Cult Member

Born on the 4th of July

Why so unsolid? Think about the Mission, please.No. The $ is in TSLA…

I’m in no rush. I love my M3…

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Why so unsolid? Think about the Mission, please.No. The $ is in TSLA…

I’m in no rush. I love my M3…

Looks like Autohaus has deep engineering expertise. They have replaced the Model 3 crappy golf-cart technology with German state-of-the-art 10-cylinder engine.

View attachment 786105

Looks like Autohaus has deep engineering expertise. They have replaced the Model 3 crappy golf-cart technology with German state-of-the-art 10-cylinder engine.

View attachment 786105

If we end the year with $13 eps (per @The Accountant) and a P/E between 150-200, then we're looking at a stock price of $1950-$2600

This is initial production, just as the former Ford LIghtning one was. That is their defense. But...Cadillac LYRIQ manufacturing video:

Is it me or is the manufacturing process really slow? The throughput time looks poor.

It becomes clearer and clearer to me that the Tesla Manufacturing Process is a competitive cost advantage that will exist for a long time.

Land use also includes switchyard, so not entirely megapacks.53 acres filled with MegaPacks at GigaAustin? Holy moly

Troys Q1 estimate now down below 320k. Seems to be making the same wrong assumptions about Shanghai production for the month of March because of Covid that he did with Fremont in Dec when he assumed Tesla would have demand issues at the end of the quarter

I don't think people realize how much money is out there for Energy. Here's hoping Tesla had pre negotiated deals in place to provide ALL ancillary service in the near term.53 acres filled with MegaPacks at GigaAustin? Holy moly

To paraphrase Walter's quote from the Big Lebowski, "Ford and GM are entering a world of pain . . .my friend".The differences are striking. Labor costs alone are vastly higher for Ford and GM. Quality control seems to be mostly manual, with all the variances built into that. Of course we do not see anything like complete assembly line for either Ford or GM.

The thing that occurs to me is that the evidence seems to suggest that the Tesla lead is accelerating

While I understand that we don't like to talk about Crypto here... I would not touch this with a Teslabot's hand. This could be rugpulled at anytime. Stay far away. And this is coming from someone who is generally positive about Bitcoin. The market cap of this is so small it can be manipulated easily. Don't look to it for much price guidance either.I occasionally glance at the "Tesla coin" price over weekends, as it tends to indicate overall fear in the world, similar to BTC. Usually the price swings within $10 of the last market trades, but this morning the price had jumped to $1100+. I get the low liquidity and all, but this seems very out of the ordinary. Is this a sign that we'll have a very fun Monday? Tesla tokenized stock FTX price today, TSLA to USD live, marketcap and chart | CoinMarketCap

I hear Mattel is massively undervalued because they make more cars than every automaker combined but is only valued at 8 billion dollars.To paraphrase Walter's quote from the Big Lebowski, "Ford and GM are entering a world of pain . . .my friend".

Even before their transition to EVs, the Operating Margins for their Auto segment are poor.

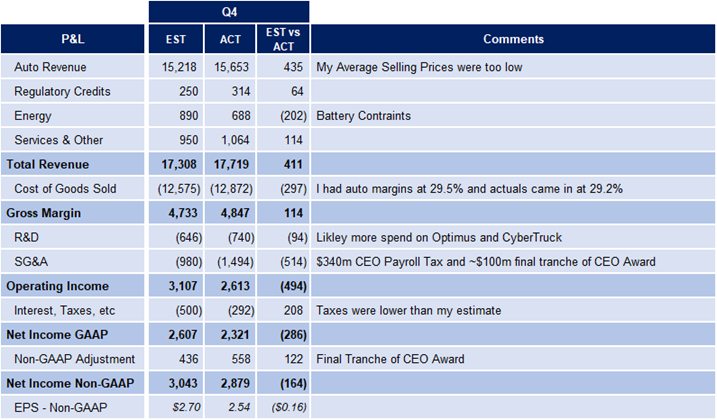

Accounting Terms:

Gross Margin = Revenues less Cost of Manufacturing

Operating Margin = Gross Margin less R&D and Selling Gen & Admin Expenses

You can't blame the pandemic. GM had 3% OpInc Margin in 2019 while Ford was losing money at -2%.

I believe as they attempt a transition to EVs, things will get worse.

Tesla had 13% OpInc margins in 2021 but they ended Q4 with 16% and by the time they get to Q4 2022 they should be at 21%.

. . . . and Wall Street is surprised that Tesla's Market Cap exceeds all of their competitors combined?

View attachment 786129

When I pencil in your 340k deliveries into my model, my non-GAAP EPS changes from $2.80 to $3.05.Troys Q1 estimate now down below 320k. Seems to be making the same wrong assumptions about Shanghai production for the month of March because of Covid that he did with Fremont in Dec when he assumed Tesla would have demand issues at the end of the quarter.

