InTheShadows

Active Member

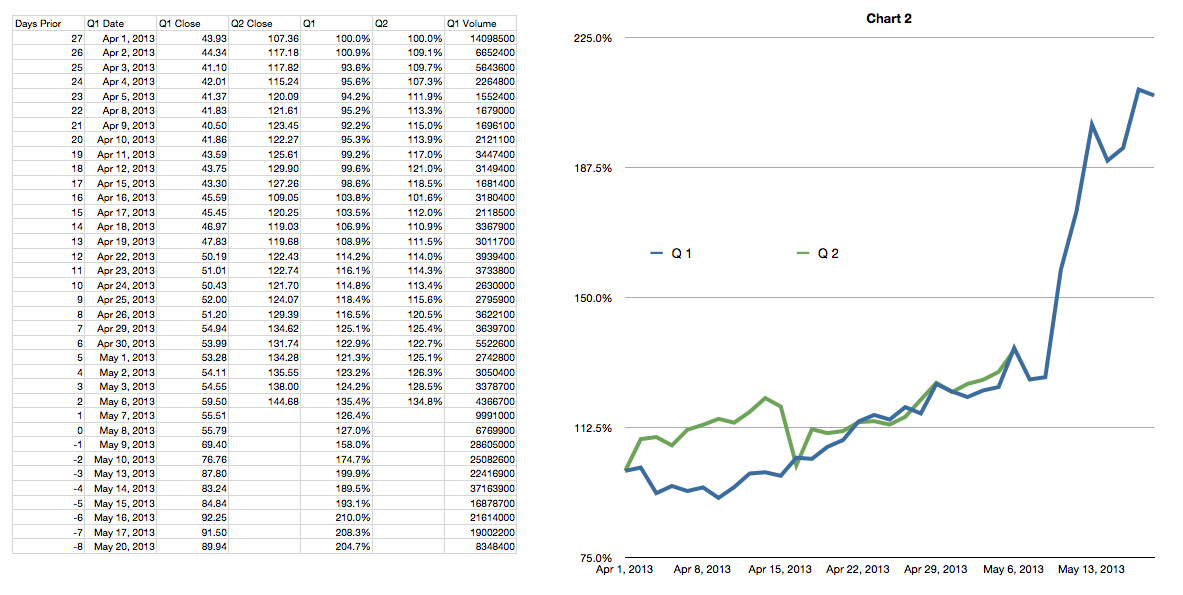

So I was curious about the comparison of the run up prior to Q1 and now. So I picked a random date (Apr 1 because I only had to change the month to get the data.) prior to earnings for Q1 then made that price 100%. I then did the same thing with Q2. Here are the results. Interesting that the run ups are some what similar percentage wise.