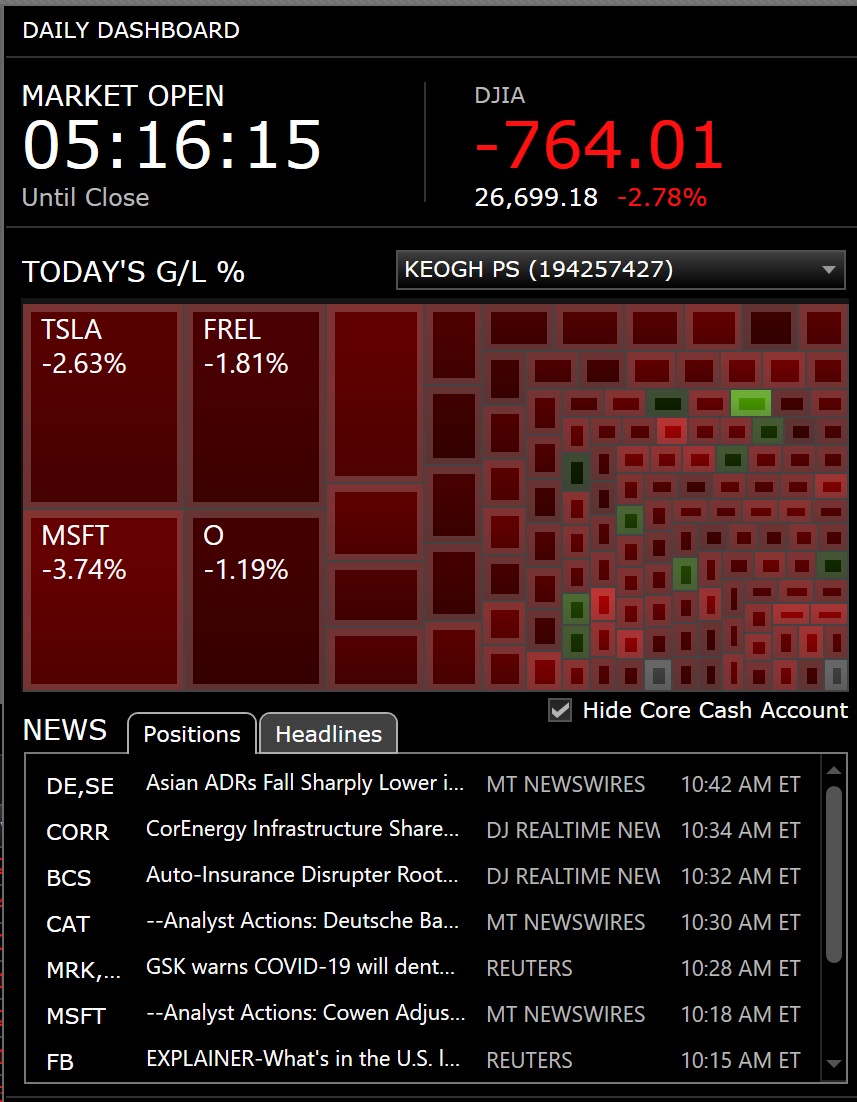

GDP numbers tomorrow, which will probably show a big QOQ increase - will be interesting to see how the market reacts to the news.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

No one is scared in a massive macro shitstorm, so we've got further to go. Got it.Who is buying other than odd lot retail?

With market in flux, if you were a big fund would you buy everything now or would you drop the bid and buy on the way down?

If I were large fund I would not be starting new large position here, I'd share the tree.

Is everyone here scared? If no, then not a bottom yet.

I read everyone still morning dip buying, at some point the market gonna break them of that habit

Why are these two or three obvious trolls not banned?

⚡️ELECTROMAN⚡️

Village Idiot

I’m about 30% in cash so bring it on. Now if I can just figure out what to buy during the dip and where the bottom might be.Uncertainty like this is brilliant for us long term investors. This will uncover the best opportunity to add on our positions while the media gets caught up in the market crash. Once the market bottoms out, again TSLA is going to emerge stronger and will hit higher highs. Investing when everybody else is scared is fantastic.

StealthP3D

Well-Known Member

Great post. At BD Musk said he thought Tesla could offer a 25K car perhaps within 3 years. We expect Chinese EV makers (and perhaps India EV makers) to meet demand in those countries for smaller, lower range EVs at much lower price points than 25K.

So it depends on how far down the EV price curve Musk thinks Tesla needs to go to assure the EV portion of the mission will succeed.

