Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

I'm expecting the same as Q3.Anyone care to share there thoughts on what the SP will do with positive earnings in Q4?

MartinAustin

Active Member

Anyone care to share there thoughts on what the SP will do with positive earnings in Q4?

Sure... it'll go up

In other news... when asked this morning on CNBC if they thought TSLA was going to be negatively affected by a Trump presidency, a guest responded that they thought TSLA was "Trump-proof." Nice term getting coined, there.

The thinking being, Tesla has a large fan base. And that they already employ a lot of Americans.

Adding my own bit of colour to this... Elon has publicly said he doesn't want to move atoms around the world long distances, therefore building-near-where-you-sell is important. A Tesla factory in or near China would not raise the ire of Trump (as I understand him), because those cars would not be destined for the USA. A Trump-proof strategy, for sure.

I'm expecting the same as Q3.

We've taken a few kicks to the face this year, however, I'd expect(hopefully) at least a small boost to the SP if we can show another solid Q. I'm expecting significantly improved margins on MX, better margins on MS from AP 2.0. A bit of a showing from TE, etc. At some point the results have to be recognized.

Here's a lens through which to consider TSLA's trading today. According to vgrinshpun's earlier post, a quarter million short shares were drawn down at Fidelity early this morning. A sale of more than 40,000 shares took place in the first minute of trading. Nonetheless, TSLA managed to hit 194 before settling down near 193. What you're likely seeing is capping by short sellers at 193. Monday is the most likely day of the week to see big gains with TSLA and so the shorts are working to minimize the gains. Unfortunately for them, the slow descent into close in afternoon hours doesn't normally take place any more. What I'd watch for is to see whether the 193 cap holds today or if longs manage to break above the cap, perhaps in the final hour of trading.

If the shorts can do it, they'll try to see TSLA close at least a penny below $193. They don't like TSLA gettting this close to the 50 dma and the upper bollinger band because those events could bring in technically-oriented buyers.

Last edited:

MitchJi

Trying to learn kindness, patience & forgiveness

Some useful information:

Tesla's Price Target Slashed: What You Need to Know -- The Motley Fool

This morning, analysts at Deutsche Bank announced they are resuming coverage on Tesla stock. That's the good news. The bad news is that Deutsche doesn't really like what it sees. According to the analyst, the stock that has lost 12% of its value over the past year might rebound slightly in 2017 -- but not nearly so much as we once hoped. Deutsche is reducing its price target on Tesla stock from $290 to just $215. And while this new target is about 12% above where Tesla shares sit today, Deutsche is only rating Tesla stock hold -- not buy.

Here are three things you need to know about why.

<Snip>

Tesla's Price Target Slashed: What You Need to Know -- The Motley Fool

This morning, analysts at Deutsche Bank announced they are resuming coverage on Tesla stock. That's the good news. The bad news is that Deutsche doesn't really like what it sees. According to the analyst, the stock that has lost 12% of its value over the past year might rebound slightly in 2017 -- but not nearly so much as we once hoped. Deutsche is reducing its price target on Tesla stock from $290 to just $215. And while this new target is about 12% above where Tesla shares sit today, Deutsche is only rating Tesla stock hold -- not buy.

Here are three things you need to know about why.

<Snip>

Jonathan Hewitt

Active Member

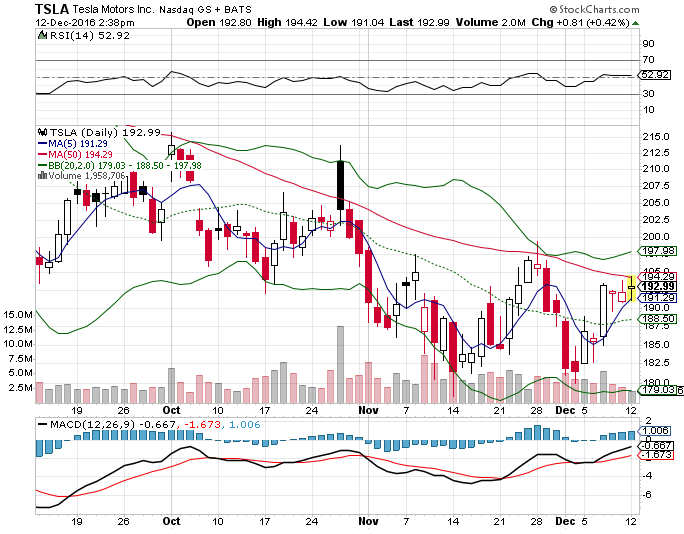

The 5 day MA (blue line) provided support again, for the 5th day in a row. We are stuck in-between the 5 day and 50 day MAs. As these two MAs converge the chance of a breakdown or breakout from these MAs increases.

larmor

Active Member

That's because DB business modelling cannot compute profits without increased debt.Some useful information:

Tesla's Price Target Slashed: What You Need to Know -- The Motley Fool

This morning, analysts at Deutsche Bank announced they are resuming coverage on Tesla stock. That's the good news. The bad news is that Deutsche doesn't really like what it sees. According to the analyst, the stock that has lost 12% of its value over the past year might rebound slightly in 2017 -- but not nearly so much as we once hoped. Deutsche is reducing its price target on Tesla stock from $290 to just $215. And while this new target is about 12% above where Tesla shares sit today, Deutsche is only rating Tesla stock hold -- not buy.

Here are three things you need to know about why.

<Snip>

If American president cannot talk to anyone he chooses, he is not the real president. Chinese are.

I think Trump is confused about who is the real president. Even if the electoral college confirms his election, we have only one president at a time. Bypassing the State Department as the conduit for diplomatic exchanges may be appropriate for some who are contemptuous of bureaucracy, but an incoherent foreign policy is not in any country's best interest. Would you like Hillary Clinton as Secretary of State communicating directly about Department business on her private server with foreign leaders? This is just another example of Trump's hypocritical amateur standing and believe me bodes ill for the country. What happens when both Putin and Trump get pissed off at the same time?

By the way, when I worked in the foreign policy establishment my job description stated I could be expected to participate in the making of treaties. However, only one person in our shop actually did so. She was paid at the GS-12 rate, some two grades below the men. I did write many cables directing our embassies to do various things. They were all signed so far as the embassy knew by Dean Rusk although I reported only to a lowly GS-15. The only time I had direct work with anyone higher up was when I drafted a note concerning my embarrassment to learn the executive dining room servers were all African Americans where we entertained foreign counterparts of color. That was so toxic it rose in a draft form which a GS-17 promised to carry forward without any further electronic or paper record.

SebastianR

Active Member

Oh, I really hope the price doesn't go up too quickly - dry powder coming in very very soon - stay put TSLA, I still want in on this ;-)

(do I seriously sound like CALGARYARSENAL already?!?)

(do I seriously sound like CALGARYARSENAL already?!?)

Meh. Elon Musk has never been afraid to do his own thing and if a 'dressing down' really occurred for the media last time, I can well imagine Elon Musk doing something really provocative (not in a sexual way people, get your minds out of the gutter) during such a meeting. In that case, it's better he stays home.

Regardless, we'll just have to trust Elon knows what he's doing whether he goes or not. Maybe he'll conference call or Skype.

Skype or conference call is no problem by me. EM certainly is not going to take my opinion into consideration but IMO, if asked, you attend. NO downside and potential upside is there to take the meeting

SuperDragon

Member

Elon just needs to put on his selling shoes and talk to Trump directly either at the Tech summit or one on one. American made rockets, cars and batteries will get the president elects attention, if its presented correctly.

Plus Trump is a egomaniac im sure he'd love a photo opp with "iron man" for the press.

im sure he'd love a photo opp with "iron man" for the press.

Plus Trump is a egomaniac

Last edited:

Elon just needs to put on his selling shoes and talk to Trump directly either at the Tech summit or one on one. American made rockets, cars and batteries will get the president elects attention, if its presented correctly.

Plus Trump is a egomaniacim sure he'd love a photo opp with "iron man" for the press.

Don't forget, Trump's son loves space/NASA/rockets (posted up thread).

Anyone care to share there thoughts on what the SP will do with positive earnings in Q4?

I think SP could move higher but needs more color on model 3 progress being on track. Also in the Q2 CC Elon said he was expecting TE to ramp Nov Dec, so confirmation here could get some analysts to put TE projections in models.

That's pretty similar narrative as Q3. Really good numbers but I'm sticking by more clearity need with M3, SCTY, and Trump positions (seems like what Wall Street is looking for or weights more).We've taken a few kicks to the face this year, however, I'd expect(hopefully) at least a small boost to the SP if we can show another solid Q. I'm expecting significantly improved margins on MX, better margins on MS from AP 2.0. A bit of a showing from TE, etc. At some point the results have to be recognized.

Let's arrange for a collective buy one of these days!View attachment 205447

Here's a lens through which to consider TSLA's trading today. According to vgrinshpun's earlier post, a quarter million short shares were drawn down at Fidelity early this morning. A sale of more than 40,000 shares took place in the first minute of trading. Nonetheless, TSLA managed to hit 194 before settling down near 193. What you're likely seeing is capping by short sellers at 193. Monday is the most likely day of the week to see big gains with TSLA and so the shorts are working to minimize the gains. Unfortunately for them, the slow descent into close in afternoon hours doesn't normally take place any more. What I'd watch for is to see whether the 193 cap holds today or if longs manage to break above the cap, perhaps in the final hour of trading.

If the shorts can do it, they'll try to see TSLA close at least a penny below $193. They don't like TSLA gettting this close to the 50 dma and the upper bollinger band because those events could bring in technically-oriented buyers.

ongba

Member

The 5 day MA (blue line) provided support again, for the 5th day in a row. We are stuck in-between the 5 day and 50 day MAs. As these two MAs converge the chance of a breakdown or breakout from these MAs increases.

View attachment 205449

Agree with you...however, recent history suggests that as they converge, the break will be down bc tesla has been held in check by the 50 day SMA since Aug 26 and the 50 day SMA is converging with a down trending line drawn from 8/1, 10/3 and 11/28...also, the 5 day SMA is usually easier to break than the 50 day SMA..but it would be nice to move above that stubborn 50 day SMA

JRP3

Hyperactive Member

Picture in your mind Elon on one of his first principle discussions on some topic, and picture Donald paying any attention for more than 10 seconds...Hopefully Elon's experience with his children, when they were very very young, has prepared him for this meeting. (This is in no way meant as an insult to Elon's kids.)NO downside

dc_h

Active Member

If we all put in small orders at 195 at the open tomorrow, are their ethical or legal issues? I'm not saying I am or would do so, but what would happen if people just started over paying in small amounts? Would this break the shorters model?View attachment 205447

Here's a lens through which to consider TSLA's trading today. According to vgrinshpun's earlier post, a quarter million short shares were drawn down at Fidelity early this morning. A sale of more than 40,000 shares took place in the first minute of trading. Nonetheless, TSLA managed to hit 194 before settling down near 193. What you're likely seeing is capping by short sellers at 193. Monday is the most likely day of the week to see big gains with TSLA and so the shorts are working to minimize the gains. Unfortunately for them, the slow descent into close in afternoon hours doesn't normally take place any more. What I'd watch for is to see whether the 193 cap holds today or if longs manage to break above the cap, perhaps in the final hour of trading.

If the shorts can do it, they'll try to see TSLA close at least a penny below $193. They don't like TSLA gettting this close to the 50 dma and the upper bollinger band because those events could bring in technically-oriented buyers.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 934

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K