Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

Yes, one of many.The call sounded good to me. So far down only down 5%. A March 1st $185p should be worth close to $7 tomorrow if we open where we are. Is that the expiration you have in mind?

The call kinda went into the weeds a bit towards the end, more evading 2024 guidance dumped the stock

Obvious that 2024 will be around 2.2million, the exit rate from Q4 of 500k + 100k extra from Texas and Berlin, let’s say 25% growth

I also think the question about Tesla aligning to S&P tax rates was not answered well, I certainly didn’t understand it - I think the bottom line is no actual impact, it’s just accounting, but this wasn’t very clear

Obvious that 2024 will be around 2.2million, the exit rate from Q4 of 500k + 100k extra from Texas and Berlin, let’s say 25% growth

I also think the question about Tesla aligning to S&P tax rates was not answered well, I certainly didn’t understand it - I think the bottom line is no actual impact, it’s just accounting, but this wasn’t very clear

EVNow

Well-Known Member

A 195 close is precariously placed. Cary thinks if 194 is broken the next stop is 190 and then 177.

I don’t think the ER was so bad as to reach 177 this week. But I’d careful selling puts next week.

I don’t think the ER was so bad as to reach 177 this week. But I’d careful selling puts next week.

Only if one wanted the shares, right? $185 seems a bit close for comfort for a pure premium play.Yes, one of many.

tivoboy

Active Member

And then afterwards, ATH, right?..if we assume the worst-case scenario of -12.65% the next 2 days,

View attachment 1011936

that means friday Close = 181.54, which means -14.44% drop 7dte, which is in line with the lowest drops since 2011

View attachment 1011937

;-)

StarFoxisDown!

Well-Known Member

One of these days I'm going to actually submit a question that goes "Why doesn't Tesla lower the monthly subscription FSD rate to drive adoption and cushion auto margins during times of pricing pressure?" It just makes no sense to be adopting the strategy of selling more hardware at lower margins and NOT doing what needs to be done to increase adoption of software revenue that is much higher margin.

The strategy around software subscriptions and adoptions has been written to a gold standard at this point. You intentionally do a high price "buy outright" and incentivize monthly subscriptions with a much lower monthly payment. When you're trying to introduce a subscription model into a space where the consumer isn't used to it, then you have to be extra aggressive with the subscription price to get "butts in seats" as they say.

Hell bundle FSD with discounted supercharging or other software perks.

In regards to the current share price, call me crazy but I think tomorrow will be green. Just too oversold on the short term where I think there will be some sort of short relief rally before a further downtrend continues (mainly because of what I feel are going to be macro pressures).

The strategy around software subscriptions and adoptions has been written to a gold standard at this point. You intentionally do a high price "buy outright" and incentivize monthly subscriptions with a much lower monthly payment. When you're trying to introduce a subscription model into a space where the consumer isn't used to it, then you have to be extra aggressive with the subscription price to get "butts in seats" as they say.

Hell bundle FSD with discounted supercharging or other software perks.

In regards to the current share price, call me crazy but I think tomorrow will be green. Just too oversold on the short term where I think there will be some sort of short relief rally before a further downtrend continues (mainly because of what I feel are going to be macro pressures).

I sold some shares and plan to sell 200c every week for this next quarter or two. Will look to start selling puts if we get down to 180 level. I just don’t see any reason for the stock to go up in the short term.

Really wish I had kept selling ITM calls the last few weeks instead of letting my innate bullishness make me try to time the market again.

Really wish I had kept selling ITM calls the last few weeks instead of letting my innate bullishness make me try to time the market again.

Knightshade

Well-Known Member

The call kinda went into the weeds a bit towards the end, more evading 2024 guidance dumped the stock

Obvious that 2024 will be around 2.2million, the exit rate from Q4 of 500k + 100k extra from Texas and Berlin, let’s say 25% growth

I also think the question about Tesla aligning to S&P tax rates was not answered well, I certainly didn’t understand it - I think the bottom line is no actual impact, it’s just accounting, but this wasn’t very clear

Based on the slide deck, remarks on the call about growth, remarks on the call about nearing the limits of COGs reductions on existing models, the RWD and LR AWD 3 not qualifying for any IRA credit, and cuts to EV credits in a bunch of EU countries, I think even 2.2 is overly optimistic for deliveries- certainly production could be that high though.

Agree on the tax question.

But the call also told us:

No Dojo as a service in any meaningful timeframe, if ever (and maybe not even meaningful internal use)

No Bot for sale this year and only, maybe, uber-elon-optimistically, any at all in 2025 (and still trying to get it to do useful things)

No next-gen car production until late (Elon used end once or twice too) of 2025

No substantive discussion at all with OEMs licensing FSD (Elon mentioning they still don't believe it's real)

Also nothing on call about the dying solar business or the hasn't-expanded-in-quite-a-while insurance business.

All of which are not conducive to much of a narrative of growth for the next -2- years in a stock that's still got a very high PE.

Energy looked good, and Elon talked it up, but even if it doubled in 2024 it'd still represent like what 15% or less of total revenue? But that was probably the nearest to a bright spot over at least the next year, if not two.... well, that and of course, we got Elon telling us, as he has annually since what 2017, THIS is the year we see ACTUAL self driving

I'd originally thought I might look at max-time LEAP buying after the IV crash and call SP drop, but honestly so much of that call was "not much going on till 2026" I'm not sure if it makes much sense yet.