Keep in mind, just 2 weeks before Q4 numbers, Troy was at 276k, which was more than 10% off from the actual number. Wouldn’t be surprised to see the same thing happen again.

Also, he states that DMV registration data points to Fremont production being exactly the same as Q4. There’s been multiple pieces of anecdotal evidence that contradicts this and we’ve had 2 different data sources that point to US deliveries being much higher than Q4 in the first two months of the quarter. If the Q1 number comes into higher than 330k, Troy needs to do find new registration data sources or stop his method of taking select data and extrapolating.

I’m staying at a range of 335k-340k using the other 2 sources of US registration data and the data we already have from China for Jan/Feb. If you go back to my post from a couple weeks ago, Tesla only needs to produce around 70-72k to hit 80k deliveries for March. If they were to do that, total deliveries for Tesla for Q1 would be above 347k

IMO selling now is not a good idea. Never know when things will reverse, and in events like this they can reverse quickly and violently.

I also think following the ticker closely now is not good for the soul either.

We all know this is temporary. For how long, we don’t know. But we know it’s temporary. I suggest not following the price for awhile to maintain your sanity.

I would be happy at 330k deliveries with non-GAAP EPS of $2.93When I pencil in your 340k deliveries into my model, my non-GAAP EPS changes from $2.80 to $3.05.

My $2.80 assumes 320k deliveries.

We all (well...the smart ones on here at least) knew $TSLA was going down due to the macro environment, and not because there is a demand problem, elon's tweets, FSD FUD, etc, etc. While this +44% swing is nice, i think they still owe us an ATH in the near future(quote above from 6:09 a.m. Feb 24, 2022) Oh, this aged well. What a differnence a month can make!

View attachment 786177

Nothing like a +44% intramonth swing to the upside, wot?

Well sussed! HODL FTW!

Cheers!

While this +44% swing is nice, i think they still owe us an ATH in the near future

GM likely does not have the battery supply to build a high volume factory.This is initial production, just as the former Ford LIghtning one was. That is their defense. But...

We also saw initial production video for Shanghai and Grùneheide and hints of Austin.

The differences are striking. Labor costs alone are vastly higher for Ford and GM. Quality control seems to be mostly manual, with all the variances built into that. Of course we do not see anything like complete assembly line for either Ford or GM.

The thing that occurs to me is that the evidence seems to suggest that the Tesla lead is accelerating. One huge factor these do not show explicitly is that the vertical integration of Tesla allows very rapid changes, so, as Geico Taiki-sha (the Grüneheide paint shop supplier) has said, their new paint shop technology saves money and time because of overall systems integration, so it really isn't suitable for retrofit in traditional factories. I made a longer post about that here:

Near-future quarterly financial projections

Europe import duties of 10% or ~$5500.... Duty is based on landed cost, not retail price. Should be less than 4k. Shipping used to be a bit under 1k, don't know current price or how long Tesla locked in their prices. They even seem to be off on the Market Share. Looking at this which doesnt...teslamotorsclub.com

The point is that in both GM and Ford we see traditional paint shops with mostly manual QC and some manual intervention. We see people doing manual sanding and surface corrections. They simply do not and cannot conceive an integrated factory management system. We often do not discuss the 'alien dreadnaught'. We rarely discuss the fact that Tesla programs the robots it uses, although they clearly do also use manufacturer support.

We we so far do not have is a systematic way to value these processes. We all see how quickly Tesla responds to changes, how adept they are in dealing with substitutes for parts shortages.

What we do have thanks to @The Accountant and others, is the progression in FCF and Gross margins. Just imagine what it means for an high volume automotive manufacturing and distribution process to deliver Tesla Gross Margin, much less improve on that. Let the critics say, 'well, Tesla isn't high volume' and anyway Ferrari (RACE) has higher GM". Keep in mind that Fremont is already the highest volume auto plant in North America and will keep that distinction until Austin passes it, because Austin is set to be the largest auto plant in the world.

That all means Tesla is getting massive scale economies right now. As @The Accountant so kindly informs us, '2022 will turn out wonderfully but you ain't seen nothin'yet, 2023 will be another world!' (I hope my paraphrase got it correctly.

With all the headwinds and questions in 2023 we'll have the next factories identified and they'll also have several massive new battery production facilities from CATL, Tesla, Panasonic and probably BYD and others all helping advance automotive and stationary storage. We'll also have some major refinements in related technologies such as AI, Starlink, Robotics etc. that will help enable long awaited FSD and better manufacturing processes.

We need not even discuss the product line enhancements. For Tesla that is the easy part once logistics, batteries and chips have been dealt with properly.