Any ideas why the markets crapped their pants at 14:40 - seems to be everything, including crypto, but I see no news to explain it??

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

buyer fatigue? Not seeing any news.Any ideas why the markets crapped their pants at 14:40 - seems to be everything, including crypto, but I see no news to explain it??

intelligator

Active Member

Today I placed a 12/1 -c260 for .75 , waiting for price to come to me , but we didn't get to 241.xx , gonna try again tomorrow and wednesday even if it's going to be lower premium. Will also watch for reversal to buy puts.

Ultimately, human emotion across the entirety of the planet, adjusted individually for their capacity and desire to engage in the market for a given security, dictates the price. However, assessing as such directly person by person is an intractable challenge. Humans are, however, often good at identifying shortcuts that allow for them to function most of the time without actually solving the hard intractable problem. Use such shortcuts when you can, where you can. (Yes, all of the above, slightly tweaked, applies to many other areas of humanity beyond securities trading.)We're hoping to use the chart as a gauge for human emotions - that's kind of reliable.

From my understanding this panoply of emotions shows up in the chart. Which is why it works for so many traders.However, assessing as such directly person by person is an intractable challenge.

The market was so dull I noticed the drop as well. Maybe coincidental but the prez was at the podium.Any ideas why the markets crapped their pants at 14:40 - seems to be everything, including crypto, but I see no news to explain it??

tivoboy

Active Member

It was overall probably more related to bond auctions and upcoming funding needs becoming a bit more defined. LOTS of supply inbound. Track the treasury auctions for USD$, auction outcomes and impact on equity markets. USD$ DOWN, markets UP, rinse and repeat.The market was so dull I noticed the drop as well. Maybe coincidental but the prez was at the podium.

The markets in general have gone on a massive run the last few weeks, with TSLA largely left behind. If CT event doesn't move the needle, I'm going full Bear mode until dl003 says otherwise, as QQQ seems tired. I'm just not ready to do it yet until the end of the week. dl003 will have a stroke, but I still believe major news can move the SP and over ride TA.

The markets in general have gone on a massive run the last few weeks, with TSLA largely left behind. If CT event doesn't move the needle, I'm going full Bear mode until dl003 says otherwise, as QQQ seems tired. I'm just not ready to do it yet until the end of the week. dl003 will have a stroke, but I still believe major news can move the SP and over ride TA.

Honestly, vehicle reveals going back to the D event in 2014 have rarely moved the stock, and a sell-the-news has been pretty reliable over the years.

We used to get runups into the event but seems like even that hasn’t been the case in a while. I think Elon threw a financial wet blanket on Cybertruck with that last ER, so I remain comfortable with my ITM calls from 215-240 for Friday.

thenewguy1979

"The" Dog

All the major indexes including SPY and QQQ are developing triple bear divergence or head and shoulder.

Tesla been flat so far since last week. If there was a bounce coming soon due to CT it may go as high as 242 then deflate. That would still make DI0003 statement true as he did mentioned loading more boatload of puts at 241.x By now I think he have a carnival ship of Put

The 244 price target aligned with wicked stock and if broken will also invalidate the bearish move down. We go long then.

We should know soon this week.

Tesla been flat so far since last week. If there was a bounce coming soon due to CT it may go as high as 242 then deflate. That would still make DI0003 statement true as he did mentioned loading more boatload of puts at 241.x By now I think he have a carnival ship of Put

The 244 price target aligned with wicked stock and if broken will also invalidate the bearish move down. We go long then.

We should know soon this week.

chillerjt

Member

16.7k China weekly numbers. According to Twitter.

