Seems to me that if you have a note that gets X in 2024, and you cash it out in 2021, you're not going to get as much as if you hold it till maturity. Whether selling now is a good deal or not depends upon whether or not the stock price rises higher than the amount you would have received by holding it to maturity.Somehow legal?

Look, I've only spent 5 minutes on this (and I haven't bothered to read the terms of the notes because I don't want any) but it's apparent to me that Tesla doesn't even have to offer early conversion if they don't want to.

You can't criticize Tesla for offering something that is optional on their part but has the potential to benefit both parties (depending upon the specific tax needs, etc. of the various holders of the debt). The debt has performed spectacularly, beyond any of the original holders wildest expectations and yet still people complain!

Sheesh! Enough of this trying to make it look like Tesla is doing something shady here!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MC3OZ

Active Member

I believe we would reach the goal of no more ICE cars faster if governments step in where needed and give the old fossils some life support. Tesla will build all the cars it can - no doubt. But the compliance cars will get better and they will have buyers. Like my Tesla driving friend who dream about a top of the range Taycan. Sure the Plaid is faster etc but he just got a special place in his heart etc. So let him.

For market dominance - if Tesla keep innovating they can very well be the dominant provider of cars even if all the ICE companies survive.

And it would be soooo boring with everybody driving Teslas. That alone would stop some people from ditching their fossil cars.

Just like Tesla want all the batteries they can get from 3rd party even when they plan to ram up their own production dramatically - I want all the EVs from everywhere since that would bring us to the goal even faster.

Tesla's aim is to accelerate clean energy and transport.

We can re-state that as 20 Million EVs annually by 2030 or 50% annual production growth until clean energy and transport is fully realised.

We have seen Tesla taking very serious actions to lock in the battery supply side of the goal, I would expect a similar roadmap and plan for expanding vehicle production.

What Tesla can't do is dictate the pace of EV adoption by other companies, but this aggressive goal makes it apparent to all that the race is on.

BY 2030 most new car buyers should want an EV. If everyone that wants an EV can buy one with EVs being close to 100% of new car sales, then that is "mission accomplished".

What is beyond Tesla's direct control is how much assistance they get in achieving the mission. The speed at which they can transition to 100% EV production mostly dictates the future for other car companies.

My impression is if Tesla can make 20 Million EVs by 2030, there will be willing buyers for every one. Even with maximum ambition other car companies will not be able scale EV production fast enough to achieve market saturation.

I think that 20 Million EVs by 2030 is 15-25% of the car market, but Tesla's will come in different shapes and sizes... Tesla will need to expand the range of models to hit that kind of number. Beyond a certain point driving an ICE will be more like horse-riding, an expensive weekend hobby for the minority.

Many urban centres may ban ICE on busy road in densely populated areas and un underground tunnels. But taking the ICE for a nice drive on a winding road in the country will be fine. So many people who really like to drive ICE wil use a RoboTaxi or a regular EV for commuting, shopping and generally day-to-day driving. They will keep the ICE for weekend recreation.. and perhaps for occasional driving trips to very remote areas...

For the vast majority of the population, a car is just a convenient way of getting from A to B, many people have other priorities and hobbies. This forum is slightly skewed in that early Tesla adopters are mostly people who value a pleasant driving experience. Maybe 10% of the population are really passionate about cars, 10% are passionate about art, music or outdoor recreation. maybe 20% are passionate about sport in some form.

I'm talking about the most motivating passion here, people have multiple passions and motivations.

Bottom line there will not be enough passion for ICE to prevent "mission accomplished".

Lots of yachts sit tired up at moorings unused most weekends, lots of ICE cars will be sitting idle in garages most weekends.

mblakele

FSD Beta (99)

If they actually keep that cadence, it’s brilliant marketing. Elon is clearly ready to own the “2 weeks” meme. If Tesla can deliver marked progress every two weeks, that would change the narrative a bit. But it’d still be funny.

I feel for the poor devs working on FSD.

