920+ in early pre market trading. Noice!!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I realize that for shorter term traders here, possible near term margin contraction from opening new factories is relevant, but for those of us looking longer term, the new factories represent significant opportunities for margin expansion as new manufacturing technologies are deployed.

Tesla’s meteoric rise to the upper echelon of mega market cap companies would be remarkable for any company, but for a vertically integrated heavy manufacturing company it is truly special. It’s once in a generation, like Toyota before it. Look at the largest 100 cap companies. Very few of them can manufacture anything bigger than what you can hold in your hand.

BuildIng on the human and financial capital Tesla now has, the sky is the limit not only for scaling manufacturing innovation, but also for applying these innovations to an ever widening array of products.

Couple that with Tesla’s software chops, and we have something without parallel in the history of business enterprise. Apple is the only company that comes even remotely close, and its combination of capabilities have so far created several trillion in value to its shareholders.

Tesla’s meteoric rise to the upper echelon of mega market cap companies would be remarkable for any company, but for a vertically integrated heavy manufacturing company it is truly special. It’s once in a generation, like Toyota before it. Look at the largest 100 cap companies. Very few of them can manufacture anything bigger than what you can hold in your hand.

BuildIng on the human and financial capital Tesla now has, the sky is the limit not only for scaling manufacturing innovation, but also for applying these innovations to an ever widening array of products.

Couple that with Tesla’s software chops, and we have something without parallel in the history of business enterprise. Apple is the only company that comes even remotely close, and its combination of capabilities have so far created several trillion in value to its shareholders.

WJS news on Panasonic progress on 4680

“Mr. Tadanobu said Panasonic planned to start a test production unit of the 4680 battery cells in Japan by March 2022.”

Strange that I was able to see the entire article at first but now getting a paywall. In any case, the only new info in the article is the above paragraph.

“Mr. Tadanobu said Panasonic planned to start a test production unit of the 4680 battery cells in Japan by March 2022.”

Strange that I was able to see the entire article at first but now getting a paywall. In any case, the only new info in the article is the above paragraph.

UkNorthampton

TSLA - 12+ startups in 1

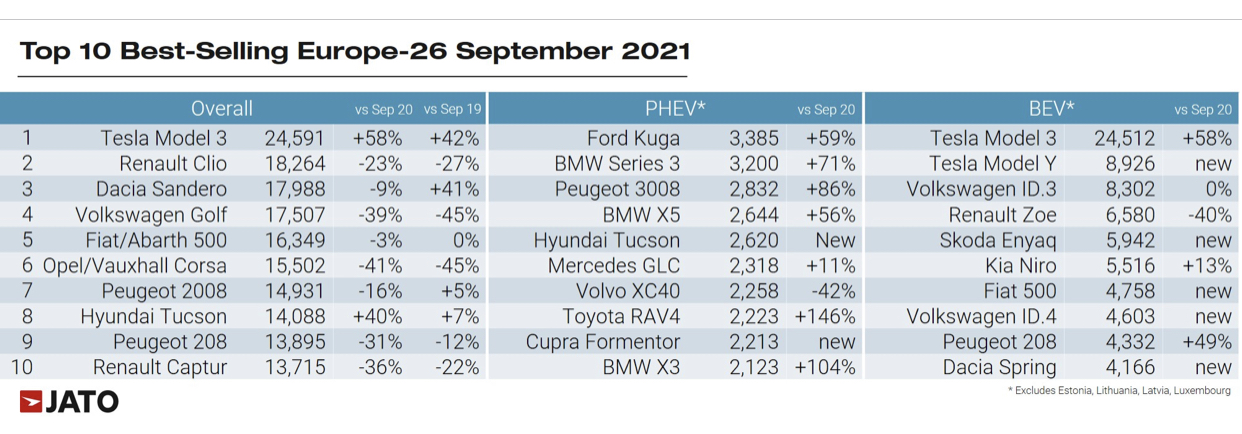

Visit EV revolution hits new milestone as Tesla Model 3 becomes Europe’s best-selling car in September - JATO for more info including that "Last month 46.5% of the passenger cars registered in Europe were SUVs" and it's growing, dying diesel & rising EVs. Just September mind, the big delivery quarter month

jkirkwood001

Active Member

Great reply to @22522 's question.I think your problem is that most people buying a Tesla can barely afford buying the car for ~$50k they don't have anywhere near $909k to invest in TSLA.

Most Tesla owners I know don't own any TSLA stock. In fact they don't own any stock for a single company, they only own mutual funds in their retirement accounts.

Secondarily, many (most?) People don't automatically jump from liking a product to wanting to own shares in the company that makes the product. Kinda like

Person 1: "skydiving looks so cool"

Person 2: "wanna go skydiving?"

Person 1: "what?? NO! are you nuts? why would I want to do that?"

It's a false assumption that all the buyers of car will want to buy the stock.

It's a false assumption that all the buyers of car will want to buy the stock.

It's a false assumption but also a false premise and a false goal.

Just choose a number that you think validly represents the share of tesla owners that are also interested into owning TSLA.

Whatever number you chose, as long as it is above 0, more cars sold directly translate into more TSLA in tesla owner hands.

Tesla addressable market grows, therefore TSLA addressable market grows.

And thus SP also grows

Looking promising indeed

Model 3 is the best selling car in Europe in September.

More notable was that this is the first time an EV took the throne to become the best selling car in Europe.

www.jato.com

www.jato.com

More notable was that this is the first time an EV took the throne to become the best selling car in Europe.

EV revolution hits new milestone as Tesla Model 3 becomes Europe’s best-selling car in September - JATO

The Tesla Model 3 topped the European model rankings in September. It's the first time that an EV leads the market.

