Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EIA projects that U.S. coal demand will remain flat for several decades - Today in Energy - U.S. Energy Information Administration (EIA)

So this is the sort of long term forecast that really irks me. Despite falling for the last 10 years, US coal demand is forecasted to remain level for the next 3 decades according to EIA modelers.

I had to force myself to read through this nonsense to see where their outlook departs from mine. The essential gap is that the EIA wonks frame coal demand in terms of completion with natural gas. Certainly that makes sense of short term fuel switching, but it fails to consider how gains in renewables and batteries will reduce the combined share of coal and natural gas over the long run. This is kind of a big deal went trying to forecast out to 2050. They may have the competition btween gas and coal correctly modeled, but net demand for fossil generated power can, must, and will decline with each passing decade.

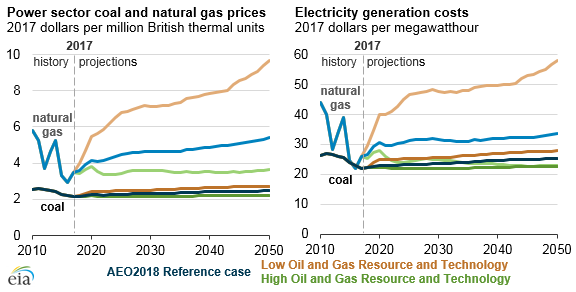

They have 3 basic scenarios: a middling Reference case, High Oil and Gas Resource and Technology case wherein gas is cheap and abundant, and a Low Oil and Gas Resource and Technology case wherein gas is expensive and scarce. In none of these cases do they spell out the competitive role of wind, solar and battery technologies. In the Low Resource scenario gas is very expensive and this allows for coal to gain market share over gas.

Last year natural gas generation lost about 2.1 points of market share while coal lost 0.4. Wind and solar gained 1.4%. So combined gas and coal stand at 61.4% share of net power generation. Even if the rate of wind and solar installation continues at a flat rate to take just 1.4% share per year. By 2050, this captures another 46% share, which would reduce the coal and gas share to less than 16%. To my mind, this is a fairly conservative scenario. It only assumes that we keep building out wind and solar at current rates, not growth, no cost decline, just a steady build out. This would also push the market share of non-hydro renewables to just 56%. This is a level that is not expected to require significant storage capacity to integrate wind and solar. In this modest scenario gas and coal might well split the 16% to about 8% each. But in the EIA Reference case coal still has about 22% share of market, 3 times what my conservative projection would suggest.

So I definitely believe there is a big squeeze in store for both coal and gas. But let's look at the EIA price assumptions.

The reason gas generation fell 7.7% last year while coal fell only 2.5% is that coal was cheaper. Coal at $2.15/mmBtu has a generation cost of $22/MWh, just the cost of the fuel. But gas at $3.47/mmBtu has a generation cost of $26/MWh. Had gas been priced at $2.93/mmBtu, the generation cost would have been about the same, and both fuels would have lost comparable market share.

The chart on the right shows the generation cost for both fuels under various scenarios. In the High Resource gas, both fuels have comparable prices. Note the historically competition has driven down the price of both coal and gas. So it seems unlikely that with both fuels at parity, the price could increase much. This price scenario would also make sense in the case where renewables continue to make progress, but then both gas and coal are pushed down to about 8% share each.

The Low Resource case seems very far fetched to me. Imagine the generation cost of gas going to $40/MWh in 2020. This price is wholly uncompetive with wind, solar and batteries at current costs for these technologies. Would wind and solar only be capturing just 1.4 points of market share each year, if gas were to become this expensive? Going out several decades the cost creeps up to $50/MWh. The current cost of battery storage is about that much already. In this case, it is cheaper to store power in a battery (fully loaded) than to burn gas (just the fuel cost). Clearly building out more stored wind and solar would be more economical than operating a fully written down combined cycle gas plant! Of course, the cost of batteries, solar and wind will keep declining, so the day of reckoning comes much sooner! Basically, the price of gas could go that high, but it would be priced out of the market and renewables would be gaining share to the tune of 3% points per year. Even though gas would lose share faster than coal, the net demand for fossil generation would fall so fast that coal would still be driven below a 8% share by 2050. Thus, I have a hard time believing that the Low Resource case is a coherent economic scenario.