What is your guess on how far down that curve Tesla will go and how far out that takes us as the 10 year ramp up proceeds?

For example, If they decide they need to mass produce 20K cars as their last step, we might project margins to expand 3 to 4 years farther out, say 2027.

Based on subtle clues provided by Elon when he talks about the $25K car, I don't think even Elon knows how the timeline will play out or how inexpensive a Tesla car can get. The further the projection, the more uncertainty in terms of physical limits and also in how far down the cost curve they will want to go. It depends upon how the "world" develops. And I doubt he feels there is much advantage to expend much time or effort thinking about it - it's more productive to focus on immediate goals and ambitions and cross those roads as they start to take form.

It occurs to me that as far ranging as Elon's thirst for new "impossible" to solve problems seems to be, once reducing CO2 emissions is moving irreversibly in a downward direction, he may look for a best first principles solution to pulling CO2 out and sequestering it in a form that pays for most of the needed equipment and energy costs. Then Tesla's unmatched manufacturing expertise may be utilized for stabilizing and then reducing CO2 levels. If this comes to pass maybe company wide margins don't expand for the next several decades?

That's one possibility of many, and I'm confident this is one reason why Elon will not project profit margins 10 years out - too many unknowns in terms of the options available and the direction he might choose to take the company. From my perspective, for purposes of estimating future enterprise value, it doesn't matter whether I think the profits will be reinvested in other initiatives, banked as cash, returned to shareholders or used to buyback shares. The future valuation is a function of management effectiveness in terms of attracting talent and successfully directing it in the most productive direction. We have to assume reasonable decisions will be made, using first-principle logic, regarding how to handle profits. If they are re-invested that will be reflected in the value of the company. As an investor, I don't need to take delivery on the profits (in the form of dividends) in order to realize value because, presumably, that value would be reflected in the share price if it is not returned to investors.

Last edited:

No one is scared in a massive macro shitstorm, so we've got further to go. Got it.

Why are these two or three obvious trolls not banned?

Why ban all those with divergent or different opinions?

⚡️ELECTROMAN⚡️

Village Idiot

Jumping in, or jumping out, or jumping off the roofs of tall buildings?I think we'll see folks start jumping Fri/Mon/Tues trying to frontrun the then inevitable $2.8B in stimulus.

engle

Member

NOT INVESTMENT ADVICE I'm not licensed to give you that! (Only licensed in CA, US for real estate #01069533 since 1990).

My prediction is this huge Covid-19 Winter Wave infecting the USA and Europe will take the Market down just as the previous surprise wave did in March 2020 by a similar percentage. This time, it will be a more drawn out decline instead of a rapid panic plunge.

There will be a "Blue Bounce" after Biden / Harris are elected but the results will be delayed. Swing state polls are tightening. Many people secretly vote for Trump while telling pollsters they will vote for Joe just like what happened to Hillary. There will be civil unrest in parts of the USA over the results - especially if Trump pulls off another November surprise while losing the popular vote - amplified by media coverage of it which will negatively affect the markets, too.

The market will recover and hit new highs in late Spring to early Summer of 2021 as Covid-19 case rates decline. The only good Covid-19 news this time is the death rate percentage is down significantly as the virus is spreading at a much higher rate among younger populations. Us "seniors" (detest that label my +3 STD. DEV. IQ has not decreased and my energy has not slowed, either!) have mostly learned by now how to avoid infection.

I would not be a $TSLA buyer right now because I think the price is going lower into the $300's before recovering and hitting new all-time highs in 2021 over $600. All of this massive economic disruption weakens Tesla's competition further which is great for us. $TSLA is still the best place to be. Due to CAGR, I think it is clearly the large-cap stock with the highest probability of eclipsing Apple to become the market cap leader of the last half of the 2020s. Applying $TSLA's anticipated average CAGR through 2030 to the SP makes that obvious.

$TSLA will get added to the S&P 500 Index as early as the December 2020 rebalancing but no later than March 2021. It will cause the predicted spike in the shares due to supply and demand factors. When it happens, the price will reach $500+ again but the panic buying will cause an overshoot so the peak level will not hold as we've seen every time there was panic buying such as after the 5-1 split was announced.

