Roadster, Semi, Cybertruck, 2...

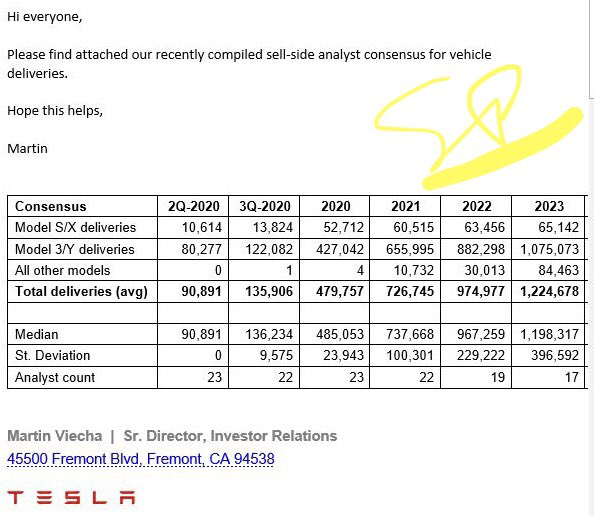

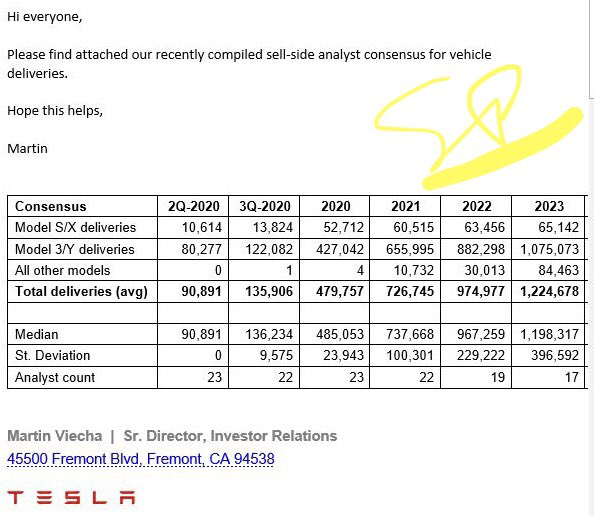

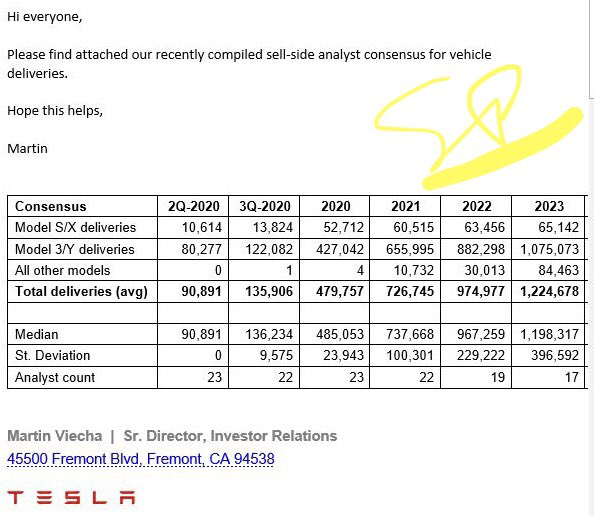

What could the third line item in the table ("All other models")? Q3 volume is 1 2020 is 4, 2021 will be over 10000?

Remember, this is Tesla collecting outside analyst's numbers, not guidance from Tesla itself.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Roadster, Semi, Cybertruck, 2...

What could the third line item in the table ("All other models")? Q3 volume is 1 2020 is 4, 2021 will be over 10000?

Roadster, Semi, Cybertruck, 2...

Remember, this is Tesla collecting outside analyst's numbers, not guidance from Tesla itself.

Those analyst are rather pessimistic on Tesla’s ability to ramp production of those new models

This shows very little knowledge of Apple if you think Apple is only '20% vertically integrated'. Apple is 90% vertically integrated by cost. Tesla is attempting to do the same. Nobody cares where you get your aluminum from if there are 10 suppliers all competitive. But when you can be cut off from a supply and shut down your business, you have a problem. Tesla is trying to address that.

What could the third line item in the table ("All other models")? Q3 volume is 1 2020 is 4, 2021 will be over 10000?

Tesla IR started doing this recently. They did this last quarter and I believe they may have done this for Q1, but my memory is fuzzy. I think it has been a great idea.

The strategy in my view is to keep the analysts more in check, to reduce outliers, and to be able to control the narrative. Tesla IR gets most Excel models from sellside analysts and they can compile delivery estimates better than somebody like FactSet or Bloomberg. Why? Because third-party consensus providers have a lower amount of analysts included for non-financial statement items. Data is pulled directly from analyst notes and not all notes include delivery numbers, while it would be in the Excel models.

So if Tesla was to say miss Bloomberg/FactSet consensus which is often sourced by financial media, but beat their internal consensus which is a more all-inclusive number, IR can then point this out to investors on callbacks. Thus, controlling the narrative.

In terms of if it matched actual deliveries, I wouldn't look to draw a direct correlation there. IR-compiled consensus by definition is just the average of "x" analysts are expecting. If it matches with actual numbers or not is more of a reflection of how accurate the analysts are. What Tesla internally knows has no bearing on these numbers.

I presume Martin Viecha sends this out to a mailing list which consists of all covering sellside analysts and some institutional investors. This is not publicly distributed, but has leaked out before the P&D reports.

Thanks for the clarification. Makes sense tactically, still strange if you compile and distribute educated guesses by analysts if you really know much more (looking at it from a scientific point of view). So I guess in the end it is a way keep expections low and (possibly) surprise to the upside.

ATS ENTERS CONDITIONAL AGREEMENT TO SELL CERTAIN TRANSPORTATION BUSINESS ASSETS Cambridge, Ontario (September 25, 2020): ATS Automation Tooling Systems Inc. (TSX:ATA) (“ATS” or the “Company”), an industry-leading automation solutions provider, today announced that as part of its previously announced plan to reorganize its Transportation business, it has entered into a conditional agreement to sell certain assets and transfer employees of one of its German-based subsidiaries to a third party. Completion of the sale is subject to several closing conditions. If the transaction does close, it is expected to partially mitigate costs of the previously announced reorganization of its transportation business. Financial terms of the transaction have not been disclosed. About ATS ATS is an industry-leading automation solutions provider to many of the world's most successful companies. ATS uses its extensive knowledge base and global capabilities in custom automation, repeat automation, automation products and value-added services, including pre-automation and aftersales services, to address the sophisticated manufacturing automation systems and service needs of multinational customers in markets such as life sciences, chemicals, consumer products, electronics, food, beverage, transportation, energy, and oil and gas. Founded in 1978, ATS employs approximately 4,400 people at 22 manufacturing facilities and over 50 offices in North America, Europe, Southeast Asia and China. The Company’s shares are traded on the Toronto Stock Exchange under the symbol ATA. Visit the Company’s website at www.atsautomation.com.

So overall, ATS Automation is valued at about $1.2 billion on the Toronto exchange. The ATW piece appears to be only a small part of the whole. Here's an article that details that ATW was expected to be closed. Perhaps Tesla uses them, so decided to purchase the company so it wouldn't be closed.

Übernahme?: Neue Hoffnung für ATW in Neuwied

Aus für ATW in Neuwied: Schock für 210 Mitarbeiter

For many years ATW has been a successful system supplier for the automotive industry, among other things, transmission assembly lines for Magna as well as state-of-the-art battery assemblies for BMW and Daimler / Accumotive were manufactured here.

How about the quad ATV?It seems this chart completely misses Cybertruck. I'm sure they will be selling more than 30K in 2022. So I'm guessing Other might mean Roadster and/or Semi.

Besides you have to undo registration, possibly a loan and many other things when you return.It doesn't appear that they aren't offering an option for a refund of the price difference, and if you return the car under the 7-day policy you can't buy another, of the same trim, for a year. So if you want that trim now you don't really have a choice.

Maybe Tesla saw an opportunity to pick up a skilled logistics company at bargain basement prices - presumably they will have to expand their logistics network like crazy in Europe when GigaBerlin comes online.Auto supplier ATW is taken over by Tesla - look for 17:01 timestamp

Let's see if I can also link to a google translation Yep, that works

And ATWs webpage. "Our product range includes not only numerous engine and transmission oils but also original spare parts for almost every car brand."

I wonder what Tesla is going to use that oil for??

My guesstimate:So, anybody have the over/under on AH today vs. premarket tomorrow?

Not a fan. Back half needs some work.