My interpretation of Alex's comments are that the supplier would be obligated to perform the contract even if they are not allowed to take water from their catchment - e.g. they'd have to truck it in from the next state over to supply Tesla.FWIW I agree 100%, and really enjoy Alexs stuff.

That said and perhaps it's a shortcoming of his using twitter as the platform- I'm a bit unclear on his argument here.

Specifically where he writes:

So I get that the contract with Tesla still exists no matter what happens with the agreement between the regulator and the water company.

But if the court decides the authorities wrongly increased available volume-- and that volume was what the contract was for the supplier to deliver-- then there's no water for the supplier to deliver.

Which seems like an actual problem, even if Tesla might have some breach of contract payment owed to them from the supplier (and depending on the state of force majure type clauses or the root cause of the court problem, maybe not even that).

Quoting from the original stories on this seems to agree that's the case

Which appears to be directly quoting the water supplier saying if they lose this case they can't supply the water as contracted.

Alexs argument seems to be they're still obligated to deliver something they literally could not deliver because the contract itself still exists.

Again- his stuff is typically excellent- so I'm mostly blaming short form twitter and not being a german law expert here- but it's unclear it's as much a non issue as his tweet suggests anyway.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2daMoon

Mostly Harmless

Tesla's mission is to accelerate the world's transition to sustainable energy.

On the other hand ...

Tesla's attorneys' mission is to accelerate the Market's transition to sustainable trading practices.

On the other hand ...

Tesla's attorneys' mission is to accelerate the Market's transition to sustainable trading practices.

hey now! right on @chronopublishHey now, some of us have much worse ratios than that.

anyone around long enough knows the difference between you, and the aforementioned algae that results from still price action. your frequency will not be correlated with those animals in my book.

here, hereGetting close to a bottom for sure

wait, where?

no…here, here.

where are we?

we’re here.

…i agree

we’re near peak lunacy.

yes im hurting as much as nay of you, pound for pound.

it’s still a long game. hang in there everyone. think may 2019. that’s what i’m thinking. tell me i’m wrong, and why.

yes im hurting as much as nay of you, pound for pound.

it’s still a long game. hang in there everyone. think may 2019. that’s what i’m thinking. tell me i’m wrong, and why.

insaneoctane

Well-Known Member

I just wish I had some dry powder or one of those couches all you guys seem to have! No, unfortunately I saw multiple buying opportunities way too early.

insaneoctane

Well-Known Member

I know with gasoline already above $5/gallon here in California and it already headed straight up, the last few days my Tesla is becoming the popular choice of everyone in my house. I have to believe these oil prices are going to be the tipping point for many considering EVs,but on the proverbial fence. Which EV company is best suited to handle an increase in demand?

UnknownSoldier

Unknown Member

Tesla's order backlog will soon be sold out through 2022, and there is still no hide nor hair of Austin and Berlin coming online soon. So....none of them?I know with gasoline already above $5/gallon here in California and it already headed straight up, the last few days my Tesla is becoming the popular choice of everyone in my house. I have to believe these oil prices are going to be the tipping point for many considering EVs,but on the proverbial fence. Which EV company is best suited to handle an increase in demand?

Artful Dodger

"Neko no me"

Getting close to a bottom for sure

Q: How do you become a Millionaire in the Stock Market?

A: Start with $2M, then use MARGIN.

Cheers!

StarFoxisDown!

Well-Known Member

Where in the world is the notion of an Austin delay coming from?Tesla's order backlog will soon be sold out through 2022, and there is still no hide nor hair of Austin and Berlin coming online soon. So....none of them?

Coming online soon? Austin is already producing.

Gigapress

Trying to be less wrong

Deep out-of-the-money call options are SUPER CHEAP now, in my non-professional opinion.

For instance, calls with strike $2475 for 17 Mar 2023 expiration are only $8 today.

I think this is nuts, because with Tesla's ridiculous 2022 growth looming, I would not be surprised if we're holding $3000+ TSLA shares by this time next year.