Highly recommend Papafox’s post #4112 for historical perspective. The question is how to balance our two prominent opinion leaders — Papafox and dl003.

intelligator

Active Member

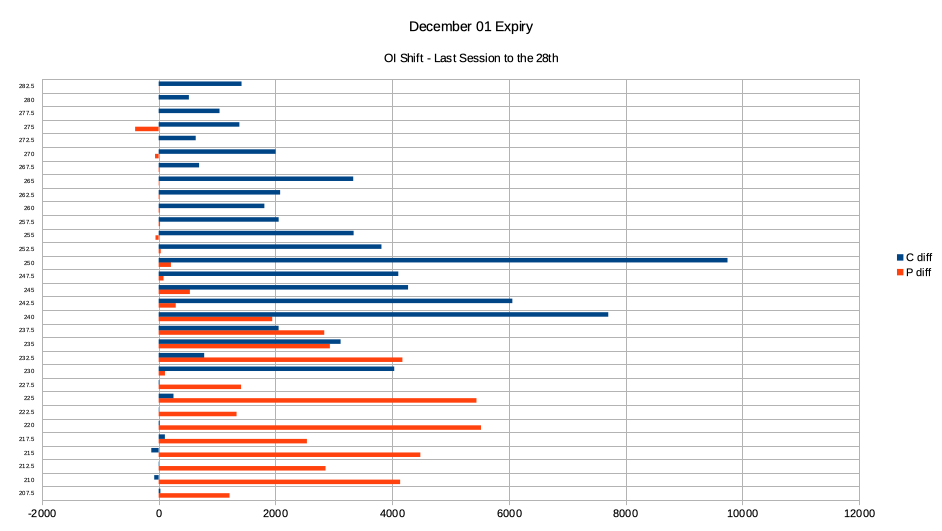

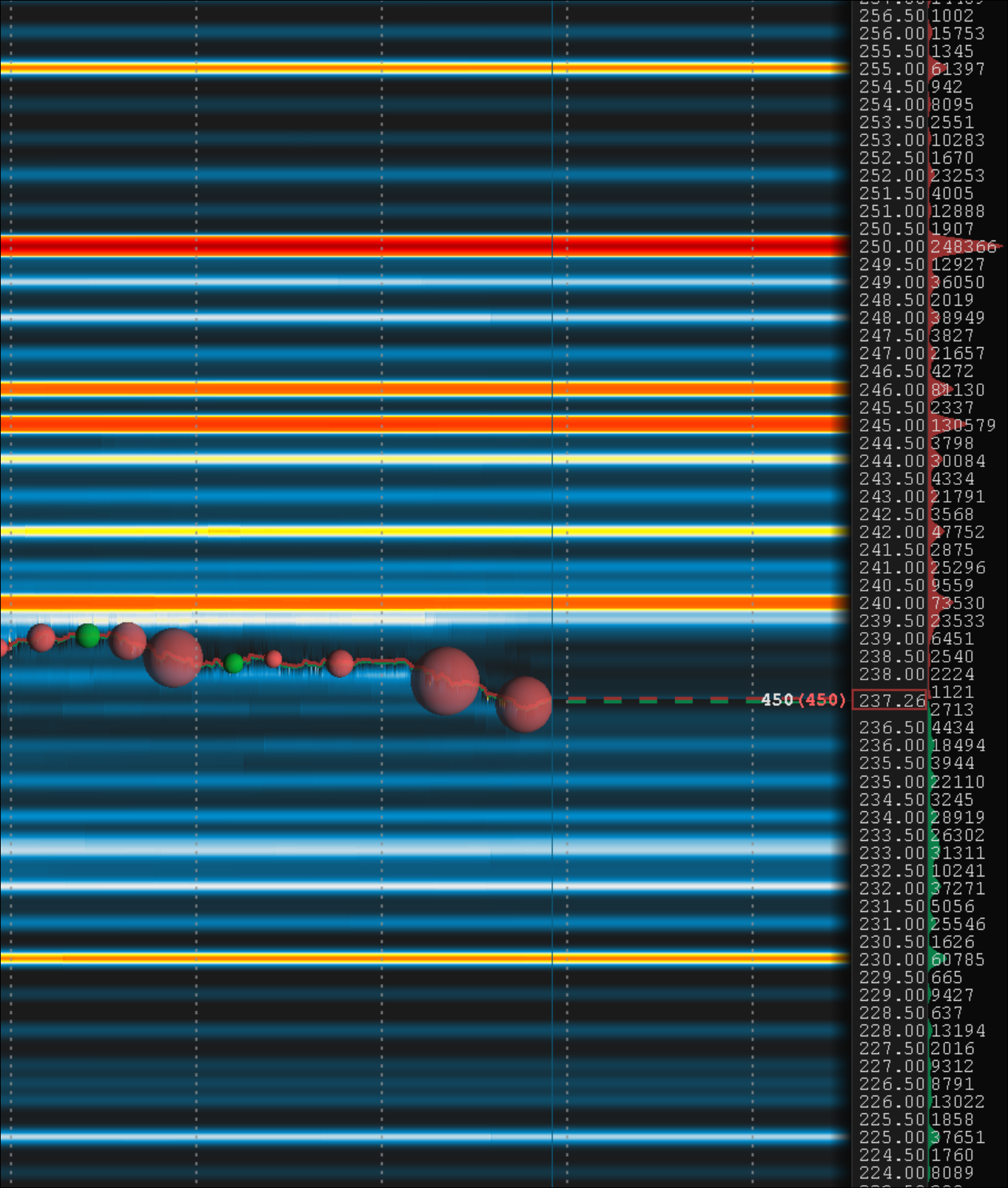

OI traffic jam at 235, busy between 232.5 and 240. Nice call increase at 250, 240, 242.5. Uniform put OI increases as well.

Being mostly flat, I may just set an IC and let time decay do its thing for a few days, shut down the losing side, momentum trade once direction is set.

EDIT: Tallest call wall is at 245, 46K. 14k of the OI is at P220 and similar size at P230. Put call ratio is .73

Being mostly flat, I may just set an IC and let time decay do its thing for a few days, shut down the losing side, momentum trade once direction is set.

EDIT: Tallest call wall is at 245, 46K. 14k of the OI is at P220 and similar size at P230. Put call ratio is .73

Last edited:

Highly recommend Papafox’s post #4112 for historical perspective. The question is how to balance our two prominent opinion leaders — Papafox and dl003.

I believe they're coming from two completely different perspectives, PoppaFox writes in that post that he hopes the market will soon see the growing value of Tesla and reacts accordingly, while DL003's data is solely based on TA and not hopes.

Agree, thus the quandary……I believe they're coming from two completely different perspectives, PoppaFox writes in that post that he hopes the market will soon see the growing value of Tesla and reacts accordingly, while DL003's data is solely based on TA and not hopes.

jeewee3000

Active Member

With all due respect to Papafox and his efforts through the years, his posts are mostly an explanation/synopsis of why the SP has moved in the past.Highly recommend Papafox’s post #4112 for historical perspective. The question is how to balance our two prominent opinion leaders — Papafox and dl003.

His goal isn't predicting short term SP moves, and he makes no attempt to. He is in essence a long term bull that many HODlers rally behind, and because $TSLA is such a strong ticker, his bullishness is rewarded whenever we rally. Papafox doesn't say: sell this top 'cause short term the stock is overbought.

dl003 is an entirely different beast, who tries to pinpoint with great accuracy the shorter term moves of the SP. I guess dl003 is a long term bull too, but that's unrelated to his short term trading/analysis. It's not because a stock will reach $X one day, you should keep holding until that day. Too many opportunities lie between now and then. In other words I don't think dl003 is too attached to any ticker, which is my view as well. I don't need the prestige of HODLing anything, I just don't want to see my portfolio drop 50% whenever $TSLA does.

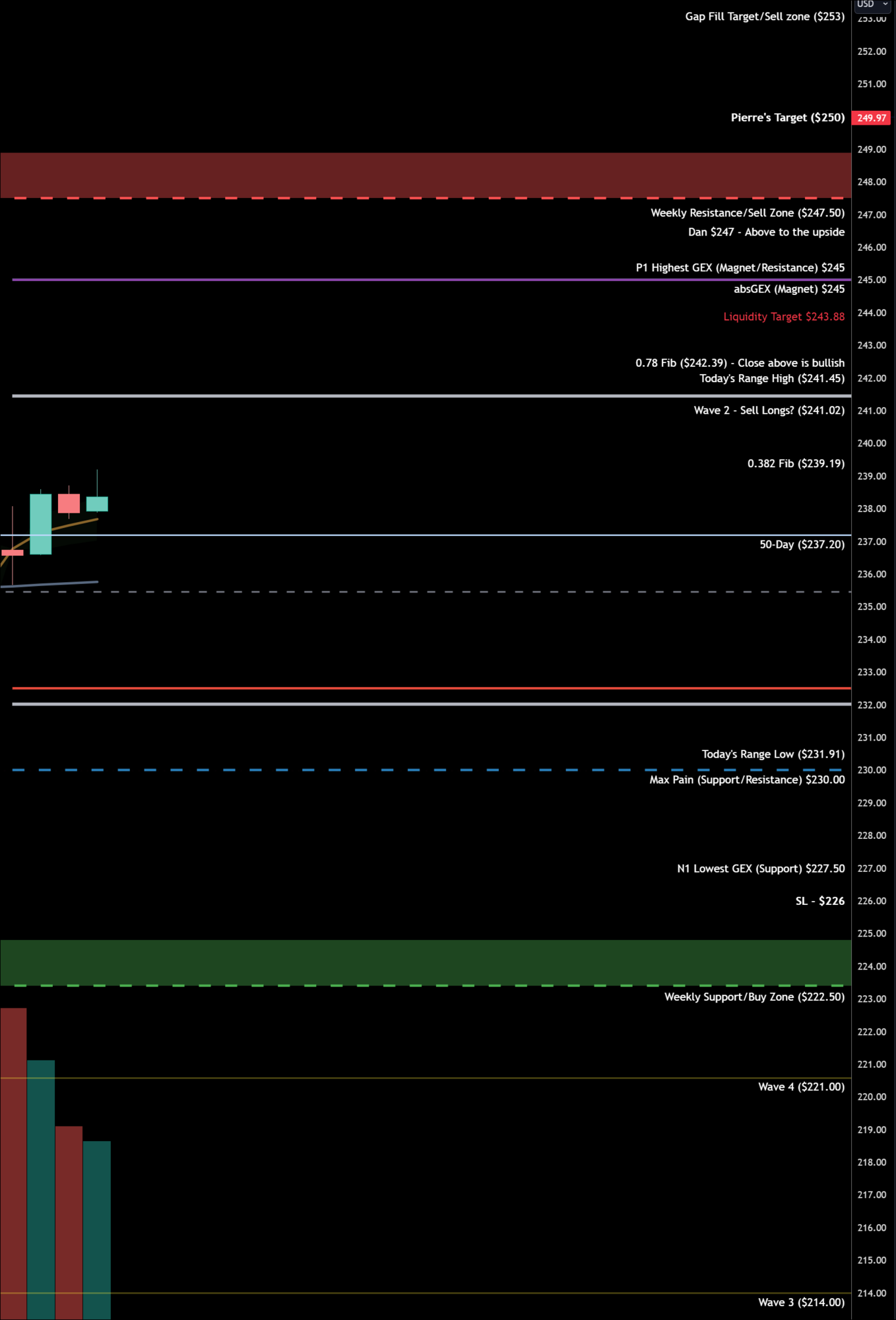

QTA levels for today + some notes

NFA

12/1

12/8

NFA

12/1

12/8

tivoboy

Active Member

Correct… I think this thread name should be changed to “tesla options trading - making money no matter what the stock does”..I believe they're coming from two completely different perspectives, PoppaFox writes in that post that he hopes the market will soon see the growing value of Tesla and reacts accordingly, while DL003's data is solely based on TA and not hopes.

SpeedyEddy

Active Member

just BTO P250 for 12/8 @ $14.90. These are already $16.50

Maybe today IS THE 225 day

Maybe today IS THE 225 day

Last edited:

Scalped several CC's from opening HOD to LOD for nice gains and went flat until next pop to resell.

Around lunchtime STO a few new starter positions:

10x -C250 12/1 @1.25

10x -C252.50 12/1 @1.05

15x -C255 12/8 @ 2.00

5x -C260 12/8 @1.50

10x -C265 12/8 @1.00

BTC all at lows for around $1,800 overnight scalp.

Looking to STO again on next pop if we get one.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K