Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Lbkmxp100d

Member

Street high PT and 1,000 Bull case. Wow!

Mo City

Active Member

Not sure if it's the same everywhere, but Tesla's traffic data is hugely inferior to Google Maps in Houston TX. Sometimes it's a total joke that completely misses road shutdowns due to construction or traffic.Tesla doesn't use google maps for anything other than the base map on the display. They don't use them for traffic, or for navigation or routing or more specific map data (they use Mapbox for the map data and their Valhalla engine for routing/nav.)- source on Mapbox/Valhala here

Elon Musk Says Tesla Will Build Its Own Maps From GPS & Fleet Data

juanmedina

Active Member

Uhhh, that $96/contract now. No way it was $7100/contract. Sorry.

X 100

Knightshade

Well-Known Member

Not sure if it's the same everywhere, but Tesla's traffic data is hugely inferior to Google Maps in Houston TX. Sometimes it's a total joke that completely misses road shutdowns due to construction or traffic.

Given they appear to ONLY be using data from their own fleet since June yes I'd expect it to suck nearly everywhere compared to larger aggregators of such data.

OTOH since covid traffic hasn't really been an issue around here.... and I suppose as investors we should care more about the costs being saved by the company not paying for other peoples data than how often someone doesn't get routed around some traffic because the free fleet data is poor.

Criscmt

Member

$52 for Jan 15th calls @ $500 strike seems a pretty darn good deal to me, and I almost never find TSLA call prices attractive. Therefore I think the combined effect of that attractiveness and an unwinding of last week's MM push-down will lead to a pretty fat pop Mon/Tues.

Doesn't hurt that more certainty has been created with the legal loss for T in Pennsylvania and the certification of recount tally in Georgia.

Could be a very good week that lands around $550.

Thanks for sharing the information.

Are you counting primarily on increase in IV to profit from these options?

Mind sharing the price ranges you expect at various times/weeks in the weeks till Dec-21?

Lbkmxp100d

Member

Maybe he is saying it’s 9,600 ($96) not 7,100 ($71)X 100

Mo City

Active Member

Don't want to derail the thread, but it's been this way since 2018 when I bought my Model 3. I've been burnt several times.Given they appear to ONLY be using data from their own fleet since June yes I'd expect it to suck nearly everywhere compared to larger aggregators of such data.

OTOH since covid traffic hasn't really been an issue around here.... and I suppose as investors we should care more about the costs being saved by the company not paying for other peoples data than how often someone doesn't get routed around some traffic because the free fleet data is poor.

First World problems are so tough to deal with sometimes.

Artful Dodger

"Neko no me"

Thunderbirds are Go (well, at least Futures are all Green)

Real-Time Stock Indices Futures

Real Time Streaming Futures Quotes (CFDs)

Index Month Last Chg. Chg.% Time (EST)

US 30 Dec 20 29,307.5 +95.5 +0.33% 22:30:07

US 500 Dec 20 3,564.88 +10.63 +0.30% 22:29:52

US Tech 100 Dec 20 11,947.62 +41.87 +0.35% 22:30:09

Small Cap 2000 Dec 20 1,792.05 +8.75 +0.49% 22:30:12

Real-Time Stock Indices Futures

Real Time Streaming Futures Quotes (CFDs)

Index Month Last Chg. Chg.% Time (EST)

US 30 Dec 20 29,307.5 +95.5 +0.33% 22:30:07

US 500 Dec 20 3,564.88 +10.63 +0.30% 22:29:52

US Tech 100 Dec 20 11,947.62 +41.87 +0.35% 22:30:09

Small Cap 2000 Dec 20 1,792.05 +8.75 +0.49% 22:30:12

gabeincal

Active Member

In a month from now, on Dec 21st, Tesla is joining the S&P 500.

Cheers to a perhaps bumpy, but overall lucrative month ahead of us!

Cheers to a perhaps bumpy, but overall lucrative month ahead of us!

Artful Dodger

"Neko no me"

OT

Well at least the Roadsign is solar-powered. But I wonder what the 400v pack in a Tesla could do to reduce future moose licking incidents...

Cheers!

Well at least the Roadsign is solar-powered. But I wonder what the 400v pack in a Tesla could do to reduce future moose licking incidents...

Cheers!

