The Accountant

Active Member

I think you mean Q4 2022 (this year). I believe he is assuming that the Deferred Tax Benefit of about $1.6B ($1.35 EPS impact) gets realized this year.Any idea what the Q4 2023 tax item is?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I think you mean Q4 2022 (this year). I believe he is assuming that the Deferred Tax Benefit of about $1.6B ($1.35 EPS impact) gets realized this year.Any idea what the Q4 2023 tax item is?

I know a guy who goofed and ordered an extra Plaid X due in a few months. Would Tesla care if he flips it for a $20,000 premium? That should more than cover taxes and such... I think I've read conflicting things about that.The absolute state of trying to buy a Tesla right now:

Ah, yeah 2022 (got confused with preceding 2023 text).I think you mean Q4 2022 (this year). I believe he is assuming that the Deferred Tax Benefit of about $1.6B ($1.35 EPS impact) gets realized this year.

View attachment 824782

As of December 31, 2021, we had $31.2 billion of federal and $21.6 billion of state net operating loss carry-forwards available to offset future taxable income, some of which, if not utilized, will begin to expire in 2022 for federal and state purposes. A portion of these losses were generated by SolarCity and some of the companies we acquired, and therefore are subject to change of control provisions, which limit the amount of acquired tax attributes that can be utilized in a given tax year. We do not expect the change of control limitations to significantly impact our ability to utilize these attributes.

Our 2021 net operating loss included corporate income tax deductions related to our CEO’s exercise of the remaining stock options from the 2012 CEO Performance Award, which resulted in a $23.45 billion tax deduction. Such increase in net operating loss is included in our deferred income tax assets, offset by a valuation allowance. Section 162(m) of the Internal Revenue Code was amended for deductibility of executive compensation for stock grants after 2017. Therefore, we are not expecting substantial corporate income tax deductions from our CEO's subsequent option exercises.

As of December 31, 2021, we had research and development tax credits of $738 million and $584 million for federal and state income tax purposes, respectively. If not utilized, the federal research and development tax credits will expire in various amounts beginning in 2024. However, the state of California research and development tax credits can be carried forward indefinitely. In addition, we have other general business tax credits of $186 million for federal income tax purposes, which will not begin to significantly expire until 2033.

I know a guy who goofed and ordered an extra Plaid X due in a few months. Would Tesla care if he flips it for a $20,000 premium? That should more than cover taxes and such... I think I've read conflicting things about that.

Top google results for "Hong Guang profit" says $14/car in July 2021. But there was a price increase in May 2022.Found this in the comments from Disqus Profile - flipsivad in the article: US: GM Delivered Over 7,000 Plug-In Vehicles In Q2 2022

"The Hong Guang is already selling at a rate of 200k as of now so that by 2025 it might be almost half of GM's global target.

"One of the biggest appeals of the little EV is its price, as it sells for the equivalent of just over $4,000 USD. This, however, means that there isn’t much room for profit. In fact, China’s Xcar reports that GM and Wuling make a profit of 89 Yuan on each example they sell. At today’s exchange rates, that’s the equivalent of just $13.73 USD."

So GM is pocketing $6-$7 per unit sold! LOL. If they can increase sales to 500,000 Hong Guangs by 2025 then GM will pocket a cool $3 mil on the entire JV! That might be enough to pay for at least Mary's base salary."

How much truth is there in the $6-$7 per unit profit for each car for GM?

The Mini EV is likely to suffer more problems than many electric vehicles, most of which are designed to last for 20 years, or 200,000 km. But this might not be as big of a trade-off as one might guess. To make up for this difference, the Mini EV is designed so the inverter and other modules can be easily swapped out, Yamamoto said.

The automaker was able to further reduce costs by using off-the-shelf parts and components. The speed reducer, which adjusts the torque of the Chinese-made motor, uses Chinese-made commodity ball bearings rather than specially designed bearings; both meet performance requirements.

Low-cost, general-purpose semiconductors are not as durable as those specifically made to go into automobile parts, but SAIC-GM-Wuling puts them together in a way that makes them easy to replace if they do wear out. (Photo by Yuki Nakao)

Electrical components, such as the inverter and battery charger, omit highly durable automotive chips for those more commonly found in home appliances; they are made by leading Western companies such as U.S. chipmaker Texas Instruments and Germany's Infineon Technologies.

While these components are more prone to wear and tear, they are designed to be easily replaced as modules, and repair work is easy to complete.

This comes to $198 million USD for 2021, if true.After removing other material costs, labor costs, and transportation costs, there is basically not much profit space left.

Of course, there is another way of saying in the market, that is: Wuling can make money from new energy points.

There is some basis for this statement. Data from the Ministry of Industry and Information Technology shows that SAIC-GM-Wuling will accumulate 443,000 tradable points in 2021. In 2021, the price of new energy points purchased by Volkswagen is about 3,000 yuan per point. According to this calculation, Wuling seems to be able to make some money.

