Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

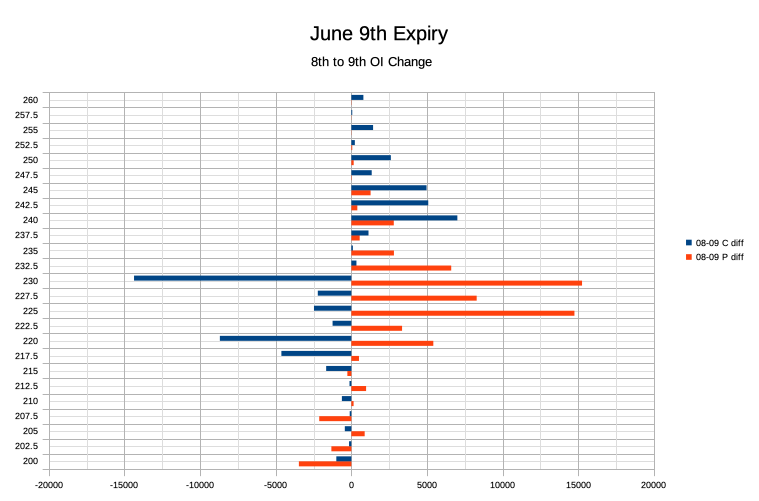

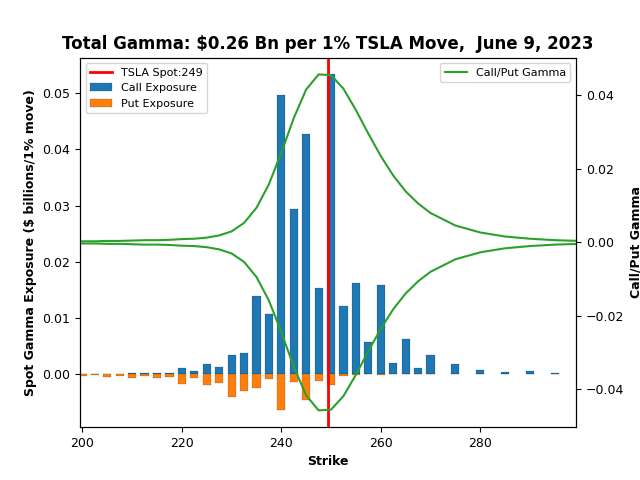

Very confusing... Call OI difference from yesterday doesn't seem unusual. Gamma exposure at 250, 240, 245 is in line with price.

I am going to stay on top of extrinsic, see if my -c237.5 and -c242.5 short legs of spread for 6/16 can survive the day, get a pulse next week if this beast halts for a few days.

I am going to stay on top of extrinsic, see if my -c237.5 and -c242.5 short legs of spread for 6/16 can survive the day, get a pulse next week if this beast halts for a few days.

I am still very skeptical of this run-up. I did expect TSLA to touch $250 by EOY but end the year below that mark, because the fundamentals don’t support that price level. P/E of 69 is going to be close to 100 following Q2 earnings. This run-up is fueled by the news and the hype, but the financials will bring everyone back to earth. I am not saying TSLA can’t reach $300 in the next month, because human emotions are unpredictable, but I think a strong pullback in July is imminent. Worst case, the stock goes back down to $150. Best case, $200 is the landing point.

The entire market seems to be on steroids, just look at what's happening to all the stocks like Carvana, Roku, etc etc. Who knows how long this will go on but sounds like people got more stimulus checks and buying short term options lol. All those furus predicting a recession and a huge down market are now looking like idiots.

I'm sure there's a big pull on the horizon but again until that happens you go with the flow. Take it day by day.

myt-e-s-l-a

Member

Rolling c230 to c250. The 30d chart for tsla looks pretty scary on the momentum side.TSLA has been up 11 days out of 13 days. Its at a 13 week high.

RSI hints that stock ma be overbought.

I am looking at the $250 level as an intermediate top.

STO 10x CC tsla 240119C230 @ 33.50

STC 1000 shr tsla @ $216.19

and

STO 10x CSP tsla 230619P200 @ 3.05

......

There should be a pause soon

BTC -10x CC tsla 240119C230 @ 54.50

STO +10x CC tsla 240119C250 @ 43.90

for debit of $10.60. TSLA @ 248.50

Daily Chart for last 360d. Notice some similar patterns of the past. And that Gap to 250 will be filled sometime in the future

Last edited:

I kicked my 232.5s to next week for $2. Happy to shave some here but also happy to do it next week with more money in my pocket. Also, next week could be volatile to say the least.

I am. Selling puts up to the daily high @ 250.@dl003 You’re probably definitely not going long here at $245, right?

Looks like I'm going to be sticking around here a bit longer. TSLA @ 250.

