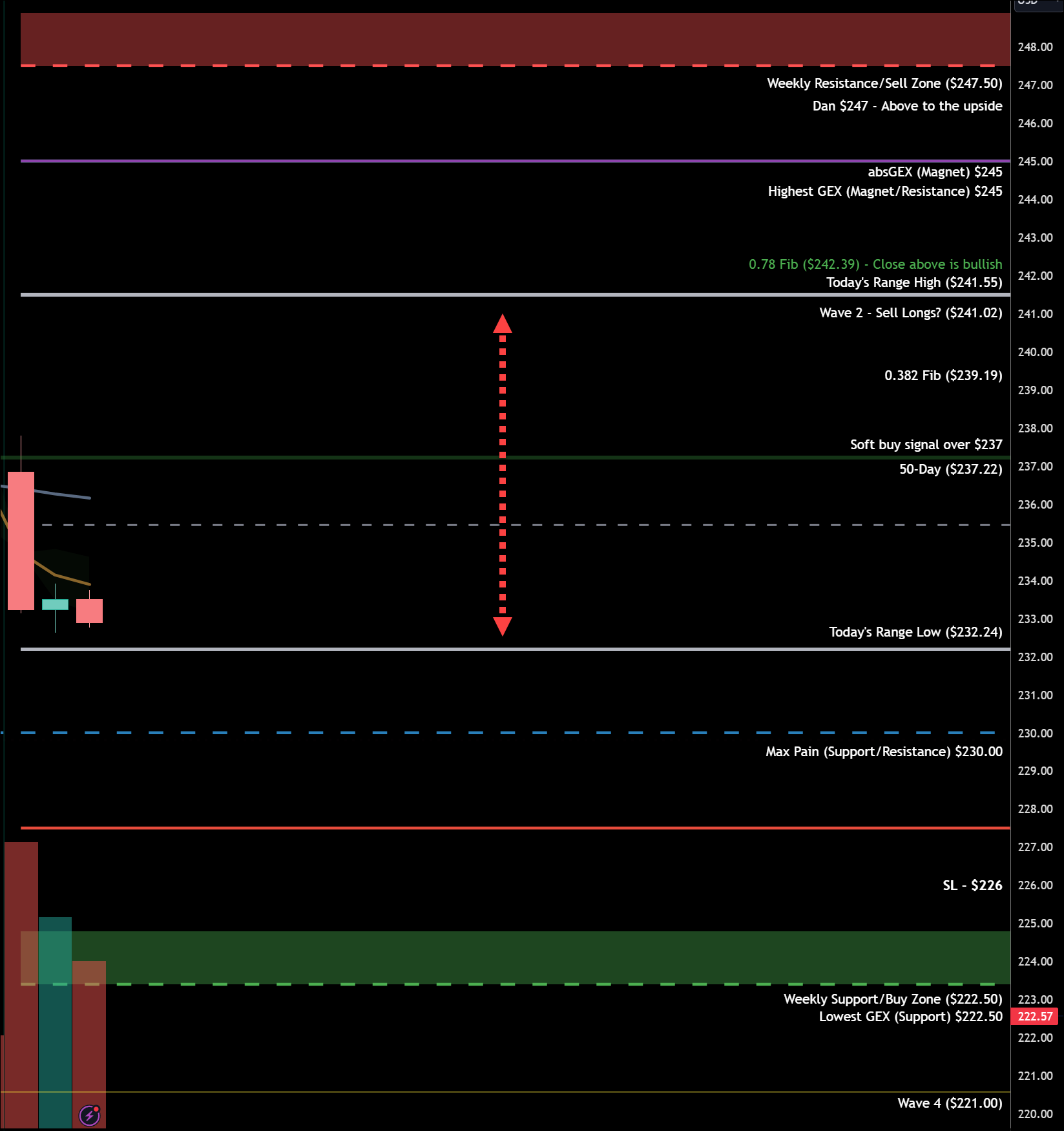

Consider starting your own thread a la Papafox which would seem to grant you the powers to delete posts and banish people?Alright. If it goes above 245 before breaking 226, I'll leave and never come back.