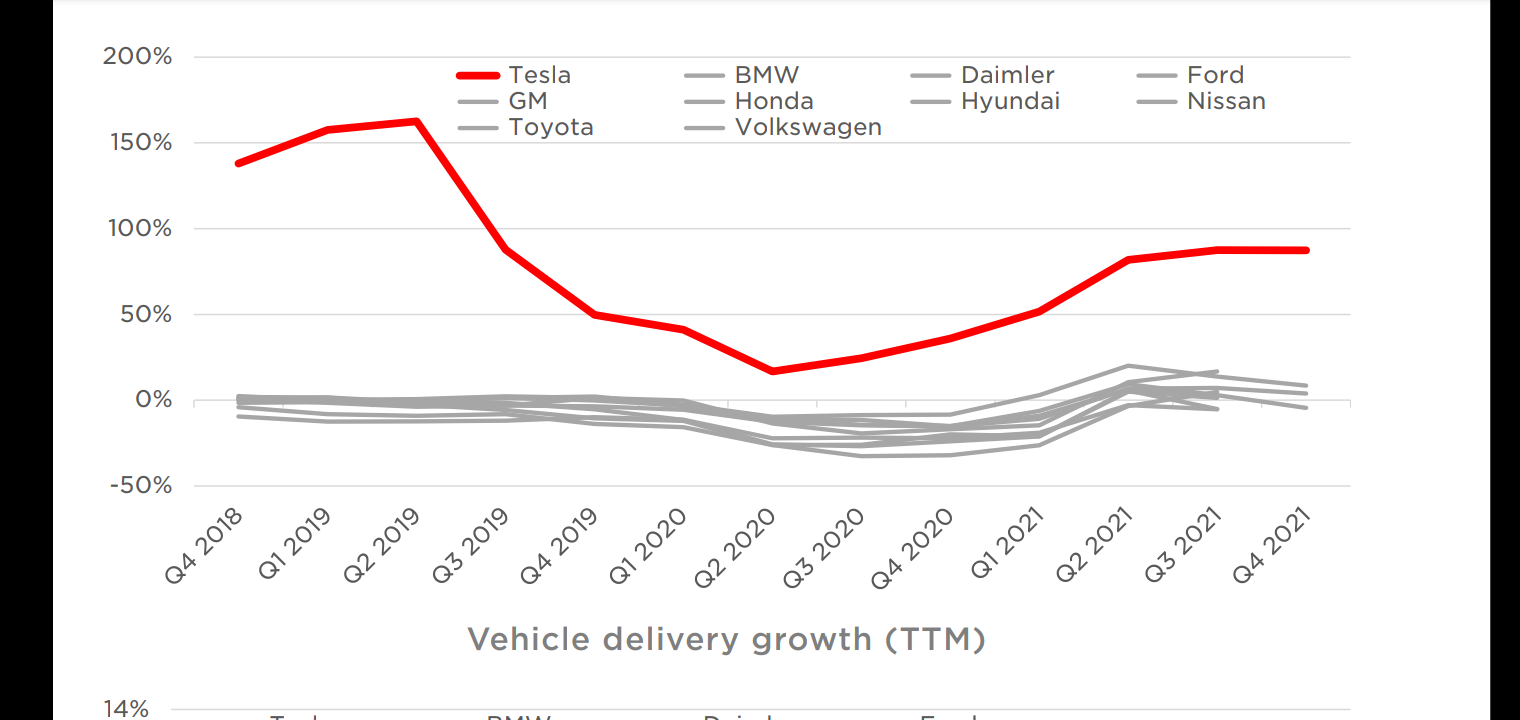

To put in context more just how low 2.2 million deliveries for 2023 would be, also remember that Elon guided a few months ago for 70-80% growth annually and maybe higher than that in the future.

2021 was 0.95M deliveries.

Two years of 70% growth would be 2.75M in 2023.

Two years of 80% growth from 0.95M gets us to 3.1M.

The actual recent trend has been 90% annual growth.

They’ve been saying 50% for years but the actual average has been substantially higher than that since 2017. The primary reason it briefly dipped below 50% in 2020 was that they spent weeks without either factories operating in Q1.Personally I don't feel 3 million delivered in 2023 is likely, to me 2.2 million is much more reasonable than 3 mil.

Tesla's official guidance is 50% average growth up to 2030. This means some years more than 50% and some years less than 50%. 2021 was a great growth year well in excess of 50%, but the Shanghai lockdown plus ramping two new factories will likely mean only around 1.4-1.5 million for 2022, or a little over 50% for 2022. With how slow the 4680's are ramping I feel like 2023 will be a similar year of growth to 2022, or about 50% again, which would equate to about 2.2 million.

3 mil in 2023 would be a 100%+ growth over 1.5 mil in 2022, and to me that just seems unrealistic.