This shouldn’t be seen as unusual. In the agile software development world, two weeks is a standard cadence for releases.

I think Tesla has been targeting a two week interval for some time, hence release numbers like 2021.4 where 4 is a week number. It seems likely to me that they interrupted this schedule in early 2021 to land a large, disruptive refactoring for 4D and pure vision. Now that’s over and they’re back to a two week tempo.

Maybe it’s more realistic to think new issues found by 9.0 testers might first be addressed in 9.2 and etc.

It might be more like a tick-tok release schedule. That the NN is updated every-other release, and the non-NN portions are updated either every release, or in the opposite releases from the NN. Or they just release what is ready and tested every two weeks, which could be either major or minor changes. (Or nothing at all related to FSD.)

Hey, I have a Petty blue 1966 Dodge A100 Custom pickup! Dad bought it new in '65! What a coincidence!Lol, I believe Karpathy said in a talk that it takes approx 2 weeks to train and validate. Of course now they have a shiny new A100 server cluster so it's probably faster now.

/s

Artful Dodger

"Neko no me"

Math like this can quickly become unrealistic. You can soon show Tesla production exceeding vehicle production in the whole world, when the reality is they will never have more than some portion.

It's a bounded curve, we know that. Elon said "20M in 2030, or maybe a little earlier". But Model 2 gets us to 10M cars/yr, and if Model 1/robotaxi comes into being, that'll take us to Elon's aspirational 20M cars/yr.

Except the math says 20M in 2028 given just a 58.5% CAGR (whereas Elon said by 2030).

Tesla Annual Vehicle Production: (est'd)

Year | Prod(M) |

2020 | 0.500 |

2021 | 0.792 |

2022 | 1.256 |

2023 | 1.991 |

2024 | 3.155 |

2025 | 5.000 |

2026 | 7.924 |

2027 | 12.559 |

2028 | 19.905 |

2029 | 31.548 |

2030 | 50.000 |

Sandbagging, wot?

Cheers!

Last edited:

StealthP3D

Well-Known Member

I've noticed the token phrase "demand worries" has now been replaced with "chip supply worries" when it comes to applying logic.

It takes me all of 2 mins using logic to determine why the wait time keeps getting extended and guess what.........it all comes down to demand crossing an inflection point.

Here's the most recent data and facts we can go off of :

- At the end of Elon's long monologue of supply challenges, he clearly states the chip supply is improving

- Seconds after that, Zach comes in and reiterates they expect the majority of their sales and production ramp to happen in the 2nd half of the year

- Meaning at worst production will be improving 10-15% each quarter. Granted most of the growth is coming from Giga China, but Fremont production is going to stay at Q2 levels. Maybe a slight improvement (I'm excluding S production)

- It's US delivery times that continually keep getting longer and longer

- Giga China is now the export HUB leaving more production for US markets now from Fremont

Therefore, if we know that US production is at worst staying at Q2 production levels, if demand wasn't exploding right now, delivery times would be moving in sync with each month of production. Meaning if say we're in July and delivery dates are Sept, then once we get into Aug delivery times should then go to Oct. But we're seeing delivery times being pushed out repeatedly, well ahead of production months.

You might be right and I would like to believe your conclusions are a given but I don't feel I have enough information to draw them with any certainty. I find your analysis likely to be correct, but not certain. Here's why:

Giga Shanghai margins are higher so it would make sense that Tesla would keep the chips flowing to support Shanghai over Fremont in the event chip supply has taken another hit recently. That would cause the same symptoms of US delivery times being pushed out further even if demand had stayed steady. The fact is, we have very little visibility into chip supply and managements predictions of improving supply don't move that needle much. The biggest evidence we have that your analysis is correct is managements statements regarding extra-strong demand. That is why I think your conclusions are correct, not because of lengthening delivery times which would also be the case if chip supply suddenly worsened.

