Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

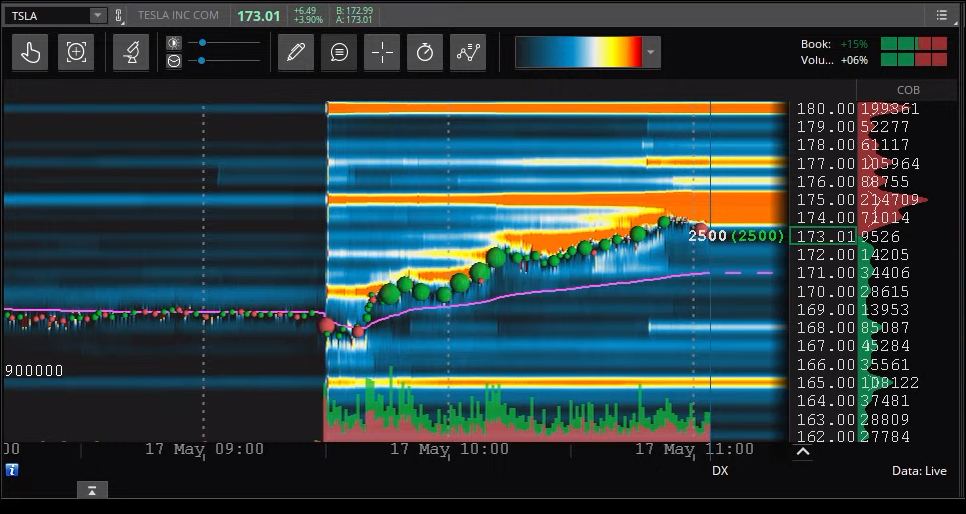

Nice buying happening on the way up (green blobs), also profit taking lined up above (see red cones on right):

Will take a LOT to get TSLA over the $175 and then $180 wall, so $187.50 -C seems safe enough away for next Friday. Still need to be cautious though. A resolution to the debt ceiling issue might spike things in nutty ways since not everyone traded the charts and there may be FOMO.

Will take a LOT to get TSLA over the $175 and then $180 wall, so $187.50 -C seems safe enough away for next Friday. Still need to be cautious though. A resolution to the debt ceiling issue might spike things in nutty ways since not everyone traded the charts and there may be FOMO.

Last edited:

Nice buying happening on the way up (green blobs), also profit taking lined up above (see red cones on right):

View attachment 938550

Will take a LOT to get TSLA over the $175 and then $180 wall, so $187.50 -C seems safe enough away for next Friday. Still need to be cautious though. A resolution to the debt ceiling issue might spike things in nutty ways since not everyone traded the charts and there may be FOMO.

Keep in mind a relief rally is in the works if the talks come through with a "fix" even if that fix is to kick the can down the road till next year.

Keep in mind a relief rally is in the works if the talks come through with a "fix" even if that fix is to kick the can down the road till next year.

It's amazing how the market never fails to generate something to worry each week about for our sold calls and puts. While I doubt a relief rally will imperil sold calls above $185 for next Friday, it pays to have a backup plan.

For me I think that means if TSLA gets over and holds $177 and $180.25 early to mid next week, then time for some defensive moves. But I'm still learning and that might not be enough reason to BTC for a loss (or roll) since it can consolidate and pull back.

EVNow

Well-Known Member

Nice buying happening on the way up (green blobs), also profit taking lined up above (see red cones on right):

View attachment 938550

Will take a LOT to get TSLA over the $175 and then $180 wall, so $187.50 -C seems safe enough away for next Friday. Still need to be cautious though. A resolution to the debt ceiling issue might spike things in nutty ways since not everyone traded the charts and there may be FOMO.

175 wall is 214k and 180 is about 200k.

Today when the SP jumped up at 9:41 AM by ~ $1.5 ... the volume was 1 Million. So, if there are buyers, these walls crumble quite easily. There are always a lot of bots trading on trend and news. These are all setup automatically and trade based on Nasdaq and news. They generate most of the volume - so, if they sense a trend upward / downward (because a big player is buying or there is some news) they pile on. Hedge funds (and other WS players) try to create the trend to get the bots to be on their side. Thats how they generate the volume needed to break resistance / support.

Seems 99% inevitable to me……..Keep in mind a relief rally is in the works if the talks come through with a "fix" even if that fix is to kick the can down the road till next year.

175 wall is 214k and 180 is about 200k.

Today when the SP jumped up at 9:41 AM by ~ $1.5 ... the volume was 1 Million. So, if there are buyers, these walls crumble quite easily. There are always a lot of bots trading on trend and news. These are all setup automatically and trade based on Nasdaq and news. They generate most of the volume - so, if they sense a trend upward / downward (because a big player is buying or there is some news) they pile on. Hedge funds (and other WS players) try to create the trend to get the bots to be on their side. Thats how they generate the volume needed to break resistance / support.