See you in 2 weeks, or never.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

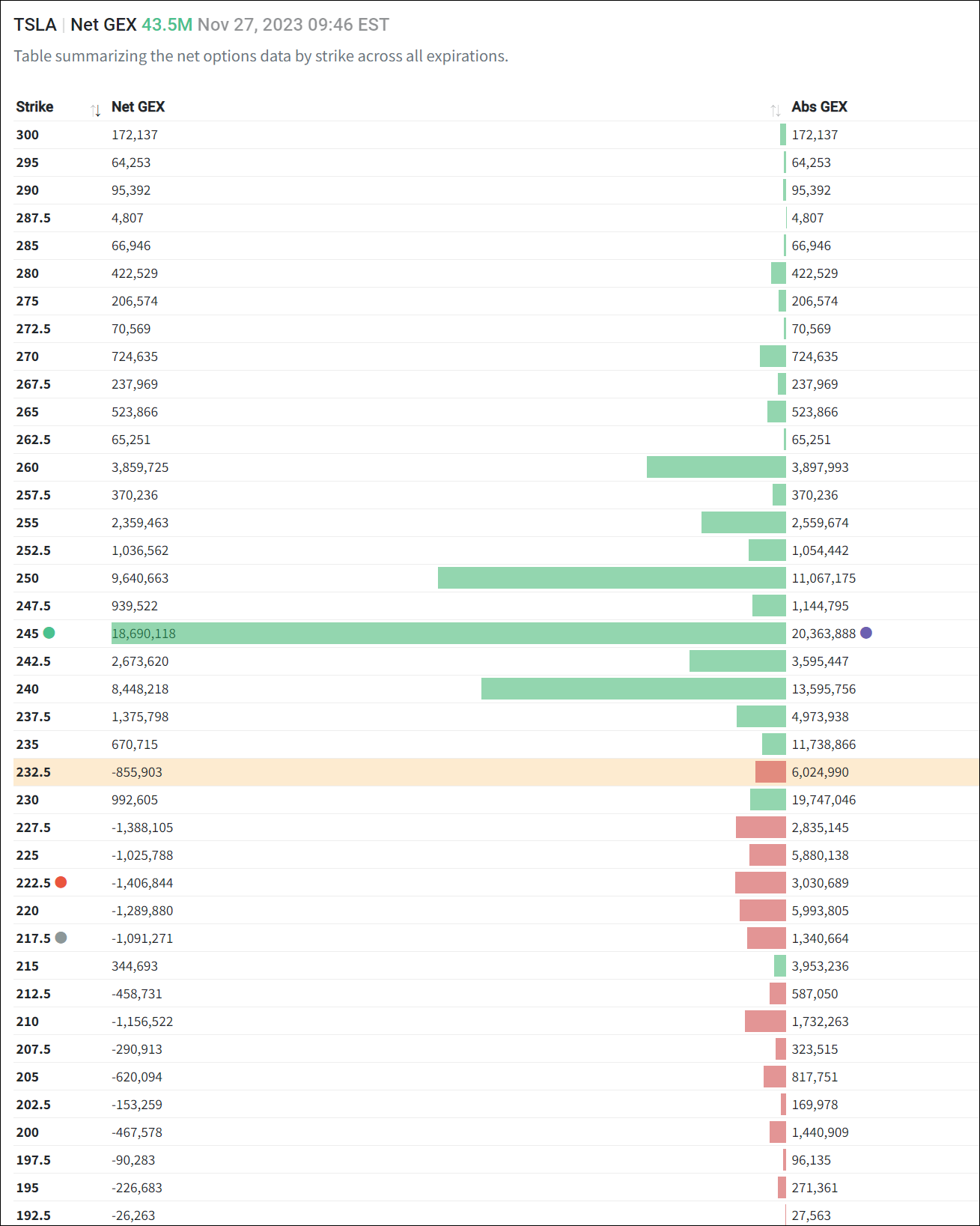

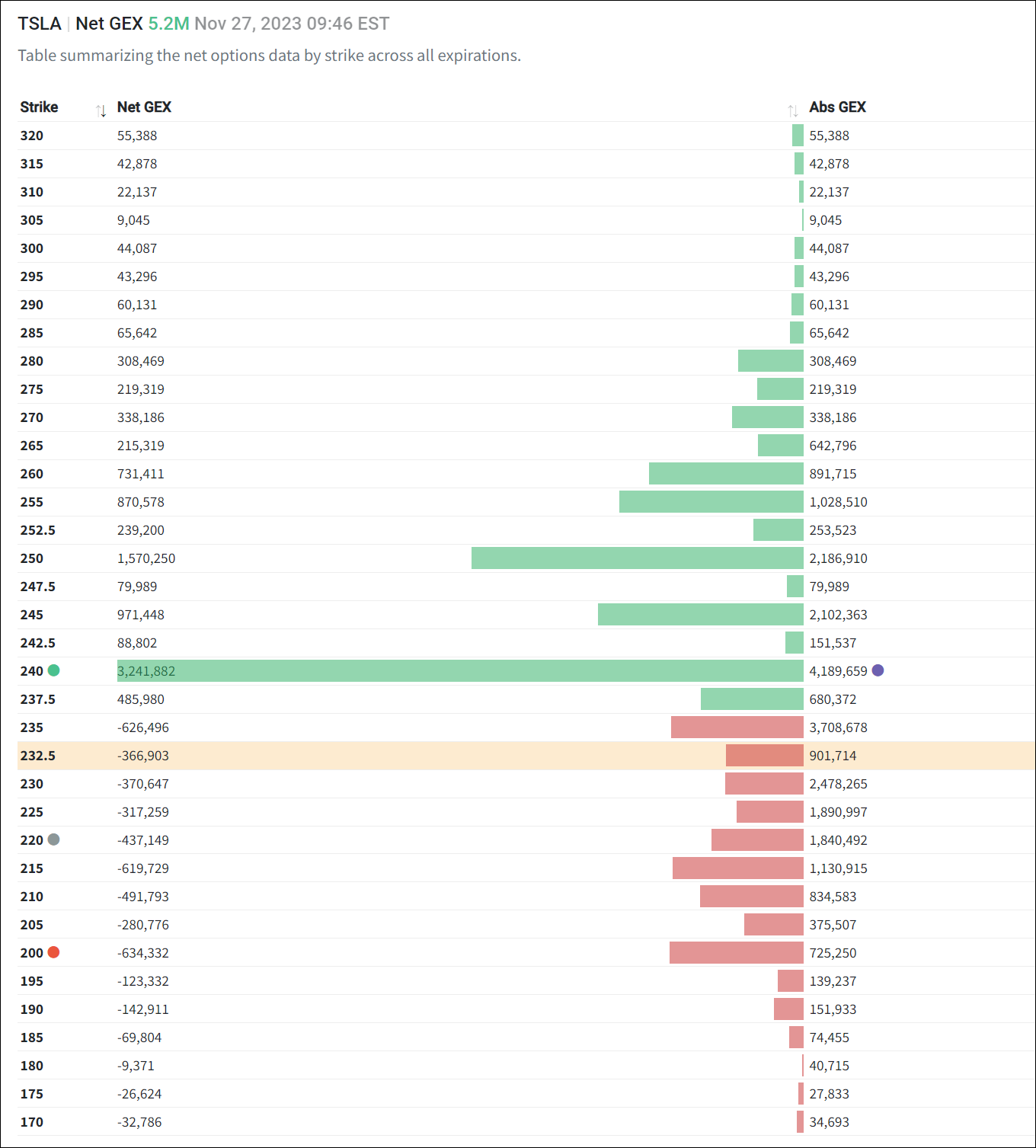

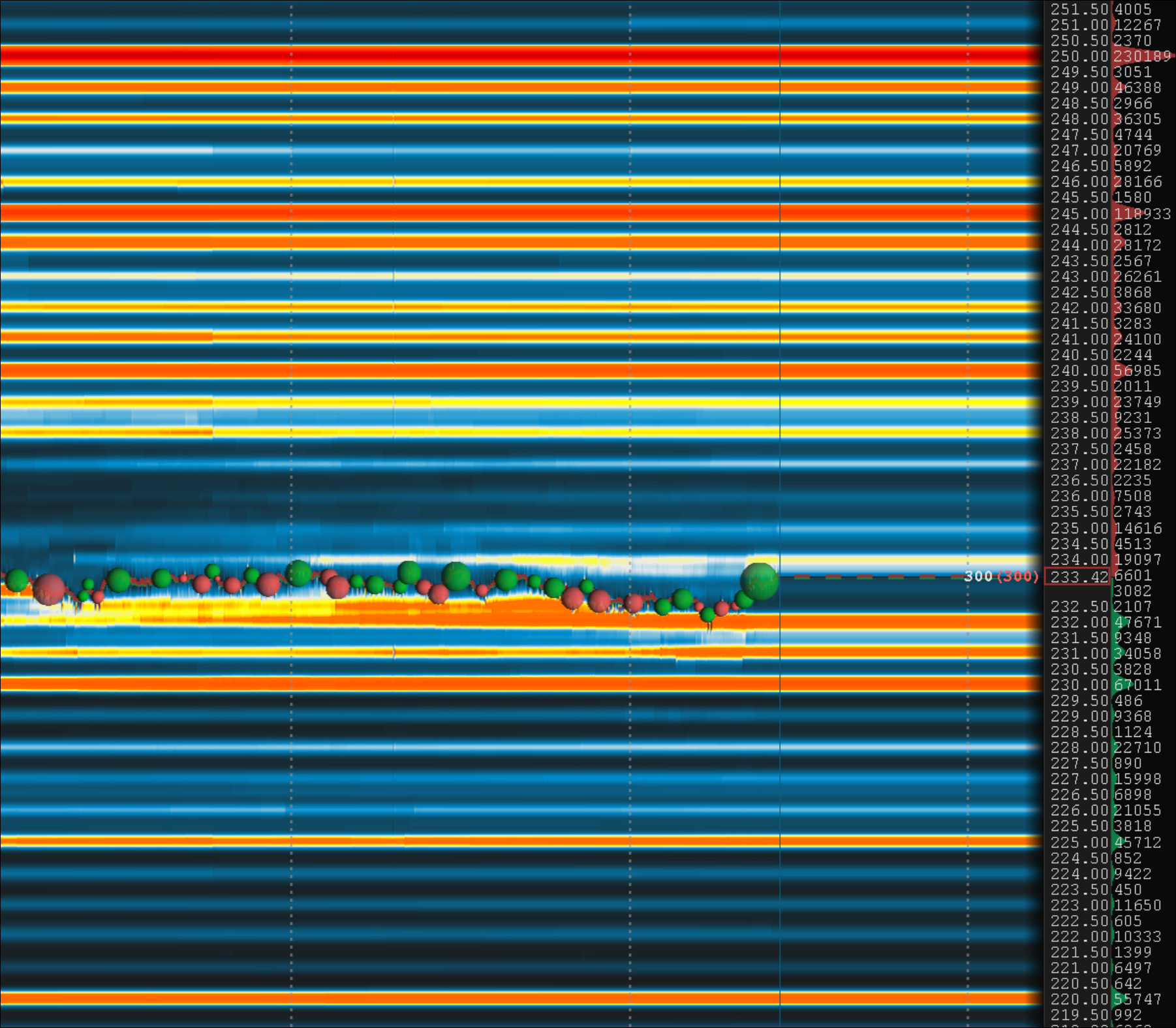

QTA levels for today

12/1

12/8

12/1

12/8

Massive Red candle on 5 minute chart at the open was interesting. All I can figure is massive short selling trying to suppress the SP after massive weekend of Cybertruck viewings/excitement. Hopefully green by noon.

I saw the delivery event on Thursday might be at 1 CST? When market is open (and I may be operating). Is this correct?

I saw the delivery event on Thursday might be at 1 CST? When market is open (and I may be operating). Is this correct?

I saw the delivery event on Thursday might be at 1 CST? When market is open (and I may be operating). Is this correct?

Yes, per Martin Viecha, interesting indeed:

I had sold a few 270CCs for Friday last week. I'm not selling any more unless the SP comes up significantly. It just isn't worth the risk. I know that delivery events in the past haven't been huge catalysts, but without a run up going into it, I don't want to get burned on this one.

