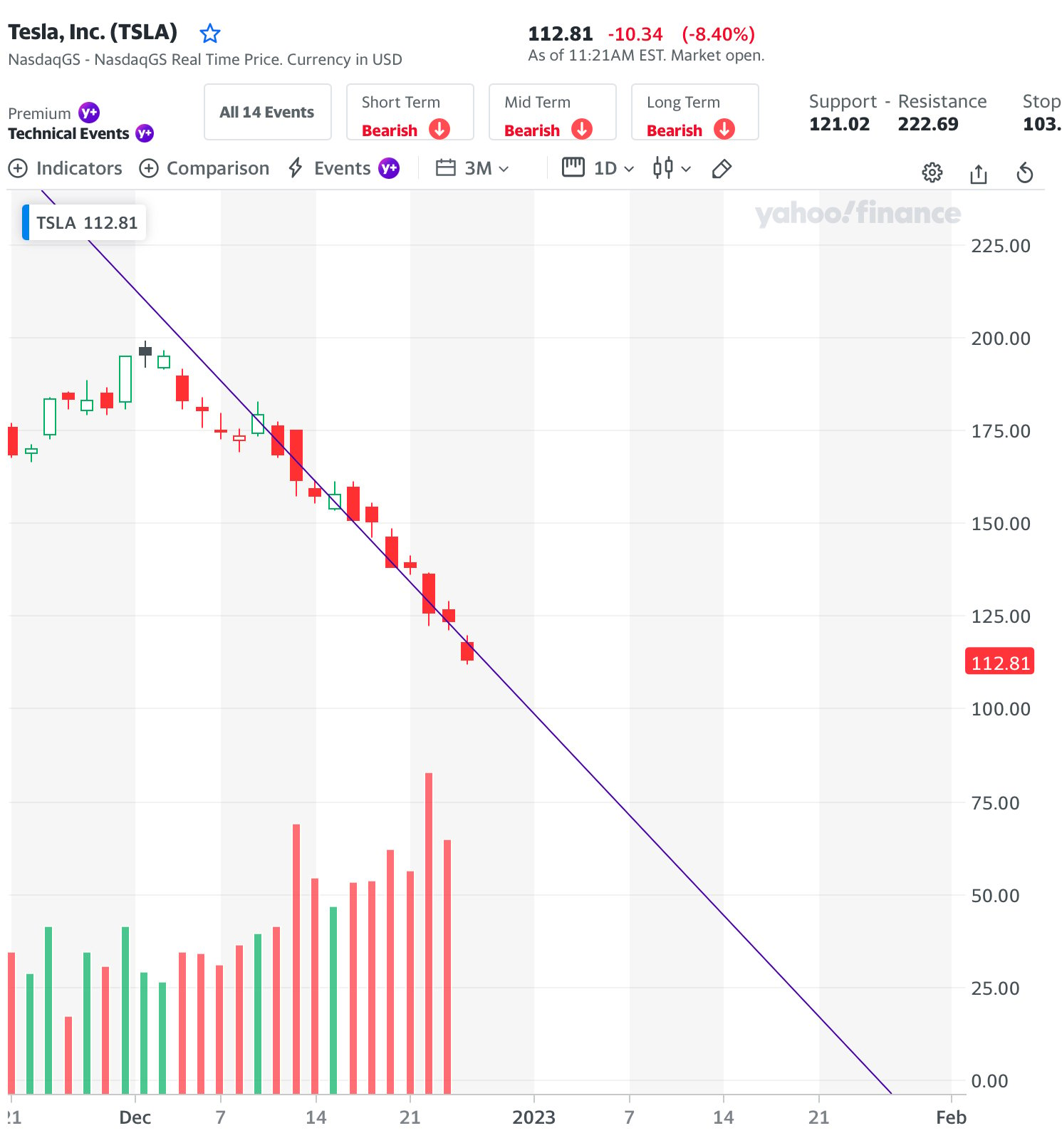

Looks like we are at a FIB level at ~$115. Hope we see some consolidation. I thought the same at $177 Fib level, which barely held on. I think what's stopping institutional money from buying in, is the expectation that we will see consumer discretionary slow down in Q1 earnings.

If Tesla has a killer Q4 like he said in the last earnings call, maybe that will give us some relief. But I'm not sure if his hard discounting on cars to be sold by end of year, is bullish or bearish to make Q4 targets.

If Tesla has a killer Q4 like he said in the last earnings call, maybe that will give us some relief. But I'm not sure if his hard discounting on cars to be sold by end of year, is bullish or bearish to make Q4 targets.

TA is making little difference in a down market with shareholders worrying about increasing losses. We just hit 112.91 for a 52 week low. At some point TSLA could be a value/growth stock but we ain't there yet.

R

ReddyLeaf

Guest

I sure hope everyone who was facing margin calls got out at open. Another brutal, soul-crushing day. Three more days until EOY and we can say good riddance to this beyond belief year. I’ve rolled my 12/30 125 straddles down to 120s and115s and bought another 50 shares (unfortunately in the $116-$114 range instead of waiting for the drop into the $112s). Where’s the bottom? We can’t go on at this rate much longer, certainly not past Jan 26th.

I sure hope everyone who was facing margin calls got out at open. Another brutal, soul-crushing day. Three more days until EOY and we can say good riddance to this beyond belief year. I’ve rolled my 12/30 125 straddles down to 120s and115s and bought another 50 shares (unfortunately in the $116-$114 range instead of waiting for the drop into the $112s). Where’s the bottom? We can’t go on at this rate much longer, certainly not past Jan 26th.