My middle expectation of annualized EBIT for Q4 '22 is $30-35B. So, a $3k+ share price would require only about a 100 P/EBIT ratio, which isn't crazy for a company selling a couple million widgets per year for $20k profit each while exponentially growing volume 80% annually.

My bull case is TSLA = $4k by Mar '23 with $40B annualized Q4 '22 EBIT.

$3k share price would give about 60x return on investment; $4k about 200x. All in a 13-month timeframe.

Plus, this same time period looks poised to yield excellent FSD progress, because of Dojo coming online, an influx of fresh AI engineering talent following AI day, and an exponentially expanding army of beta testers gathering training data. If visible FSD improvements finally make the robotaxi dream more believable for investors and the roof is blown off the stock price, then these dirt cheap call options could plausibly return 300x. This is much less likely, but it's probable enough to add to the value of the option.

I don't know if I'm missing something major, or if the market is just being absurdly irrational with this options pricing.

For instance, calls with strike $2475 for 17 Mar 2023 expiration are only $8 today.

I think this is nuts, because with Tesla's ridiculous 2022 growth looming, I would not be surprised if we're holding $3000+ TSLA shares by this time next year.

My middle expectation of annualized EBIT for Q4 '22 is $30-35B. So, a $3k+ share price would require only about a 100 P/EBIT ratio, which isn't crazy for a company selling a couple million widgets per year for $20k profit each while exponentially growing volume 80% annually.

My bull case is TSLA = $4k by Mar '23 with $40B annualized Q4 '22 EBIT.

$3k share price would give about 60x return on investment; $4k about 200x. All in a 13-month timeframe.

Plus, this same time period looks poised to yield excellent FSD progress, because of Dojo coming online, an influx of fresh AI engineering talent following AI day, and an exponentially expanding army of beta testers gathering training data. If visible FSD improvements finally make the robotaxi dream more believable for investors and the roof is blown off the stock price, then these dirt cheap call options could plausibly return 300x. This is much less likely, but it's probable enough to add to the value of the option.

I don't know if I'm missing something major, or if the market is just being absurdly irrational with this options pricing.

Last edited:

Artful Dodger

"Neko no me"

Tesla's order backlog will soon be sold out through 2022, and there is still no hide nor hair of Austin and Berlin coming online soon. So....none of them?

I realize you are enjoying wallowing in your current misery, but you are ignoring Telsa's guidance which was given less than 4 weeks ago: the company will COMFORTABLY increase production by more than 50% in 2022 even WITHOUT Austin or Berlin.

Yes, both Fremont and Shanghai are positioned to increase production substantially in 2022.

Again, Tesla 2022 production is chip-supply constrained. Opening new factories WILL NOT increase the supply of chips, nor the number of total cars that Tesla is able to build in 2022. The limiting factor is chip supply, not factories.

All that opening new factories can affect in 2022 is to trade gross margin (increased operating overhead) for a faster production ramp in 2023, once supply constraints begin to ease. I trust Tesla Management to make the best choice.

Cheers!

Last edited:

Thekiwi

Active Member

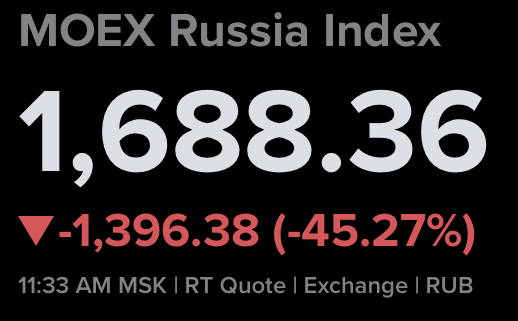

Russian stock exchange index currently down 45%…TODAY.

So all things considered, could be worse things to be than a TSLA investor at the moment.

So all things considered, could be worse things to be than a TSLA investor at the moment.

