ValueAnalyst

Closed

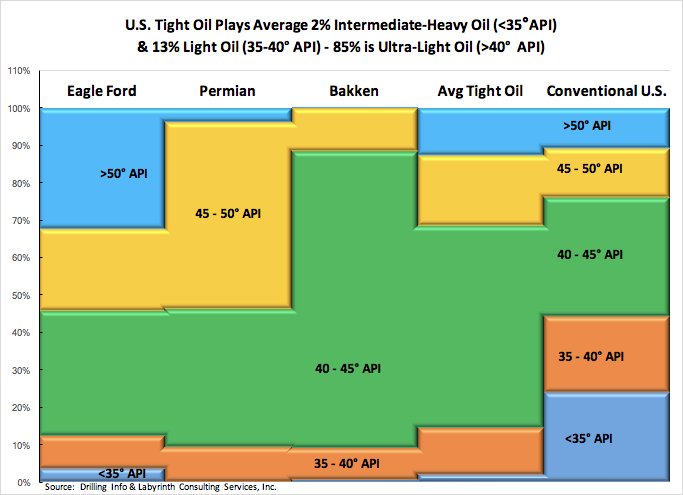

Shale oil is too light (i.e. high API) to be useful for US refineries, which are geared for heavy crude. I expect light crude oil exports from the US to other parts of the world to remain high throughout the summer, leading to accelerating draws in US crude oil inventories as seasonality turns.