Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

SpeedyEddy

Active Member

SAPharmD

Member

Okay! Long term HODL share goal completed! (And still have extra dry powder - and a good job - for “life” if TSLA goes to $0 someday or if we have a recession).

Now time for SP to recover and stay above $200.

Now time for SP to recover and stay above $200.

Last edited:

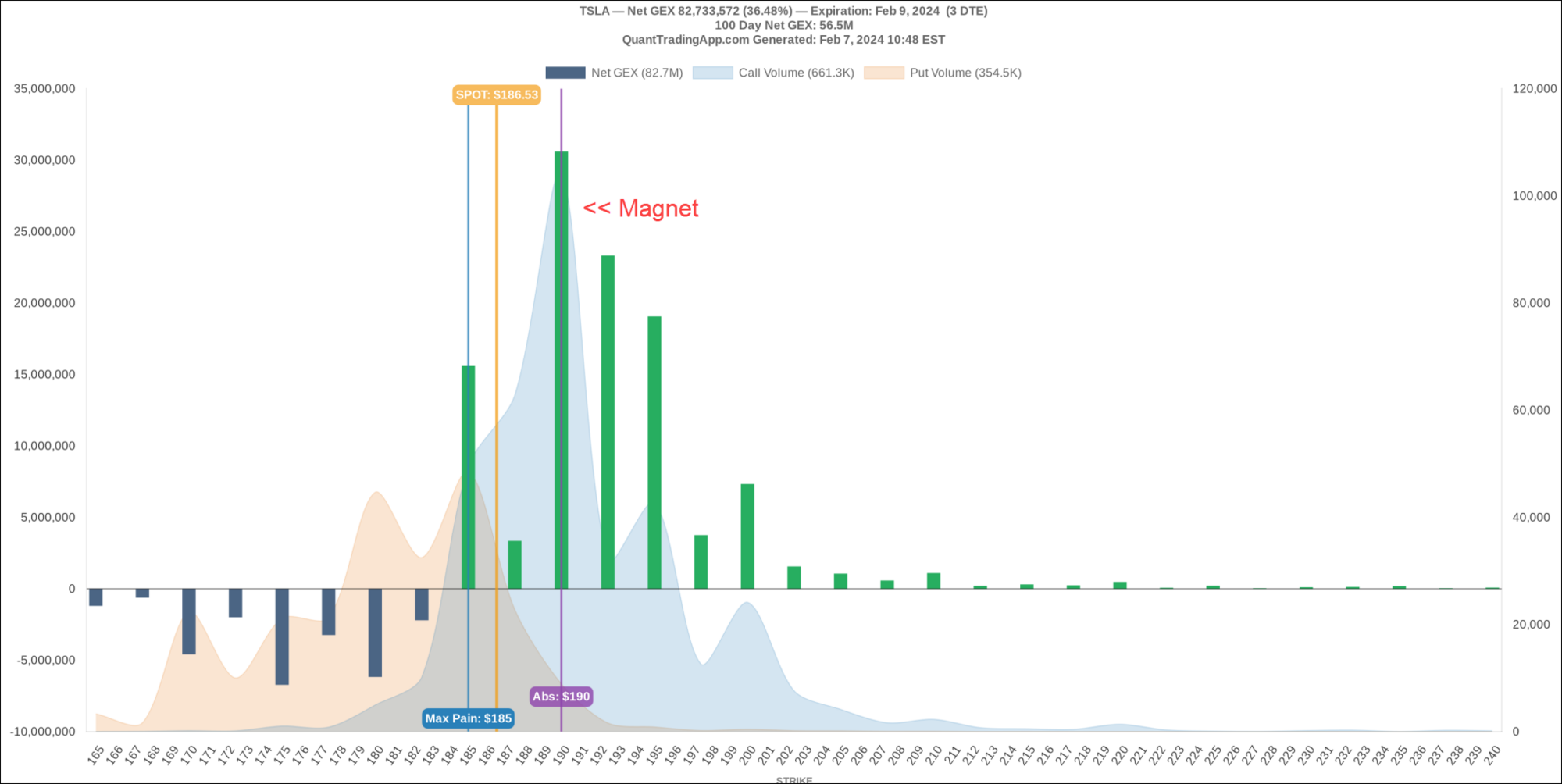

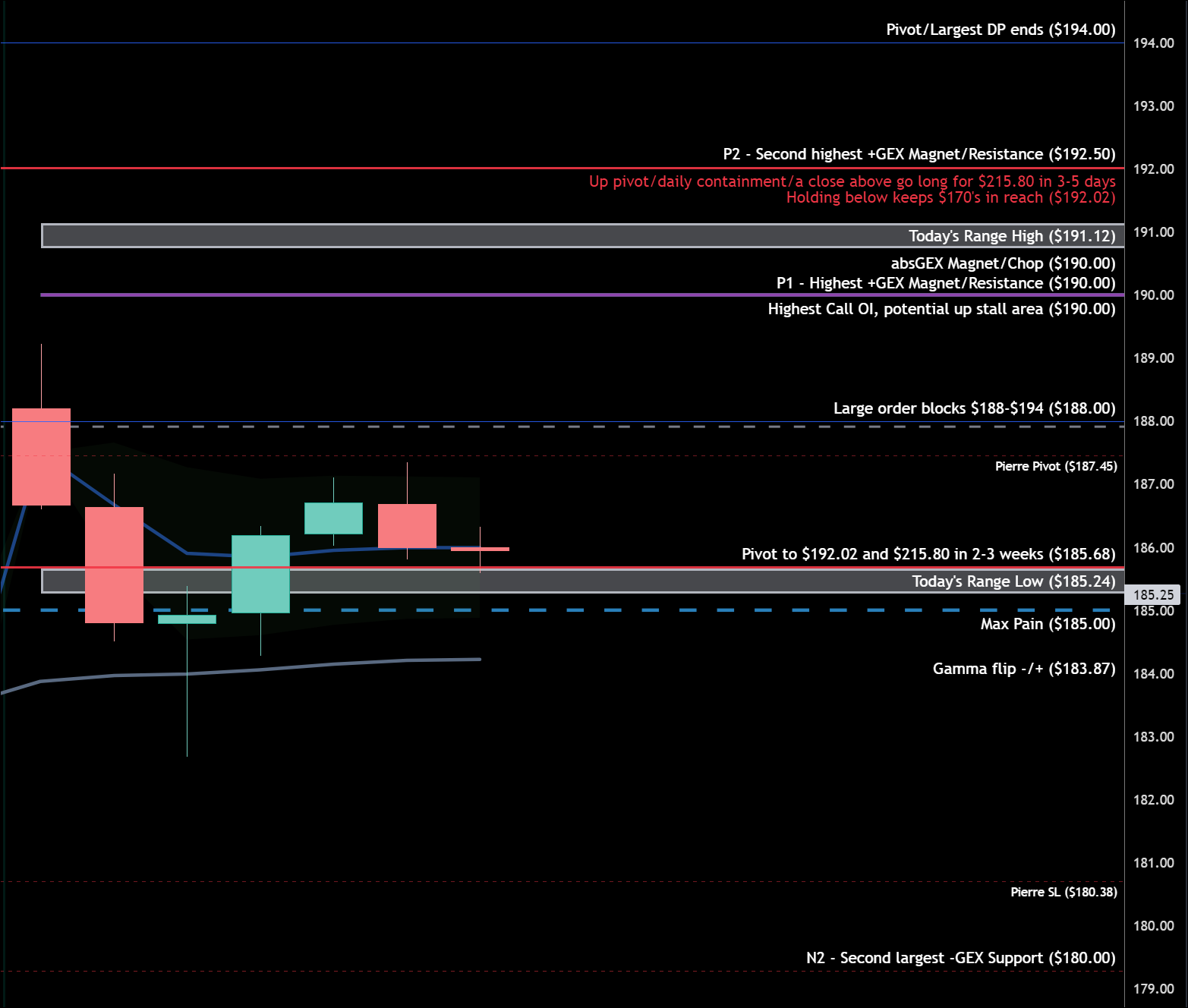

GEX + MP corridor range possible +/- $185-$190 through EOW:

Knightshade

Well-Known Member

Test drove a Highland yesterday in Bellevue and found out FSD transfer works for a lease. But what happens when the lease is up? FSD stays with the vehicle and... https://www.tesla.com/support/leasing-your-vehicleView attachment 1016184

FWIW that 2022 change was for S/X.... the 3/Y have never allowed buyouts on a lease.

Originally Tesla claimed that was because they planned to use returned 3s for Robotaxis, but that...has not really worked out... ended up being a profitable mistake for them during Covid when used car prices were crazy though as Tesla got a nice profit reselling those returned cars.

Knightshade

Well-Known Member

BTW did actually do a tiny bit of trading today too, decided to be weirdly optimistic and opened a handful of +195c/-205c spreads for 3/1 at $2.35/sh net debit... pays ~3:1 max profit vs risk.

