Tslynk67

Well-Known Member

YesSo is that 53K or 74K total?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

YesSo is that 53K or 74K total?

Please bear in mind these China numbers represent the sales, i.e. delivered cars, only.

One reason to not raise prices is to protect resale value - For your customers. People do total cost of ownership calculations - particularly for leases. A stable resale value percentage obtains more positive word of mouth advertising.While I personally withdrew my interest in the MY as the price creep drove it over $60K for most configurations, I don't see how Tesla won't continue the price creep trend. MY backlog is about 1 year today. That's not going to be a great customer experience waiting in that line. Why not increase the price until the backlog is more reasonable?

I was pissed about not ordering before all the increases, especially when I see Gross Margin at 30% (seems greedy or like gouging), but I realized lowering the price would not accelerate the mission one bit. The only way to accelerate the mission, with the current demand, is to make more cars faster. Tesla, being battery constrained, can't move the needle on more cars faster until they get more batteries. Lots of batteries. Tesla's prices will continue upward until batteries flow. Obviously, GigaTX and GigaBerlin will help, but they'll take many quarters to improve this calculus.

I'm so thankful that Elon was such a visionary with conviction and nerves of steel- willing to embark on the first gigafactory knowing early that inconceivable scale was one of the key components.

I expect you have heard about how the west hobbles African economic development by pushing solar onto them.Isn't subsidizing EVs AND gasoline simultaneously an oxymoron?

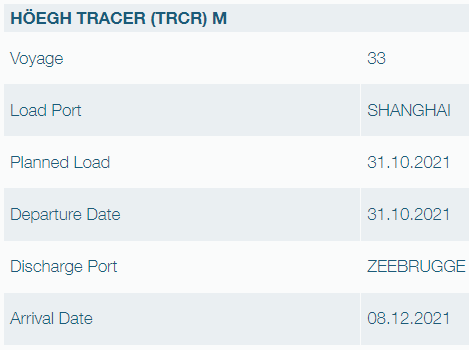

It's hard to get ships, crews, dock services due to various reasons. Tesla are getting them whenever they can. We've seen before that a ship leaving in last few days of a month isn't counted until it arrives (in the next month). It only takes 1 or 2 ships to cause concern on monthly numbers. If I'm reading ship ytracking correctly, GRAND DAHLIA left Shanghai on Nov 14, 01:30 and gets to Southampton, United Kingdom (UK) around Dec 11, 04:00If I'm not totally wrong, there has been quite rough weathers for Tesla carriers from Shanghai, and there are some delays in shipments. And if a Tesla is not delivered to the customer, it's not conted as saled/exported..?

2021 Shipping Movements

HOEGH TRACER may be heading for Gibraltar. I don't know why. I don't know what has happened to the cars she was taking to Zeebrugge. If your car was onboard I suggest you check My Cargo again to see if it's still onboard or whether it was unloaded in Santander. Please post here the result...teslamotorsclub.com

anywhere other than NASDAQ to get bi-monthly short data older than a year?

Could be supply-chain, maybe priority to China sales, unwinding the wave, all of these...

from the forms, it looks like the 3 executives got some $0 cost shares A, and sold around 1/2 of them, most likely for tax purposes (53%?) ending up with more sharesYeah I know I fixed it. Just three other people. It seems kind of weird though if he really didn’t sell anything yesterday or today. Mondays and Tuesdays seemed to be somewhat of the pattern at least.

I too was looking to buy a MY in early 2022, but the constant price increases this year bothered me as well. It excited me as an investor, but bothered me as a soon to be customer.While I personally withdrew my interest in the MY as the price creep drove it over $60K for most configurations, .....I was pissed about not ordering before all the increases, especially when I see Gross Margin at 30% (seems greedy or like gouging)...

| Consolidated Last Sale | $1,058.00 +6.25 (+0.59%) |

|---|---|

| Pre-Market Volume | 273,870 |

| Pre-Market High | $1,057 (08:01:49 AM) |

| Pre-Market Low | $1,034.1 (04:18:47 AM) |

You could try the CBOE data shop,,, relatively inexpensive. Problem would be parsing all the data to find short interests/spikes.anywhere other than NASDAQ to get bi-monthly short data older than a year?