Going from a DITM short leap put to ATM short weekly put is a risk reduction move. I meant it when I said to expect some consolidation.Oh wow, you're really expecting this to pump next week...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Going from a DITM short leap put to ATM short weekly put is a risk reduction move. I meant it when I said to expect some consolidation.

Ah! I didn't understand the DITM improvement angle

SpeedyEddy

Active Member

Today no gamma squeeze, I guess the stakes are too high for some people to cross 250 before the weekend. Maybe I will buy a lot of crazy 5ct calls late in the evening tomorrow, just to sell them for 15ct or more on Monday's jump. (when the 250 lid is finally lifted). Dollar dropping like a stone BTW. I might add that all indices have filled their gap-ups (just about) so $TSLA is showing a first round of bull-spirit after underperforming a really long time.

TexasGator

Member

right as the naz went negative and SP was ~ 250, sold 10x c255 for Friday just to make things interesting

juanmedina

Active Member

I have a bunch of $247.5cc for tomorrow that I should have closed yesterday for a nice profit. I might let them go and buy something boring like VTI.

thenewguy1979

"The" Dog

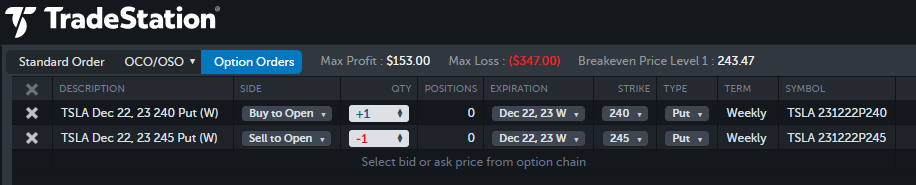

Would coupling that Put with a Short Call at 270 be a safe move ---if we are consolidating next week. Doing a straddle offset some of the max risk and provide better win/loss ratio of near 1:1Going from a DITM short leap put to ATM short weekly put is a risk reduction move. I meant it when I said to expect some consolidation.

Guess big bull trap for Macro going on after morning pump. All I see is Red now.

TexasGator

Member

agree for most except for EV stocks why LCID is +14% is beyond meGuess big bull trap for Macro going on after morning pump. All I see is Red now.

thenewguy1979

"The" Dog

Reason why considering a straddle / condor vs a single sided short for doing credit spreads.

It increased the profit slightly but also decrease the max loss. The bulk of the win would be on the Put Legs - the call legs are just acting as risk reduction to soften the blow if the Puts stragedy are DITM. 246 -274 are profit zone.

For the experts - is this a good plan?

It increased the profit slightly but also decrease the max loss. The bulk of the win would be on the Put Legs - the call legs are just acting as risk reduction to soften the blow if the Puts stragedy are DITM. 246 -274 are profit zone.

For the experts - is this a good plan?

strago13

Member

Oh, I am well awareSafe to assume everything I say is trolling, unless it starts with "Alright. If..." and ends with "...never come back."

Yeah that's the point of that post, too. Drives me crazy when people keep trying to trade around known "catalysts" when in reality the stock rarely does what they think it should do. Then, bam, just shoot up or crash 5% on zero news. Seeing Lushit also shooting up 15%, I wouldn't be surprised to hear the IRS has found a way to extend the EV credit or some other EV news that we as retails are not privy too. While we're looking at the bait, big money is making the move behind the scene.Oh, I am well awareI just thought it was funny given the conversation we've been having around catalysts

intelligator

Active Member

There's quite a bit of value left, intrinsic/extrinsic, no? I have same, will decide tomorrow far out to roll.I have a bunch of $247.5cc for tomorrow that I should have closed yesterday for a nice profit. I might let them go and buy something boring like VTI.

Meh, was out playing music this evening so missed the "dip" to close out this week's -c240's, in the end I started to roll them up to -c250 to take the extra extrinsic, got the -c250's sold, but didn't get the BTC done as the SP was all over the place, well, will see what tomorrow brings - you would think that huge c250 wall would hold tomorrow, but TSLA goes nuts soemtimes!

I added 40x extra -p240's @$2.31 to next week's -c240's, shalme I didn't sell those yesterday with the 10x others I sold @$7.2, meh!

I added 40x extra -p240's @$2.31 to next week's -c240's, shalme I didn't sell those yesterday with the 10x others I sold @$7.2, meh!

I could see this dovish pivot by the Fed as an inflection point - interest rates dropping give a boost to the stock directly and also boost demand, enabling higher prices and improving margin. If we get good deliveries and then improving margins next month, maybe we can finally break out into the 300s.

Not at all comfortable with my ITM covered calls anymore and I should have just BTC some this morning. Instead I sold some -p250 and raised -c242.50s to -c250s (all for tomorrow) to make a straddle. Hoping for a flat Friday tomorrow.

Not at all comfortable with my ITM covered calls anymore and I should have just BTC some this morning. Instead I sold some -p250 and raised -c242.50s to -c250s (all for tomorrow) to make a straddle. Hoping for a flat Friday tomorrow.

IDK where I first heard it, but it's been clear to me for years. TSLA goes down on good news, down on bad news, and up randomly.Yeah that's the point of that post, too. Drives me crazy when people keep trying to trade around known "catalysts" when in reality the stock rarely does what they think it should do. Then, bam, just shoot up or crash 5% on zero news. Seeing Lushit also shooting up 15%, I wouldn't be surprised to hear the IRS has found a way to extend the EV credit or some other EV news that we as retails are not privy too. While we're looking at the bait, big money is making the move behind the scene.

How far out with dating do you like to go for “crazy calls”. Like the idea.Today no gamma squeeze, I guess the stakes are too high for some people to cross 250 before the weekend. Maybe I will buy a lot of crazy 5ct calls late in the evening tomorrow, just to sell them for 15ct or more on Monday's jump. (when the 250 lid is finally lifted). Dollar dropping like a stone BTW. I might add that all indices have filled their gap-ups (just about) so $TSLA is showing a first round of bull-spirit after underperforming a really long time.

Our friend AJ piped up:

"We remain OW with a $380 PT, and bull and bear cases at $550 and $120, respectively."

"We remain OW with a $380 PT, and bull and bear cases at $550 and $120, respectively."

Last edited:

juanmedina

Active Member

There's quite a bit of value left, intrinsic/extrinsic, no? I have same, will decide tomorrow far out to roll.

Yeah $1.49. if we finish at $250 tomorrow it would be nice.

I could see this dovish pivot by the Fed as an inflection point - interest rates dropping give a boost to the stock directly and also boost demand, enabling higher prices and improving margin. If we get good deliveries and then improving margins next month, maybe we can finally break out into the 300s.

Not at all comfortable with my ITM covered calls anymore and I should have just BTC some this morning. Instead I sold some -p250 and raised -c242.50s to -c250s (all for tomorrow) to make a straddle. Hoping for a flat Friday tomorrow.

By when do you think the rate cuts will get reflected on the auto loans?

By when do you think the rate cuts will get reflected on the auto loans?

Have they not already? Mortage rates dropped.

A few hours before close I STO 5 x p250 12/22 for $6.00. Ofcourse I could have done that at 230 yesterday, but then things still looked bleak. I now feel more confident we’ll be going up towards P&D and earnings, with the occasional dip. I’ll roll if necessary, but having shares assigned is also an option.

juanmedina

Active Member

Have they not already? Mortage rates dropped.

Yes mortgage are down some but still way too high.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K