I don't have any evidence of this but I wouldn't be all that surprised to learn at a future date that operatives working for big oil/auto have tried to turn lemons into lemonade. Namely, an attempt to use the chip shortage to their advantage to slow Tesla's growth by taking actions to further constrain them of chips. Of course, if something like this was attempted, Tesla has, so far, proved to be a difficult mark by adapting software to more available chips. While this is mere speculation that such an attack is conceivable and could have happened, I will guarantee that if Tesla saw signs of this (without proof) they would not make that accusation publicly. So we wouldn't know anyway. Instead, they would employ first principles thinking and proven principles from history (such as that contained in the book "The Art of War") in order to forge ahead in the face of adversity and make as many state of the art cars as physically possible using every means available. We know they are doing that, we don't know if bad actors have taken any action to capitalize on the shortage in an attempt to further constrain Tesla of chips.

I'm not specifically worried about the possibility of this but, as an investor, I just lump it in with all the risks associated with disrupting large and powerful industries. A lot people don't want Tesla to succeed and even those who have come to terms with the fact that Tesla has and will continue to succeed still want it to happen as slowly as possible (and if they can have any say in the matter, no matter how small, they will). Tesla has, so far, proved very adept at neutralizing or minimizing headwinds, whether they be natural or manufactured.

StarFoxisDown!

Well-Known Member

You might be right and I would like to believe your conclusions are a given but I don't feel I have enough information to draw them with any certainty. I find your analysis likely to be correct, but not certain. Here's why:

Giga Shanghai margins are higher so it would make sense that Tesla would keep the chips flowing to support Shanghai over Fremont in the event chip supply has taken another hit recently. That would cause the same symptoms of US delivery times being pushed out further even if demand had stayed steady. The fact is, we have very little visibility into chip supply and managements predictions of improving supply don't move that needle much. The biggest evidence we have that your analysis is correct is managements statements regarding extra-strong demand. That is why I think your conclusions are correct, not because of lengthening delivery times which would also be the case if chip supply suddenly worsened.

I don't have any evidence of this but I wouldn't be all that surprised to learn at a future date that operatives working for big oil/auto have tried to turn lemons into lemonade. Namely, an attempt to use the chip shortage to their advantage to slow Tesla's growth by taking actions to further constrain them of chips. Of course, if something like this was attempted, Tesla has, so far, proved to be a difficult mark by adapting software to more available chips. While this is mere speculation that such an attack is conceivable and could have happened, I will guarantee that if Tesla saw signs of this (without proof) they would not make that accusation publicly. So we wouldn't know anyway. Instead, they would employ first principles thinking and proven principles from history (such as that contained in the book "The Art of War") in order to forge ahead in the face of adversity and make as many state of the art cars as physically possible using every means available. We know they are doing that, we don't know if bad actors have taken any action to capitalize on the shortage in an attempt to further constrain Tesla of chips.

I'm not specifically worried about the possibility of this but, as an investor, I just lump it in with all the risks associated with disrupting large and powerful industries. A lot people don't want Tesla to succeed and even those who have come to terms with the fact that Tesla has and will continue to succeed still want it to happen as slowly as possible (and if they can have any say in the matter, no matter how small, they will). Tesla has, so far, proved very adept at neutralizing or minimizing headwinds, whether they be natural or manufactured.

I get the notion of bad actors that need/want Tesla to fail trying to buy up as many chips as possible stunt Tesla's growth, but I just don't see how anyone can ignore Zach's clear comments on the earnings call.

Keep in mind, Tesla changed the Model Y dates for new orders to November just a couple of days before the earnings call and they changed the S dates for new orders a day after the earnings call. And then the latest Model Y dates for new orders just 5 days after the earnings call. So for Zach to reiterate that they expect the majority of their production ramp and deliveries to happen in the second half of 2021, you'd essentially have to be saying Zach was lying......especially when there wasn't any need for him to add that part after Elon's talk about supply issues. And for these new delivery dates for new orders to be chip supply related.......you would have to be talking about a serious reduction in production which goes completely against what Zach said.

Also, in the scenario you mentioned about them adjusting the flow of where chips are sent to favor one factory over the other, yes MIC Tesla's have higher gross margin, but if they took production from Fremont, they actually would take a noticeable hit on operating margin.....because Fremont is much more expensive to run than Giga China. Fremont needs to stay at it's production capacity to cover the costs and make a good operational margin.

I still think that a lot of Elon's frustrations and focus on the supply chain is that he wants to hit 1 million P/D this year. There was the Tesla all hands meeting back in Q1 where I was told from the person I know that works there and attended that meeting (virtually) that Elon specifically said Tesla was shooting for 1 million cars this year. Tesla's goals for 2021 add a ton of context as to why he's focusing so much on the supply chain. At least that's my thoughts on it.

Last edited:

StealthP3D

Well-Known Member

I believe we would reach the goal of no more ICE cars faster if governments step in where needed and give the old fossils some life support. Tesla will build all the cars it can - no doubt. But the compliance cars will get better and they will have buyers. Like my Tesla driving friend who dream about a top of the range Taycan. Sure the Plaid is faster etc but he just got a special place in his heart etc. So let him.

For market dominance - if Tesla keep innovating they can very well be the dominant provider of cars even if all the ICE companies survive.

And it would be soooo boring with everybody driving Teslas. That alone would stop some people from ditching their fossil cars.

Just like Tesla want all the batteries they can get from 3rd party even when they plan to ram up their own production dramatically - I want all the EVs from everywhere since that would bring us to the goal even faster.

While it's true that ICE companies could help the world ramp EV's more quickly than Tesla alone, it could come to the point where they are actually slowing down the transition due to competing for the same battery supply and making fewer EV's with the same number of batteries. We may already be there or almost be there. Tesla has a history of using fewer batteries (kWh) per car to make them go more miles. If ICE makers don't improve their EV efficiencies immediately, I would say we are already at that point at which they are actually slowing down the transition to sustainable transport by consuming batteries that Tesla could be using to make more EV's. And more efficient EV's not only save on batteries, they lower the amount of fossil fuel required to power the same number of EV miles. So, no, I don't take it as a given that other manufacturers will necessarily help speed the transition in coming years, I think it's much more likely that they slow the transition (even if they produce increasing numbers of EV's every year).

And I disagree that it's a given that a single dominant manufacturer necessarily implies a more boring auto market. While it's true today that every available Tesla Model has obvious and dominant similarities that identify them as a Tesla, Tesla is only supplying less than 2% of all cars sold. In order for them to grow past something around 25-30% market share, they will need to diversify designs to satisfy more diverse tastes and expectations. That's the only way they can grow beyond what might be considered a typical automotive market share for a major manufacturer. And first principles thinking informs that there is nothing preventing a talented and forward-thinking manufacturer from filling diverse market needs. The Tesla on the road today have designs that are very similar in philosophy but that all starts to change with the Cybertruck.

Elon has actually said that he doesn't care at all if the Tesla lineup has a cohesive design philosophy that makes them all immediately recognizable as a Tesla. This is a break from conventional ICE manufacturer thinking. Looking ahead, the only way Tesla could conceivably grow beyond a "normal" automotive market share is if they are able to offer a superior product at any given price point and they offer compelling designs with enough diversity to satisfy increasingly larger portions of the market. Don't make the mistake of assuming it is impossible for one super-efficient company to fulfill multiple roles. The style and design is the easy part. Manufacturing efficiently is the hard part.

I don't know what Tesla's future is, no one does, but don't assume something is impossible simply because it's not common. Elon has already done a surprising number of things that smart people said couldn't be done. People should practice looking at possibilities, not limitations. That's how Elon is changing the world for the better.

Guy in Norway got drunk, then became unconscious while driving down the highway. Another motorist captured video of him sleeping on the steer wheel while the car was in motion. (Click on Twitter link below). Lucky for him he was driving a Tesla. The Tesla slowed down then safely pulled over and stopped. Police arrested him.

Hope this story gets wide publication (I can dream...) to raise awareness of Tesla safety features even for non-Tesla owners.

In the future Autopilot should take breath samples (or brain scans or something) when this happen, then drive them directly to the nearest police station instead of stopping on the highway.

Hope this story gets wide publication (I can dream...) to raise awareness of Tesla safety features even for non-Tesla owners.

In the future Autopilot should take breath samples (or brain scans or something) when this happen, then drive them directly to the nearest police station instead of stopping on the highway.

Last edited:

Words of HABIT

Active Member

@PeterJA ECNALUBMA Make sure you mirror image the text so that those in front of you see you coming.You might be right, but people seem to tolerate buying iPhones despite their ubiquity. If someone buys a Samsung phone, I don't think it is due to boredom with iPhones.

Many people decorate their iPhones with stickers or cases to express their individuality. The same could happen with Tesla cars (colored wraps), or Tesla could produce more colors and models. I plan to decorate my Cybertruck with graffiti (as shown in my avatar), but of course my individuality is pretty odd.

...Elon has actually said that he doesn't care at all if the Tesla lineup has a cohesive design philosophy that makes them all immediately recognizable as a Tesla. This is a break from conventional ICE manufacturer thinking....

Yes, BWM insists on putting two nostrils on the nose of every model, which makes their first EV (i3) look like an angry baby pig.

StealthP3D

Well-Known Member

I get the notion of bad actors that need/want Tesla to fail trying to buy up as many chips as possible stunt Tesla's growth, but I just don't see how anyone can ignore Zach's clear comments on the earnings call.

Keep in mind, Tesla changed the Model Y dates for new orders to November just a couple of days before the earnings call and they changed the S dates for new orders a day after the earnings call. And then the latest Model Y dates for new orders just 5 days after the earnings call. So for Zach to reiterate that they expect the majority of their production ramp and deliveries to happen in the second half of 2021, you'd essentially have to be saying Zach was lying......especially when there wasn't any need for him to add that part after Elon's talk about supply issues.

Please don't take offense or claim I'm calling Zach a liar. A forward looking statement is managements best guess as to how the chip situation will play out. But it's a very dynamic situation, all I'm saying is we don't know that Tesla didn't learn things had taken a turn for the worse after the conference call ended and adjusted their delivery timelines. If you want to claim your theory is based solely on delivery timelines published before the conference call then say that. Don't accuse me of calling Zach a liar.

Companies are not required to update on forward looking statements as soon as they learn otherwise. They are only prohibited from continuing to make the same statements after they know they are probably unlikely. I know the basics of what is required of a company.

And for these new delivery dates for new orders to be chip supply related.......you would have to be talking about a serious reduction in production which goes completely against what Zach said.

That was a forward-looking statement. And yes, it's common for things to play out differently than any management guided for even when that management is doing their best to give accurate guidance. As I thought I made clear, I think things will likely play out in line with your analysis - I was only commenting on your level of confidence.

Also, in the scenario you mentioned about them adjusting the flow of where chips are sent to favor one factory over the other, yes MIC Tesla's have higher gross margin, but if they took production from Fremont, they actually would take a noticeable hit on operating margin.....because Fremont is much more expensive to run than Giga China. Fremont needs to stay at it's production capacity to cover the costs and make a good operational margin.

That's not how company wide margins work and Tesla does not publish margins for each plant separately. Yes, it's important for lines to be operated at capacity. However, the scenario under consideration was a potential chip shortage that required lines to be idled. At that point you idle the least profitable lines (subject to other considerations) without regard for the margins in each local.

I still think that a lot of Elon's frustrations and focus on the supply chain is that he wants to hit 1 million P/D this year. There was the Tesla all hands meeting back in Q1 where I was told from the person I know that works there and attended that meeting (virtually) that Elon specifically said Tesla was shooting for 1 million cars this year. Tesla's goals for 2021 add a ton of context as to why he's focusing so much on the supply chain. At least that's my thoughts on it.

I totally agree with that. I think they could have made and delivered 1 M in 2021 if the chip shortage hadn't happened. I would love it if they still could but I'm thinking it's definitely less likely then more likely. At this point, I would be super happy with 900K and, depending on how the chip shortage unfolds, that could be optimistic.

StarFoxisDown!

Well-Known Member

Please don't take offense or claim I'm calling Zach a liar. A forward looking statement is managements best guess as to how the chip situation will play out. But it's a very dynamic situation, all I'm saying is we don't know that Tesla didn't learn things had taken a turn for the worse after the conference call ended and adjusted their delivery timelines. If you want to claim your theory is based solely on delivery timelines published before the conference call then say that. Don't accuse me of calling Zach a liar.

Companies are not required to update on forward looking statements as soon as they learn otherwise. They are only prohibited from continuing to make the same statements after they know they are probably unlikely. I know the basics of what is required of a company.

That was a forward-looking statement. And yes, it's common for things to play out differently than any management guided for even when that management is doing their best to give accurate guidance. As I thought I made clear, I think things will likely play out in line with your analysis - I was only commenting on your level of confidence.

That's not how company wide margins work and Tesla does not publish margins for each plant separately. Yes, it's important for lines to be operated at capacity. However, the scenario under consideration was a potential chip shortage that required lines to be idled. At that point you idle the least profitable lines (subject to other considerations) without regard for the margins in each local.

I totally agree with that. I think they could have made and delivered 1 M in 2021 if the chip shortage hadn't happened. I would love it if they still could but I'm thinking it's definitely less likely then more likely. At this point, I would be super happy with 900K and, depending on how the chip shortage unfolds, that could be optimistic.

No don't get me wrong. I'm not saying that you're calling Zach a liar.

I was just pointing out that while what is said on the earnings call are forward looking statements, I don't think there's any way that Zach would make that comment days after Tesla updated new Y orders from October to November. That's the main point of why I don't think this is chip supply related. Zach made that comment after they had already pushed new orders to November.

It's really hard to get around that point because if the push of new orders from Sept to Oct and then Nov (which all happened over the course of mid June to the earnings call date) and Zach then states on the earnings call they expect the majority of sales and production to be in the 2nd half of 2021, then it has to be because demand has continued to outstrip the current production and also the production Tesla plans on doing in the 2nd half of 2021.

Absolutely my confidence could be misplaced here and unexpected things could always happen. It's the context of they already pushed the Y delivery dates 2-3 months before Zach makes that comment that gives me the confidence that they're pretty comfortable at least hitting a certain production/delivery level that's noticeably higher than Q1 and Q2.

Hey I just remembered Tesla's multibillion-dollar deferred tax allowance that @The Accountant and @st_lopes wrote about last year. What happened to that?

teslamotorsclub.com

teslamotorsclub.com

Near-future quarterly financial projections

yes - My model has Model Y Fremont and Model 3 Shanghai with similar margins: Model Y 22.8% and MiC Model 3 at 23.9%. I have the Model 3 at Fremont at 18.5%. With the Q4 China price cuts, the 23.9% margin should be lower in Q4 unless they can continue to reduce manufacturing costs to maintain...

The Accountant

Active Member

Hey I just remembered Tesla's multibillion-dollar deferred tax allowance that @The Accountant and @st_lopes wrote about last year. What happened to that?

Near-future quarterly financial projections

yes - My model has Model Y Fremont and Model 3 Shanghai with similar margins: Model Y 22.8% and MiC Model 3 at 23.9%. I have the Model 3 at Fremont at 18.5%. With the Q4 China price cuts, the 23.9% margin should be lower in Q4 unless they can continue to reduce manufacturing costs to maintain...teslamotorsclub.com

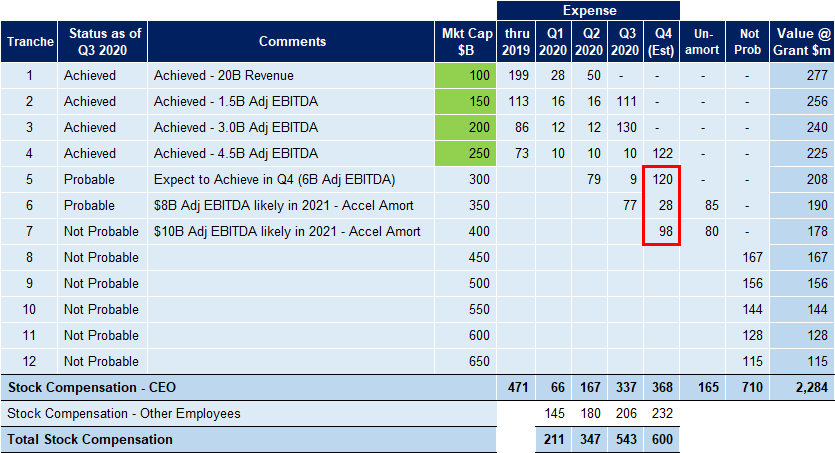

I am hoping for Q4 but it may be later. The issue is that Tesla will have Tax losses even in years when they have GAAP income. One of main reasons for this is that Stock Option Expense is much higher for the Tax Return than it is for GAAP financials.

For a more detailed explanation, see my post written this past January:

Near-future quarterly financial projections

Breaking: Tesla China Achieves Record Delivery of 21,604 China-Made Model 3 in November, 78% MoM increased Presumably a reasonable impact on Q4 models?

StealthP3D

Well-Known Member

No don't get me wrong. I'm not saying that you're calling Zach a liar.

I was just pointing out that while what is said on the earnings call are forward looking statements, I don't think there's any way that Zach would make that comment days after Tesla updated new Y orders from October to November. That's the main point of why I don't think this is chip supply related. Zach made that comment after they had already pushed new orders to November.

Your post on this topic embedded Sawyer Merritt's Tweet from this morning announcing recent changes in delivery timelines. The time gap between the earnings call and the postponed delivery dates is exactly what I was referencing as the uncertainty and is also why I suggested in my previous message that if you had intended to reference increased delivery timelines that were posted before the earnings call, then you should have mentioned that.

My point was solely the possibility for the chip situation to change between the earnings call and the recently extended delivery timelines in Sawyer's Tweet this morning.

I am hoping for Q4 but it may be later. The issue is that Tesla will have Tax losses even in years when they have GAAP income. One of main reasons for this is that Stock Option Expense is much higher for the Tax Return than it is for GAAP financials.

For a more detailed explanation, see my post written this past January:

Near-future quarterly financial projections

Breaking: Tesla China Achieves Record Delivery of 21,604 China-Made Model 3 in November, 78% MoM increased Presumably a reasonable impact on Q4 models?teslamotorsclub.com

Thanks. So do you still think the allowance will hit Tesla's earnings like a bomb in Q4 or later? @st_lopes wrote the following right after the post I linked:

Tesla would not have the ability to slowly recognize the benefit. Once they pass the more likely than not measure in terms of likelihood of sufficient future income to consume these tax attributes, there will be a windfall impact to GAAP earnings (and once PWC agrees). Also spot on that SOME may be held back due to aggressive tax positions (if any).

Wife got her bday M-Y surprise today & was agog for several minutes as her mind raced to understand that she now owned a tesla. She’d never sat in or driven one until today so I had my fingers crossed that she’d like it. About 5 minutes into the first drive she was ready to sell her current car, by the time we got home 30 minutes later she said the old car couldn’t even be in the garage with the tesla and was literally kicked to the curb. Said it was one of the two happiest days in our 14 years together, the other being our wedding day of course. When I asked which day ranked #1 she declined to comment further. As I feared but also hoped, she said ‘husband no drive’ & I already miss it—it was that much fun to drive. So the wait begins anew for my cybertrk...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M