Last edited:

Artful Dodger

"Neko no me"

New intraday-ATH in the early Premarket with good volume and macros:

15,372.50 +31.50 (+0.21%)

As of 5:46 AM EDT. Market open

Data last updated Oct 25, 2021 05:46 AM ET

Nasdaq 100 Dec 21 (NQ=F)

CME Delayed Price. Currency in USD15,372.50 +31.50 (+0.21%)

As of 5:46 AM EDT. Market open

TSLA Pre-Market Quotes Live

This page refreshes every 30 seconds.Data last updated Oct 25, 2021 05:46 AM ET

| Consolidated Last Sale | $927.99 +18.31 (+2.01%) |

|---|---|

| Pre-Market Volume | 160,859 |

| Pre-Market High | $931 (05:45:28 AM) |

| Pre-Market Low | $910.01 (04:00:00 AM) |

Last edited:

Phobi

Member

Looking long term always…it needs to be said:

Should we setup the gofundme now to cover the arthritis treatment for the orchestra?

Should we setup the gofundme now to cover the arthritis treatment for the orchestra?

CB in China in 2022? [Edit:I am not sure if it is saying Tesla is going to make CB, which we already know, or Tesla will deliver CB in China. I now think it is the former. ]

Last edited:

nativewolf

Active Member

Thank you for saying this. What a sad testament. Glancing at TMC was beyond depressing all weekend.What a horrible weekend of posting, I expect much better from you people starting tomorrow.

Boasting about money all weekend, now topped of with political trolling. Shameful!

Artful Dodger

"Neko no me"

And what designation do us early birds get that have achieved over 100x ?

Well one thing's for sure, it can't be 'Ornithologist', because extensive research here at TMC University has proven conclusively that "BIRDS AREN'T REAL".

Cheers!

nativewolf

Active Member

I find some projections to be at odds with deeper thinkers, the points on the labor impacts are however, spot on and concerning. It's what the current federal admin has right. There is concern, valid concern, about the negative impacts of the EV revolution on the few remaining high quality blue collar labor jobs. I am at odds with the tactics but the larger point that this transition will be deep..and sometimes painful is worth thinking about. Especially for all those bragging about personal wealth all weekend long.Didn't see this posted yet - Parts and service, the coming EV disruption that nobody's talking about. The topic has been covered before, but the article has some good facts in it. Here are a few examples:

The only thing I saw that I thought was pretty poor was the video at the end that is an informercial for the 2022 Bolt, which has the header, "Related Video." Related only in that the advertising fee for it probably helped pay for the writer's job. To me this was a well researched article that factually lays out the tsunami that is arriving, albeit not mentioning that Tesla is driving the wave and riding it at the same time.

- Making, selling and servicing vehicles employ an estimated 4.7 million people in the U.S., according to the Bureau of Labor Statistics. Some of the jobs won’t go away, of course — there will still be a need for dealerships and tire shops. [I deleted the link to the dealerships, because they don't list Tesla as a manufacturer, lol]

- The shift will reduce demand for oil nearly by 4.7 million barrels a day by 2040 in the U.S. alone, according to projections by BloombergNEF. That’s about 26% of U.S. consumption, roughly equivalent to the amount that Germany and Brazil combined consumed daily in 2020. Less gasoline being sold also means the need for ethanol, which is blended into motor fuels and consumes a third of the U.S. corn crop, will also fall.

2

22522

Guest

Yes, I sometimes assume that:Great reply to @22522 's question.

Secondarily, many (most?) People don't automatically jump from liking a product to wanting to own shares in the company that makes the product. Kinda like

Person 1: "skydiving looks so cool"

Person 2: "wanna go skydiving?"

Person 1: "what?? NO! are you nuts? why would I want to do that?"

It's a false assumption that all the buyers of car will want to buy the stock.

1) People care about their financial futures

2) People follow best practices (Copy Fidelity Magellan, Peter Lynch)

When trying to figure out where this breaks, 30% don't think forward. So, Item 1 breaks. That leaves 70%.

Of those left, very few people are willing to a) copy success, b) do work and c) accept risk.

So a lot of them will delegate to a financial advisor (TSLAQ) and diworsify.

Cramer is pretty smart. He bought the stock after buying the car...

I guess when I think through.

Most people either don't care about their financial futures or don't follow best practice (for whatever reason (bad advice)).

Bears, Wallstreet, the world be like putting on special glasses and seeing the world for the first time. (Seriously great stuff to watch to be reminded of the marvels of the world, "Enchroma")

2

22522

Guest

I am sure you have heard about people who guarantee that they can pick a winner, then predict 2 different outcomes and send those answers out in a 50-50 ratio. After 4 passes they have a small group of people who believe that they can actually pick a winner.I find some projections to be at odds with deeper thinkers, the points on the labor impacts are however, spot on and concerning. It's what the current federal admin has right. There is concern, valid concern, about the negative impacts of the EV revolution on the few remaining high quality blue collar labor jobs. I am at odds with the tactics but the larger point that this transition will be deep..and sometimes painful is worth thinking about. Especially for all those bragging about personal wealth all weekend long.

This group has been through a lot of ups and downs. For making a pick that happens to be ahead right now. You see it as personal wealth. I see it as people have a right to crow after passing through a risk window. Neither of us has the moral high ground.

S&P's rating upgrade??

Tesla is upgraded by S&P Global and is closer to an investment grade rating (NASDAQ:TSLA)

S&P Global Ratings boosts its credit rating on Tesla to BB+. Read more on Tesla's ratings.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M