Last edited:

myt-e-s-l-a

Member

Shares of charging companies such as ChargePoint Holdings Inc, EVgo Inc and Blink Charging Co fell between 7% and 10% in heavy trading.

"Tesla's been one step ahead in this game and with other operators trying to play catch up they were already at a disadvantage," said Danni Hewson of AJ Bell, adding that charging business could become a big growth driver for Tesla.

Wedbush Securities estimated Ford and GM combined could add $3 billion to services EV charging revenue for Tesla over the next few years. The brokerage also raised its price target on the stock to $300, which is nearly 30% above its last close.

The stock has a forward 12-month price-to-earnings ratio of 60.46, among the highest in the S&P 500 index, and far greater than GM's 5.29 and 7.94 for Ford.

I guess this means our 6/30 -C220 are toast, or do you see some relief by then?I am. Selling puts up to the daily high @ 250.

Looks like I'm going to be sticking around here a bit longer. TSLA @ 250.

walkrunflyy

Member

I have a 205 CC June16 and 210 CC July21.

My cost basis is $299

I am confused on what to do here. Please advice.

1) Roll to Dec or Jan 2024 to a higher price (280 or 270) closer to my cost basis and exit breakeven in Jan?

2) Let the contract expire

3) Roll same price to Aug/sept

My cost basis is $299

I am confused on what to do here. Please advice.

1) Roll to Dec or Jan 2024 to a higher price (280 or 270) closer to my cost basis and exit breakeven in Jan?

2) Let the contract expire

3) Roll same price to Aug/sept

I love how they compare TSLA's PE to Ford and GM. Tesla has 20% positive margins on its EVs, while Ford and GM are around Negative 100%. Tesla is growing EV deliveries by almost 1,000,000 vehicles/year, while F and GM are barely making any. Tesla also has revenue from solar panels, energy storage, Superchargers, and soon FSD. These writers/analysts are complete morons.View attachment 945344

Shares of charging companies such as ChargePoint Holdings Inc, EVgo Inc and Blink Charging Co fell between 7% and 10% in heavy trading.

"Tesla's been one step ahead in this game and with other operators trying to play catch up they were already at a disadvantage," said Danni Hewson of AJ Bell, adding that charging business could become a big growth driver for Tesla.

Wedbush Securities estimated Ford and GM combined could add $3 billion to services EV charging revenue for Tesla over the next few years. The brokerage also raised its price target on the stock to $300, which is nearly 30% above its last close.

The stock has a forward 12-month price-to-earnings ratio of 60.46, among the highest in the S&P 500 index, and far greater than GM's 5.29 and 7.94 for Ford.

My puts expire next week. I'm betting on an at least once retest of 250. Let's see on 6/30.I guess this means our 6/30 -C220 are toast, or do you see some relief by then?

You could repair it slightly with something like:I have a 205 CC June16 and 210 CC July21.

My cost basis is $299

I am confused on what to do here. Please advice.

1) Roll to Dec or Jan 2024 to a higher price (280 or 270) closer to my cost basis and exit breakeven in Jan?

2) Let the contract expire

3) Roll same price to Aug/sept

Btc June 16 - 205cc

Sto June 30 - 220cc

Sto June 30 - 245p

Gets you a slight credit and you can buy some breathing room and see how this plays out.

Macros have completely pulled back on the day and TSLA still up almost 5%. I'm still watching my 252.5CC for today, and next week's 280 and 300s.Classic blow-off top looks like?

Fresh daily high on the RSI so my bet is no. Pullback yes but this is not the top yet.Classic blow-off top looks like?

Fresh daily high on the RSI so my bet is no. Pullback yes but this is not the top yet.

Yeah..the drop to $242ish is what prompted the comment, and now we're back up to $246+. Knew I should have waited for the day's trading to end before running my mouth.

Classic blow-off top looks like?

I thought so too but the bounce was sick. And on option flow seeing nonstop call buying. I don't think this is the end of the run.

Decided to add some 225 strike CSP for next week, to go with the 200 strike cc I have for end of month. The cc are pretty badly ITM - not a situation I wanted to get into, but one I was ready for. I've let some shares go in the $200 range; the rest of these may also be going.

I would rather be doing put spreads, but with the shares behaving as they have been, decided that a smaller weekly income makes for a happier position for me emotionally. Share price back down to 210, making both sides ITM, would be just about ideal for me! But not what I expect or am even hoping for.

I would rather be doing put spreads, but with the shares behaving as they have been, decided that a smaller weekly income makes for a happier position for me emotionally. Share price back down to 210, making both sides ITM, would be just about ideal for me! But not what I expect or am even hoping for.

walkrunflyy

Member

Sounds like a good idea.You could repair it slightly with something like:

Btc June 16 - 205cc

Sto June 30 - 220cc

Sto June 30 - 245p

Gets you a slight credit and you can buy some breathing room and see how this plays out.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K