In my case, I'm extremely fortunate to be able to take my family to Taipei, Taiwan until we have to bring our son back whenever UCLA reopens their campus. The earliest is late March 2020. I expect they will decide to keep Zooming so we won't return to California until September 2021. The silver lining for us is we'll be able to visit all the countries in the Asian region that are relatively Covid-safe. I hope to arrange a tour of GigaShanghai through my Shenzhen friend (last name Xi with a VIP rich Uncle ;-). She attends private Rolls Royce parties, flies in private jets, owns three homes in the US, numerous businesses, and investments including a hotel in Shanghai and a winery in France since she enjoys red wines.

My prediction is this huge Covid-19 Winter Wave infecting the USA and Europe will take the Market down just as the previous surprise wave did in March 2020 by a similar percentage. This time, it will be a more drawn out decline instead of a rapid panic plunge.

There will be a "Blue Bounce" after Biden / Harris are elected but the results will be delayed. Swing state polls are tightening. Many people secretly vote for Trump while telling pollsters they will vote for Joe just like what happened to Hillary. There will be civil unrest in parts of the USA over the results - especially if Trump pulls off another November surprise while losing the popular vote - amplified by media coverage of it which will negatively affect the markets, too.

The market will recover and hit new highs in late Spring to early Summer of 2021 as Covid-19 case rates decline. The only good Covid-19 news this time is the death rate percentage is down significantly as the virus is spreading at a much higher rate among younger populations. Us "seniors" (detest that label my +3 STD. DEV. IQ has not decreased and my energy has not slowed, either!) have mostly learned by now how to avoid infection.

I would not be a $TSLA buyer right now because I think the price is going lower into the $300's before recovering and hitting new all-time highs in 2021 over $600. All of this massive economic disruption weakens Tesla's competition further which is great for us. $TSLA is still the best place to be. Due to CAGR, I think it is clearly the large-cap stock with the highest probability of eclipsing Apple to become the market cap leader of the last half of the 2020s. Applying $TSLA's anticipated average CAGR through 2030 to the SP makes that obvious.

$TSLA will get added to the S&P 500 Index as early as the December 2020 rebalancing but no later than March 2021. It will cause the predicted spike in the shares due to supply and demand factors. When it happens, the price will reach $500+ again but the panic buying will cause an overshoot so the peak level will not hold as we've seen every time there was panic buying such as after the 5-1 split was announced.

In my case, I'm extremely fortunate to be able to take my family to Taipei, Taiwan until we have to bring our son back whenever UCLA reopens their campus. The earliest is late March 2020. I expect they will decide to keep Zooming so we won't return to California until September 2021. The silver lining for us is we'll be able to visit all the countries in the Asian region that are relatively Covid-safe. I hope to arrange a tour of GigaShanghai through my Shenzhen friend (last name Xi with a VIP rich Uncle ;-). She attends private Rolls Royce parties, flies in private jets, owns three homes in the US, numerous businesses, and investments including a hotel in Shanghai and a winery in France since she enjoys red wines.

TheTalkingMule

Distributed Energy Enthusiast

I should probably write a quick blog post on where SP is headed the next month because it's clearly locked directly on the strike of my calls. It's like I'm in a mind-meld with Max Pain.TSLA doing great with all the hammers on the market lately.

When things turn think we will be a leader again for a while.

Testing 500? 550?

I can tell you this for sure, TSLA will close at precisely $500 on Nov 20th......or it will blast off. There is no $505-545 option.

Phobi

Member

Those one time earnings sure seem to keep coming.

Whatever gives me more time to shift my legacy earnings to TSLA shares, I’ll all for it

lafrisbee

Active Member

Your answer:That can't be right! On CNBS Gordon said Tesla has used up all the FSA credits. Or, was it Yahoo Finance. Anyway, I believe he actually said that Tesla must have PULLED CREDITS FORWARD from next year, because, by his calculations, they shouldn't have had that many in Q3.The guy is such a lying moron, but it does make me ask: can Tesla even do that, pull credits forward? It seems highly unlikely, but GJ keeps dreaming these lies up and spitting them out as "essentially" correct.

When are they going to start calling him out on some of these dopey theories of his?

Cash Advance / Payday Loans

TheTalkingMule

Distributed Energy Enthusiast

Jumping the gun on the blue wave. We're at max uncertainty today market-wise, but in reality there's about a 70% chance of everything being fine this time next week. Certainly the algos will be buying on this macro dip but maybe not til Wednesday. People will start gambling starting Friday IMO, trying to get in front to ride the wave.Jumping in, or jumping out, or jumping off the roofs of tall buildings?

jhm

Well-Known Member

I like your style!Bought 10 more at $408, have another limit for 20 at $402. Bargain bin!

