Man that was a good quote. "It's not the big that eats the small, but rather the fast that eats the slow".

Must watch

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Carl Raymond

Active Member

More and more comments these days are AI generated so don't read too much into them.

I work in AI

Which reminds of the need of a “proof of human” id. Facebook, Twitter etc will become rapidly worthless if flooded by bot generated content that is indistinguishable from human generated content.

Relevance to Tesla is that free media is how the word spreads. Also seems likely that cars will self drive at about the same point in history that AI can pass for human in conversation.

TheTalkingMule

Distributed Energy Enthusiast

I never really thought about the avg cost explosion all these legacy manufacturers are gonna feel due to decreasing demand. Moving from 3 shifts to 1 or even 2 when building engibes is crushing from an efficiency standpoint.Must watch

These poor bastards are just gonna bleed out.

Just thought id share some good humor for this Friday. Schwab contacted me offering their 'CFP service' $300 down and $30/month. I've been with them for a while now and have 100% of my holdings in $TSLA. The last 20% i bought after the battery day dip. Here is my conversation with them:

Schwab: "Hello, would you like to hear about our CFP service?"

Me: "Sure, what does that exactly entail?"

Schwab: "We would pretty much advise you on your plans, ETF's, what you want to achieve in the near future and when you retire"

Me: "So you want me to pay you $300 initially, and then $30/month advisory fee so you can 'advise' me on what i need to plan, etc?"

Schwab: "Yes, that is correct. You will get unlimited 1:1 guidance from a CFP"

Me: "Do you know that i have 100% of my holdings in $TSLA now and have made 6x my money in the last 4 years?"

Schwab: "Do you have any concerns about running out of money in your retirement"

Me: "Tesla is going to be the most valuable company by the time i retire...i think ill be alright"

Schwab: "So....is this something you might be interested in?"

Me: "I'll give you some advice...go drive a Tesla and then buy some $TSLA....it will be Schwab calling you offering you this service if you buy and hold till 2030"

Schwab: "Hello, would you like to hear about our CFP service?"

Me: "Sure, what does that exactly entail?"

Schwab: "We would pretty much advise you on your plans, ETF's, what you want to achieve in the near future and when you retire"

Me: "So you want me to pay you $300 initially, and then $30/month advisory fee so you can 'advise' me on what i need to plan, etc?"

Schwab: "Yes, that is correct. You will get unlimited 1:1 guidance from a CFP"

Me: "Do you know that i have 100% of my holdings in $TSLA now and have made 6x my money in the last 4 years?"

Schwab: "Do you have any concerns about running out of money in your retirement"

Me: "Tesla is going to be the most valuable company by the time i retire...i think ill be alright"

Schwab: "So....is this something you might be interested in?"

Me: "I'll give you some advice...go drive a Tesla and then buy some $TSLA....it will be Schwab calling you offering you this service if you buy and hold till 2030"

Mokuzai

Member

Just thought id share some good humor for this Friday. Schwab contacted me offering their 'CFP service' $300 down and $30/month. I've been with them for a while now and have 100% of my holdings in $TSLA. The last 20% i bought after the battery day dip. Here is my conversation with them:

Schwab: "Hello, would you like to hear about our CFP service?"

Me: "Sure, what does that exactly entail?"

Schwab: "We would pretty much advise you on your plans, ETF's, what you want to achieve in the near future and when you retire"

Me: "So you want me to pay you $300 initially, and then $30/month advisory fee so you can 'advise' me on what i need to plan, etc?"

Schwab: "Yes, that is correct. You will get unlimited 1:1 guidance from a CFP"

Me: "Do you know that i have 100% of my holdings in $TSLA now and have made 6x my money in the last 4 years?"

Schwab: "Do you have any concerns about running out of money in your retirement"

Me: "Tesla is going to be the most valuable company by the time i retire...i think ill be alright"

Schwab: "So....is this something you might be interested in?"

Me: "I'll give you some advice...go drive a Tesla and then buy some $TSLA....it will be Schwab calling you offering you this service if you buy and hold till 2030"

I hold accounts in TD Ameritrade and Fidelity. The amount of calls that I've avoided answering since investing in Tesla is staggering. They see an account grow exponentially and think they can "help". Sad.

Jack6591

Active Member

I hold accounts in TD Ameritrade and Fidelity. The amount of calls that I've avoided answering since investing in Tesla is staggering. They see an account grow exponentially and think they can "help". Sad.

On three occasions, my broker has called me to let me know I was on his exception report. To his credit, he asks for advice. To my credit, I refer him to you guys.

