RobStark

Well-Known Member

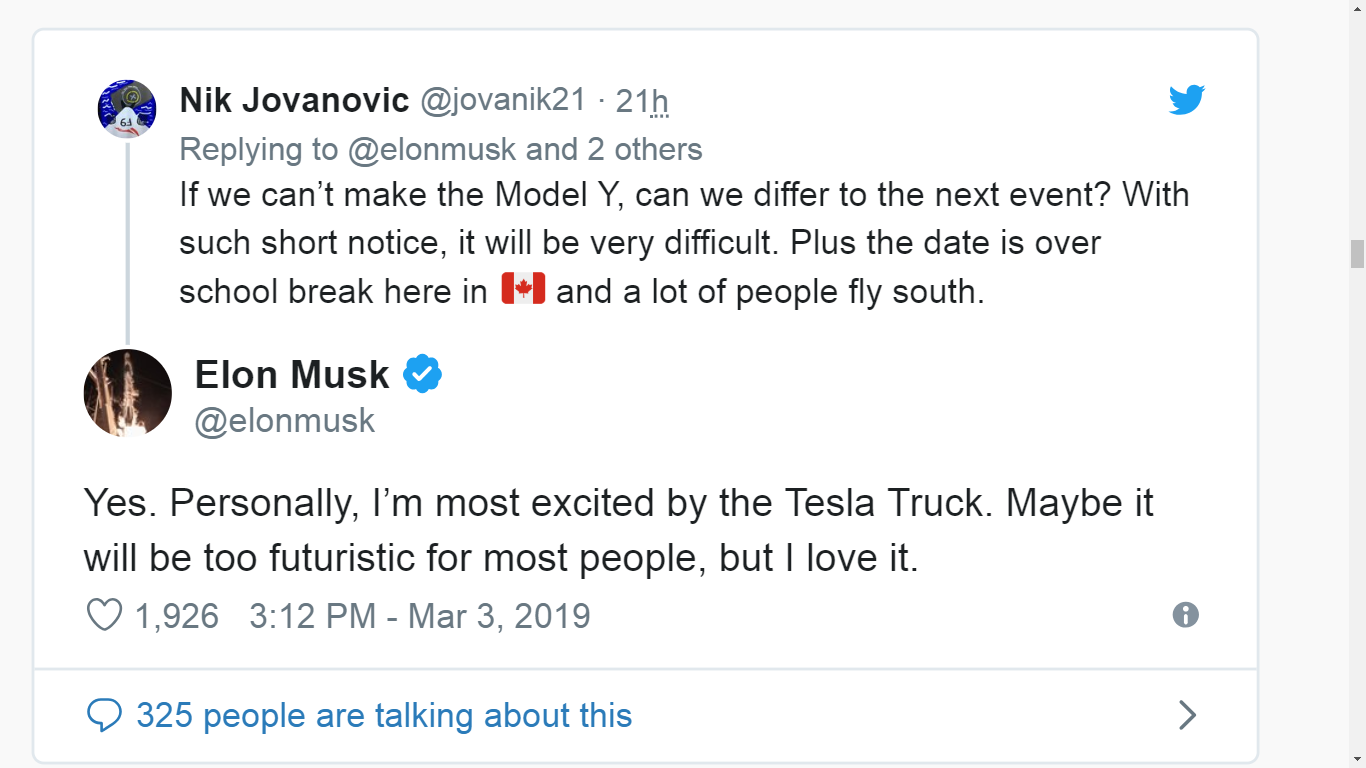

Tesla pickup still in highly futuristic mode.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

But why then just 2 weeks for a SR+ or 2-4 weeks for a SR? I'd love to hear something like "we've got orders for 30k of SR, new orders can expect delivery in 4-6 months."Alright, in plain English: what Elon implies is, that we have a new "secret" demand lever/regulator: the SR/SR+

If you want a Model 3 right now, you buy the LR. If you want the SR - better wait until June (or longer if you haven't ordered yet). The SR/SR+ is to fill-up the lines if they have spare capacity.

The SR is not to KEEP demand up, the SR is the stocking stuffer to buffer those last 20 cars/day or so? Sounds great to me: Tesla keeps its promise (35k Model 3 exists) and they keep their margins + volume at max.

