Instead of rolling 10x XXX @$1 you can roll 20x XXX @50c at a higher strike, simple as thatCan you expand on this? What number of contracts is "too many" to easily roll? Is the lack of wiggle room trying to find buyers of your contracts if strikes are not liquid enough? Thanks.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

I sold $167.5cc for next week at $2.45 .... what's with this bearishness?

There a a lot of different TA tools and not all of them work on the basis which presumes participants believe in it. Stuff like 3m / 5m / 15m EMAs are in that camp. But I don't give you those, do I? I deal in higher timeframe psychology which allows me to make calls most people dare not to make. There being so many ways to read the chart is not an issue with TA just like there being so many ways to make an EV didn't make it an issue for Musk.It definitely is not. TA is useless in the face of major news. TA is useful only when enough people believe in it to make it self-fulfilling.

Another issue is there are so many different TA methods that don't yield the same results.

I'm writing this not to start an argument but to make sure different perspectives are represented.

My last post on this subject.

Remember in October 2021 when everyone was afraid we would crash after ER and I predicted we would climb for weeks and be at 1000 in January? Whats the major news that came out on October 18? Cricket.

Did Rob tell you this? No I did but nobody listened.Also, my interpretation:

Today move is a reflection of a market-wide change. Might not all be about TSLA. Below are my rationales:

1. LEAP call IVs didn't budge last week during the $65 run but they all go crazy today. Purely an ER FOMO run-up? I doubt it.

2. Stocks beaten up due to supply chain issues and chip shortage are all leading the market today. Looks like big buyers who have their finger on the global supply chain know something is improving.

In my opinion, a long-term trendline reflects the market perception about the long term growth of a company. Conveniently, we broke below the red trendline in May amid a global chip shortage, supply chain disruptions, and China dramas. Now that all of those things are almost in the rearview mirror, is it too crazy to expect TSLA to resume its previous trajectory which was more bullish than the current? My takeaways:

a. Today run-up is simply a product of delta hedging as well as big purchases intended to get TSLA up to the old trendline.

b. We're unlikely to run up much further from here until the ER confirms healthy gross margin.

c. I doubt we will end the week below 860 if ER is a beat.

d. We will continue to climb in the weeks ahead. My target for January is $1k.

Called the bottom on December 30th

Had to convince you guys that we will go down to 160 back when "the fundamentals were so strong TSLA should be worth much higher."Dead cat bounce: DCBs lead to lower lows. Just because we haven't seen consolidation doesn't mean we're in a DCB. We may very well go down again to near the low and chop around for a bit. That'd be the consolidation needed. I think we went way past the point of consolidation, though, as this crash in TSLA stock is beyond reasons. Past 160, market participants have had ample time and opportunities to load up on the stock on zero valid fundamental concerns at all so if we have a good P&D, I say we just rocket up from here. No lookie backsie.

In term of wave count, I don't agree with Mauro. See, if the market has seen terrible P&D and ER and decided the stock should crash below 160 then yes, we can talk about wave counts which are interpretations followed by predictions of human psychology. In this case, the market hasn't seen P&D or ER. It hasn't seen demand destruction but the deed has already been done. I'm more in Cory's camp. At this point, it's a screaming buy.

Now that I've called 152.3 to be the bottom and we will see 250, still nobody is listening. Now that everyone apparently seems to be discouraged and bearish, I'm gonna make a bet.All the TA guys you say? Well when everyone says the same thing I have to have some doubt now.

I don't really see why it's so hard to believe TSLA will go down, while at the same time knowing how much more it should be worth. We ran from 102 to 218 - 116 point zipper. 115% gain in 2 months. Since then, we have only corrected 38 points, or 32% of the rally. That is nothing. TSLA is still firmly in the super bullish zone. It can and will (IMO) go down and still be bullish. Remember: not all people who bought from 102 to 218 were long term investors. In fact, I'd wager the ones buying after ER consisted mainly of traders. Traders don't hold despite how strong the fundamentals are. They will sell when they have to. That will take the stock down.