I got my Patreon for that. I welcome differing opinions. In fact, everyday I ask myself how I can be wrong here and how the market can trick me. Last week, someone asked me why I didn't consider Wednesday to be the peak instead of Tuesday. I loved that - well structured discussions. Through my charts, I give people a set of parameters I use to make my calls and I prefer them to find holes in my rationale. I cannot work in an environment where the assumption is anything can happen, TA is voodoo and trading based on readily available information is a valid strategy. "Sentiment" can work both ways. Selling the FOMO is just as valid as buying the fear. I wonder how many people still remember how bullish they were when Adam Jonas jacked up the SP to 280 just 3 months ago and the length I had to go to convince them to back off from the trap. Then I had to do it all over again with my 200 call. And again and again.Consider starting your own thread a la Papafox which would seem to grant you the powers to delete posts and banish people?

I know I can ignore people but unfortunately I'm not the type who can flourish in this social environment. In my Discord group back in the days, I prohibited members from posting news of any kind, no matter + or -. So you can imagine how much I hate these CT and V12 posts.

Here’s a question I hope qualifies: I’ve been trading TSLA for a little over two years now, and by no means an expert, I’m just learning a bit more each day, and much of it thanks to you and the gang here. Can you help me understand the reasoning as you understand it why the SP follows such defined TA rules as we’ve clearly see happen (276=flush, 246=flush, etc etc), is it a self-fulfilling actualization since all the TA pros are looking at the chart and stop at those places or is there something deeper going on, and if yes, what is it?I loved that - well structured discussions.

Thanks in advance.

