Nolimits

Member

No one is going to want to build in Germany if this keeps up.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Not in any accredited college. That has zero to do with advertising or any part of marketing. Not to be rude, but factual. That would never be said by any qualified person.In advertising class in college, they taught us that one of the advantages of advertising is that it hastens the bankruptcy of uncompetitive or failing businesses. So why not!!?!

ARKK is going to ask to change the ticker for HOOD to HOLEThe stock price down 5.3% is not that bad all things considered. Nasdaq down 3.3% and ARKK down 7.6%.

Some small and mid cap growth stocks hit all time low today and most were hit pretty hard.

Well, thank Gott “intensively in the process of entering into the actual final review ”. I’m feeling good about this.I'll be pleasantly surprised if Tesla delivers more than 1 car from Giga Berlin in the first half of this year. It's at the point where the red tape is like a Monty Python sketch.

I feel like the characters in the Wack-A-Mole game, not the person with the club of course.....

Selecting Germany was a serious misstep by Tesla.I'll be pleasantly surprised if Tesla delivers more than 1 car from Giga Berlin in the first half of this year. It's at the point where the red tape is like a Monty Python sketch.

Maybe short term. Six months delay is nothing if the factory is humming for the next 50 yearsSelecting Germany was a serious misstep by Tesla.

Selecting Germany was a serious misstep by Tesla.

No.Selecting Germany was a serious misstep by Tesla.

No one is going to want to build in Germany if this keeps up.

... and THERE IT IS, FOLKS: GAP CLOSED. 15:24:17 $1,082.00

Getting the factory open is just the first battle in this war.

The next one I predict will be Tesla fighting the German unions and keeping them at bay as much as legally possible. Like @Chunky Jr. I will be pleasantly surprised if we see any deliveries from Berlin in the first half of this year.

Still think holland would have been a better choice. I think it will be 2023 before things are rolling. And even then I think there will be a constant pressure by Germany to move the factory out of the country. Definitely a head shaker.Getting the factory open is just the first battle in this war.

The next one I predict will be Tesla fighting the German unions and keeping them at bay as much as legally possible. Like @Chunky Jr. I will be pleasantly surprised if we see any deliveries from Berlin in the first half of this year.

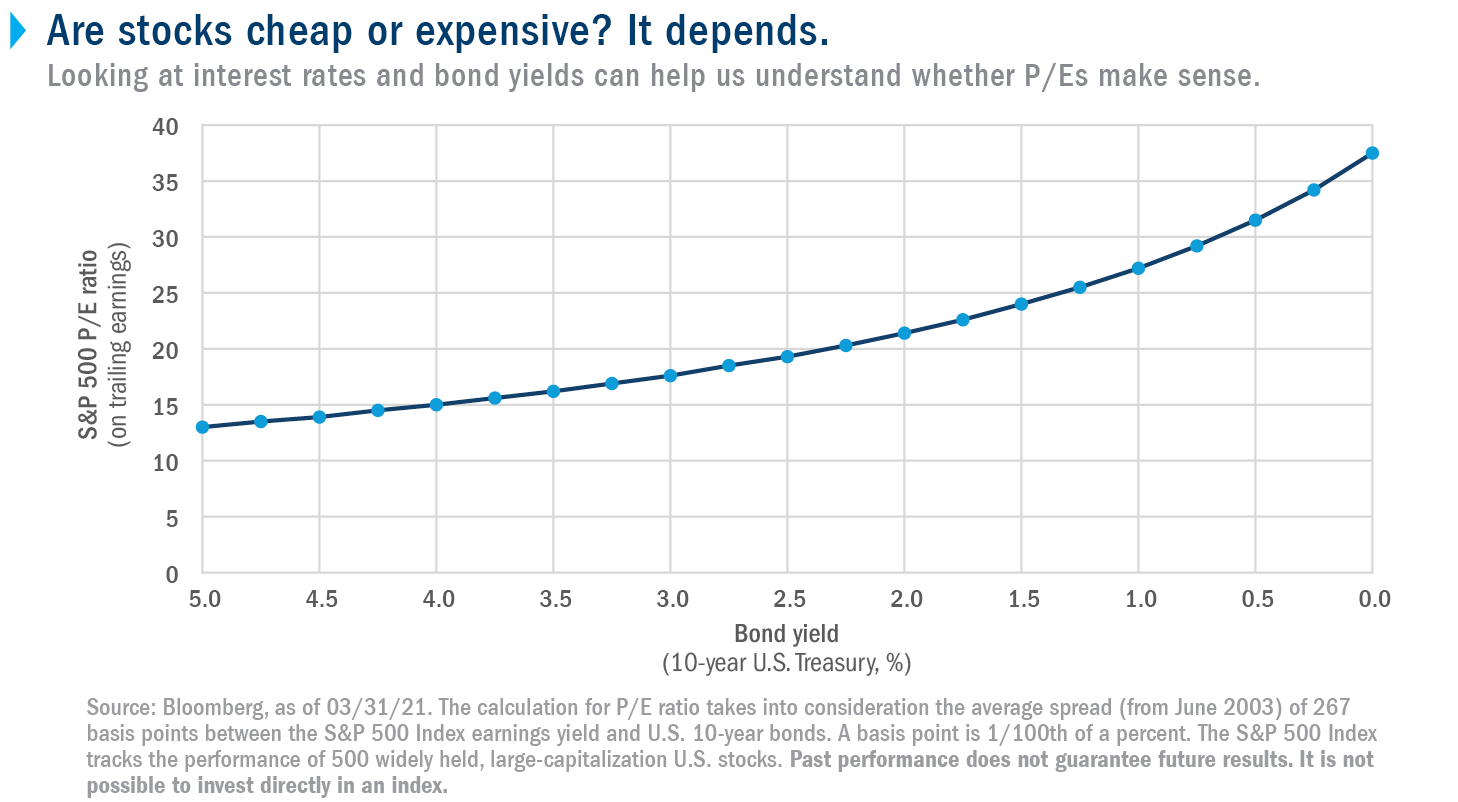

Just looking at TSLA today the PE ratio dropped by 34. So there's 1 data point.Anyone have an idea of how much PE ratios are reduced by higher interest rates?

Theres no exact rule of thumb because the math is nonlinear.Anyone have an idea of how much PE ratios are reduced by higher interest rates?

You’ll eat those words in time. It was a brilliant choice and it’s going to pay off big time. Patience.Selecting Germany was a serious misstep by Tesla.

S&P P/E sits at 29 today. Here's a chart of what historically the PE is vs the 10 year.Anyone have an idea of how much PE ratios are reduced by higher interest rates?

High PE isn’t the problem.. high PE with low earnings or cashflow, that’s the problem. I did that screen a few months ago, and they are all getting crushed. QQQ puts helped. We’ll have some margin and multiple compression for sure, but some of the relatively high PE WITH strong earnings and even earnings growth will be buys pretty soon here.Anyone have an idea of how much PE ratios are reduced by higher interest rates?