Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I'm missing options quotes on IBKR as well, having to feel my way into orders. But it appears to be only for March 31 expiry, the next week expiry and beyond are showing quotes.Am I the only one not seeing quotes for many options? Does IBKR have problems, or the options market as a whole?

Edit: And now they've just appeared for March 31 as well.

jeewee3000

Active Member

Not missing quotes, no. Care to give an example of a specific option contract so I can verify?Am I the only one not seeing quotes for many options? Does IBKR have problems, or the options market as a whole?

chiller

Member

Seems like IBKR just fixed itself, I was having the same problems here.

I sold 225CC for Friday on the opening pop for 0.2

I wish I had sold more. I will not do anything else today. I hope China numbers are strong tomorrow morning for another pop. I don't expect to be below 190 on Friday, but I also don't think the market is going to do a huge run up before P&D. Maybe we will have a good week next week if there is a solid beat.

I wish I had sold more. I will not do anything else today. I hope China numbers are strong tomorrow morning for another pop. I don't expect to be below 190 on Friday, but I also don't think the market is going to do a huge run up before P&D. Maybe we will have a good week next week if there is a solid beat.

Sold a -c200 and -p190 for this week - waited until this morning instead of last week like I usually do. Also sold 10x -p207.50 as well as holding 8x -p197.50 in retirement account that I rolled (too early) from 192.50 last week.

juanmedina

Active Member

I haven't sold anything yet waiting for the FOMO and IV to go up.

Where is the FOMO?

Where is the FOMO?

Last edited:

Tech sector is so weak today that killed the run this morning. We might see it again (or not) when having China number this week. Btw, the macro is not supportive at all.I haven't sold anything yet waiting for the FOMO and IV to go up.

Where is the FOMO?

EVNow

Well-Known Member

Yes - all the calls and puts are down today. Missed selling calls early morning ...I haven't sold anything yet waiting for the FOMO and IV to go up.

Where is the FOMO?

Irritating! Earlier when it was ripping, put a $2.4 limit buy to the -p190's I sold Friday, that's 60% profits and a chance to resell, missed by 16c

Is everyone selling tech and buying the banks?

Is everyone selling tech and buying the banks?

Last edited:

SpaceXaddict

Member

Greetings. I've been investing and doing speculation for a long time, with several periods trading options. One thing I've learned is that options really vary depending on the nature of the underlying. For a couple months I've been dabbling in TSLA options. I've been trying to find a strategy that fits. Lately, I've been following the sort of "tasty trade" method: Sell wide strangles at 1SD and then roll up the untested sides. Unfortunately, TSLA has been so dynamic that I keep rolling myself into being short a straddle (or too close for comfort.)

I'm new here, and it seems the posters in this thread are doing weekly strangles? I'd love it if anyone could point me to a summary of the strategy you are following-- particularly how you manage positions as the stock moves.

I'm trading from a cash account (no margin is a rule for me) and have 200 shares of TSLA and enough cash to sell 200 more shares worth of cash secured puts. So I can do 2 short calls and 2 short puts at a time.

Thanks in advance!

PS-- I am reading this thread from the beginning, but it is 1360 pages so will take me awhile. I too started thinking of the "wheel" strategy".

I'm new here, and it seems the posters in this thread are doing weekly strangles? I'd love it if anyone could point me to a summary of the strategy you are following-- particularly how you manage positions as the stock moves.

I'm trading from a cash account (no margin is a rule for me) and have 200 shares of TSLA and enough cash to sell 200 more shares worth of cash secured puts. So I can do 2 short calls and 2 short puts at a time.

Thanks in advance!

PS-- I am reading this thread from the beginning, but it is 1360 pages so will take me awhile. I too started thinking of the "wheel" strategy".

Last edited:

I put in a STC order for my $190P's this morning - opened for $7 each (part of a collar) Friday and closed for $2.75 this morning.Irritating! Earlier when it was ripping, put a $2.4 limit buy to the -p190's I sold Friday, of 60% profits and a chance to resell, missed by 16c

Is everyone selling tech and buying the banks?

Also closed a ratio of the Calls $200's at $4.25 each to pay for the Put closing - now free rolling 03/31 $200's at $0 cost basis

Looking to be out for the P&D next week - so I am letting these run this week to see if we get a good pop near or just over $200.

So, the market is expecting flat sailing sideways ?Yes - all the calls and puts are down today. Missed selling calls early morning ...

That means, some big moves are incoming

wish I knew which direction...

Don't try to beat Mr. MarketSo, the market is expecting flat sailing sideways ?

That means, some big moves are incoming

wish I knew which direction...

intelligator

Active Member

I'd missed selling puts spreads at the dip to 190 ... set a walk-away open order for -177.5p/+172.5p at .75 , never got there.

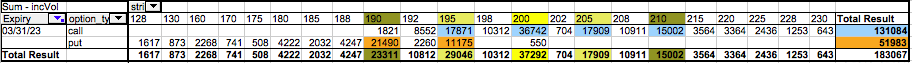

Options Volume (where contracts > 500) as of 3pm.

Call to Put ratio is 2.52:1 , c200 is hot, +-$5 strike are second up.

Options Volume (where contracts > 500) as of 3pm.

Call to Put ratio is 2.52:1 , c200 is hot, +-$5 strike are second up.

Last edited:

I'd missed selling puts spreads at the dip to 190 ... set a walk-away open order for -177.5p/+172.5p at .75 , never got there.

Options Volume (where contracts > 500) as of 3pm.

Call to Put ratio is 2.52:1 , c200 is hot, +-$5 strike are second up.

View attachment 921916

Looks like we drift to 200 max before Friday.

I STO 2x -P185. I plan to BTC on TSLA’s next manic episode to 197 or so tomorrow morning or whenever it comes

(Already sitting on 5x -P187.50 from $4 for Friday. Same plan.)

Good China delivery numbers overnight might give us a pop like last week. Planning to close my 200s before close today.

chiller

Member

sold 210C for this friday for 1.15, closed at 0.57 one hour later (0.58 gain).

sold 210C for next Friday for 4.05, closed at 2.98 just before end of trading for 1.07 gain.

Sold both of them 40-ish minutes after open, when IBKR fixed their quotes.

Was planning on keeping them open until Friday, but seemed smart to take profit.

sold 210C for next Friday for 4.05, closed at 2.98 just before end of trading for 1.07 gain.

Sold both of them 40-ish minutes after open, when IBKR fixed their quotes.

Was planning on keeping them open until Friday, but seemed smart to take profit.

Quite possible and I thought to do the same, but the huge dump into close spiked IV and the call premiums actually went up as the SP droppedGood China delivery numbers overnight might give us a pop like last week. Planning to close my 200s before close today.

Anyway, I'm not too worried about 20x -c200's, I have my July -c250 safety-roll there if needed...

As for delivery numbers, all reported territories in Europe absolutely bossing it, seems Denmark is also going nuts too, +200% yoy

On Friday, rolled 24Mar$200 to 31Mar$200 and $210. Also holding 6Apr$185 and $210, and 21Jul$200 (all CC on half of shares). Considering 19May$230 and $285.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K