BTO 2x +C200 12/2024 @29.00

BTO 5x +C200 6/2024 @16.20

I plan to STC both @ any test of $192-$193 and if we close above that level then re-BTO and hold for $210-$215 area and STC then again.

BTO 5x +C200 6/2024 @16.20

I plan to STC both @ any test of $192-$193 and if we close above that level then re-BTO and hold for $210-$215 area and STC then again.

Personally, I would write 4-5 $2.5 OTM calls for two weeks out every week for a couple months or until they get assigned and see where you land, on the basis that you have access to capital and your concerns are more long-term.What would you guys do...

thenewguy1979

"The" Dog

ChiefRollo

Member

Relatively new here, both to the forum and this thread. I feel like I'm learning quite a bit as I follow this thread. It's impressive how active you guys (and gals) are with options. It seems more than possible that money can be made by playing SP oscillations with options and their rolling. It just seems a bit different for my current style of play / comfort level. I do see however a role for options that I will begin to put to use (vs. simply buying / selling shares). The reason to do so (short or long) remains unchanged...at least for me. If I feel the technicals are favoring shorts, instead of selling share, I would now consider -C or +P; would +C or -P if long is favored. Below is my typical collection of dimensions...that constitutes a lense if you will to guide my action. Would love reactions from you all for my learning:

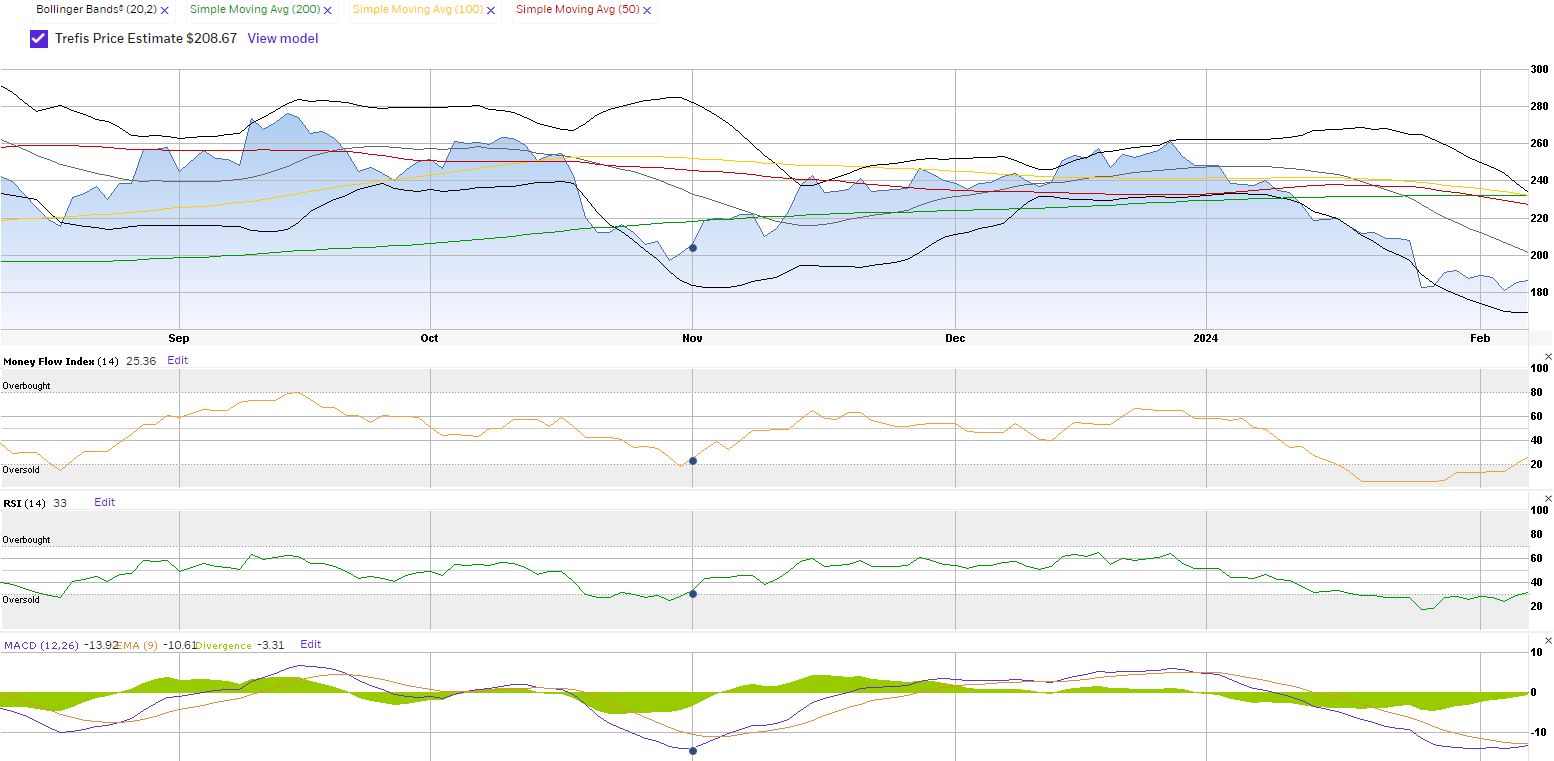

The combination of MACD, RSI, and MFI complementing Bollinger Bands & MA's seems to indicate more of a bottom for TSLA...that it would take more work / effort / cost to push its SP lower, not unlike a rubber band that's quite stretch; tendency as I see it seems to favor SP increase. For now, it seems the ceiling to this leg up is the level at which the 3 MA's are consolidating (230's).

Based on this read, I would hesitate to short (+P or -C or sell my shares outright)...again due to my perceived exhaustion. If I were to make a move, those on the long side would be considered.

Please let me know your thought...and remember that I am relatively inexperienced and entirely self-taught.

The combination of MACD, RSI, and MFI complementing Bollinger Bands & MA's seems to indicate more of a bottom for TSLA...that it would take more work / effort / cost to push its SP lower, not unlike a rubber band that's quite stretch; tendency as I see it seems to favor SP increase. For now, it seems the ceiling to this leg up is the level at which the 3 MA's are consolidating (230's).

Based on this read, I would hesitate to short (+P or -C or sell my shares outright)...again due to my perceived exhaustion. If I were to make a move, those on the long side would be considered.

Please let me know your thought...and remember that I am relatively inexperienced and entirely self-taught.

Last edited:

That is sensible, but it is possible to roll into another position that is logical, and accomplish both things — 1) avoid loss of shares if CC is ITM = selling for tax purposes if in a taxable account, and 2) collect credit or small debit. Judging by your post, you fully understand that, but others may not. For example, 9Feb$187.50 —> 16Feb$190 which may be OTM next week. Otoh, there can be benefits to closing/allowing expiry or assignment at end-week and selling early the following week as it seems that SP often muddles along at the end of the week, then pops enough on Mon/Tue to positively affect premiums.Two reasons:

The first is simply, I am OK selling those shares at the $187.50 strike price...if I wasn't OK doing so, I wouldn't have sold the calls.

The second is the more important reason...it's because I have a fundamentally different perspective on options than most (nearly all?) of those in this thread. It seems the prevalent philosophy here is along the lines of (poorly paraphrased, I'm sure): "If I roll the call I avoid taking the loss, and get to hopefully eventually make good on it." However, I look at rolling as two atomic actions (because in reality it *is* two atomic actions), 1) buying back the sold call (A) at a loss and fully recognizing that loss and 2) selling the new call (B) hoping to make a profit. IMHO, it is fundamentally wrong to look at rolling as "I didn't take the loss on (A) yet, because I just rolled it out." No. Full stop, "No." I took the loss on (A). It was a poor trading decision. If I lose money on (A) and make money on (B), I don't want to blur them together and tell myself that it was all just one transaction that got dragged out over a second (or third or fourth or ...) week (or month or year). I want to be very honest with myself that (A) was a money-losing trade. And if (B) works out to be a profitable trade, I want to be very honest with myself about that, too.

Even worse, by rolling, it's right at the point of having lost money on (A) that I'm making a decision on whether (B) is a good trade or not. Separating them out (by hours, days, etc) gives me time to pause and contemplate *why* I chose (A), what was incorrect about my assumptions (or what happened randomly / unexpectedly). When I've made a decision that did not work out for me, it is the perfect time to think about that. A time to reflect, not a time to instantly make a decision again. Then I can really internalize that (A) was a bad choice and (B) <even if done hours / days later than (A)> was a good choice, instead of mentally blurring them together.

NOTE: Hopefully this is read in the intented "This is just my opinion and I hold no judgement over those who think differently" manner, and does not bother or offend anyone. Different approaches are best for different people. This is just what works for me. YMMV, NFA, etc.

StarFoxisDown!