Favguy

Member

All any of these financial advisers will do is help you diversify your risk away from exponential growth and into mundane returns.

Great video.

What I wondered while listening to his commentary... why are OEMs collaborating on EV platforms and features? Why don't they share ICE engines instead? Seems like everyone has more or less the same palette of 4-cylinder engines these days. Could they start shedding legacy obligations by sharing engine designs, freeing up engineers and factories to focus on EVs, where there's more opportunity and potential for differentiation?

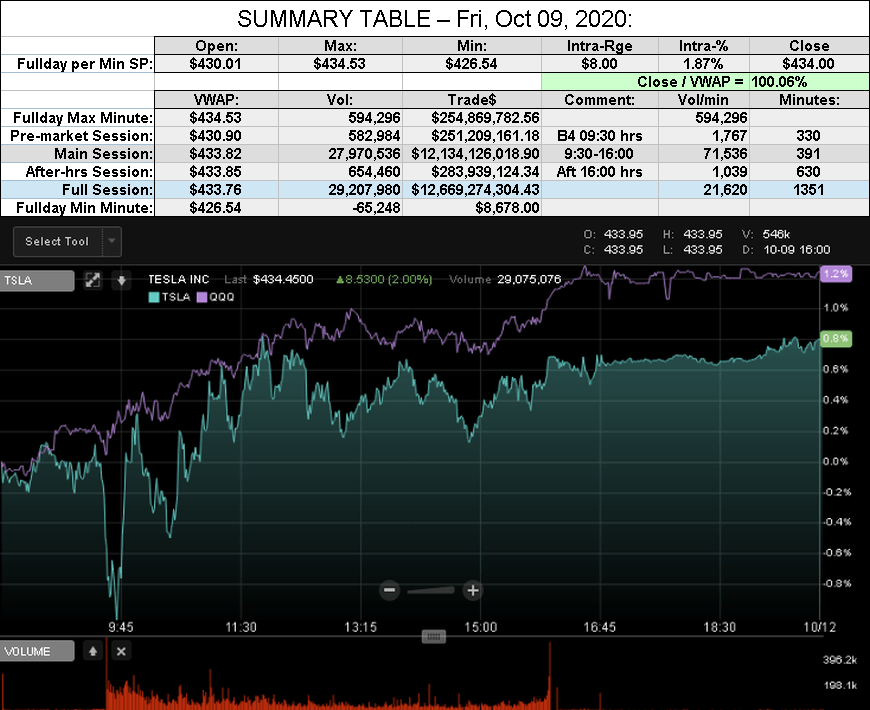

After-action Report: Fri, Oct 09, 2020: (Full-Day's Trading)

There's plenty I don't understand about this, but how can the VWAP exceed the Max? And it certainly doesn't look from the chart like "TSLA closed BELOW today's Avg SP".

That silence after he spoke about Tesla...CNBC - this morning:

Priceless

MC3OZ

Active Member

Tesla’s 4680 battery cell production facility is ramping its operations

I did strongly suspect Elon and Drew were sandbagging, however you can't tell the production rate and yield rate of a factory, from the car park.

2 other interesting things we were told or that were rumored. (before Battery Day)

But like most people I now think the Semi has new High Nickel 4680s...

Then we comes to an older rumor (news report in a Korean paper), Tesla buying battery formation equipment apparently for Fremont, Berlin, Shanghai and Nevada.

At the time I also thought that rumor was significant, but now we learn at Battery Day that Tesla has their own cell formation equipment.

My best guess now is this is a fluid and rapidly changing situation, even if we guess right and read the tea leaves correctly at a point in time, plans will change as soon as Tesla discovers a better option, or hits an issue.

So overall I've still got some niggling suspicion of sandbagging, or more accurately conservative estimates. If something goes wrong, that might just chew up a built in project buffer. Because this is all new, things can still go wrong/right and things can still change.

I did strongly suspect Elon and Drew were sandbagging, however you can't tell the production rate and yield rate of a factory, from the car park.

2 other interesting things we were told or that were rumored. (before Battery Day)

- Tesla Semi packs were apparently going to come from GF Nevada (shipping 4680 cells from Fremont to Nevada is odd, but possible)

- GF Nevada apparent had one line converted to a new higher density formula.

But like most people I now think the Semi has new High Nickel 4680s...

Then we comes to an older rumor (news report in a Korean paper), Tesla buying battery formation equipment apparently for Fremont, Berlin, Shanghai and Nevada.

At the time I also thought that rumor was significant, but now we learn at Battery Day that Tesla has their own cell formation equipment.

