Long term TSLA should outperform but short term, warnings or slow growth from one of these big boys are seen as having negative impact on the entire economy, Tesla included. How Tesla ends up navigating these headwinds will set it apart from everything else but that remains to be seen.With the crappy earnings reports, you would think that TSLA would rise as it clearly stands-out as the best growth stock of the lot, by a wide margin. But no, it gets dragged down too. I never understood this mentality

Also AAPL miss is due to C19 related production issues, a one-off, not a reason to hammer the stock, they still printed money like crazy

When we were trading in the 190's, I nearly closed-out this week's -p180's, but then decided the risk was very low and let them be... however now I'm thinking to let them assign as they'll then cover my ITM -c180's, of they assign, we'll see - lots of call-walls 180 and above, in fact there's one at 175, so those that do this kind of thing might want a close 173ish tomorrow, if they can

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Personally, I'm not buying any put. My opinion is we have seen the low @ 102. Any correction from here is just that, a correction. No fresh low so no need to hedge for me. Since we made it all the way up to 197, I think the maximum drawback has now moved up to 140 so if your account could survive at 140, you should be fine.So what now? if it breaks $183 load up on puts?

On the flip side, pay attention to the 2/17 expiry. BRK usually files its 13d in the middle of February. If it bought any TSLA, watch out above.

Last edited:

Automated sector trading vs. individual company tug-of-war?With the crappy earnings reports, you would think that TSLA would rise as it clearly stands-out as the best growth stock of the lot, by a wide margin. But no, it gets dragged down too. I never understood this mentality

Also AAPL miss is due to C19 related production issues, a one-off, not a reason to hammer the stock, they still printed money like crazy

When we were trading in the 190's, I nearly closed-out this week's -p180's, but then decided the risk was very low and let them be... however now I'm thinking to let them assign as they'll then cover my ITM -c180's, of they assign, we'll see - lots of call-walls 180 and above, in fact there's one at 175, so those that do this kind of thing might want a close 173ish tomorrow, if they can

juanmedina

Active Member

Personally, I'm not buying any put. My opinion is we have seen the low @ 102. Any correction from here is just that, a correction. No fresh low so no need to hedge for me. Since we made it all the way up to 197, I think the maximum drawback has now moved up to 140 so if your account could survive at 140, you should be fine.

I am all cash now but I lost some shares in the way down. I would like to recover some and I am too afraid now to use my margin.

Personally, I'm not buying any put. My opinion is we have seen the low @ 102. Any correction from here is just that, a correction. No fresh low so no need to hedge for me. Since we made it all the way up to 197, I think the maximum drawback has now moved up to 140 so if your account could survive at 140, you should be fine.

On the flip side, pay attention to the 2/17 expiry. BRK usually files its 13d in the middle of February. If it bought any TSLA, watch out above.

This is a breath of fresh air! Thank you!

Do you also track the indices? If yes, what do you make of the current run in SPY, is it sustainable? I have some bearish put debit spreads on SPY 390/387 3/31/23 that I am trying to climb out of (currently red) and wondering if we may see a retracement to 400 area so I can escape. I am not great at reading charts.

Thanks.

I am all cash now but I lost some shares in the way down. I would like to recover some and I am too afraid now to use my margin.

I’m in a similar boat. Delevered on the way down and am sitting on about half of my original share count, but with cash to deploy. Reluctant to take on any significant margin for obvious reasons.

