Got my shares, probably should have waited another 20 minutes or so though for the MMD@fiveten - you should buy five or ten sharescheers!!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

J

jbcarioca

Guest

Indeed it does....

Sorry for the O/T but this Starlink-to-Tesla fever really needs to end.

We already know that the vehicle solutions will almost certainly be through cooperation with cellular providers, including 5G and successors. The Starlink role is exactly what Elon repeatedly says, providing backhaul and remote area internet, directly and through Telco deals. It is certainly a bit too pessimistic to say 'never' because new solutions to impossible problems happens with amazing frequency (bad pun, that).

Our problem seems to be an inability to see obvious solutions that do not need an exotic direct expansion of existing technology.

We all are Tesla enthusiasts, so we should not fall victim to the status quo.

I recommend Hitchikers Guide to the Galaxy (all five volumes of the Trilogy). Then read some Asimov. When we do that we might be less imprisoned by the status quo.

Starlink: Ships, aircraft, remote areas, backhaul all YES. Cars NO. but high data use in cars might well happen through entities that want one of these other services.

Well the thing with the car is that quality or reliability doesn't tell the entire story. Brand image is almost as important as built quality and reliability. How many people drop a mil on a super car knowing it's reliability doesn't allow it to be a daily driver? There are so many objects in the world people buy just for prestige even though they are totally a pain to service and maintain.It always surprises me when people dismiss Chinese cars as 'lower end' or something analogous.

I am old enough to remember when Japanese cars were derided fro low quality, a short time later it was Korean cars, now it is Chinese.

Ploitics is another subject, which I will not discuss.

Tesla build quality and component quality is China is quite clearly better than is Fremont quality,

The Chery line has the highest consumer satisfaction and lowest defect ratings in Brazil. Of course those Cherys are built here, as are Hyundais, the #2. Both are built by the same company in Brazil.

Canadian Solar is now among the more higher regarded solar providers, a Chinese company despite the name.

In BEV production and technology and solar panels China is the world leader.

Of course, just as with Japan in the 1960's and Korea in the 1970's, people bleat about technology theft.

Industrial espionage has been around as long as industry has existed.

Tesla, pretty much alone in the auto business succeeds pretty much everywhere they go, just as Apple has done.

Bluntly, first mover complacency destroys innovation. Histrionics about any given political system as another subject, Tesla and Apple thrive despite impediments.

The impediments of duties and outright promotions plus creative approaches to bureaucracy simply act to reduce the need to be competitive. With Tesla we have little worries. No matter the impediments superior solutions do find a way to succeed. Just take a quick view of SpaceX for that perspective.

Regardless of political objections Chinese vehicles will continue to take greater share globally. Leadership in BEV's is already one way and in renewables another way.

The Chinese destroyed their brand image through decades of mediocre product. They are known for "race to the bottom" business model vs pride themselves on detail and luxury. This goes for everything Chinese, from restaurant food to cars. Where is the Italian made dollar tree and the Japanese star #1 fast food restaurant?

Criscmt

Member

In the last year or so, money has been going into money markets, seemingly more than into stocks.There has never been a market crash in the entire history of the market when interest rates are at 0. Reason? No other alternatives. Putting money in a bank or bonds today = losing to inflation.

So basically money generated by the economy is going straight into the market. That's why it just keeps going up with no end in sight. But to make extra money, large hedge funds are creating volatility with sector rotations. So sometime markers (like low 10 yr is good for nasdaq) used to be correlated but now it's not. So a lot of BS going on from their money generating scheme, leaving many folks who buy on run ups holding the bag as big money takes profit and start creating another BS narrative so they can rotate their money into.

..a record US$5.5-trillion is now sitting on the market sidelines in money market funds in the U.S...

I don't know the historical numbers, so can't speak of the magnitude.

Artful Dodger

"Neko no me"

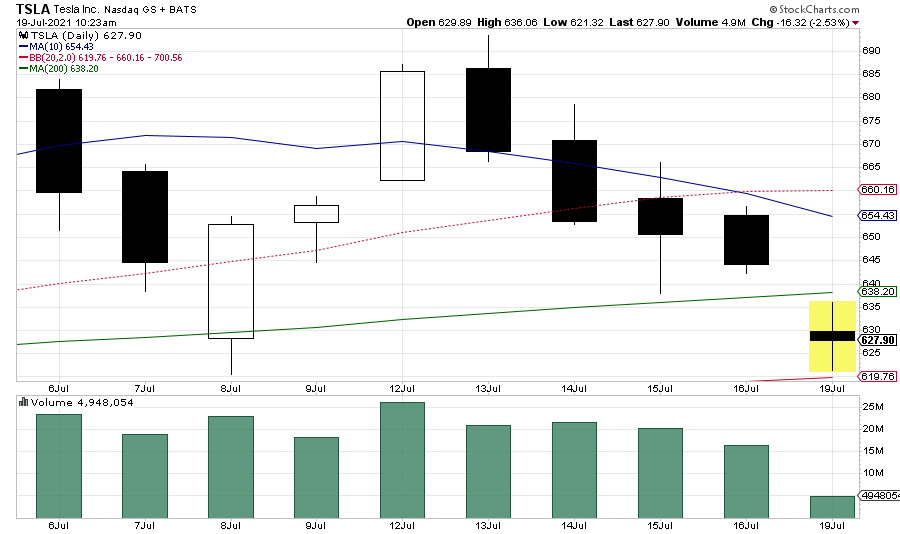

TSLA moved to within a couple bux of the Lower-BB during the MMD, and has now pushed up from that level. Let's see what macros do next: (although wedgies were bucking macros to create the fake drop with this MMA)

Cheers!

Cheers!

J

jbcarioca

Guest

Sorry to be impolite, but you will learn how wrong you are even though it may take another decade to do so....

The Chinese destroyed their brand image through decades of mediocre product. They are known for "race to the bottom" business model vs pride themselves on detail and luxury. This goes for everything Chinese, from restaurant food to cars. Where is the Italian made dollar tree and the Japanese star #1 fast food restaurant?

Just remember that Tesla has had the success it has had by ignoring conventional wisdom and following Elon's "first principles". First principles cannot survive through preconceptions.

Please read Einstein: His Life and Universe by Walter Isaacson:

Einstein: His Life and Universe: Isaacson, Walter: 9780743264747: Amazon.com: Books

Buy Einstein: His Life and Universe on Amazon.com ✓ FREE SHIPPING on qualified orders

www.amazon.com

That will help avoid falling in the trap of conventional wisdom.

All these China theories and nobody mentioned the word Dumping (selling below cost, exactly how China stole memory chips from the US, it's illegal Int'l).

The way this new world is fought in cyberspace vs bombs, I don't think countries care much for the rules. As if Russia will listen to Biden to stop the hacking. Today more so, China does what it wants. If (Edit: China) is selling EVs below cost... what are we going to do? No really...

The way this new world is fought in cyberspace vs bombs, I don't think countries care much for the rules. As if Russia will listen to Biden to stop the hacking. Today more so, China does what it wants. If (Edit: China) is selling EVs below cost... what are we going to do? No really...

Meh, I'm Chinese..we have family in China..we have dealt with Chinese people our entire lives. We have a very good perspective in how Chinese people do business outside of China and inside of China. We also have a very good perspective in how Westerners see us as individuals and our products.Sorry to be impolite, but you will learn how wrong you are even though it may take another decade to do so.

Just remember that Tesla has had the success it has had by ignoring conventional wisdom and following Elon's "first principles". First principles cannot survive through preconceptions.

Please read Einstein: His Life and Universe by Walter Isaacson:

Einstein: His Life and Universe: Isaacson, Walter: 9780743264747: Amazon.com: Books

Buy Einstein: His Life and Universe on Amazon.com ✓ FREE SHIPPING on qualified orderswww.amazon.com

That will help avoid falling in the trap of conventional wisdom.

Now I'm not saying Chinese products are all bad, in fact we find Chinese quality to be pretty good today. I am just saying the Chinese BRAND is bad..most likely due to stereotypes and a dash of racism.

I mean you used Canadian Solar as an example for being successful even though their panels are all Chinese made and is a Chinese company. Why didn't they call themselves Chinese Solar? How come so many companies advertise "Italian made", "USA made", or "German Engineering"...but hide "Made In China" under the shoe? The Chinese branding is just bad because they are not known for being innovative. Most people think all they do is steal IP and sell you the value version of similar things without proper licensing agreements (which they absolutely do if you just go on Aliexpresss). This will never go away as long as those practices are common in China. "Chinese knock offs" is a term synonymous to many Chinese made products. I have never seen Italian knock offs, Japanese knock offs, or Korean knock offs.

Last edited:

If America had any ability to plan or actually govern itself instead of focusing on election conspiracies and the best ways to inject disinfectant, we would respond in kind. They support domestic companies so they can dump? You do the same. It's game theory and the US is sitting the game out.All these China theories and nobody mentioned the word Dumping (selling below cost, exactly how China stole memory chips from the US, it's illegal Int'l).

The way this new world is fought in cyberspace vs bombs, I don't think countries care much for the rules. As if Russia will listen to Biden to stop the hacking. Today more so, China does what it wants. If (Edit: China) is selling EVs below cost... what are we going to do? No really...

J

jbcarioca

Guest

This is actually not even a real situation, in the US, that is:There has never been a market crash in the entire history of the market when interest rates are at 0. Reason? No other alternatives. Putting money in a bank or bonds today = losing to inflation.

So basically money generated by the economy is going straight into the market. That's why it just keeps going up with no end in sight. But to make extra money, large hedge funds are creating volatility with sector rotations. So sometime markers (like low 10 yr is good for nasdaq) used to be correlated but now it's not. So a lot of BS going on from their money generating scheme, leaving many folks who buy on run ups holding the bag as big money takes profit and start creating another BS narrative so they can rotate their money into.

us-interest-rates

US bank has a mini-primer:

How do interest rates affect investments?

Understanding how federal reserve interest rate changes affect investments can help you better diversify your portfolio. U.S. Bank explains the impacts.

www.usbank.com

lessons-from-japan-early-experience-of-ultra-low-rates-now-relevant-to-investors-around-world

Globally there has tended to be a movement fo funds from lower net interest rate environments to higher net interest rate environments. There are always multiple factors involved and a single aspect does not rule. That is, if inflation is ignore a zero rate environment seems clear enough but is not. Nearly every zero rate environment has been associated with asset deflation. The asset deflation often can act to depress securities preferences. Realistically, simplistic characterization of monetary policy are never valid, except by coincidence.

For Tesla the effects of such an environment are most likely to be associated with a decrease in sales volumes because of the underlying economic stagnation that usually is associated with ultra-low real interest rates. The impacts are quite complex. They usually do not yield direct positive impact on stock markets because of all that uncertainty, and uncertainty depresses fixed asset purchases.

Tesla will do best with economic stability. Most businesses tend to perform that way also.

Zero real interest rates are a mark of instability, so, as in Japan's recent case, the result tends to be a flood of money to foreign markets and foreign investment.

mickificki

Member

I'm far more excited about that rumor than FSD right now. I need a darn truck and I NEED a Cybertruck.

I'm just old enough to remember the Korean knockoffs (hyundai) in the 1990's.I have never seen Italian knock offs, Japanese knock offs, or Korean knock offs.

Luckily the internet has been around for a while now.

From the L.A.Times in 1998

Hyundai set American sales records in 1987 and 1988, but stumbled badly as officials in South Korea pursued a high-volume strategy in the U.S. at the expense of quality control. The Excel developed a reputation for unreliability, and sales plunged after hitting a high of 264,282 units in 1988.

Today Hyundai is a respectable brand and quality concerns aren't at the top of the list.

What’s wrong with up-front being a better deal if you want FSD always, and subscription being a better deal if you want to turn it on and off for occasional road trips or periodic evaluations or whatever? A little something for everyone.A little perspective from Chicken Genius about FSD subscription pricing.

I think he is spot on with his assessment of the pricing being a calculated marketing ploy to increase FSD purchases.

MOD:

End the political discussions right now.

Jingoism masquerading as concern over trading issues is still jingoism, it still shows your ignorance, and it still violates TMC rules.

End the political discussions right now.

Jingoism masquerading as concern over trading issues is still jingoism, it still shows your ignorance, and it still violates TMC rules.

Cheeky EM, left the Cybertruck on top of Austin GF as an easter egg to send a message ... no one got it at that time

ChefBoyardee

Member

I don't like to read into Elon's tweets too much... but could this be a reference to the "Money printer goes brrr" meme?

I like the sound of Cybertruck being a money printer

I like the sound of Cybertruck being a money printer

2daMoon

Mostly Harmless

Well, this strategy doesn't have to make anything wrong in order to work.What’s wrong with up-front being a better deal if you want FSD always, and subscription being a better deal if you want to turn it on and off for occasional road trips or periodic evaluations or whatever? A little something for everyone.

It is a tried and true marketing strategy to, instead of giving a customer a "Buy or Don't Buy" choice, make them consider "Should I get this one or that one" instead. It removes the "Don't Buy" choice from consideration more often than not. This is but one of many "Closing" techniques in the realm of sales.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K