Anyone with closer knowledge of Tesla's sales operations, please speak up, but this is my best guess currently:

I think the 140 stores comment is just referring to pure sales locations. Tesla has c.300 stores & galleries in total, but some of them are combined with service centres.

In each store i would guess there are 7-10 advisors and 8-12 customer experience staff. So that is maybe 2500 advisors and 3000 customer experience staff globally.

For advisors hourly pay is c.$21 and commission is $100 per car (if they hit monthly target), i think with some extra for performance cars or immediate delivery etc. Commission can be from sales finished online as long as a sales staff tags themselves to a customer. I don't think customer experience staff get bonus, so maybe their hourly pay is a bit higher.

After adding 50% for taxes, health plan etc, that could be c.$200m advisor pay, c.$50-100m advisor bonus, c.$250m experience specialist pay. Managers then likely make more, and there will be some other admin staff and cost per store. Lets say another $100m. Rent may be another $100-150m (total Tesla rents are c.$200m and operating leases c.$275m).

So all together i'd guess the current sales infrastructure might be $700-800m annual SG&A costs.

Where The Tesla Bears Are Wrong

MangoTree Analysis | SA | Mar 04, 2019

Summary:

- Both sides of the bull/bear spectrum are extreme. One hand, ARK Invest has a $4,000 price target. On the other hand, there are bears who think the company is going bankrupt.

If my hypothesis is correct, the new "adjustable" Grohmann battery pack machine will mean they can tweak the battery pack sizes for Model Y with very little difficulty as well.Indeed, that's an excellent point: biggest difference would be chassis and internal plastic elements - relatively low cost parts that are perhaps $5k of a $39k car.

All the high value, high complexity parts are likely close to 100% shared between the Model 3 and Model Y:

Elon said 76% of the 10,000 parts are shared - I'd not be surprised if ~90% of the CoGs value was shared. (Maybe @ReflexFunds wants to chime in.)

- cells, battery pack,

- drive train,

- electronics, sensors,

- Autopilot computer,

- heat pump, cooling system,

- (perhaps seats too)

Both sides of the bull/bear spectrum are extreme. One hand, ARK Invest has a $4,000 price target.

Could it be possible that a new GF is silently going online these days? Producing additional 5k of M3+MY?

But why then just 2 weeks for a SR+ or 2-4 weeks for a SR? I'd love to hear something like "we've got orders for 30k of SR, new orders can expect delivery in 4-6 months."

But why then just 2 weeks for a SR+ or 2-4 weeks for a SR? I'd love to hear something like "we've got orders for 30k of SR, new orders can expect delivery in 4-6 months."

So you did mean 1.8 billion? 1.1 million got you a "funny" reaction from meDespite the other corrections, which I acknowledged, his original 'correction' was totally wrong and that got the number of informatives. etc...

I did actually but made a silly typo in doing it. Sorry about that. (#20700).

I'd also say that Tesla probably wouldn't have to build too many Superchargers to be able to claim: "there's a Supercharger within 150 miles public road driving distance from every point in the contiguous U.S."?

If Musk would discuss the current margins on the cheapest model (it sounds like he avoided that topic on the call), coupled with publishing current orders of the short range if they're going thru the roof...I think you would see a bump even ahead of Q1 earningsI guess SP won’t move until Q1 numbers are out. I read lots of optimism for long term here but pessimism about SP for short term, even after Q1 numbers. Trying to wrap my head around why.

So, let’s see, the negative narratives from analysts might be:

Is there any Q1 outcome that we think is both possible and would convert some analysts to the buy side?

- If Q1 shows a loss that is anything other than tiny, shouts of doom of course.

- if Q1 shows close to break even and only modest sales and production, same shouts of doom.

- if Q1 shows close to break even but strong sales and production, see they can’t make money on the 35k M3

- If inventory goes up, will be argued due to demand drop rather than new pipeline of cars in transit to overseas.

- If order backlog increases, will be argued they are rationing M3 SR production because it loses money, and they are just putting off doomsday.

- If Q1 shows a small but real profit that surprises, will be somehow attributed to creative accounting that just defers the final day of reckoning.