intelligator

Active Member

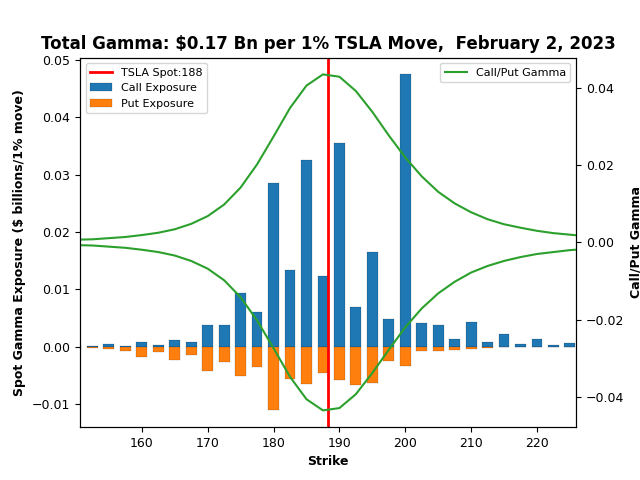

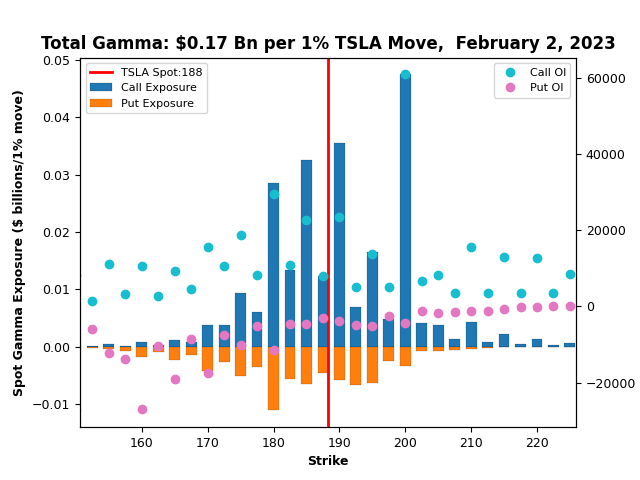

Put OI at 160 and 170 is about the same as c180 and c190. The c200 must be a distraction of sold calls; interest is beginning to build at 200 for next week as well. I personally hope we slide down some to have a chance at expiring c170 and c175. I'll be out of wash sale jail then but don't want to buy back just yet... had to sell to save account, most at and below 120. Today we are gamma positive hard, yesterday was .13 , call to put ratio was close to 4:1 mid-day, then poof. Given the weak earnings readout today, will we walk down through 180? Feels like a reversal is possible. Congrats to those that were lucky enough to time and sell 210 and 220 for next week ... don't forget to take profit !!!

R

ReddyLeaf

Guest

Thanks so much for helping everyone understand a bit better. I’m a slow learner, but every time you post something, I learn just a little bit more. Case in point, I’ve always had difficulty understanding how to read alternative indicators like MACD, RSI. etc. It always just looked like voodoo that turned at the same time as the stock price, so not very predictive. Now, with this post, I read about bearish divergence on Investopedia and understand just a little better. Also, your use of hourly charts seems very helpful, so I tried plotting with momentum indicators. All three indicators are showing lower highs, while the SP has a higher high. This definitely looks like there was a local top at ~197, and that we will trend downward from here. Given recent tech earnings, $165 MaxPain, and trading in AH & futures, the bears now look to be in “temporary“ control. This afternoon looked like a great time to sell CCs (unfortunately I’m still trying to save -c155s, so no great premiums for me). Thanks again and GLTA.First I see a new high without any bearish divergence (181 last Friday)

Then I wait for a pullback

Then I wait for a higher high with bearish divergence (197 today)

Edit: When I add stochastics to the chart per @Jim Holder ‘s comments, it also shows a slightly lower number, further suggesting the bearish divergence. Again, I’m just a newbie, but trying to learn more about these additional indicators.

Last edited by a moderator:

Thanks so much for helping everyone understand a bit better. I’m a slow learner, but every time you post something, I learn just a little bit more. Case in point, I’ve always had difficulty understanding how to read alternative indicators like MACD, RSI. etc. It always just looked like voodoo that turned at the same time as the stock price, so not very predictive. Now, with this post, I read about bearish divergence on Investopedia and understand just a little better. Also, your use of hourly charts seems very helpful, so I tried plotting with momentum indicators. All three indicators are showing lower highs, while the SP has a higher high. This definitely looks like there was a local top at ~197, and that we will trend downward from here. Given recent tech earnings, $165 MaxPain, and trading in AH & futures, the bears now look to be in control. This afternoon looked like a great time to sell CCs (unfortunately I’m still trying to save -c155s, so no great premiums for me). Thanks again and GLTA.

