In my first paragraph I said If you have solar in VT, and you are connected to the grid, then they don't allow TOU rates. I think you didn't understand my last sentence because I said they don't allow TOU rates with net metering. There would be value (in VT) in home storage but only if you had TOU rates and no solar, OR you went off the grid. I haven't checked to see what Green Mtn Power is offering with the Powerwall but there must be something compelling because they became a Tesla Energy Partner.

Yes we were talking past each other. I understand that if you are selling to the grid in Vermont you can not have TOU. I think the misunderstanding could be in what each of us mean by "connected to the grid" . My point was that the cost effective battery option with the PowerWall means you don't have to ask for permission to install solar because the battery can store your solar generation and you are not selling to the grid. You can still be connected to the grid, but just not selling to the grid. You would not be on Net Metering because technically your solar and batteries are "off the grid" because they are behind your meter and operate in purchasing mode and do not sell to the grid. Net Metering is what we have to ask permission to do. We only need a building permit to install solar and batteries if we are not grid tied.

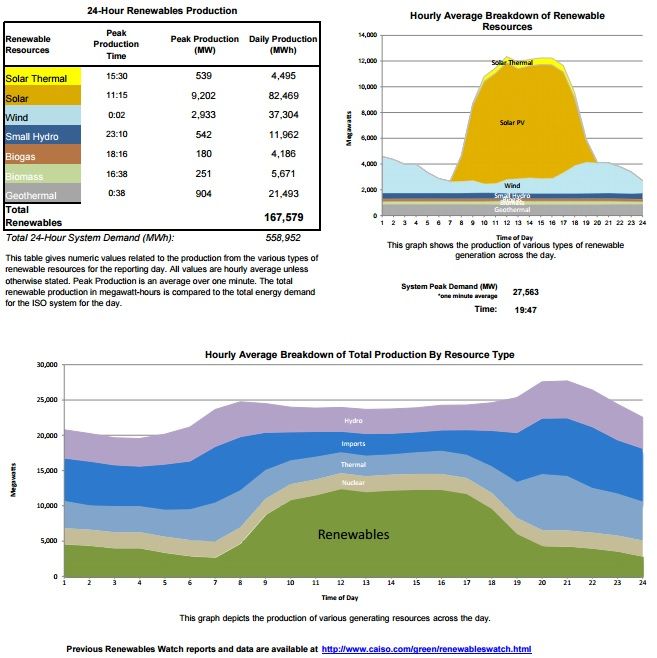

Theoretically, in Vermont you could be on a TOU rate, charge your batteries at the low TOU rate or from your solar. Then you could use your solar and batteries to run your house during the high TOU rate period. That could save some money if the rate differential is large enough. I think it will be interesting to see what Green Mountain is doing. Other utilities in California are installing battery systems because batteries can respond faster that Peaker Plants, and are more cost effective that buying power from Peakers. That is the value equation that makes solar and batteries a cost effective solution. And that is the value that batteries have when used in combination with solar. Did that explanation make my theory more clear?

Last edited: