Todd Burch

14-Year Member

Hard to say how much of this is the Gordon Johnson Effect though. Until European deliveries are more steady with output from Berlin, this may be unwarranted exuberance, just as Gordy exhibits unwarranted pessimism.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Hard to say how much of this is the Gordon Johnson Effect though. Until European deliveries are more steady with output from Berlin, this may be unwarranted exuberance, just as Gordy exhibits unwarranted pessimism.

Well based on that calculation a Model 3 AWD has $48000 of powerwalls in them.If long range semi = 3 packs * 16 powerwalls/pack = 48 powerwalls worth of batteries. Powerwalls retail for $8,000 to $12,500 (1st = $12.5k, 2-4=$8k, 5-10=$8.5k), so 48 * $8k= $384K. In batteries. I understand that their are some electronics and case, but I don't see how you guys get anywhere close to 30%+ GM% for semi...

This initial batch is small volume and based 2170 cells. The 30%+ GM comes after Tesla converts to 4680. At that point, Tesla's battery costs will be much much lower. Perhaps half the cost if they qualify for the Advanced Materials Manufacturing credit which is $45/ kWh.If long range semi = 3 packs * 16 powerwalls/pack = 48 powerwalls worth of batteries. Powerwalls retail for $8,000 to $12,500 (1st = $12.5k, 2-4=$8k, 5-10=$8.5k), so 48 * $8k= $384K. In batteries. I understand that their are some electronics and case, but I don't see how you guys get anywhere close to 30%+ GM% for semi...

I tweeted him to ask where he got this knowledge and let him know there is some controversy about battery pack size here at TMC... we'll see if he replies.He said specifically the LR has 3 packs, the SR has 2 packs. So that 648 & 432 KWh respectively.

Is the 4680 battery pack in the Cybertruck going to be structural or is it dead weight because the exoskeleton provides enough structural integrity?

It's not a question of whether Chinese autos are "legitimate competitors" or not. The point is, they will have a very difficult time making inroads into N. America and Europe in high volumes over the next 4-7 years. The have almost zero presence currently. They will need to grow service and support networks at the same time they establish brand recognition and trust. Even if wildly successful at doing these things, the volumes would need to be very high, miraculously high, to slow down Tesla's expansion before 2030. To reach that kind of volume they not only need impressive supply chains, they also need to figure out how to substantially undercut Tesla on price when comparing apples to apples. That's harder than it seems because Tesla can lower prices as needed. Two more years is not going to tell us much more than we know right now. Which is that Tesla has a high-volume cost to produce advantage and the best Chinese makers will be able to displace ICE sales but will not fare very well if they have to battle head-to-head for market share with Tesla. And, guess what? For the next 7 years, they don't have to battle head-to-head with Tesla for market share, and they won't.

I would also be careful about taking analysis published on Reddit too seriously. Yes, potential outcomes must always be analyzed. But it baffles me why you think that is not being done before dismissing the idea that cheap, high quality EV's from China are going to provide a knock-down punch to Tesla's growth plans. You talk as if people are not aware of the growing EV production in China. Of course, quality and price are going to improve with time and higher volumes. But it's not clear why you think that's going to slow Tesla down. Tesla will continue to improve as well. That's what they do and how they got to where they are so quickly. I would be more worried about scarcity of raw materials slowing Tesla down than direct competition from Chinese automakers. One thing is clear, a lot of ICE sales will be displaced over the next 7 years.

Yep. But you forgot: stop getting credit rating upgrades, and stop being disproportionately rewarded by government tax incentives.Since 2022 is bizarro-year, I'm convinced the path to TSLA's ATH is to start failing at everything. Stop setting records, stop making money, stop making more cars this quarter than last, stop having industry-leading margins, stop announcing start of production for long-awaited products, etc.

It’s been looked at for years. Unless there are some engineering breakthroughs I am unaware of, the transmission from medium/high orbit was the tough part.Haha, "long-range" wireless transfer has now been extended to 16m (50 feet) In the laboratory. After which it's efficency drops precipitously.

Eid, A., Hester, J., & Tentzeris, M. M. (2022, March). Extending the Range of 5G Energy Transfer: Towards the Wireless Power Grid. In 2022 16th European Conference on Antennas and Propagation (EuCAP) (pp. 1-4). IEEE.

P.S. Haha "flip.it"

Elon has shut down the idea of putting photovoltaic farms in space and beaming the power back down to Earth. However, I think he hasn't commented on this in several years and I'm not sure how much the math changes with the targeted launch costs for Starship and Superheavy.Elon has shut down this idea many times in the past. Power satellites also need to be In very high orbit. Starlinks are too low.

caseyhandmer.wordpress.com

caseyhandmer.wordpress.com

Since 2022 is bizarro-year, I'm convinced the path to TSLA's ATH is to start failing at everything. Stop setting records, stop making money, stop making more cars this quarter than last, stop having industry-leading margins, stop announcing start of production for long-awaited products, etc.