My best guess now is this is a fluid and rapidly changing situation, even if we guess right and read the tea leaves correctly at a point in time, plans will change as soon as Tesla discovers a better option, or hits an issue.

So overall I've still got some niggling suspicion of sandbagging, or more accurately conservative estimates. If something goes wrong, that might just chew up a built in project buffer. Because this is all new, things can still go wrong/right and things can still change.

Weekend OT

New plate came today. Thank you all, especially StealthP, who taught me to HODL.

New plate came today. Thank you all, especially StealthP, who taught me to HODL.

Artful Dodger

"Neko no me"

There's plenty I don't understand about this, but how can the VWAP exceed the Max? And it certainly doesn't look from the chart like "TSLA closed BELOW today's Avg SP".

Ah, that's a good catch. Looking at the EDGAR data from their spreadsheet, we see this value for TSLA volume at 3:09 PM (that's per minute vol):

So, EDGAR most likely choked in recording the data. Does somebody else have per min vol data for TSLA?

Fun Fact: EDGAR uses at least 2 different instances of this process to post data. One of them (possibly an older version running hot backups) consistently shifts the data backwards by 1 minute. The programmers likely didn't have a rigorous definition of the time range for each data point.

At any rate, assuming the negative volume reported at 15:09 is an error, removing the neg. sign moves the daily means to Full Session: $433.76 and Close / VWAP = 100.04%

I'll add some error checking logic to my worksheet template to look for this in the future. Thanks for the catch.

EDIT: The EDGAR data is also incorrect for the Closing Share Price. They listed $433.95 (see the graph value) vs $434.00 which is the NASDAQ official closing price (NOCP).

The After-Action Report for Fri, Oct 09, 2020 has been re-issued below.

Cheers!

Last edited:

Weekend OT

New plate came today. Thank you all, especially StealthP, who taught me to HODL.

View attachment 597055

Excuse me for saying this but in that picture you don’t look old enough to drive, much less own a Tesla?

Excuse me for saying this but in that picture you don’t look old enough to drive, much less own a Tesla?

Really begging for that FSD rewrite.

Artful Dodger

"Neko no me"

After-action Report: Mon, Oct 12, 2020: (Full-Day's Trading)

Headline: "TSLA Volume Slows to a Trickle as Mkt Cap exceeds $400B"

TSLA 1-mth Moving Avg Market Cap: $391.55

TSLA 6-mth Moving Avg Market Cap: $257.90

Nota Bene: 4th tranche of CEO comp. likely unlocked earlier this week

'Short' Report:

Note: Report re-issued due to EDGAR data issues. h/t to @ammulder

Comment: "Lowest TSLA volume since Apr 12th, 2016"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Volume Slows to a Trickle as Mkt Cap exceeds $400B"

Traded: $12,669,274,304.43 ($12.67B)

Volume: 29,207,980

VWAP: $433.76

Close: $434.00 / VWAP: 100.06%

TSLA closed ABOVE today's Avg SP

Mkt Cap: TSLA / TM = $404.405B / $184.357B = 219.36%

Volume: 29,207,980

VWAP: $433.76

Close: $434.00 / VWAP: 100.06%

TSLA closed ABOVE today's Avg SP

Mkt Cap: TSLA / TM = $404.405B / $184.357B = 219.36%

TSLA 1-mth Moving Avg Market Cap: $391.55

TSLA 6-mth Moving Avg Market Cap: $257.90

Nota Bene: 4th tranche of CEO comp. likely unlocked earlier this week

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 51.0% (56th Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 36.8% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.38% of Short Volume (43rd Percentile Rank)

FINRA Short/Total Volume = 36.8% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.38% of Short Volume (43rd Percentile Rank)

Note: Report re-issued due to EDGAR data issues. h/t to @ammulder

Comment: "Lowest TSLA volume since Apr 12th, 2016"

View all Lodger's After-Action Reports

Cheers!

Last edited:

Causalien

Prime 8 ball Oracle

Why not have some sort of a survey or google form feeding a sheet that is not accessible until a certain day? Why overcomplicate this...?

It is so that any random spectator can have confidence that you are not changing the result before the reveal.

Artful Dodger

"Neko no me"

It isn’t FUD. SpaceX did ink a military contract to study delivering cargo worldwide within an hour.

U.S. Transportation Command to study use of SpaceX rockets to move cargo around the world - SpaceNews

Twisting that contract into fears about Chinese retaliation against Tesla for scary new Space weapons is DEFINATELY FUD.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M