The problem with thinking TSLA should go up because the company is doing so well is in assuming everyone who bought was a long term investors and the fundamentals gave them conviction. Traders rule this market, at least for now.

If we don't see 250 in 2023, I'll leave this forum and never come back.

bkp_duke

Well-Known Member

There a a lot of different TA tools and not all of them work on the basis which presumes participants believe in it. Stuff like 3m / 5m / 15m EMAs are in that camp. But I don't give you those, do I? I deal in higher timeframe psychology which allows me to make calls most people dare not to make. There being so many ways to read the chart is not an issue with TA just like there being so many ways to make an EV didn't make it an issue for Musk.

Remember in October 2021 when everyone was afraid we would crash after ER and I predicted we would climb for weeks and be at 1000 in January? Whats the major news that came out on October 18? Cricket.

Did Rob tell you this? No I did but nobody listened.

Called the bottom on December 30th

Had to convince you guys that we will go down to 160 back when "the fundamentals were so strong TSLA should be worth much higher."

Now that I've called 152.3 to be the bottom and we will see 250, still nobody is listening. Now that everyone apparently seems to be discouraged and bearish, I'm gonna make a bet.

If we don't see 250 in 2023, I'll leave this forum and never come back.

I like everything but this last line. You are a valuable asset to this forum, and would be sorely missed. Are we biased/bulls here? Yes, we are, but your analytical skills bring a wonderful balance to that and would be sorely missed.

juanmedina

Active Member

There a a lot of different TA tools and not all of them work on the basis which presumes participants believe in it. Stuff like 3m / 5m / 15m EMAs are in that camp. But I don't give you those, do I? I deal in higher timeframe psychology which allows me to make calls most people dare not to make. There being so many ways to read the chart is not an issue with TA just like there being so many ways to make an EV didn't make it an issue for Musk.

Remember in October 2021 when everyone was afraid we would crash after ER and I predicted we would climb for weeks and be at 1000 in January? Whats the major news that came out on October 18? Cricket.

Did Rob tell you this? No I did but nobody listened.

Called the bottom on December 30th

Had to convince you guys that we will go down to 160 back when "the fundamentals were so strong TSLA should be worth much higher."

Now that I've called 152.3 to be the bottom and we will see 250, still nobody is listening. Now that everyone apparently seems to be discouraged and bearish, I'm gonna make a bet.

If we don't see 250 in 2023, I'll leave this forum and never come back.

Are you selling any CC's right now? what strikes are you targeting? I am trying to stay objective but I am also emotional because of my job. This last two years have been hard.

Have you seen this? it seems that Powell wants to keep raising rates. Maybe this is what we are making aggressive trades because short term looks kind of bad. Maybe by the end of the year $250 will happen:

I like everything but this last line. You are a valuable asset to this forum, and would be sorely missed. Are we biased/bulls here? Yes, we are, but your analytical skills bring a wonderful balance to that and would be sorely missed.

This! We’ve been through good times and bad times together and we shouldn’t let anything break us up.

@dl003 How about once we see $250–whenever it is—we all celebrate and grow closer rather than farther.

Like a symphony orchestra, we all have something to add and the music falls apart when players walk off the stage.

Last edited:

EVNow

Well-Known Member

Dude, whats your problem ? I bought TSLA in 2011 and held it till now - neither Rob tell me this - and definitely not you either. You joined TMC 10 years after I did. I already said that was my last post on the issue. Just move on ... I don't need your approval to post here, you don't need mine.Did Rob tell you this?

It looks like they are aiming for 165 today.

I’m not taking any chances with my 10 x c170 for next week and rolled them to c180 and a few weeks out, netting another $1.15 in the process. I don’t want to lose those shares yet.

The 20 x p150 / p146 / p144 for next week which I sold a few days ago can be closed for 25% / 12.5% / 10% of the premium received but I think I will let them run for now. Could change my mind later today

I’m not taking any chances with my 10 x c170 for next week and rolled them to c180 and a few weeks out, netting another $1.15 in the process. I don’t want to lose those shares yet.

The 20 x p150 / p146 / p144 for next week which I sold a few days ago can be closed for 25% / 12.5% / 10% of the premium received but I think I will let them run for now. Could change my mind later today

Ok, I admit it, those -c150's I sold not looking great at this moment in time!

Quite the bounce from 153, on no news whatsoever, so it goes!!

Quite the bounce from 153, on no news whatsoever, so it goes!!

I appreciate the kind words. There's a place for everything and I understand TMC is first and foremost an investor forum. I'd hoped that as time goes by and my TA proven effective to a certain degree, people will stop looking at it as voodoo but things haven't turned out that way. So that's why I'm making this one last bet. If I'm right, I'll stay and make another one. If I'm wrong, I'll save myself the embarrassment and leave.I like everything but this last line. You are a valuable asset to this forum, and would be sorely missed. Are we biased/bulls here? Yes, we are, but your analytical skills bring a wonderful balance to that and would be sorely missed.

EVNow

Well-Known Member

Interestingly enough - Max Pain is apparently 160.Ok, I admit it, those -c150's I sold not looking great at this moment in time!

Quite the bounce from 153, on no news whatsoever, so it goes!!

This month's (quarte's ?) institutional holding changes will be interesting to see.

ps :

Talking of Max Pain - here is an interesting youtube on why it doesn't make sense for institutions to try to manipulate price to hit max pain, from an insider.

I only have my -180C opened earlier in the week. 99% it won't be ITM. However, I'll need to see how the stock reacts to 167.Are you selling any CC's right now? what strikes are you targeting? I am trying to stay objective but I am also emotional because of my job. This last two years have been hard.

Have you seen this? it seems that Powell wants to keep raising rates. Maybe this is what we are making aggressive trades because short term looks kind of bad. Maybe by the end of the year $250 will happen:

R

ReddyLeaf

Guest

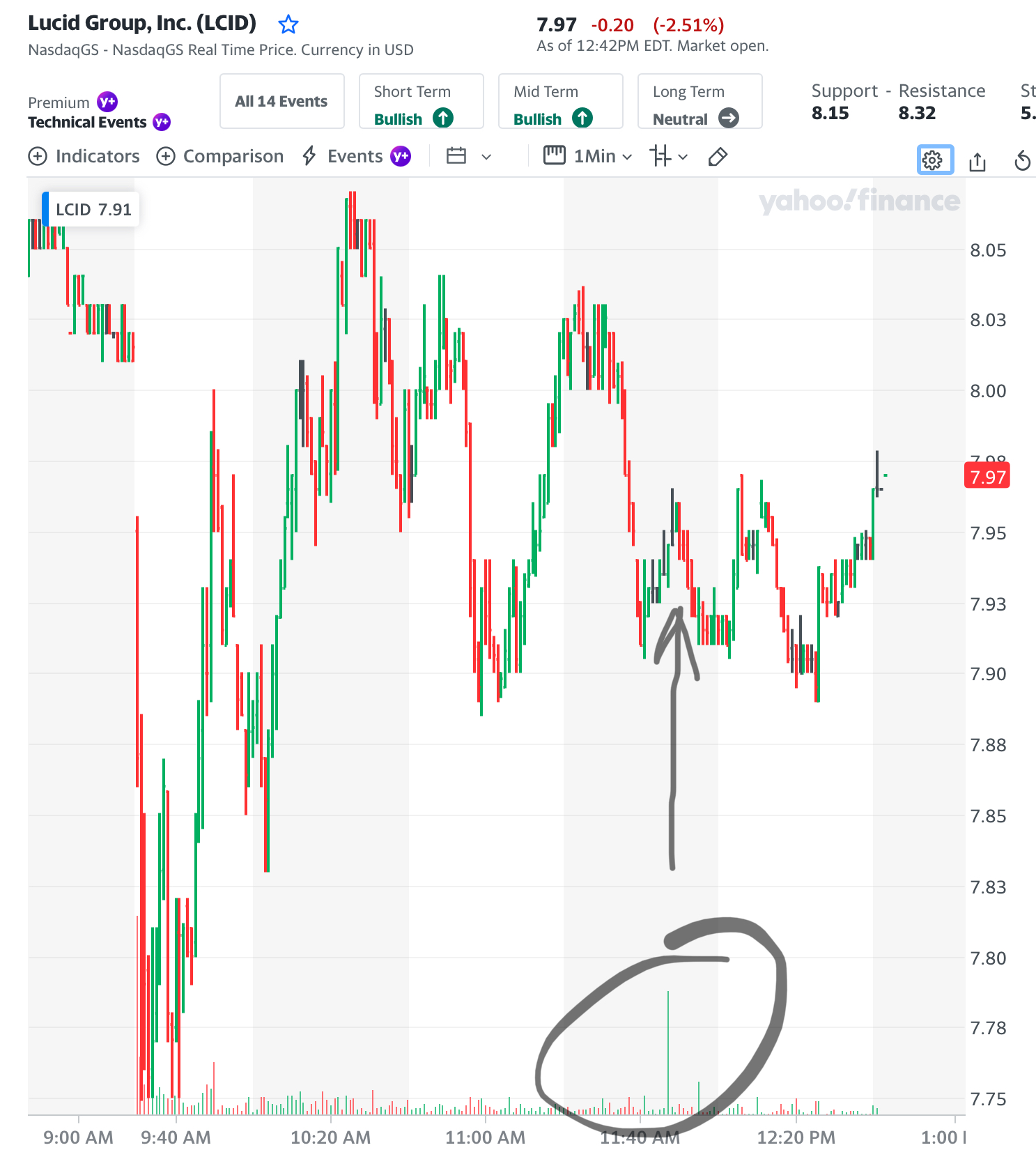

Tried a little experiment yesterday:

Iron butterfly 2x LCID +p7-p8-c8+c9

Iron condor 1x LCID +p7-p7.50-c8.50+c9

Received about 10% total premium on 1 DTE

What was most interesting, is that all of the premiums were most advantageous to the other party, not close to the midpoint. STO/BTC at bid, STC/BTO at ask. Furthermore, I wasn’t able to close 2x IBs in the same order, it was only a partial fill, even OUTSIDE of the bid-ask spread!!! So, very lightly traded market. I thought it was a great learning opportunity for $300 risk, and a pretty good chance that LCID would tractor beam right into a $8 close today. Made beer money, literally: cheap American beer money that is, and only a six-pack.

Edit: How can somebody trade 500k shares and not affect prices?

Iron butterfly 2x LCID +p7-p8-c8+c9

Iron condor 1x LCID +p7-p7.50-c8.50+c9

Received about 10% total premium on 1 DTE

What was most interesting, is that all of the premiums were most advantageous to the other party, not close to the midpoint. STO/BTC at bid, STC/BTO at ask. Furthermore, I wasn’t able to close 2x IBs in the same order, it was only a partial fill, even OUTSIDE of the bid-ask spread!!! So, very lightly traded market. I thought it was a great learning opportunity for $300 risk, and a pretty good chance that LCID would tractor beam right into a $8 close today. Made beer money, literally: cheap American beer money that is, and only a six-pack.

Edit: How can somebody trade 500k shares and not affect prices?

i sold the $165cc for next week $3.90I sold $167.5cc for next week at $2.45 .... what's with this bearishness?

EVNow

Well-Known Member

Either wrong stats - or buy / sell at a limit (instead of sweep).Edit: How can somebody trade 500k shares and not affect prices?

The problem with TA and also with FA by the way, is that it doesn't work. Of course, sometimes you bet the right side. I intentionally use the word "bet" because TA and FA is nothing more than betting on an opinion, whether it's TA or FA.I appreciate the kind words. There's a place for everything and I understand TMC is first and foremost an investor forum. I'd hoped that as time goes by and my TA proven effective to a certain degree, people will stop looking at it as voodoo but things haven't turned out that way. So that's why I'm making this one last bet. If I'm right, I'll stay and make another one. If I'm wrong, I'll save myself the embarrassment and leave.

But as the casino always wins, mr. market does also. In trading, especially in options, you have no "system", position or analysis which guarantees you profit.

You need to know how options work, the Greeks. Delta, gamma, theta, vega, rho and omega. And please bear in mind, trade the option, not the strike. I know many people don't like I use this phrase, but it is essential to be successful in trading options.

Last but not least, give me one name of a TA or FA analyst who makes money on a permanent base.

Disclaimer: With this reaction I did not mean to offend @dl003, on the contrary, I respect his opinion and I appreciate his extensive explanation of his view.

There a a lot of different TA tools and not all of them work on the basis which presumes participants believe in it. Stuff like 3m / 5m / 15m EMAs are in that camp. But I don't give you those, do I? I deal in higher timeframe psychology which allows me to make calls most people dare not to make. There being so many ways to read the chart is not an issue with TA just like there being so many ways to make an EV didn't make it an issue for Musk.

Remember in October 2021 when everyone was afraid we would crash after ER and I predicted we would climb for weeks and be at 1000 in January? Whats the major news that came out on October 18? Cricket.

Did Rob tell you this? No I did but nobody listened.

Called the bottom on December 30th

Had to convince you guys that we will go down to 160 back when "the fundamentals were so strong TSLA should be worth much higher."

Now that I've called 152.3 to be the bottom and we will see 250, still nobody is listening. Now that everyone apparently seems to be discouraged and bearish, I'm gonna make a bet.

If we don't see 250 in 2023, I'll leave this forum and never come back.

Your posts have been very informative - thank you for your contributions. I think you have a solid chance of staying in this forum past 2023, though I do hope you retract the bet

What are your thoughts on another dip in July? This quarter is going to be brutal for the financials due to the incessant price cuts and inventory build-up - many potential customers are anticipating another round of price cuts and will be holding off on their purchase. But I think the stock will recover in Q3 with the potential Cybertruck and refreshed Model 3 announcements.

And yet we seem to gravitate to it more often than not...Interestingly enough - Max Pain is apparently 160.

This month's (quarte's ?) institutional holding changes will be interesting to see.

ps :

Talking of Max Pain - here is an interesting youtube on why it doesn't make sense for institutions to try to manipulate price to hit max pain, from an insider.

Anyway, I'm not convinced by this rally tbh. The GDP number this week was dreadful, today's economic indicators were quite mixed, I've no idea what the FED will do next week, based on recent form they'll raise again...

Edit: in the Max Pain video he's saying that institutions shorting or selling stock to manipulate a stock price is not a great approach due to the risk and exposure, but I think we all know a lot of the manipulation comes from naked shorting and spoofing

Last edited:

I appreciate the kind words. There's a place for everything and I understand TMC is first and foremost an investor forum. I'd hoped that as time goes by and my TA proven effective to a certain degree, people will stop looking at it as voodoo but things haven't turned out that way. So that's why I'm making this one last bet. If I'm right, I'll stay and make another one. If I'm wrong, I'll save myself the embarrassment and leave.

Why be embarrassed? If the economy tanks and takes the stock market with it, meaning TSLA doesn't see $250 this year, that doesn't mean you were a fool. At least you put yourself out there and backed yourself up as to why. Your name is one that I always enjoy seeing pop up on this thread and I hope you stick around.

To the larger discussion at hand, personally, I ascribe to the theory that TA seems to have some value, but that it is always trumped by fundamental (and I mean fundamental) developments.

As an example, what do we think would happen if (heaven forbid) China and the US started a shooting war tomorrow? No TA would predict the absolute bloodbath in markets.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K