"The critical difference in the Super Cruise system is a driver-facing infrared camera to make sure he or she is paying attention to the road and is ready to take over manual control when necessary, said Kelly Funkhouser, head of connected and automated vehicle testing at Consumer Reports." Once again a metric based on how much it can revert back to a human driver, not how well the system actually drives. My guess is these surveys do not believe full self driving will be achieved, so they award their points based on how well it interacts with humans in control.

Edit: "The Ford Model T ranks last in our list of horse transportation, as it produces no fertilizing manure at all!"

FSD and horse transportation is good to look at together. You see, before Ford started meddling with the Model T, the vast majority of transportation via horse carriages was much closer to a limited FSD than our current fleet of cars on the road (except Teslas). A well trained horse could find its way home from the pub transporting its intoxicated owner in Full Self Driving mode. Sure, it was limited to known and well practiced routes, but so is Waymo and Cruise today. You can see with the introduction of the 'automobile' we went backwards for a 100 year of dark ages in terms of FSD. The Tesla approach is so foreign to analysts and CR reviewers, because it was traditional 100 years ago that FSD was only possible on well trained routes.

Last edited:

Pezpunk

Active Member

There will be a "Blue Bounce" after Biden / Harris are elected but the results will be delayed.

delayed results are looking less and less likely.

Swing state polls are tightening.

swing state polls are not tightening.

Many people secretly vote for Trump while telling pollsters they will vote for Joe just like what happened to Hillary.

there is zero evidence this is happening, or ever happened.

engle

Member

After Nov 3rd, Super Spreader Election rallies will subside. Poltics will not matter anymore, policies will. I think we will see return back to caution from all sides.

Market is a tweet away from Covid relief being announced.

Herd mentality will always be present ...

I agree that additional Covid economic relief in the US will cause a rally but predict it will not last. I think unfortunately there will be some very dark, morbid days this winter in Europe and the USA, including supply chain interruptions. Some ICU's are already planning to triage ventilators based upon age and probability of not surviving due to risk factors. Much of the US population will be on economic life support from our government. That is not good for consumer spending.

Market psychology will be depressed. Smart institutions and investors who have dry powder will swoop in to buy everything on sale from the herd that panics and sells, just like we saw in March. The Street always makes a ton of money from the retail investors who freak out when they see paper losses in their portfolio and sell to actualize them lol. The Street loves customers who buy using margin because they are forced to sell. The Street used to promote churning because they made commissions on every transaction. Now they don't so it's different today.

I learned a lot about investing from my parents who started in the 1960s. My late father used to hand plot candlestick charts on graph paper. My 87-year-old mother buys and never sells anything. For example, she bought Microsoft when one of her nephews got a job there *many* years ago (he's a senior director now close to retirement) and told her it's a "good company". It had a period of non-performance after 2000 but look at it now. The investment grew to 7 figures for her with compounded dividends. If she panicked and sold it in 2000 or after she would not have this gain. Too bad one of her other relatives didn't get a job at Amazon!

Covid-19 Economy: "This too shall pass..."

engle

Member

Response needs be re-written - and highly condensed - to be acceptabledeleted for blatant disregard of No Political Posts

Last edited by a moderator:

During WW II the US built the 442 foot long,14 ton Liberty (cargo)Ships at the average of three ships every two days!This is key to Tesla's future prospects. I think it highly unlikely that other companies will scale.

To match Tesla mining, chemical processing, battery manufacturing, parts suppliers and OEMs all need to grow their EV business by 40% or more a year. This is just about unheard of for large manufacturers [*], even for a single year, and to keep it up year after year is unprecedented (as far as I know). To do this would require long term (decade long) plans, something that public companies are not good at.

The $40T hyper-bull case for 2030, relies on Tesla making 3 TWh of cells and buying another 3 TWh from other suppliers out of a total supply of about 20 TWh (or 30% of the total). If the other cell manufacturers cannot scale then Tesla would be in an even more dominant position.

[*] except in war time, USA, Russia, UK and Germany all increased plane and tank manufacturing at much more than this compound rate in WW II.

StarFoxisDown!

Well-Known Member

GDP numbers tomorrow, which will probably show a big QOQ increase - will be interesting to see how the market reacts to the news.

That and earnings this week. So far, earnings have been pretty good......the market is just selling off everything regardless(on light volume I might add). I'm curious as to who is going to blink and start buying in volume at the cheaper prices, which could lead to the overall market reversing pretty quickly. Feels like the big boys are just playing a game of chicken right as to how low they're ok with everything going before they say enough is enough

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K