Last edited:

CT current capacity is 125K, so I am thinking even 2.1M is a stretch for 2024. Not sure how another 200K of 3&Y will happen for 2024...The call kinda went into the weeds a bit towards the end, more evading 2024 guidance dumped the stock

Obvious that 2024 will be around 2.2million, the exit rate from Q4 of 500k + 100k extra from Texas and Berlin, let’s say 25% growth

I also think the question about Tesla aligning to S&P tax rates was not answered well, I certainly didn’t understand it - I think the bottom line is no actual impact, it’s just accounting, but this wasn’t very clear

If guidance for 2.2 was given, I think the SP would atleast be neutral AH.

So I think 2024 is basically based on macro trends for Tesla ... rate cuts basically ...

Also elections might need to be over. DT himself said the other day - SP is up because market is anticipating R will win in Nov

Q1 P&D is going to list the Energy metrics, so hopeful, analyst will start factoring in energy as well.

+internally, Tesla is busy as ever with scaling battery lines, AI, Dojo, Semi and M2, but nothing to show for it in 2024 it looks like ...

Last edited:

How many times have you tried software that did not work very well and gave it another shot?One of these days I'm going to actually submit a question that goes "Why doesn't Tesla lower the monthly subscription FSD rate to drive adoption and cushion auto margins during times of pricing pressure?" It just makes no sense to be adopting the strategy of selling more hardware at lower margins and NOT doing what needs to be done to increase adoption of software revenue that is much higher margin.

The strategy around software subscriptions and adoptions has been written to a gold standard at this point. You intentionally do a high price "buy outright" and incentivize monthly subscriptions with a much lower monthly payment. When you're trying to introduce a subscription model into a space where the consumer isn't used to it, then you have to be extra aggressive with the subscription price to get "butts in seats" as they say.

Hell bundle FSD with discounted supercharging or other software perks.

In regards to the current share price, call me crazy but I think tomorrow will be green. Just too oversold on the short term where I think there will be some sort of short relief rally before a further downtrend continues (mainly because of what I feel are going to be macro pressures).

The strategy might be as simple as silently admitting that FSD is not ready for mass consumption. Tesla is walking a fine line. I’m sure they will reduce it when they think it’s fully ready.

So at least there is some hope

Well, if we aren't green next week that will be 7 Red Weekly candles in a row. You stated the previous record over the last 3.5 years was 4.

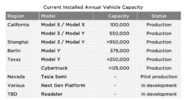

That is with Extremely good Q4 Free cash flow, Auto margins improving, Energy more than doubling, current production capacity of over 2.3M vehicles, and likely revenue of $120 Billion in 2024. So the question is, just how stupid is Wallstreet?

Attachments

so far, the 194.07 Order Block held up AH; the last 4 candles bounced on that suppWell, if we aren't green next week that will be 7 Red Weekly candles in a row. You stated the previous record over the last 3.5 years was 4.

That is with Extremely good Q4 Free cash flow, Auto margins improving, Energy more than doubling, current production capacity of over 2.3M vehicles, and likely revenue of $120 Billion in 2024. So the question is, just how stupid is Wallstreet?

EXOTIC1

Member

That’s exactly what I was thinking I’m confusedSo the drop from 260+ to 200 now didn't price any of this in....

I own about 2500 shares purchased in 2016 and 2017. Should’ve taken my profits when it was all-time high in 2021.

However, sometimes the stock makes no sense. They beat Wall Street projections for Q4 deliveries and the stock dropped and with with the news today dropped again. Might be time to just take my profits and move on into something else I don’t see any positive movement for 2024. Might roll it in AMZN

Last edited:

The Accountant

Active Member

Would anyone know when Sep 2026 LEAPS will be listed?

⚡️ELECTROMAN⚡️

Village Idiot

Ok I'm out. Is it all down from here, or should I wait for $260 again? I'll get back in when I see some hope, but I'm not leaving my ass hanging out there for two more years. I just did that for the last three years, and it wasn't pretty.Based on the slide deck, remarks on the call about growth, remarks on the call about nearing the limits of COGs reductions on existing models, the RWD and LR AWD 3 not qualifying for any IRA credit, and cuts to EV credits in a bunch of EU countries, I think even 2.2 is overly optimistic for deliveries- certainly production could be that high though.

Agree on the tax question.

But the call also told us:

No Dojo as a service in any meaningful timeframe, if ever (and maybe not even meaningful internal use)

No Bot for sale this year and only, maybe, uber-elon-optimistically, any at all in 2025 (and still trying to get it to do useful things)

No next-gen car production until late (Elon used end once or twice too) of 2025

No substantive discussion at all with OEMs licensing FSD (Elon mentioning they still don't believe it's real)

Also nothing on call about the dying solar business or the hasn't-expanded-in-quite-a-while insurance business.

All of which are not conducive to much of a narrative of growth for the next -2- years in a stock that's still got a very high PE.

Energy looked good, and Elon talked it up, but even if it doubled in 2024 it'd still represent like what 15% or less of total revenue? But that was probably the nearest to a bright spot over at least the next year, if not two.... well, that and of course, we got Elon telling us, as he has annually since what 2017, THIS is the year we see ACTUAL self driving

I'd originally thought I might look at max-time LEAP buying after the IV crash and call SP drop, but honestly so much of that call was "not much going on till 2026" I'm not sure if it makes much sense yet.

At least wait for the DCB..Ok I'm out. Is it all down from here, or should I wait for $260 again? I'll get back in when I see some hope, but I'm not leaving my ass hanging out there for two more years. I just did that for the last three years, and it wasn't pretty.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K