View attachment 902762

I wonder if bearish divergence needs to be confirmed on the next day or so, coupled with losing stochastic > 60 and a downward break through a support from a congestion zone after fall from local top (ala Pierre Roberge), before we can be confident it’s a downward correction requiring serious attention (repositioning, going to cash, buying protective hedges, etc.). Perhaps sometimes, like today, the downward divergence may be a temporary (short lived) sympathy move with the market, and not really instructive for TSLA specifically, and TSLA will resume its upward trajectory shortly. Hence the need for some confirmation.

I’m no expert, just sharing some thoughts.

CN retail, +241% yoy, huge considering the focus on exports early in the quarterNasdaq(-1.35) and SP500(-0,73) futures down, Tesla up 0,9%. With a call wall at 200(56k contracts) this could be an interesting day.

EDIT: hot jobs data crashing the markets, and yet wages stable, very low unemployment, inflation falling -> perfect scenario IMO to avoid recession

Last edited:

So much for my -p180's assigning, pfff!

I'm kind of shocked....

Horrible earnings by various companies last night, and terrible futures. We all know that Tesla is a shining star and everyone should be investing in it instead of AMZN, etc., but usually WallStreet doesn't seem to catch on. But this morning's price action has me thinking that maybe investors have finally figured it out?....

When I went to bed I thought my 200CCs were safe. Now this will be interesting. I do think we might end the day right around 200 (like 199.98)....

Horrible earnings by various companies last night, and terrible futures. We all know that Tesla is a shining star and everyone should be investing in it instead of AMZN, etc., but usually WallStreet doesn't seem to catch on. But this morning's price action has me thinking that maybe investors have finally figured it out?....

When I went to bed I thought my 200CCs were safe. Now this will be interesting. I do think we might end the day right around 200 (like 199.98)....

Really, could always take a 1-week roll and worry about it next week and enjoy your weekendI'm kind of shocked....

Horrible earnings by various companies last night, and terrible futures. We all know that Tesla is a shining star and everyone should be investing in it instead of AMZN, etc., but usually WallStreet doesn't seem to catch on. But this morning's price action has me thinking that maybe investors have finally figured it out?....

When I went to bed I thought my 200CCs were safe. Now this will be interesting. I do think we might end the day right around 200 (like 199.98)....

intelligator

Active Member

2/10 -c220 are $2.35 -c230 are $1.43 , they were 1.26 and .69 at end of day. I didn't record what they were at this price point yesterday after noon , seems like a good premium for the 230's , I'd expect those to be safe.

EDIT: Following the price movement, 20% + OTM , -c240 for $1.40+ while at 198... wow.

EDIT: Following the price movement, 20% + OTM , -c240 for $1.40+ while at 198... wow.

Last edited:

I'm kind of shocked....

Horrible earnings by various companies last night, and terrible futures. We all know that Tesla is a shining star and everyone should be investing in it instead of AMZN, etc., but usually WallStreet doesn't seem to catch on. But this morning's price action has me thinking that maybe investors have finally figured it out?....

When I went to bed I thought my 200CCs were safe. Now this will be interesting. I do think we might end the day right around 200 (like 199.98)....

If it breaks 197 it might not be a bad idea to close these and reopen later instead of rolling. If 197 breaks we could see 200s in a hurry. The fact that it is getting tight here could make this go either way.

Yes, but I would rather they expire worthless so I can earn some income next week with a strike 20% OTM.Really, could always take a 1-week roll and worry about it next week and enjoy your weekend

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K