All my opinion of course, none of us have crystal balls or anything....

Data is published in the US always earlier than in other continents. I used a tweet from Omar where he included a table with data and added data from manufacturers I found in other articles. It's still not complete as Ford and Mercedes are missing. I will update it once I get hold of them.Thanks, looks good! Where did you find this?

I would probably mentally prepare yourself for at least testing the 600 low if the macros don’t hold steady. Any weakness in the macros is probably gonna embolden hedgies to take another stab at dropping TSLA to another leg lower and set a lower low.

From a technical analysis level, it would be very bearish for the stock to set a new low and unless TSLA comes out with blowout earnings and/or the macros go on a major rally, I think it would probably mean the stock is going to be down in the 500/600’s until late Aug/early Sept

Anybody else finding the whole south end of Giga Austin expansion odd? The following comment found on Teslarati makes some good points. The oddest thing seems the late stage pivot. What changed in the past months to suddenly go: oops, need an extra 15% factory space? On the one hand bullish, more space more output. On the other hand, poor planning?

The pivot we know about, max the Y output first… can that explain it? My gut says there’s a surprise in the works.

Happy hols over there.

View attachment 824807

My understanding (per Sawyer) is that the expansion is across the access road and not contiguous (at least at ground level). So #1 isn't an issueAnybody else finding the whole south end of Giga Austin expansion odd? The following comment found on Teslarati makes some good points. The oddest thing seems the late stage pivot. What changed in the past months to suddenly go: oops, need an extra 15% factory space? On the one hand bullish, more space more output. On the other hand, poor planning?

The pivot we know about, max the Y output first… can that explain it? My gut says there’s a surprise in the works.

Happy hols over there.

View attachment 824807

Correction: Between Q4 2017 when the Model 3 ramp began and Q4 2021, the last quarter we were allowed to have the factories open every week, Tesla grew vehicle production with an average 87% CAGR, not 75%.They’ve been saying 50% for years but the actual average has been substantially higher than that since 2017. The primary reason it briefly dipped below 50% in 2020 was that they spent weeks without either factories operating in Q1.

If they’ve been growing at 75% annually on average in the midst of Production Hell and then the gauntlet of Chip Hell, Supply Chain Hell, and Plant Shutdown Hell, I would expect at least that rate in 2022 and 2023 as they now have two major new factories ramping, chip shortages easing, and most of the growth coming from Model Y which is their easiest product to manufacture.

Good catch. James is using an old figure here. There was a time that the Deferred Tax Asset (DTA) for Net Operating Losses (NOLs) was $2.2B good to provide a benefit of $1.87 EPS (James was taking $1.35).Question one: The deferred item is more than $1.35 per share, so is this recognized on a continuing basis as tax is accrued? That seems off since it has a "more likely than not trigger", not an "as needed" trigger.

I am not sure who can answer that question. Perhaos Zach (CFO) has an idea when the benefit will be taken.Question 2: Is that even possible (federal tax due) with Tesla's $31.2 Billion in Federal carry forward losses? Austin needs to start pumping out cars to get domestic income on the positive side (accounting wise). Fremont production improvement with help as well, but it would have to be forward looking, wouldn't it (which goes back to question one).

I mostly agree,These margins will not last. The Chinese are coming, from the Electric Viking:

Will China be prevented from competing in some of our markets? If so, then maybe our margins will survive somewhat longer?

Over the long run, autos will act like commodities. Whoever has the lowest cost of production will win. That's why Elon says the car business is not where Tesla's value lies.

We need to win real-world AI.

Well they are transitioning to LFP and that's a huge win. Tesla is losing marketshare in solar slowly but surely. I hope this does not become the case with the other energy solutions (powerwalls, megapacks,etc) and to keep that from being the case they need to move faster I think. Why isn't the powerwall an LFP solution by now?The only person likely to be working on batteries and FSD is Elon.

On battery day some senior members of the team came up for the Q&A.

On autonomy day we met some of the team.

I am guessing little to no overlap in team members, no overlap in equipment. Adequate cash reserves to fund both projects, and all of the other projects.

Megapack storage is moving to LFP, perhaps that is overdue. Has the ball been dropped, or do things just take time?

IMO a lot of what Drew said on battery day did relate to energy storage, it is a target and part of the mission.

Well they are transitioning to LFP and that's a huge win. Tesla is losing marketshare in solar slowly but surely. I hope this does not become the case with the other energy solutions (powerwalls, megapacks,etc) and to keep that from being the case they need to move faster I think. Why isn't the powerwall an LFP solution by now?

If the cfo, coo, ceo are not all in on batteries- the actual constraint to the mission than it will lag. Does EM even tweet about energy ? i wouldn't know I don't do social media other than two forums. I certainly don't hear much about it and solar market share is slipping.

cleantechnica.com

cleantechnica.com