A guy I used to work with at NASA was a die-hard Solar Power Satellite proponent. It would indeed be interesting to see how his thesis would improve with Starship economics.Elon has shut down the idea of putting photovoltaic farms in space and beaming the power back down to Earth. However, I think he hasn't commented on this in several years and I'm not sure how much the math changes with the targeted launch costs for Starship and Superheavy.

This idea is different because the proposal is to use satellites for power transmission but put the solar panels on the Earth's crust. Another key difference compared to any previous space solar proposals I've ever seen is that they want to put the satellites in low-earth orbit instead of geostationary orbit.

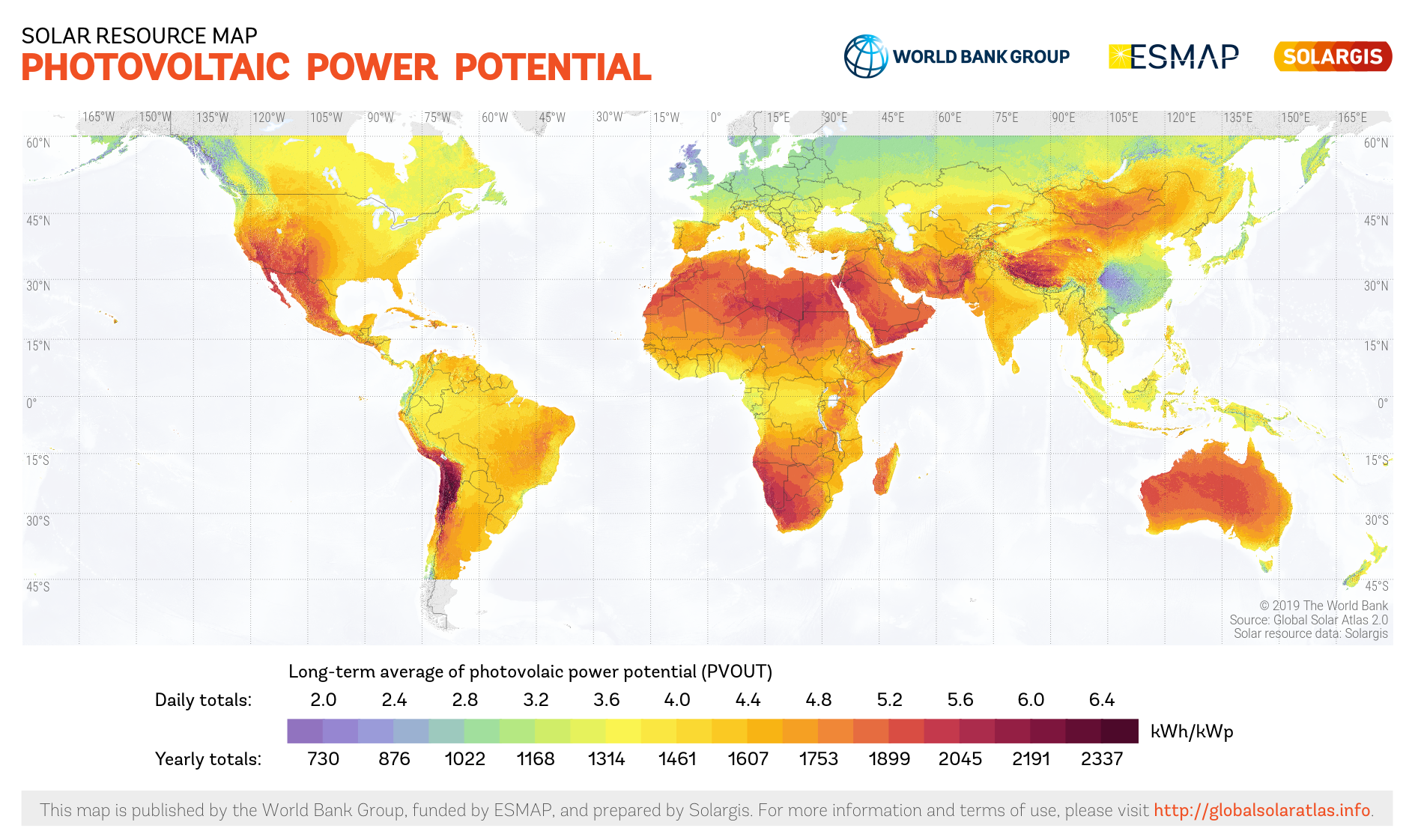

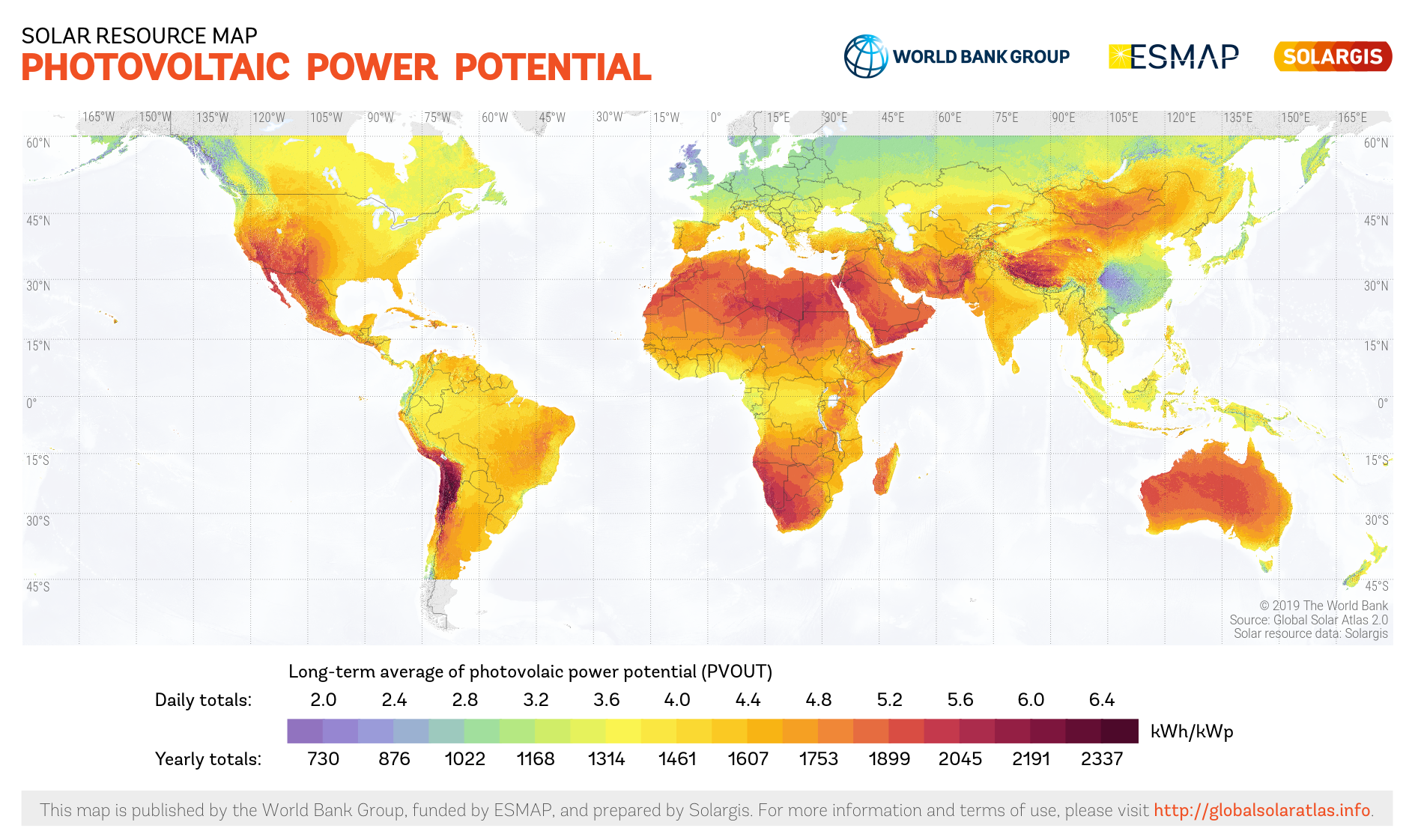

That being said, after reading the article I think this idea will not be economically competitive, even if they could solve all the technical challenges, for the same reason that other long-distance power transmission with high-voltage direct current lines will not be competitive and even today's regional grids will lose their current competitiveness and eventually be retired.

Dr. Casey Handmer has good explanation for the math behind why this is the case.

The future of electricity is local

I frequently read about proposals for new solar power developments where the resulting power is moved great distances to less sunny places, such as northern Europe from the Sahara, the US North Eas…caseyhandmer.wordpress.com

I used to be intrigued by space-based solar power. I still think in the far future it might end up being the source of most of Earth's power because there's a gigantic amount of solar power available at a nice, uniform 1.4 kW/m^2 flux, whereas land on Earth's surface is finite and pretty limited. This is not coming any time soon though.

Elon stated the Semi will have a structural pack.We've had reports of the test Semis performing as designed with 2170 cells. Semis won't use structural packs so I don't think they require 4680 cells in the short term.

...A significant part of the market will just want the EV equivalent of a corolla or accord...

I would be very surprised if the Cybertruck doesn't have a structural battery.

The joke about jinxing the stock price was funny the first few times, but after hundreds of repetitions, it has gotten incredibly old.SSSSHHHHHHH.

I'd be happy just to see proof that someone besides Telsa is building EVs profitably. Every company either admits they make nothing or close to it, or hides their EV data with their ICE business.Before I worry about competition from Chinese EV makers, I need to see them developing vision-based driving AI equivalent to Tesla's. If you have evidence of that, please share.

You are confusing/ commingling Semi & Cybertruck here.. and not even quoting Musk.I'd be surprised if it does. It's going to have heavy frame rails for load carrying.

*Edit: Actually Elon said it will use a structural pack according to this Tweet: