petit_bateau

Active Member

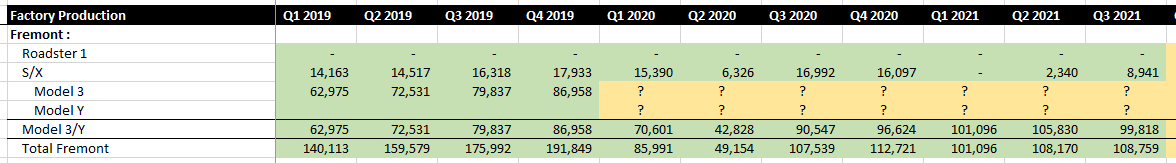

Can anyone point me to any data and/or estimates on the split between model 3 and model Y production at Fremont ? For that matter S/X split would be interesting as well. It is really only out of curiousity re mfg ramps and line capacities, as I don't drill to the financial level of detail of ascribing different prices, costs, margins. This is what I have at present.

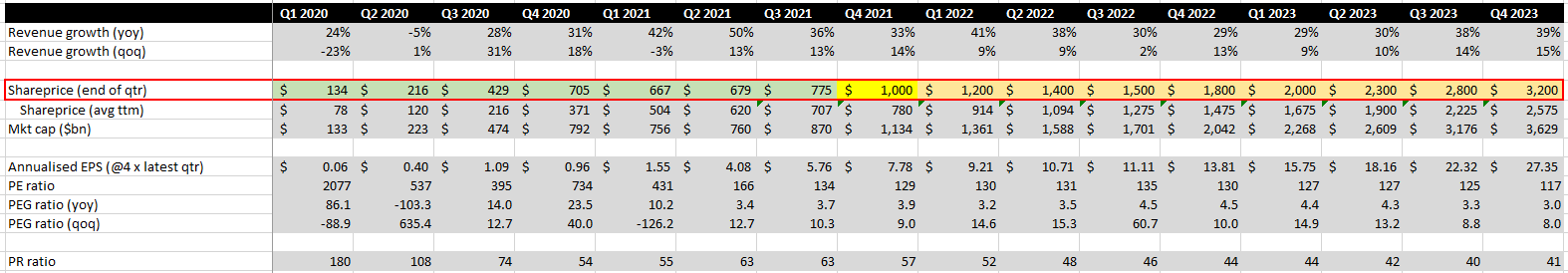

I've been trying to get better granularity on my near-term (24m) forecasts. (Previously I'd only done some annual numbers). You can see why analysts are reluctant to put their estimates out there, the numbers just get unbelievably large, fantastically fast. Here is what I get if I assume no revenue growth in energy or services, and I assume that shareprice responds to maintain PE at approx 130. These are just bonkers numbers.

I hope Tesla start issuing this level of data routinely. Plus in about a year's time start issuing more data on energy division and services (inc chargers).

I've been trying to get better granularity on my near-term (24m) forecasts. (Previously I'd only done some annual numbers). You can see why analysts are reluctant to put their estimates out there, the numbers just get unbelievably large, fantastically fast. Here is what I get if I assume no revenue growth in energy or services, and I assume that shareprice responds to maintain PE at approx 130. These are just bonkers numbers.

I hope Tesla start issuing this level of data routinely. Plus in about a year's time start issuing more data on energy division and services (inc chargers).