What makes more economic sense is to assume that both coal and gas generation prices remain at parity for the long run., which is the case if there is sufficient generation capacity for fuel switching. This means that even the Reference case is not economically valid as it violates price parity.

So this is the sort of long term forecast that really irks me. Despite falling for the last 10 years, US coal demand is forecasted to remain level for the next 3 decades according to EIA modelers.

I had to force myself to read through this nonsense to see where their outlook departs from mine. The essential gap is that the EIA wonks frame coal demand in terms of completion with natural gas. Certainly that makes sense of short term fuel switching, but it fails to consider how gains in renewables and batteries will reduce the combined share of coal and natural gas over the long run. This is kind of a big deal went trying to forecast out to 2050. They may have the competition btween gas and coal correctly modeled, but net demand for fossil generated power can, must, and will decline with each passing decade.

They have 3 basic scenarios: a middling Reference case, High Oil and Gas Resource and Technology case wherein gas is cheap and abundant, and a Low Oil and Gas Resource and Technology case wherein gas is expensive and scarce. In none of these cases do they spell out the competitive role of wind, solar and battery technologies. In the Low Resource scenario gas is very expensive and this allows for coal to gain market share over gas.

Last year natural gas generation lost about 2.1 points of market share while coal lost 0.4. Wind and solar gained 1.4%. So combined gas and coal stand at 61.4% share of net power generation. Even if the rate of wind and solar installation continues at a flat rate to take just 1.4% share per year. By 2050, this captures another 46% share, which would reduce the coal and gas share to less than 16%. To my mind, this is a fairly conservative scenario. It only assumes that we keep building out wind and solar at current rates, not growth, no cost decline, just a steady build out. This would also push the market share of non-hydro renewables to just 56%. This is a level that is not expected to require significant storage capacity to integrate wind and solar. In this modest scenario gas and coal might well split the 16% to about 8% each. But in the EIA Reference case coal still has about 22% share of market, 3 times what my conservative projection would suggest.

So I definitely believe there is a big squeeze in store for both coal and gas. But let's look at the EIA price assumptions.

The reason gas generation fell 7.7% last year while coal fell only 2.5% is that coal was cheaper. Coal at $2.15/mmBtu has a generation cost of $22/MWh, just the cost of the fuel. But gas at $3.47/mmBtu has a generation cost of $26/MWh. Had gas been priced at $2.93/mmBtu, the generation cost would have been about the same, and both fuels would have lost comparable market share.

The chart on the right shows the generation cost for both fuels under various scenarios. In the High Resource gas, both fuels have comparable prices. Note the historically competition has driven down the price of both coal and gas. So it seems unlikely that with both fuels at parity, the price could increase much. This price scenario would also make sense in the case where renewables continue to make progress, but then both gas and coal are pushed down to about 8% share each.

The Low Resource case seems very far fetched to me. Imagine the generation cost of gas going to $40/MWh in 2020. This price is wholly uncompetive with wind, solar and batteries at current costs for these technologies. Would wind and solar only be capturing just 1.4 points of market share each year, if gas were to become this expensive? Going out several decades the cost creeps up to $50/MWh. The current cost of battery storage is about that much already. In this case, it is cheaper to store power in a battery (fully loaded) than to burn gas (just the fuel cost). Clearly building out more stored wind and solar would be more economical than operating a fully written down combined cycle gas plant! Of course, the cost of batteries, solar and wind will keep declining, so the day of reckoning comes much sooner! Basically, the price of gas could go that high, but it would be priced out of the market and renewables would be gaining share to the tune of 3% points per year. Even though gas would lose share faster than coal, the net demand for fossil generation would fall so fast that coal would still be driven below a 8% share by 2050. Thus, I have a hard time believing that the Low Resource case is a coherent economic scenario.

What makes more economic sense is to assume that both coal and gas generation prices remain at parity for the long run., which is the case if there is sufficient generation capacity for fuel switching. This means that even the Reference case is not economically valid as it violates price parity.