Fascinating! I guess nothing is certain.

What are some methods you use to pick and then gauge that a sold covered call (or put) strike is “safe” for, say, 5-7 days out?

Do you have any positions open currently or plan to open?

rolled my -172.5c out to 7/21 -200c. This slow roll doesn't feel like it'll subside anytime soon.

EVNow

Well-Known Member

10% to 15% OTM, Friday or Monday. Even this is not "safe" as all my losses / puts being assigned in '22 tells us. I also don't play high volatility weeks - ER, P&D, investor day, AI day etc. I also don't bet on any direction i.e. I always assume SP can go in either direction - but not by "too much".What are some methods you use to pick and then gauge that a sold covered call (or put) strike is “safe” for, say, 5-7 days out?

Do you have any positions open currently or plan to open?

This time I actually forgot about the company meeting and sold 182.5 and 185 calls.

A tool I like to use is fib channel. You can see that major-intermediate highs/lows fell very close to levels on these channels. Circled are the closing price on the last day before P&D of each quarter. For 6/30, I'm looking at 158 or 186 as the closing price.

10% to 15% OTM, Friday or Monday. Even this is not "safe" as all my losses / puts being assigned in '22 tells us. I also don't play high volatility weeks - ER, P&D, investor day, AI day etc. I also don't bet on any direction i.e. I always assume SP can go in either direction - but not by "too much".

This time I actually forgot about the company meeting and sold 182.5 and 185 calls.

Thanks.

By Friday you mean same day expiration, and by Monday you mean for the coming Friday’s expiration (same week)?

A tool I like to use is fib channel. You can see that major-intermediate highs/lows fell very close to levels on these channels. Circled are the closing price on the last day before P&D of each quarter. For 6/30, I'm looking at 158 or 186 as the closing price.

View attachment 938597

Thanks. Do you have a favorite tool to gauge momentum?

175 wall is 214k and 180 is about 200k.

Today when the SP jumped up at 9:41 AM by ~ $1.5 ... the volume was 1 Million. So, if there are buyers, these walls crumble quite easily. There are always a lot of bots trading on trend and news. These are all setup automatically and trade based on Nasdaq and news. They generate most of the volume - so, if they sense a trend upward / downward (because a big player is buying or there is some news) they pile on. Hedge funds (and other WS players) try to create the trend to get the bots to be on their side. Thats how they generate the volume needed to break resistance / support.

Just adding onto this that I used to look at Level 2 data during TSLA rallies and it's amazing how quickly these "walls" will just disappear.

EVNow

Well-Known Member

No - by Friday I mean for next week (so 6 DTE) or the next Monday (5 DTE).By Friday you mean same day expiration, and by Monday you mean for the coming Friday’s expiration (same week)?

intelligator

Active Member

Watching the SP , 173.35 was tough to break through and stay above. We got through it and now 173.98 which was morning peak. Maybe not good to hold -177.5/+182.5 BCS for 5/19 , huh

Rolled 8x -c172.5 to 8x -c177.5c next week - I may double it to 16 contracts to move the strike higher if we keep going up. Also sold a couple -p170 for next week.

Just 1 tip, be careful with blowing up your position (from 8 to 16).Rolled 8x -c172.5 to 8x -c177.5c next week - I may double it to 16 contracts to move the strike higher if we keep going up. Also sold a couple -p170 for next week.

If short calls get ITM, I usually prefer to buy premium. Handicap in this case is that you trade on the short term.

Just 1 tip, be careful with blowing up your position (from 8 to 16).

If short calls get ITM, I usually prefer to buy premium. Handicap in this case is that you trade on the short term.

Agree that doubling the contracts can be playing with fire. What do you mean by “buy premium” - roll the strike up and take a partial loss?

With "buy premium" (in Dutch "premie kopen") I mean buy calls with a higher strike or buy calls on an expiration date before your short calls. That's what I meant with the handicap, you trade on a very short term so room for adjusting your positions can be quite limited.Agree that doubling the contracts can be playing with fire. What do you mean by “buy premium” - roll the strike up and take a partial loss?

Again apologies for my English, I hope you all understand what I mean

SebastienBonny

Member

Sold 6/30 190 CC for 4.52.

Prefer going further right now than weekly.

If we head down a bit the premium fades very quickly, so chances are big I’ll close this early when there’s an opportunity.

Prefer going further right now than weekly.

If we head down a bit the premium fades very quickly, so chances are big I’ll close this early when there’s an opportunity.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K