Well-Known Member

Yeah there would have to be a material breakdown in Tesla's business and/or a huge macro selloff to get the stock back down to the 100-125 area. The FCF Tesla printed in Q4 combined with there cash balance now makes it much harderr to justify 100/share. I still think the 146 gap gets filled but I think it'll literally a single day, intraday dip from say 160 to 146 and then recover to 155-160 level.I still think $16x is in the cards, but as I’ve said there is a lot of buying interest in the $16x range, so getting below $160 would be hard…once below though, it’s a quick run into $14x. Again, LOTS of buyer interest so I don’t think we’re going to truly retest the Jan’23 lows.

I'm just hoping that the day it happens, I'm not preoccupied or away from my pc to where I can't take advantage. But knowing my luck, that's exactly what's going to happen

The combination of MACD, RSI, and MFI complementing Bollinger Bands & MA's seems to indicate more of a bottom for TSLA...that it would take more work / effort / cost to push its SP lower, not unlike a rubber band that's quite stretch; tendency as I see it seems to favor SP increase. For now, it seems the ceiling to this leg up is the level at which the 3 MA's are consolidating (230's).

Based on this read, I would hesitate to short (+P or -C or sell my shares outright)...again due to my perceived exhaustion. If I were to make a move, those on the long side would be considered.

Please let me know your thought...and remember that I am relatively inexperienced and entirely self-taught.

Welcome Rollo!

That's a decent analysis for being self-taught!

That is all very true. It is possible that that same moment of realizing the loss on (A) is also the right time to open the position (B). I have done a roll before, when I was firmly convinced this was the case, but more often I simply find I benefit from a thinking period in between closing (A) and potential opening (B) (or deciding not to open (B).That is sensible, but it is possible to roll into another position that is logical, and accomplish both things — 1) avoid loss of shares if CC is ITM = selling for tax purposes if in a taxable account, and 2) collect credit or small debit. Judging by your post, you fully understand that, but others may not. For example, 9Feb$187.50 —> 16Feb$190 which may be OTM next week. Otoh, there can be benefits to closing/allowing expiry or assignment at end-week and selling early the following week as it seems that SP often muddles along at the end of the week, then pops enough on Mon/Tue to positively affect premiums.

Also, yes, tax considerations may come

Into play for some. Certainly each should be aware of all the impacts of their considered trade. In my case, virtually all activity is in accounts structured where tax considerations do not matter for me for these trades. But when taxes do matter, I would simply remind myself that if a position is a losing position, holding onto a losing position for tax reasons is still holding onto a losing position, and only in extreme edge cases would the tax savings offset the potential loss about to be incurred.

7th attempt to cross above the red Order BlockSold 100X 197.5CC for Friday at 0.4.

This paid for the roll on the other 100X to next week 200 strike from 190 strike this week.

stay safe, TSLA can still move -13% to +9% OTM 2DTE (last 52 weeks)

Last edited:

thenewguy1979

"The" Dog

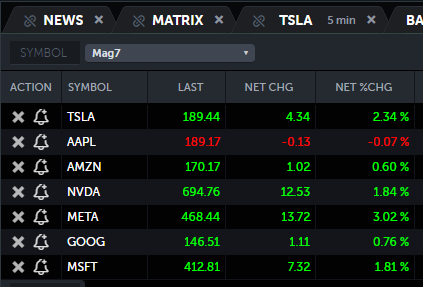

Definitely trying hard to break 190 with help from Macro.

1hrs candles consolidating. Let see if we have a repeat of yesterday near closing upward momentum

1hrs candles consolidating. Let see if we have a repeat of yesterday near closing upward momentum

Last edited:

Remember when I said I sold 100x 2/16 -c175 to "stop the rot", I was just kidding!!

Anyway, with things looking a bit bullish, I decided to split my risk so BTC 50x -c175 and STO 50x -c200 + 50x -p200

Still 50x -c175 remaining, but that's a much easier proposition to deal with

Anyway, with things looking a bit bullish, I decided to split my risk so BTC 50x -c175 and STO 50x -c200 + 50x -p200

Still 50x -c175 remaining, but that's a much easier proposition to deal with

thenewguy1979

"The" Dog

We should be bullish. The good doc this morning got his Puts assigned. Took a bullet for the team. A good man indeedRemember when I said I sold 100x 2/16 -c175 to "stop the rot", I was just kidding!!

Anyway, with things looking a bit bullish, I decided to split my risk so BTC 50x -c175 and STO 50x -c200 + 50x -p200

Still 50x -c175 remaining, but that's a much easier proposition to deal with

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K