TheTalkingMule

Distributed Energy Enthusiast

Who in their right mind is going to build any significant amount of new coal capacity?

If we need to rely for the most part on existing coal plants, how are these already deteriorating plants going to keep up production?

If we need to rely for the most part on existing coal plants, how are these already deteriorating plants going to keep up production?

Exactly, the EIA is accounting for planned retirements over the five years or so. After that, they think that capacity factors will go up and the size of the fleet remains flat for another 25 years. So implicit in this seems to be the idea, that coal plants will be worth maintaining over the next 30 year or possibly replacing. So of this long-term maintenance is capital intensive. So you get to decision points where the point is either worth sinking capital into for renovations, upgrades and repairs or it isn't. Even if the price of gas were to go up, it's hard to believe that this old fleet will be worth maintaining for another 3 decades. At some point, it's just cheaper to add more wind, solar and storage, but that is exactly the realism the EIA seems bent on ignoring.Who in their right mind is going to build any significant amount of new coal capacity?

If we need to rely for the most part on existing coal plants, how are these already deteriorating plants going to keep up production?

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

thanks for explaining.

you are right about the difficulty of predicting such complex things. i do, however, believe that it will take much more time for electric vehicles to make a noticeable dent in oil demand. a growing population, especially in countries like india, will raise demand more than some EVs will lower it imo

For 2017, more than 1/3 of all electricity capacity growth in India was solar PV and 4Q17 saw renewables account for 93% of capacity additions. If oil-based transport were cheaper I'd say India will lag, but since it'll be far cheaper to operate a BEV, the transition in transport should mirror that of electricity infrastructure.

China is out. Their oil demand will climb modestly for maybe a couple more years, but policy has been made clear and the Chinese follow policy....obviously. Indians don't have the same centralized authority, but Modi is able to push resources toward renewables. It's in the national interest to build out solar, so it will likely come to pass. Mid-day charging will be essentially free, therefore Indians will buy BEVs en masse.

ValueAnalyst

Closed

For 2017, more than 1/3 of all electricity capacity growth in India was solar PV and 4Q17 saw renewables account for 93% of capacity additions. If oil-based transport were cheaper I'd say India will lag, but since it'll be far cheaper to operate a BEV, the transition in transport should mirror that of electricity infrastructure.

China is out. Their oil demand will climb modestly for maybe a couple more years, but policy has been made clear and the Chinese follow policy....obviously. Indians don't have the same centralized authority, but Modi is able to push resources toward renewables. It's in the national interest to build out solar, so it will likely come to pass. Mid-day charging will be essentially free, therefore Indians will buy BEVs en masse.

Agree that the direction is as you laid out. How many years before we see the inflection point?

I think the biggest barrier India has to EVs and renewable energy is simply protectionist politics. They insist on made in India sourcing. This is especially problematic for emerging industries like solar and batteries because manufacturers like Tesla cannot find enough locally sourced material to make it work. So the Indian government is creating a chicken and egg problem. They are preventing Tesla from importing products until Tesla can fulfill the local sourcing requires. So this simply delays getting a market started simply because it hasn't already started domestically. This sort of mindset will only delay EVs and renewables.Agree that the direction is as you laid out. How many years before we see the inflection point?

The irony here is that India remains stuck having to import a lot of fossil fuels because it is trying to create domestic jobs in the clean tech sector. They have recently discovered that they can radically curtail coal imports by simply building out solar and wind. But they are years behind on this because they were so resistant to simply importing cheap solar panels from China. So the irony is that they could have cut coal imports years earlier and created a ton of domestic solar installation jobs had they preferred to import solar panels to importing coal. Likewise with batteries and EVs, they could start now to build out a more efficient and cleaner grid if they would simply import some batteries and start installing them. Developing domestic installation, sales and service jobs and cultivating demand is a great prelude to developing manufacturing supply chains.

So the question is when the politics will shift to see that the Indian economy will benefit by simply opening up clean tech imports and not delaying the transition.

ValueAnalyst

Closed

There could be a bigger than expected Crude inventory draw tomorrow at 10:30 EDT, which may lead to higher in oil prices. Products inventories will likely build, but for whatever reason, market participants usually focus on the Crude number. We shall see.

Generally speaking, signs of higher oil prices have been building in the last few months. You may read some of them here. Of course, I do not know for certain if my 2Q18: The Perfect Oil Storm theory will pan out, but we sure will find out soon enough.

Generally speaking, signs of higher oil prices have been building in the last few months. You may read some of them here. Of course, I do not know for certain if my 2Q18: The Perfect Oil Storm theory will pan out, but we sure will find out soon enough.

ValueAnalyst

Closed

Trade Wars could elongate the timing to an oil price surge, as uncertainty puts global growth at risk, but also increase the chances of a serious oil supply risk in 2020 and beyond, as higher steel prices etc. reduce CapEx into exploration and production.

The above statement assumes Tesla & others will not be able to grow to 30+ million vehicles per year or achieve Level 5 autonomy before 2020.

The above statement assumes Tesla & others will not be able to grow to 30+ million vehicles per year or achieve Level 5 autonomy before 2020.

Indeed a trade war cannot possibly be good for the oil markets. It will raise the costs of both consumption and production hurting both demand growth and supply growth. Specifically, shipping for international trade is a source of demand that takes an immediate hit. Then agricultural and industrial production slow down too, taking demand for fuels down with it. Then consumption is depressed and slows economic growth around the world.Trade Wars could elongate the timing to an oil price surge, as uncertainty puts global growth at risk, but also increase the chances of a serious oil supply risk in 2020 and beyond, as higher steel prices etc. reduce CapEx into exploration and production.

The above statement assumes Tesla & others will not be able to grow to 30+ million vehicles per year or achieve Level 5 autonomy before 2020.

Taken to an extreme a massive trade war could bring about peak oil much faster than EVs. Of course, this would be by undermining demand growth across the economy. So it is not the kind of oil peak I'd like to see. While $100/b for oil may be wonderful news for bullish oil traders, it could leave the rest of global economy in tatters.

ValueAnalyst

Closed

Indeed a trade war cannot possibly be good for the oil markets. It will raise the costs of both consumption and production hurting both demand growth and supply growth. Specifically, shipping for international trade is a source of demand that takes an immediate hit. Then agricultural and industrial production slow down too, taking demand for fuels down with it. Then consumption is depressed and slows economic growth around the world.

Taken to an extreme a massive trade war could bring about peak oil much faster than EVs. Of course, this would be by undermining demand growth across the economy. So it is not the kind of oil peak I'd like to see. While $100/b for oil may be wonderful news for bullish oil traders, it could leave the rest of global economy in tatters.

Agreed. Higher oil prices are always net detrimental for the world, although oil exporters benefit greatly. Also agreed with your points on oil demand due to international trade. Definitely topics to watch for the middle-to-longer term global oil demand.

Porsche’s all-electric ‘Mission E tractor’ shouldn’t be an April fools joke

We haven't addressed battery electric farm equipment here, but it is a good idea. Note the really fine discussion following this article. I especially like the idea of smaller farming robots. There is no need to believe that as farm equipment is electrified that it needs to remain at a large scale. I suspect most of the scale of tractors has to do with optimizing the productivity of the human operator. Heavy equipment compress the soil and push more area out of production, but lightweight robots can avoid this.

We haven't addressed battery electric farm equipment here, but it is a good idea. Note the really fine discussion following this article. I especially like the idea of smaller farming robots. There is no need to believe that as farm equipment is electrified that it needs to remain at a large scale. I suspect most of the scale of tractors has to do with optimizing the productivity of the human operator. Heavy equipment compress the soil and push more area out of production, but lightweight robots can avoid this.

mspohr

Well-Known Member

Look like there is a formal critique of IEA projections.

IEA accused of undermining global shift from fossil fuels

IEA accused of undermining global shift from fossil fuels

Many here have stated the same. It notes that the latest report was written by two Shell Oil employees.

IEA accused of undermining global shift from fossil fuels

IEA accused of undermining global shift from fossil fuels

Many here have stated the same. It notes that the latest report was written by two Shell Oil employees.

TheTalkingMule

Distributed Energy Enthusiast

The IEA getting away with calling their "projections" legitimate for so long just baffles me. At what point do major news outlets not accept figures that have been 180 degrees wrong for 10 years in a row? Human nature is confusing sometimes.

neroden

Model S Owner and Frustrated Tesla Fan

How electric vehicles could help oil majors in the medium-term

Hypothesis is that oil companies do better when they underinvest. Combination of EV threat and weak market leads to low investment and higher profit.

Interesting point. I stated ten years ago (!) that the path to good performance for oil copmanies was to halt investment entirely.

But I also said that they wouldn't: it was a cultural problem; they'd keep spending money in wasteful oil exploration.

I don't see that the EV threat or the weak market will change that. It's a *cultural* problem. They think of themselves as "oilmen" and if they ended oil exploration and development (just pumping out the wells they already have) they wouldn't be able to think of themselves as "oilmen". Any oil CEO who thinks of himself as a businessman rather than an "oilman"... leaves the declining oil business and goes into something with growth.

neroden

Model S Owner and Frustrated Tesla Fan

Well, this is discouraging

'Extreme' fossil fuel investments have surged under Donald Trump, report reveals

'Extreme' fossil fuel investments have surged under Donald Trump, report reveals

My takeaway: I would avoid investing in banks.

This sort of garbage, oil sands and the like, is money-losing, period. It'll all be bankrupt by 2025. The banks will lose their money -- it could cause the next banking crisis.

neroden

Model S Owner and Frustrated Tesla Fan

Seriously? I thought most TBMs were already electric. Underground equipment usually is, for ventilation reasons.Elon has been flying below the radar on another way to undermine demand for diesel. Oddly, enough he has been doing this with plenty of hype too.

I would encourage people to read the FAQ for The Boring Company, FAQ. Obviously, we've been thinking of these "loops" as electric transportation systems, and that is quite valid as a way to defeat demand for transport fuels. But notice the challenge TBC is taking on, tunneling roads costs about $1B per mile. As SpaceX is doing with space travel, TBC is trying to knock 90% or more off the cost of tunneling. One of the ways you do that is by electrifying the large tunnel boring machines. These have run on diesel

SebastianR

Active Member

I don't see that the EV threat or the weak market will change that. It's a *cultural* problem. They think of themselves as "oilmen" and if they ended oil exploration and development (just pumping out the wells they already have) they wouldn't be able to think of themselves as "oilmen". Any oil CEO who thinks of himself as a businessman rather than an "oilman"... leaves the declining oil business and goes into something with growth.

It is the same for legacy car makers: The amount of vitriol and hatred that new car makers (be it Tesla or Streetscooter) need to endure in Germany is nothing short of astonishing. Car folks in Germany seem to be personally insulted that a new propulsion technology will replace Diesel & Co.

I initially thought this is only directed towards Tesla ("EPA made VW suffer, now we want to make Tesla suffer") but it is equally nasty towards any German EV maker...

According to the FAQ, most TBMs are still using diesel. Reducing ventilation costs would be one clear benefit of complete electrification of all tunneling equipment. But given what we've seen in terms of batteries replacing diesel generators and other diesel drivetrains, I would expect that a battery electric TBM would save a lot over diesel in fuel costs alone.Seriously? I thought most TBMs were already electric. Underground equipment usually is, for ventilation reasons.

For equipment operating within a limited area such as farming, construction, mining, etc., it seems that battery swapping could provide a way to maximize up time for equipment and utilization of the batter packs. For example, in a TBM, battery modules can be transported to and from the TBM while it is in operation. And the same modules can be used by other equipment transporting materials through the tunnel. Thus, the battery modules can be charged anywhere convenient and at any time, like while the sun shines. In farming, agricultural robots can pick up their own modules as needed and these can be swapped between different kinds of robots. So again charging can be anytime and anywhere convenient, but through the year the battery modules are well utilized being swapped into whatever equipment needs them through the growing cycle.

Similar threads

- Replies

- 101

- Views

- 2K

- Replies

- 1

- Views

- 507

- Replies

- 0

- Views

- 793

- Replies

- 19

- Views

- 4K