Normally I might agree, but the macro environment is the scariest I’ve seen since I started investulating 4 years ago. March ‘23 is right around the corner relatively speaking. I’m looking at the right time to re-buy my beloved LEAPS at a low, often re-checking the Option Chain, as if reasonably priced January 2026 LEAPS are gonna miraculously appear because I’m a huge fan of owning the latest-expiration LEAPS I can buy in order to more likely bridge over the timespan of a recession or crash. I’m not smart enough to Delta hedge with those complicated call-spread-put-wheel thingies some of you guys do, so I rely on my Neanderthal- level understanding and a lot of conservative caution.Deep out-of-the-money call options are SUPER CHEAP now, in my non-professional opinion.

For instance, calls with strike $2475 for 17 Mar 2023 expiration are only $8 today.

I think this is nuts, because with Tesla's ridiculous 2022 growth looming, I would not be surprised if we're holding $3000+ TSLA shares by this time next year.

My middle expectation of annualized EBIT for Q4 '22 is $30-35B. So, a $3k+ share price would require only about a 100 P/EBIT ratio, which isn't crazy for a company selling a couple million widgets per year for $20k profit each while exponentially growing volume 80% annually.

My bull case is TSLA = $4k by Mar '23 with $40B annualized Q4 '22 EBIT.

$3k share price would give about 60x return on investment; $4k about 200x. All in a 13-month timeframe.

Plus, this same time period looks poised to yield excellent FSD progress, because of Dojo coming online, an influx of fresh AI engineering talent following AI day, and an exponentially expanding army of beta testers gathering training data. If visible FSD improvements finally make the robotaxi dream more believable for investors and the roof is blown off the stock price, then these dirt cheap call options could plausibly return 300x. This is much less likely, but it's probable enough to add to the value of the option.

I don't know if I'm missing something major, or if the market is just being absurdly irrational with this options pricing.

Perhaps THAT'S the major thing you might be missing, @Gigapress .

Aaaand, I gotta say, many thanks to our beloved MODS, and let's not forget to tip our cashiers, boys and girls!

Thekiwi

Active Member

What was the S&P500 inclusion price? $695 ?

Looks in play judging by premarket trade (saw $710 for a minute there)

Looks in play judging by premarket trade (saw $710 for a minute there)

Featsbeyond50

Active Member

A "key reversal" is the only thing I know of. Otherwise, you just have to have the guts to buy in when you think think the value is too good not too.How do they determinate we have reached capitulation day and tomorrow is massive buying day?

A key reversal is when you have a massive drop in the share price then it bounces back and actually closes above the opening price. From what I see in the premarket, it won't shock me if we have a key reversal today. But then, there's really nothing that would shock me today.

-5% 2 days agoA "key reversal" is the only thing I know of. Otherwise, you just have to have the guts to buy in when you think think the value is too good not too.

A key reversal is when you have a massive drop in the share price then it bounces back and actually closes above the opening price. From what I see in the premarket, it won't shock me if we have a key reversal today. But then, there's really nothing that would shock me today.

-7% yesterday

-6% premarket

Aren’t there buyers somewhere?

I'm not expecting buyers to have the upper hand on a day like today-5% 2 days ago

-7% yesterday

-6% premarket

Aren’t there buyers somewhere?

Todd Burch

14-Year Member

IMO selling now is not a good idea. Never know when things will reverse, and in events like this they can reverse quickly and violently.

I also think following the ticker closely now is not good for the soul either.

We all know this is temporary. For how long, we don’t know. But we know it’s temporary. I suggest not following the price for awhile to maintain your sanity.

I also think following the ticker closely now is not good for the soul either.

We all know this is temporary. For how long, we don’t know. But we know it’s temporary. I suggest not following the price for awhile to maintain your sanity.

Featsbeyond50

Active Member

In the mean time, while we're waiting for buyers to step back in, Tesla is still executing.-5% 2 days ago

-7% yesterday

-6% premarket

Aren’t there buyers somewhere?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M