Mike Smith

Active Member

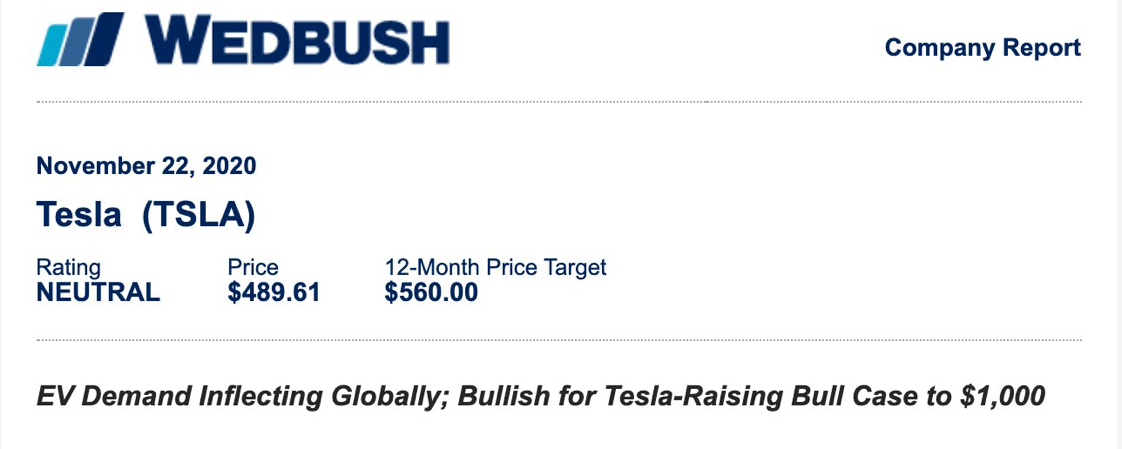

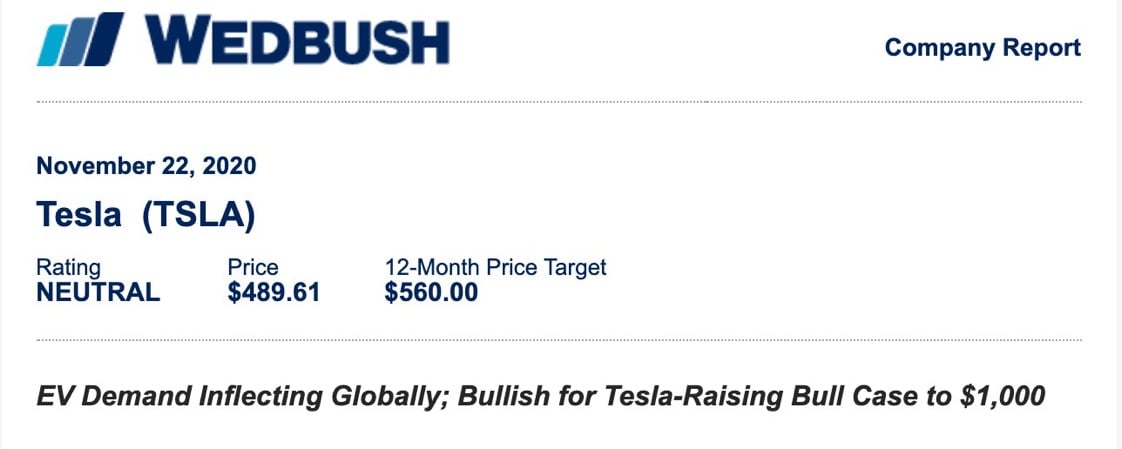

Street high PT and 1,000 Bull case. Wow!View attachment 611004View attachment 611003

From Streetinsider:

Tesla (TSLA) PT Raised to $560 at Wedbush, Bull Case Raised to $1000

Wedbush analyst Daniel Ives raised the price target on Tesla (NASDAQ: TSLA) to $560.00 (from $500.00) while maintaining a Neutral rating. The analyst also raised his Bull Case to $1000 from $800 to reflect this steeper demand EV adoption curve over the next 18 to 24 months for Tesla with China and Europe the linchpins of growth.

"With the sustained path to profitability and S&P 500 index inclusion achieved, the Tesla bull story is now all about a stepped up EV demand trajectory into 2021," Ives commented. "Overall we are seeing a major inflection of EV demand globally with our expectations that EV vehicles ramp from ~3% of total auto sales today to 10% by 2025. We believe this demand dynamic will disproportionately benefit the clear EV category leader Tesla over the next few years especially in the key China region which we believe could represent ~40% of its EV deliveries by 2022 given the current brisk pace of sales with 150k+ deliveries in its first year out of the gates with Giga 3."

StealthP3D

Well-Known Member

As we dive deeper into this fascinating and unprecedented event, many here undoubtedly would like to understand things better on a theoretical and practical basis.

Well, which is it, practical or theoretical?

It seems the consensus is that the inclusion will power the share price steadily higher. Partly because of that, I think we might be in for a rocky and surprising ride. Keep in mind that I don't believe anyone can predict these things accurately and that any prediction will be a moving target through the process of inclusion. The market has a way of constantly surprising and there are powerful and monied forced already at work behind the scenes. Every conceivable scenario is potentially on the table including a macro meltdown and a bull run that makes every other bull run look tame. The reality will probably be more boring but anyone who tells you they know how it will play out is guessing.

Watch and let me know what you think.

Anyone else getting tired of all analysts upgrading Tesla right after Tesla has had a bull run? It’s like they use a formula

new price target = current price + ∆analyst where ∆analyst is a fixed percentage. That these random publishing of this totally predictable number should somehow change the future earnings of the company is absurd.

Imo if they have failed to predict the past, their mental model is wrong and they should have very low weight. First they need to change their model, then they need to be right a few years before they should get back any meaningful influence.

Tesla China-Made Model Y to Use LG Chem Batteries for Giga Shanghai Production

Tesla has struck a deal with LG Chem to supply batteries for its Model Y, which will be manufactured at Giga Shanghai in China. According to a number of foreign publications, LG Chem is currently the only battery supplier for the future model.

In this deal, LG Chem outpaced strong competitors such as China's Contemporary Amperex Technology Co. (CATL) and Japan's Panasonic Corp., industry sources said on November 20.

The cost of the deal was not disclosed, however, based on the expected annual sales of the model, the contract is estimated at approximately $2.7 billion per year. Under the deal, LG Chem will supply lithium-ion batteries, known as NCM (nickel cobalt manganese) batteries, for the Model Y, which is slated to start mass production in Shanghai in Q1 2021, sources said.

CATL was named one of the strongest candidates but was excluded as a supplier because it focuses on another type of battery—LFP (cobalt-free lithium-iron-phosphate).

LG Chem executives said last month that the company is working on a new form factor cylindrical cell, sparking rumors in the market that the company may supply a new type of battery to Tesla.

I assume this means that storage will get a lot of CATL LFP batteries the next year. I am thinking 100-200% growth in storage in 2021 compared to 2020.

new price target = current price + ∆analyst where ∆analyst is a fixed percentage. That these random publishing of this totally predictable number should somehow change the future earnings of the company is absurd.

Imo if they have failed to predict the past, their mental model is wrong and they should have very low weight. First they need to change their model, then they need to be right a few years before they should get back any meaningful influence.

Tesla China-Made Model Y to Use LG Chem Batteries for Giga Shanghai Production

Tesla has struck a deal with LG Chem to supply batteries for its Model Y, which will be manufactured at Giga Shanghai in China. According to a number of foreign publications, LG Chem is currently the only battery supplier for the future model.

In this deal, LG Chem outpaced strong competitors such as China's Contemporary Amperex Technology Co. (CATL) and Japan's Panasonic Corp., industry sources said on November 20.

The cost of the deal was not disclosed, however, based on the expected annual sales of the model, the contract is estimated at approximately $2.7 billion per year. Under the deal, LG Chem will supply lithium-ion batteries, known as NCM (nickel cobalt manganese) batteries, for the Model Y, which is slated to start mass production in Shanghai in Q1 2021, sources said.

CATL was named one of the strongest candidates but was excluded as a supplier because it focuses on another type of battery—LFP (cobalt-free lithium-iron-phosphate).

LG Chem executives said last month that the company is working on a new form factor cylindrical cell, sparking rumors in the market that the company may supply a new type of battery to Tesla.

I assume this means that storage will get a lot of CATL LFP batteries the next year. I am thinking 100-200% growth in storage in 2021 compared to 2020.

it would be even funnier if the first half of that warning was blacked out.OT

Well at least the Roadsign is solar-powered. But I wonder what the 400v pack in a Tesla could do to reduce future moose licking incidents...

Cheers!

Excerpt from the note (emphasis added):Street high PT and 1,000 Bull case. Wow!View attachment 611004View attachment 611003

Raising PT to $560, Bull Case now $1,000. While Model 3's remain the core driver, going forward new designs around Cybertruck and Model Y will further aid growth globally and thus enable to Tesla to achieve its million delivery units likely by 2023 (2022 not out of the question) in our opinion. As such, we are raising our price target from $500 to $560 and new Bull Case target from $800 to $1,000 to reflect this steeper demand EV adoption curve over the next 18 to 24 months for Tesla with China and Europe the linchpins of growth.

Their base case delivery model has 710K units for 2021, 932K units for 2022, and 1,085K units for 2023. 2030 deliveries are only 1,961K. I mean this is a really low bar to beat. I know some of you are looking for the 1M delivery milestone in 2021 so I think it's good to give this context. Personally, I think 1M will be a challenge with three factories ramping up simultaneously (including the Model Y in Shanghai) but 900K is a good goal. Happy to be wrong though!

Artful Dodger

"Neko no me"

Artful Dodger

"Neko no me"

CATL is likely to continue supplying their LFP packs for the MiC Model 3 SR, and Tesla will continue to buy every single battery they can get their hands on, regardless of the source...I assume this means that storage will get a lot of CATL LFP batteries the next year. I am thinking 100-200% growth in storage in 2021 compared to 2020.

Cheers!

Consumer Reports should add a few more questions to their owner survey:

1) Is your car a chick magnet?

2) Do chicks measure your panel gaps when you pick them up?

3) Has any chick, ever, in your lifetime with chicks, given half a shite about your panel gaps?

It's probably well known, but this consumer report piece on the Model Y (and other quality police) always show up during a Tesla new product ramp when process variation is highest - as with all new products. But Tesla ramps are so fast compared to conventional "factories", some panel gaps likely slip through, and every one of them is counted... twice I think.

The news story on NPR was all about Tesla being 2nd to last on the quality list, and not about the Top 10 as one might expect from a ranking system. This would be like David Letterman giving us the Bottom 10. So we're last in vehicle automation, second last in quality, and now I'm waiting for the demand gap in between ship deliveries. It's cyclical. Trade the FUD, why not!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K