View attachment 889235

I didn’t

I was skiing with the kids

I’m disgusted by the market

Straigh down, no bounce, rigged markets

Will never use leverage again

Last edited:

Do you remember guys when there was so much news that retail Tesla investors stuck it to Wall Street ..... I think now Wall Street is taking it all back ... and some, more than some

intelligator

Active Member

Was called last week, sold some high cost basis TSLA and non-TSLA to satisfy margin. Slowly closing Jan 2025 DITM BPS that are so underwater, taking those with the least extrinsic time value. I have -300, -280, -260 short legged BPS and a Sep '24 -290 CSP that I don't believe I will be able to roll - not enough cash or collateral.

Although the -300p have $2.30, I am nervous if assigned and a possible run up, losing value on the +250p ... am I thinking this rationally?

I can write CC but call premiums are so low, not sure I want to risk 20% out and then get caught going the other direction.

EDIT: -260p ($2.30 extrinsic), not the -300p ($2.85) ... similar lousy position.

Although the -300p have $2.30, I am nervous if assigned and a possible run up, losing value on the +250p ... am I thinking this rationally?

I can write CC but call premiums are so low, not sure I want to risk 20% out and then get caught going the other direction.

EDIT: -260p ($2.30 extrinsic), not the -300p ($2.85) ... similar lousy position.

Last edited:

walkrunflyy

Member

Hi everyone. I've been a reader of this thread for many years.

I made good money selling puts over the last few years but lost everything with this crash.

Now, I need some advice. I have sold 2 puts $300 and 2 puts $305 dated May 2023.

I got a message that I have been assigned! I don't have the cash required and have a margin of $200k.

What can I do now? This never happened to me.

I made good money selling puts over the last few years but lost everything with this crash.

Now, I need some advice. I have sold 2 puts $300 and 2 puts $305 dated May 2023.

I got a message that I have been assigned! I don't have the cash required and have a margin of $200k.

What can I do now? This never happened to me.

myt-e-s-l-a

Member

I didn’t

I was skiing with the kids

I’m disgusted by the market

Straigh down, no bounce, rigged markets

Will never use leverage again

Amen

And

Cut your Losses

TexasGator

Member

The extrinsic is getting low enough that it may be worth closing now vs having SP drop further and then closing is much worse (think of SP at 105 or lower tomorrow)Was called last week, sold some high cost basis TSLA and non-TSLA to satisfy margin. Slowly closing Jan 2025 DITM BPS that are so underwater, taking those with the least extrinsic time value. I have -300, -280, -260 short legged BPS and a Sep '24 -290 CSP that I don't believe I will be able to roll - not enough cash or collateral.

Although the -300p have $2.30, I am nervous if assigned and a possible run up, losing value on the +250p ... am I thinking this rationally?

I can write CC but call premiums are so low, not sure I want to risk 20% out and then get caught going the other direction.

EDIT: -260p ($2.30 extrinsic), not the -300p ($2.85) ... similar lousy position.

I closed Jan 250p at open this morning those look like they likely to get assigned tonight they currently look to have 0 time value down to 110

Interesting article on TSLA by Alexander Mers:

alexandramerz.substack.com

alexandramerz.substack.com

Do know, there is more Drama ahead

While no one wants to talk about it, you can bet, it's coming.

bkp_duke

Well-Known Member

Hi everyone. I've been a reader of this thread for many years.

I made good money selling puts over the last few years but lost everything with this crash.

Now, I need some advice. I have sold 2 puts $300 and 2 puts $305 dated May 2023.

I got a message that I have been assigned! I don't have the cash required and have a margin of $200k.

What can I do now? This never happened to me.

Generally you would have to sell the assigned shares to pay for the margin call.

Nate the Great

Member

I have gone down the rout of selling CC instead of Puts.

Strike price at $400.

Strike price at $400.

EVNow

Well-Known Member

Waited for today to sell calls instead of on Friday .... so ofcourse the SP goes down by another 8%. I guess I'll wait another day or two before selling calls for this week.

JSML

Member

Sold shares I bought last week at the open. $ 10 loss per share. The market is so volatile, I am putting a few dollars on the side in case it goes down. I imagine at some point, I will deploy all my capital and go into leverage again. Just don't know when that will be. I am also Ok to buy back if the price trend should reverse. Down so much this year, I am just trying to survive and come through the other side at this point.

Rolled down Dec 30 -c137 and -c140 to Dec 30 -c128, and -c130.

Still holding Dec 30 -c135

Rolled down Dec 30 -c137 and -c140 to Dec 30 -c128, and -c130.

Still holding Dec 30 -c135

JSML

Member

It's hard to assess without the whole picture of your portfolio. Just on a mechanical basis,Hi everyone. I've been a reader of this thread for many years.

I made good money selling puts over the last few years but lost everything with this crash.

Now, I need some advice. I have sold 2 puts $300 and 2 puts $305 dated May 2023.

I got a message that I have been assigned! I don't have the cash required and have a margin of $200k.

What can I do now? This never happened to me.

1) You now own 400 shares at a cost basis close to $ 300 depending on the original premium you received. If you need tax harvesting, you can sell some of these and get the tax loss.

2) If your margin was $ 200K before the assignment, you should be fine margin wise. The stocks cost basis is around $ 120K and the broker will give you some margin on the stock. The broker also assigned some margin amount for your puts before the assignment. This amount will be freed up.

However, if the 200K margin is not "available margin" but some other meaning of margin, you may need to do something, like selling the stock to raise cash.

If you end up holding the stock and using margin to hold it, you'll pay interest.

3) Your future moves are greatly dependent on what you want to do and your view of the market and Tesla stock.

@dl003:

How’ve you been holding up? Seeing anything interesting in the cards?

Mauro posted a scary wave structure today:

How’ve you been holding up? Seeing anything interesting in the cards?

Mauro posted a scary wave structure today:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K