It doesn't have to flush. It just has to slow down and give bad news enough time to come out. Then it flushes. Why does it slow down? Maybe it's a liquidity zone for big buyers/sellers, maybe it's a gap, maybe it's a number that our internal clock finds worthy, Mass psychology is more intimately influenced by mathematics than most realize. We don't have to understand why it happens. We just need to assign the proper probability to it based on historical data.Here’s a question I hope qualifies: I’ve been trading TSLA for a little over two years now, and by no means an expert, I’m just learning a bit more each day, and much of it thanks to you and the gang here. Can you help me understand the reasoning as you understand it why the SP follows such defined TA rules as we’ve clearly see happen (276=flush, 246=flush, etc etc), is it a self-fulfilling actualization since all the TA pros are looking at the chart and stop at those places or is there something deeper going on, and if yes, what is it?

Thanks in advance.

"Safe" CCs are still down for the day, but I like where the SP is going....

Must be the 10Y yield. (I kid, I kid.)

It doesn't have to flush. It just has to slow down and give bad news enough time to come out. Then it flushes. Why does it slow down? Maybe it's a liquidity zone for big buyers/sellers, maybe it's a gap, maybe it's a number that our internal clock finds worthy, Mass psychology is more intimately influenced by mathematics than most realize. We don't have to understand why it happens. We just need to assign the proper probability to it based on historical data.

Is there a teachable/understandable reason why is HAS to--probabilities wise--go down before going up, like your conviction re very high probability of $226 before $246 even though we are currently hovering around the 50-day and are equally close.

I have mentioned this reason countless times. You've liked every single one of those posts.Is there a teachable/understandable reason why is HAS to--probabilities wise--go down before going up, like your conviction re very high probability of $226 before $246 even though we are currently hovering around the 50-day and are equally close.

When the first wave (247-226) is a 5 waver then there will be a 2nd leg that exceed it.

This was true when I predicted a 2nd up leg that would exceed 250.

This was also true when I predicted a 2nd leg down that would break 234, even 200.

Most recently was a 2nd leg up that would break 227.

I have mentioned this reason countless times. You've liked every single post.

When the first wave (247-226) is a 5 waver then there will be a 2nd leg that exceed it.

Yes, yes! My question is WHY? Who made that rule and why does it work with such a high degree of accuracy?

It's fascinating.

john tanglewoo

2012 Roadster Owner

Buddy we really appreciate your presence here. I make some pretty big swings with your projections in mind, so would appreciate you sticking around.Alright. If it goes above 245 before breaking 226, I'll leave and never come back.

See you in 2 weeks, or never.

If you do decide the forum doesn't suit you due to the contrarians, I'd be happy to follow you on another platform where you can share your levels in peace. But stay here!

It's not a rule. It's a theory, first proposed by a guy named Ralph Nelson Elliott, hence the name Elliott Wave Theory. In TA, everything is based on historical data. There're no rules, no guns pointing at us making us buy and sell at any level. It's not an exact science. We're hoping to use the chart as a gauge for human emotions - that's kind of reliable.Yes, yes! My question is WHY? Who made that rule and why does it work with such a high degree of accuracy?

It's fascinating.

Scalped several CC's from opening HOD to LOD for nice gains and went flat until next pop to resell.

Around lunchtime STO a few new starter positions:

10x -C250 12/1 @1.25

10x -C252.50 12/1 @1.05

15x -C255 12/8 @ 2.00

5x -C260 12/8 @1.50

10x -C265 12/8 @1.00

Around lunchtime STO a few new starter positions:

10x -C250 12/1 @1.25

10x -C252.50 12/1 @1.05

15x -C255 12/8 @ 2.00

5x -C260 12/8 @1.50

10x -C265 12/8 @1.00

It's not a rule. It's a theory, first proposed by a guy named Ralph Nelson Elliott, hence the name Elliott Wave Theory. In TA, everything is based on historical data. There're no rules, no guns pointing at us making us buy and sell at any level. It's not an exact science. We're hoping to use the chart as a gauge for human emotions - that's kind of reliable.

Thank you. Still sounds mysterious to me but I'll accept that I don't have to understand, and just follow the chart.

I won't ask the same question again

chiller

Member

I do have a little interpretation of my own.Thank you. I won't ask the same question again

The completion of the 5th wave validates the trend supposedly created by the 3rd. By the end of the 3rd, if the sequence is indeed creating a trend in its direction, a 4th wave would form for profit taking purpose, then come the 5th wave that would extend past the 3rd. If there's no 5th wave, then the 3rd wave cannot be confirmed as trend making. In that case, it's called wave C, not 3.

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K